Finance

Why Is Banking Regulation Important?

Published: December 19, 2023

Find out why banking regulation is crucial in the world of finance and how it impacts the stability and security of the financial system.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Ensuring Financial Stability

- Consumer Protection

- Minimizing Systemic Risk

- Promoting Fair Competition

- Preventing Money Laundering and Financing of Terrorism

- Safeguarding Depositors’ Interests

- Controlling Risk and Ensuring Prudent Management

- Maintaining Public Confidence in the Banking System

- Conclusion

Introduction

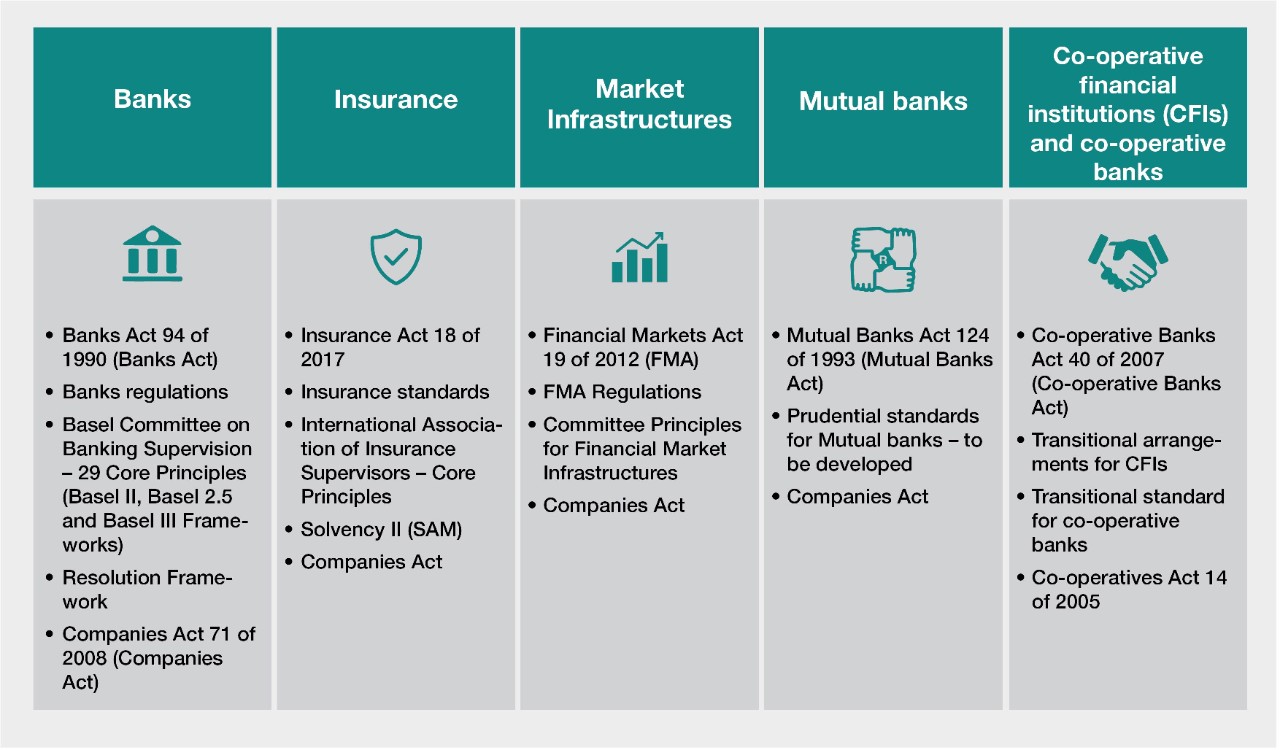

In today’s dynamic and interconnected financial landscape, banking regulations play a crucial role in maintaining stability, protecting consumers, managing risk, and promoting fair competition. These regulations are imposed by governmental bodies and regulatory authorities to ensure that banks operate in a responsible and transparent manner.

Banking regulation encompasses a wide range of policies and guidelines that govern the activities and operations of banks. These regulations are designed to address the inherent risks and vulnerabilities associated with the banking sector, which can have far-reaching consequences for the economy as a whole. By imposing rules and standards, banking regulations aim to strike a balance between fostering innovation and safeguarding the interests of depositors, investors, and the overall financial system.

This article explores the importance of banking regulation and its various benefits. From ensuring financial stability to protecting consumers and preventing money laundering, these regulations are essential for the functioning of a healthy and robust banking system. By understanding the significance of banking regulations, individuals, businesses, and governments can make informed decisions and contribute to a more secure and efficient financial environment.

Ensuring Financial Stability

One of the primary objectives of banking regulation is to ensure the stability of the financial system. The stability of banks and financial institutions is crucial for maintaining the overall economic well-being of a country.

