Home>Finance>Application Programming Interface (API): Definition And Examples

Finance

Application Programming Interface (API): Definition And Examples

Modified: October 10, 2023

Learn the definition and examples of Application Programming Interface (API) in the finance industry. Discover how APIs are transforming financial services.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the World of Finance: An Introduction to Application Programming Interfaces (APIs)

Welcome to our Finance category, where we uncover the secrets to optimizing your financial journey. In today’s digital era, technology plays a crucial role in shaping the way we manage our finances. One such technology that has revolutionized the financial world is Application Programming Interfaces, more commonly known as APIs. In this post, we will delve into the definition of APIs and explore examples of how they are used in the finance industry to enhance efficiency and accessibility.

Key Takeaways:

- Application Programming Interfaces (APIs) act as intermediaries that allow different software applications to communicate and exchange data with each other.

- APIs play a significant role in the financial industry, enabling seamless integration of financial data, automating processes, and providing innovative financial services to users.

So, What is an API?

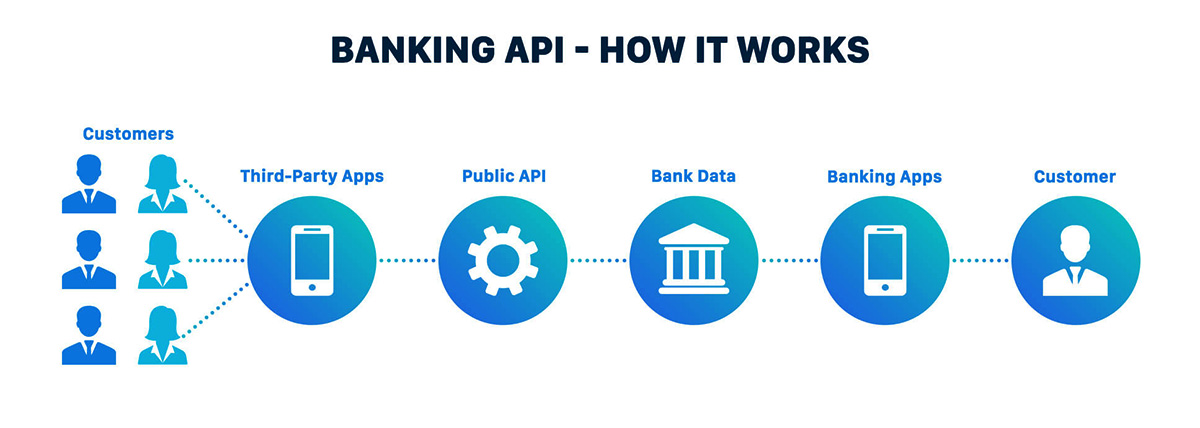

An Application Programming Interface (API) serves as a bridge between different software applications, enabling them to communicate with each other and share data efficiently and securely. In simpler terms, an API acts as a messenger that facilitates the smooth exchange of information between various systems, applications, or even organizations.

Imagine you are ordering food from your favorite restaurant using a food delivery app. When you place your order, the app uses an API to send the order details to the restaurant’s system. The restaurant system receives the request, processes it, and sends the response back to the app, notifying you about the status of your order. This seamless interaction between the food delivery app and the restaurant’s system is possible thanks to the API.

Examples of APIs in Finance

The finance industry is no stranger to the power of APIs. APIs bring agility, speed, and enhanced user experience to financial services. Here are a few examples of how APIs are being used in the finance sector:

- Payment APIs: Payment processors like PayPal and Stripe provide APIs that businesses can integrate into their websites or applications to enable smooth and secure online transactions. These APIs handle the transfer of payment information securely, reducing the risk of fraud and providing peace of mind for financial transactions.

