Home>Finance>Articles Of Organization: Definition, What’s Included, And Filing

Finance

Articles Of Organization: Definition, What’s Included, And Filing

Published: October 8, 2023

Learn the definition and what's included in articles of organization for finance, and understand the process of filing them. Gain valuable insights in this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Articles of Organization: Definition, What’s Included, and Filing

Have you ever wondered what the term “Articles of Organization” means in the world of finance? If you’re a business owner or planning to start your own venture, understanding this document is crucial. In this blog post, we’ll delve into the definition of Articles of Organization, what it typically includes, and the process of filing it. So, let’s get started!

Key Takeaways:

- Articles of Organization are legal documents filed with the state government to officially register a limited liability company (LLC).

- The document typically includes information such as the LLC’s name, purpose, principal address, registered agent, management structure, and duration.

Defining Articles of Organization

In simple terms, Articles of Organization are the official paperwork required to form an LLC. When you file these documents with the state government, your business becomes recognized as a separate legal entity. It provides your business with limited liability protection, separating your personal assets from the company’s liabilities. This is often a popular choice for small businesses and startups due to its flexibility and fewer requirements compared to other business structures.

What’s Included in Articles of Organization?

When drafting your Articles of Organization, there are several important details you need to include. Here’s a breakdown of what’s typically included in this document:

- LLC Name: Choose a unique name for your business that complies with state regulations. Ensure it includes “LLC” or the abbreviation “L.L.C.”.

- Purpose: State the primary purpose of your LLC, whether it’s a product or service-oriented business.

- Principal Address: Provide the physical address where your LLC’s main office or place of business is located.

- Registered Agent: Designate an individual or professional entity responsible for receiving legal papers on behalf of your LLC.

- Management Structure: Specify how your LLC will be managed, whether it’s by members or appointed managers.

- Duration: Indicate whether your LLC will operate indefinitely or for a specific duration.

It’s important to remember that the specific requirements for Articles of Organization can vary from state to state. Therefore, it’s advisable to consult your state’s secretary of state website or seek professional advice to ensure compliance with local regulations.

Filing Articles of Organization

Once you have all the necessary information defined, the next step is filing your Articles of Organization. Here’s a general overview of the filing process:

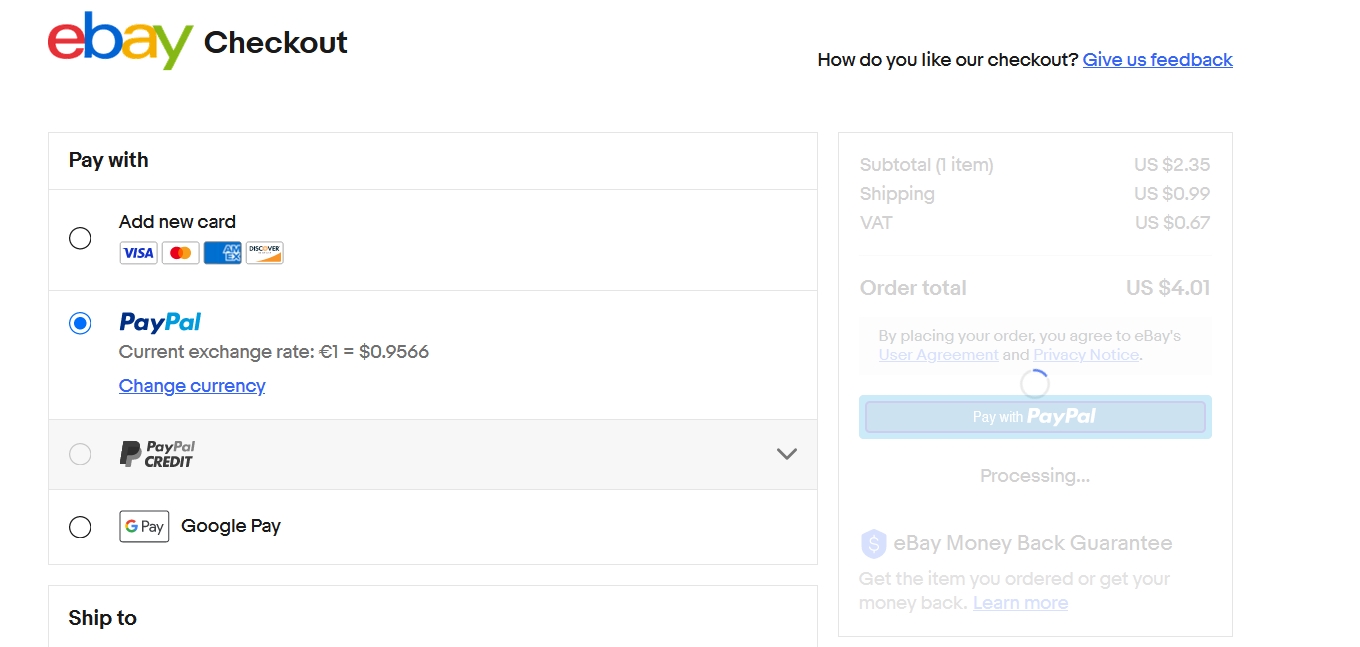

- Research your state’s specific requirements and fees for filing Articles of Organization.

- Prepare the document, ensuring that all required information is included.

- File the Articles of Organization with the appropriate state agency, usually the secretary of state office.

- Pay the required filing fee, which can vary depending on the state.

- Wait for your LLC to be officially approved and receive your Certificate of Organization.

It’s worth mentioning that some states may also require additional steps, such as publishing a notice of intent to form an LLC in a local newspaper or appointing a registered agent. Therefore, it’s crucial to thoroughly research and follow the specific requirements of your state.

In Conclusion

Understanding the definition, components, and filing process of Articles of Organization is crucial for any entrepreneur or business owner forming an LLC. By completing and filing this document correctly, you can establish your business as a separate legal entity, ensuring legal protection and laying the foundation for your success. So take the time to research your state’s specific requirements, gather the necessary information, and file your Articles of Organization diligently.