Banking regulations are designed to prevent excessive risk-taking and protect against the possibility of bank failures. They establish capital requirements that banks must meet to maintain a sufficient buffer against potential losses. By ensuring that banks have enough capital to absorb losses, regulations help mitigate the chances of a financial crisis.

Furthermore, banking regulations impose restrictions on activities such as proprietary trading and derivatives trading, which can contribute to market volatility and systemic risks. These regulations aim to promote greater transparency and accountability in the financial industry, reducing the likelihood of a widespread collapse.

During times of economic downturns or external shocks, banking regulations also provide a framework for crisis management and resolution. They outline procedures for dealing with troubled banks, such as implementing mergers, acquisitions, or even government interventions. These measures help maintain the stability of the financial system and reduce the impact of a crisis on the broader economy.

Overall, by ensuring financial stability, banking regulations help safeguard the interests of depositors, investors, and the economy as a whole. They create a more resilient banking sector that is better equipped to withstand and navigate through periods of economic uncertainty.

Consumer Protection

Banking regulations place a strong emphasis on consumer protection, aiming to safeguard the rights and interests of individuals and businesses that interact with banks and financial institutions.

One of the key aspects of consumer protection in banking is ensuring that financial products and services are offered in a fair and transparent manner. Regulations require banks to provide clear and easily understandable terms and conditions for products such as loans, mortgages, and credit cards. They also mandate the disclosure of fees, interest rates, and any potential risks associated with these products, enabling consumers to make informed decisions.

Additionally, banking regulations establish standards for fair lending practices, prohibiting discriminatory practices based on race, gender, or other protected characteristics. These regulations help to promote equal access to credit and prevent unfair or predatory lending practices.

Banking regulations also mandate the establishment of mechanisms for addressing customer complaints and disputes. By requiring banks to have effective complaint handling processes, consumers have a means to recourse if they encounter issues with their banking transactions or services.

Furthermore, regulations play a vital role in protecting the privacy and security of consumer information. Banks are required to implement robust data protection measures and adhere to strict guidelines to ensure the confidentiality of customer data and prevent unauthorized access or breaches.

Overall, consumer protection regulations in banking contribute to fostering trust and confidence in the financial system. They empower individuals and businesses to make informed decisions, guard against unfair practices, and ensure that their rights are respected in their interactions with banks and financial institutions.

Minimizing Systemic Risk

Systemic risk refers to the risk of a failure or disruption in the financial system that can have widespread and cascading effects on the economy as a whole. Banking regulations play a critical role in minimizing systemic risk by establishing measures to identify, assess, and manage potential threats to the stability of the financial system.

One of the key ways in which banking regulations address systemic risk is by imposing risk management requirements on banks. These requirements include stress testing, liquidity management, and risk diversification measures. By ensuring that banks have robust risk management practices in place, regulations help minimize the likelihood of a domino effect in the event of a financial crisis.

Regulations also impose limits on the concentration of risks in the banking sector. They require banks to have diversified portfolios and set limits on exposures to individual borrowers, industries, or types of financial instruments. These measures reduce the interconnectedness between banks and mitigate the potential amplification of shocks within the financial system.

Furthermore, banking regulations establish frameworks for the oversight and regulation of financial market infrastructures such as clearinghouses and payment systems. By ensuring the efficiency, transparency, and resilience of these infrastructures, regulations contribute to reducing the risk of disruptions in core financial operations.

Additionally, regulations aim to prevent contagion effects by establishing mechanisms for the orderly resolution of failed banks. These mechanisms help limit the spillover effects of a bank failure and mitigate the impact on the wider financial system.

By minimizing systemic risk, banking regulations not only protect the stability of the financial system but also safeguard the broader economy. They promote confidence in financial markets and reduce the likelihood of severe disruptions that can have far-reaching consequences, such as economic recessions or depressions.

Promoting Fair Competition

Fair competition is a fundamental principle of a healthy and thriving economy. Banking regulations play a crucial role in promoting fair competition within the banking industry by fostering an environment where all market participants have equal opportunities.

One way in which banking regulations promote fair competition is by preventing anti-competitive practices and ensuring a level playing field. Regulations prohibit activities such as price fixing, collusive behavior, and unfair trade practices that can stifle competition and limit consumer choice. This helps encourage innovation, efficiency, and better service offerings from banks.

Moreover, regulations establish guidelines for market entry and accreditation. These guidelines aim to ensure that new entrants face a fair and transparent process for obtaining the necessary licenses and permits to operate as banks. By preventing arbitrary barriers to entry, regulations encourage competition from new players, fostering innovation and driving improvements in the quality of banking services.