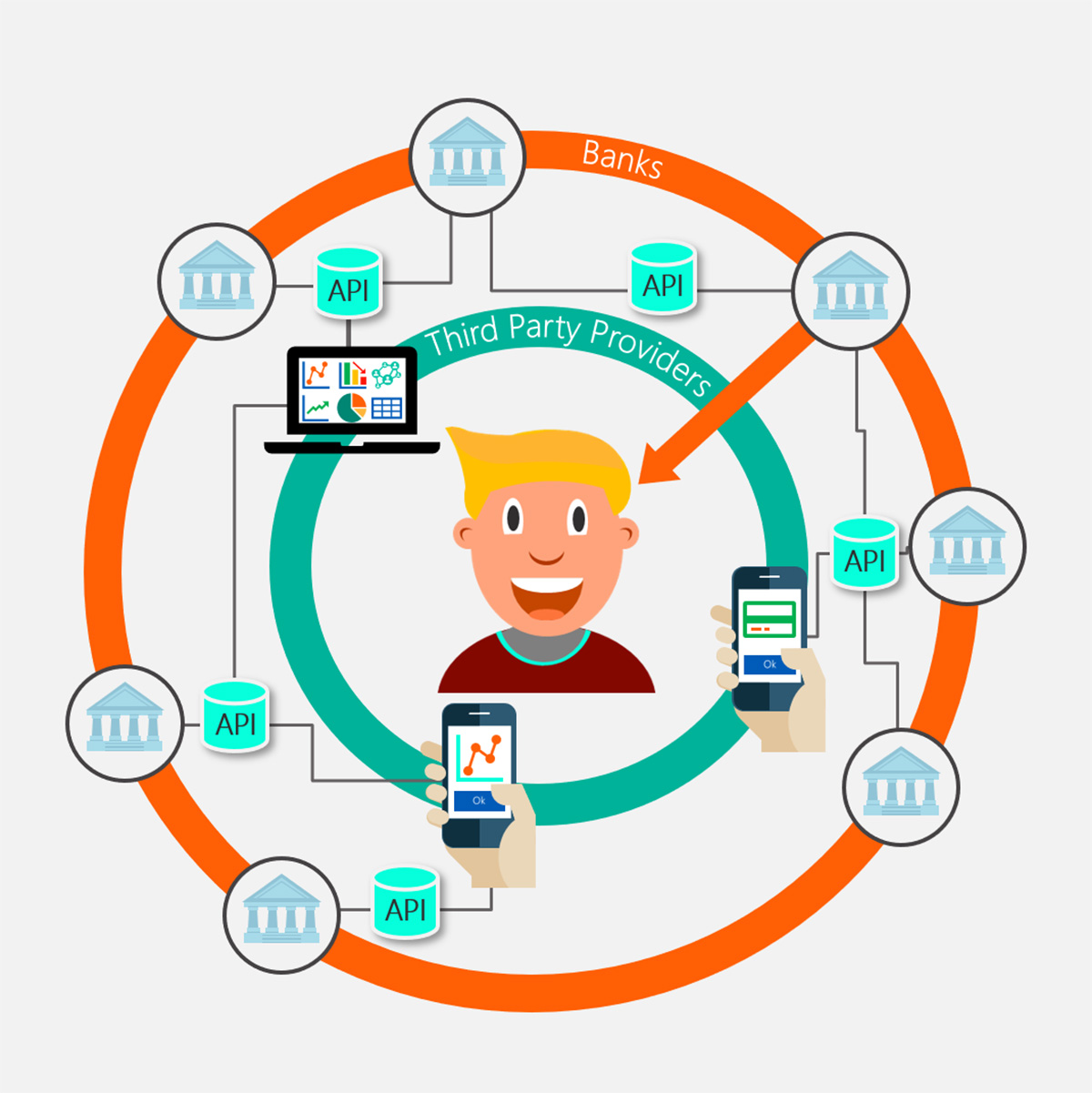

- Banking APIs: Banks and financial institutions have embraced APIs to offer their customers streamlined banking experiences. With banking APIs, users can check their account balances, transfer funds, and even make payments directly from third-party applications without needing to visit the bank’s website or app. This seamless integration provides convenience and efficiency for users.

- Stock Market APIs: Stock market APIs provide real-time financial data to developers, traders, and investment firms. These APIs enable users to retrieve information such as stock prices, historical data, market trends, and much more. With access to reliable and up-to-date data, investors can make informed decisions, automate trading strategies, and build financial applications.

- Cryptocurrency APIs: The rise of cryptocurrencies has led to the creation of numerous APIs that enable developers to integrate cryptocurrency transactions, market data, and wallet services into their applications. These APIs facilitate secure and efficient management of cryptocurrencies, opening up new possibilities in the world of finance.

Conclusion

The role of APIs in shaping the state of finance cannot be underestimated. By acting as connectors, APIs revolutionize the way different software applications interact and share information, leading to improved efficiency, enhanced user experiences, and innovative financial services. Whether you are an individual, a business, or a financial institution, APIs have the potential to unlock a world of possibilities in the world of finance.

Thank you for joining us on this journey through the world of APIs. We hope this post has shed some light on their definition and provided you with valuable examples of how APIs are transforming the finance industry. Stay tuned for more finance-related insights and tips!