Finance

Annuitization Phase Definition

Published: October 7, 2023

Learn the meaning of annuitization phase in finance and how it affects your financial planning. Explore its significance and implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Annuitization Phase: A Comprehensive Definition and Guide

Welcome to our Finance category! In this blog post, we will dive deep into the annuitization phase of financial planning. If you’re wondering what the annuitization phase is and how it can impact your overall financial stability, you’ve come to the right place. We’ll provide you with a comprehensive definition, discuss its importance, and guide you through the process. So, let’s get started!

Key Takeaways:

- The annuitization phase is the period when an individual begins receiving regular income payments from an annuity contract.

- There are different options to choose from during the annuitization phase, such as fixed annuities, variable annuities, and indexed annuities.

Understanding the Annuitization Phase

The annuitization phase is a crucial stage in financial planning, particularly for individuals who have accumulated considerable savings and want to ensure a steady stream of income during retirement. It is the point at which an individual begins receiving income payments from an annuity contract they have contributed to throughout their working years.

An annuity is an investment vehicle typically provided by insurance companies that allows individuals to contribute a certain amount of money over a period of time. The accumulated funds within the annuity contract grow on a tax-deferred basis until the annuitization phase begins, at which point the contributor can start receiving regular payments.

During the annuitization phase, individuals have several options to consider, which can significantly impact the amount and duration of their income payments. Let’s explore some of the more common annuity options:

1. Fixed Annuities

A fixed annuity offers a guaranteed fixed interest rate for a predetermined period. This means that the income payments received during the annuitization phase will remain the same throughout the agreed-upon period, providing a stable source of income. Fixed annuities are a popular choice for individuals seeking predictable income streams and a low-risk investment option.

2. Variable Annuities

Variable annuities offer the potential for higher returns but come with greater risk. With variable annuities, the income payments during the annuitization phase fluctuate based on the performance of the underlying investment options chosen by the annuity holder. This means that the income payments may increase or decrease based on market performance. Variable annuities are suited for individuals willing to take on more risk in exchange for the potential for higher returns.

3. Indexed Annuities

Indexed annuities combine characteristics of both fixed and variable annuities. They offer a minimum guaranteed interest rate while also tying the annuity’s performance to a specified market index, such as the S&P 500. The income payments during the annuitization phase may vary based on the performance of the chosen index, allowing for potential growth while providing downside protection. Indexed annuities can be an appealing option for individuals seeking a balance between stability and potential market upside.

The Importance of the Annuitization Phase

Now that we have defined the annuitization phase and discussed different annuity options, you might be wondering about its significance. Here are two key takeaways regarding its importance:

- Steady Income: The annuitization phase ensures a steady income stream during retirement, providing financial stability and peace of mind. By choosing the right annuity option, you can tailor your income payments to align with your specific financial goals and needs.

- Risk Mitigation: Through annuitization, individuals can protect themselves against market volatility and minimize the risk associated with unpredictable investment returns. Fixed annuities, in particular, provide a secure and reliable income source.

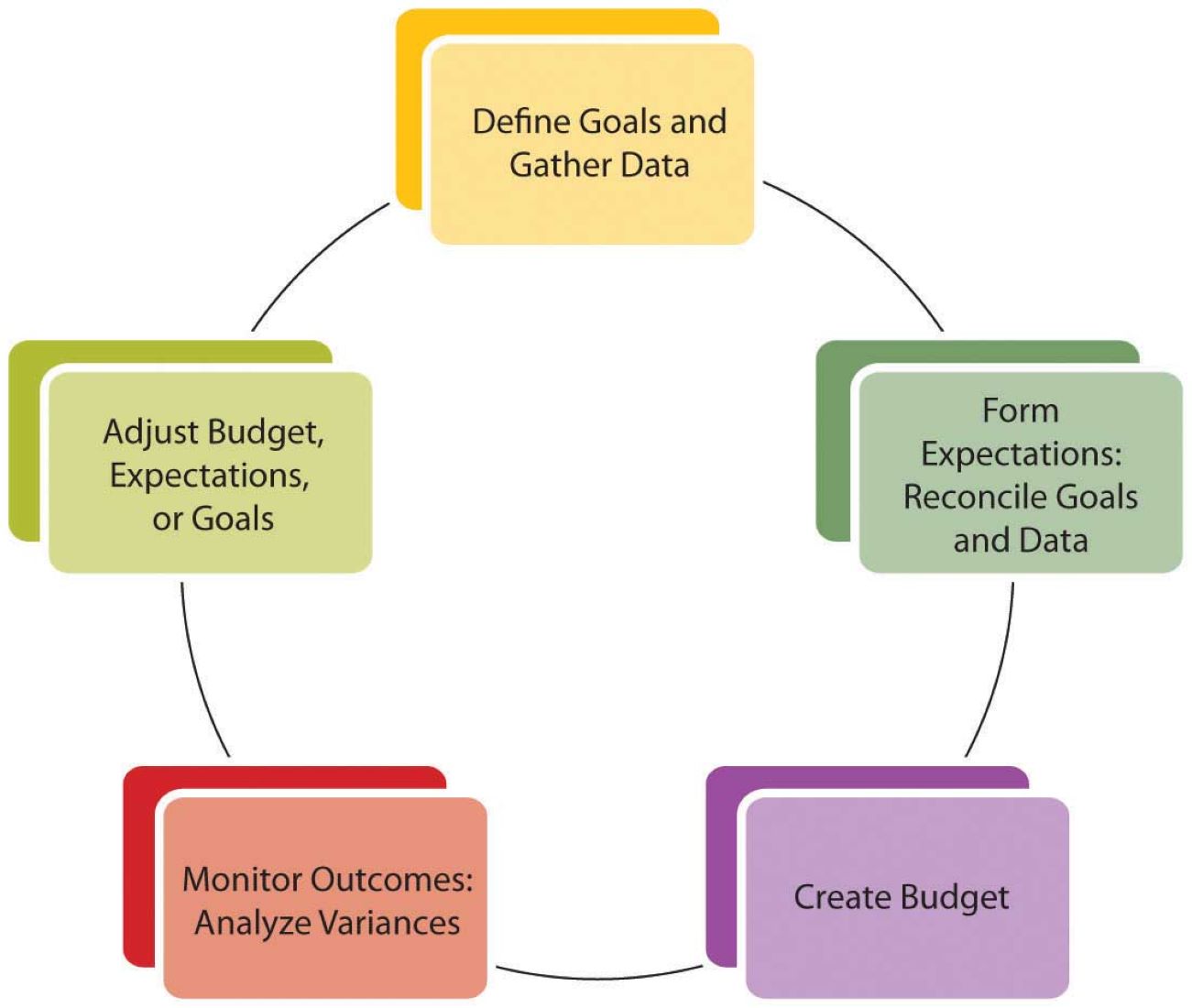

Ultimately, the annuitization phase serves as the transition point from accumulating savings to receiving a regular income. It allows individuals to make the most of their hard-earned money and enjoy a comfortable retirement.

We hope this comprehensive definition and guide to the annuitization phase has provided you with valuable insights into this crucial aspect of financial planning. Remember to consult with a financial advisor who can help you navigate the complex world of annuities and select the best option for your unique circumstances. Stay tuned for more informative articles in our Finance category!