Banking regulations also address the issue of conflicts of interest within the industry. They prescribe rules and procedures to manage conflicts that may arise between a bank’s different business activities, such as advisory services and proprietary trading. These regulations promote transparency and integrity, reducing the potential for unfair advantages and protecting the interests of customers.

Additionally, regulations govern mergers and acquisitions in the banking sector to prevent the formation of monopolistic or oligopolistic practices. They require banks to obtain regulatory approval for such transactions and assess them based on criteria like market concentration and impact on competition. This helps maintain a competitive landscape where a diverse range of banks can coexist and offer innovative products and services.

By promoting fair competition, banking regulations encourage a vibrant and dynamic banking sector. This leads to better choices, improved customer service, and increased innovation, ultimately benefiting consumers and the broader economy.

Preventing Money Laundering and Financing of Terrorism

Money laundering and the financing of terrorism are serious global threats that undermine the integrity of the financial system and pose risks to national security. Banking regulations play a pivotal role in preventing these illegal activities and ensuring that banks maintain strict adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) measures.

Regulations require banks to have robust know-your-customer (KYC) procedures in place to verify the identities of their customers and assess the purpose of their transactions. This helps to establish a system of due diligence, ensuring that banks are not unknowingly facilitating money laundering or terrorist financing activities.

Banks are also mandated to report suspicious transactions to the appropriate regulatory authorities. These reports enable authorities to investigate and take necessary action to prevent illicit activities. Regulations establish a framework for cooperation and information sharing between banks, law enforcement agencies, and financial intelligence units, facilitating the detection and disruption of illicit financial flows.

Furthermore, banking regulations require banks to implement internal controls and processes to identify, assess, and mitigate the money laundering and terrorist financing risks they face. These controls include transaction monitoring, customer screening, and ongoing staff training to ensure the bank’s employees are equipped to detect and report suspicious activities.

Regulatory authorities conduct regular audits and examinations to assess banks’ compliance with AML and CTF regulations. Non-compliance can result in severe penalties, including financial penalties and reputational damage. The threat of strict regulatory enforcement encourages banks to prioritize AML and CTF measures, further deterring would-be money launderers and terrorist financiers.

By preventing money laundering and the financing of terrorism, banking regulations contribute to maintaining the integrity and stability of the financial system. They help protect banks from being exploited by individuals or organizations involved in criminal or terrorist activities and ensure that the financial system does not inadvertently facilitate and support illegal actions.

Safeguarding Depositors’ Interests

Depositors play a vital role in the banking system, entrusting their hard-earned money to banks for safekeeping. Banking regulations are designed to protect the interests of depositors and ensure the safety and stability of their funds.

One of the key ways in which banking regulations safeguard depositors’ interests is through the establishment of deposit insurance schemes. These schemes, typically operated by governmental or quasi-governmental entities, provide a guarantee that depositors will be compensated up to a certain amount in the event of a bank failure. Deposit insurance helps maintain public confidence in the banking system and gives depositors peace of mind that their funds are protected, even in adverse circumstances.

Regulations also require banks to maintain adequate capital levels and liquidity to absorb potential losses and meet the demands of depositors. By imposing capital adequacy and liquidity requirements, regulations ensure that banks have the financial strength and ability to honor their obligations to depositors.

Moreover, regulations establish rules for the segregation and protection of client assets. Banks are required to keep customer funds separate from their own assets, which helps safeguard depositor funds and prevent commingling or misappropriation.

Additionally, banking regulations impose disclosure requirements on banks, ensuring that depositors are provided with clear and accurate information about the terms and conditions of their deposits. This includes information about interest rates, fees, and any potential risks associated with their accounts.

Banking regulations also mandate regular audits and examinations of banks to assess their financial health and compliance with regulatory requirements. These assessments help identify any potential risks to depositors’ interests and ensure that banks are operating in a safe and sound manner.

Overall, by safeguarding depositors’ interests, banking regulations contribute to maintaining public trust and confidence in the banking system. They provide a safety net for depositors and help ensure that their funds are protected, even in challenging economic times.

Controlling Risk and Ensuring Prudent Management

Risk management and prudent management practices are essential for the stability and sustainability of banks. Banking regulations play a critical role in controlling and managing risks, ensuring that banks operate in a responsible and prudent manner.

One of the key aspects of risk management regulated by banking authorities is credit risk. Regulations establish requirements for assessing the creditworthiness of borrowers, setting limits on exposures to individual borrowers or industries, and maintaining adequate provisions for potential loan losses. These measures help banks mitigate the risk of default and minimize the impact of loan losses on their financial health.

Regulations also address liquidity risk, which refers to the ability of banks to meet their obligations in a timely manner. Banks are required to have contingency plans and maintain sufficient liquidity buffers to withstand unexpected liquidity shocks. These regulations help ensure that banks are capable of honoring their commitments and avoid the need for taxpayer-funded bailouts.

Market risk is another area regulated by banking authorities. Regulations establish guidelines for managing exposure to market fluctuations, such as interest rate risk, foreign exchange risk, and equity market risk. Banks are required to have robust risk management systems in place to monitor and control these risks effectively.

Operational risk, including risks arising from internal processes, information systems, and external events, is also addressed by banking regulations. Regulations mandate the implementation of robust internal controls, cybersecurity measures, and business continuity plans to mitigate operational risks and ensure the smooth functioning of banks.

Moreover, banking regulations establish criteria for capital adequacy and require banks to maintain a certain level of capital relative to their risk-weighted assets. This ensures that banks have a sufficient buffer to absorb losses and protects depositors and creditors from potential insolvency risks.

By controlling risk and ensuring prudent management practices, banking regulations contribute to the stability and resilience of the banking system. They help prevent excessive risk-taking, promote sound decision-making, and protect the interests of depositors, investors, and the broader economy.

Maintaining Public Confidence in the Banking System

Public confidence is crucial for the smooth functioning of the banking system. When individuals and businesses have faith in the stability and integrity of banks, they are more likely to deposit money, seek financial services, and participate in economic activities. Banking regulations play a significant role in maintaining public confidence and ensuring the continued trust of customers and investors.

One way in which banking regulations maintain public confidence is through stringent oversight and supervision of banks. Regulatory authorities closely monitor the activities of banks and conduct regular inspections to ensure compliance with regulations. This oversight helps detect any potential issues early on and enables swift action to address them, reinforcing the notion that banks are being held accountable for their actions.

Transparency is another crucial aspect of maintaining public confidence. Banking regulations require banks to disclose relevant financial and non-financial information to the public, investors, and regulatory authorities. This includes publishing financial statements, risk disclosures, and regulatory filings. By providing transparency and access to information, regulations empower stakeholders to make informed decisions and hold banks accountable for their actions.

Furthermore, regulations establish mechanisms for consumer protection and dispute resolution. They mandate processes for handling customer complaints and establish avenues for recourse for individuals who feel aggrieved by the actions of banks. These mechanisms contribute to the perception that customers’ interests are protected, enhancing public confidence in the banking system.

In addition, regulations limit conflicts of interest within the banking sector. They impose restrictions on insider trading and establish rules regarding the separation of commercial and investment banking activities. These measures help prevent abuses of power and promote fair and ethical practices, reinforcing public trust in the integrity of banks.

Educational initiatives and public awareness campaigns organized by regulatory authorities also play a part in maintaining public confidence. These initiatives aim to enhance financial literacy, educate the public about their rights and responsibilities when dealing with banks, and raise awareness about the importance of strong banking regulations. By increasing knowledge and awareness, these initiatives empower individuals to make informed decisions and contribute to a better-informed society.

Ultimately, by effectively implementing and enforcing banking regulations, authorities can foster an environment of trust and reliability within the banking system. Public confidence in banks strengthens economic stability, encourages financial participation, and contributes to the overall well-being of the economy.

Conclusion

Banking regulations play an essential role in ensuring the stability, integrity, and sustainability of the financial system. They are crucial for maintaining financial stability, protecting consumers, minimizing systemic risk, promoting fair competition, preventing money laundering, safeguarding depositors’ interests, controlling risk, and maintaining public confidence in the banking system.

By imposing capital requirements, liquidity standards, and risk management guidelines, banking regulations help prevent excessive risk-taking and mitigate the chances of a banking crisis. They establish consumer protection measures, such as clear disclosure requirements and fair lending practices, to ensure that individuals and businesses are treated fairly and transparently.

Banking regulations also focus on combating money laundering and the financing of terrorism, thus safeguarding the integrity of the financial system and promoting national security. Additionally, regulations foster fair competition by preventing anti-competitive practices and encouraging market entry and innovation.

Safeguarding depositors’ interests is another critical aspect of banking regulations. Deposit insurance schemes, capital adequacy requirements, and disclosure obligations help protect depositors’ funds and maintain public trust. Furthermore, by controlling risk and ensuring prudent management practices, regulations contribute to the stability and soundness of banks.

Lastly, maintaining public confidence is paramount in the banking system. Through oversight, transparency, consumer protection mechanisms, and educational initiatives, banking regulations work to instill trust, empower individuals, and create a sense of accountability within the industry.

In conclusion, banking regulations play a pivotal role in establishing a robust and resilient banking sector. They ensure the safe and responsible functioning of banks, protect the interests of consumers, and contribute to the overall stability and confidence in the financial system. By striking the right balance between regulation and innovation, banking regulations create an environment where banks can thrive while maintaining the trust and well-being of the public they serve.