Finance

What Is Article 3 Pension Funds?

Published: January 23, 2024

Learn about the role of Article 3 pension funds in finance and how they impact retirement planning. Understand the significance of these funds for long-term financial security.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Article 3 Pension Funds

- Purpose of Article 3 Pension Funds

- Eligibility for Article 3 Pension Funds

- Contributions to Article 3 Pension Funds

- Investment Options in Article 3 Pension Funds

- Withdrawal and Distribution of Article 3 Pension Funds

- Tax Implications of Article 3 Pension Funds

- Conclusion

Introduction

Welcome to the comprehensive guide to Article 3 pension funds! In the dynamic landscape of personal finance and retirement planning, understanding the intricacies of pension funds is crucial for securing a stable and fulfilling future. Article 3 pension funds hold a significant place in the realm of retirement savings, offering individuals the opportunity to build a robust financial cushion for their post-employment years. As we delve into the depths of Article 3 pension funds, we will unravel the core aspects, ranging from eligibility criteria and contributions to investment options and tax implications.

Throughout this article, we will navigate the intricate pathways of Article 3 pension funds, shedding light on their purpose, structure, and the array of benefits they offer to participants. Whether you are a seasoned investor or a novice in the realm of pension funds, this guide aims to provide valuable insights that will empower you to make informed decisions regarding your retirement savings.

By the end of this journey, you will emerge with a comprehensive understanding of Article 3 pension funds, equipping you with the knowledge to navigate the complexities of retirement planning with confidence and clarity.

Overview of Article 3 Pension Funds

Article 3 pension funds, also known as defined contribution plans, are retirement savings vehicles designed to provide employees with a means to accumulate funds for their post-employment years. These funds are established and governed by the regulations outlined in Article 3 of the Employee Retirement Income Security Act (ERISA), which sets forth the standards for the administration and management of pension plans in the United States.

Unlike traditional pension plans, which guarantee a specific benefit amount upon retirement, Article 3 pension funds operate on a defined contribution basis. This means that the ultimate value of the fund is contingent upon the contributions made by the employee, employer, or both, as well as the performance of the investments within the fund.

Participants in Article 3 pension funds have the flexibility to make contributions through payroll deductions, often with the added advantage of employer matching contributions, which can significantly augment the growth of the fund over time. These funds are typically portable, allowing employees to retain their accrued benefits even if they change employers, providing a valuable element of flexibility and continuity in their retirement savings strategy.

Moreover, Article 3 pension funds offer a diverse array of investment options, ranging from stocks and bonds to mutual funds and exchange-traded funds (ETFs). This variety empowers participants to tailor their investment allocations based on their risk tolerance, financial goals, and time horizon, thereby customizing their retirement savings strategy to align with their individual circumstances.

Throughout the lifespan of an Article 3 pension fund, participants have the opportunity to monitor and manage their contributions and investment allocations, fostering a sense of active engagement and ownership over their retirement savings journey. The dynamic nature of these funds enables participants to adapt their strategies in response to changing market conditions and personal financial objectives, thereby optimizing the potential for long-term growth and stability.

Purpose of Article 3 Pension Funds

Article 3 pension funds serve a multifaceted purpose, encompassing a range of benefits and opportunities aimed at fortifying the financial security of employees during their retirement years. At the core of their purpose is the provision of a structured and tax-advantaged vehicle for individuals to systematically accumulate funds, thereby laying the groundwork for a financially resilient and fulfilling retirement.

First and foremost, these pension funds offer a mechanism for employees to proactively save and invest for their retirement, fostering a disciplined approach to long-term financial planning. By facilitating regular contributions, often through convenient payroll deductions, Article 3 pension funds instill a sense of consistency and commitment in building a substantial nest egg for the future.

Furthermore, Article 3 pension funds play a pivotal role in promoting financial independence and security for retirees. As participants contribute to these funds over the course of their careers, they are effectively creating a reservoir of resources that can sustain them through their post-employment years, mitigating the risk of financial hardship and dependency on external support systems.

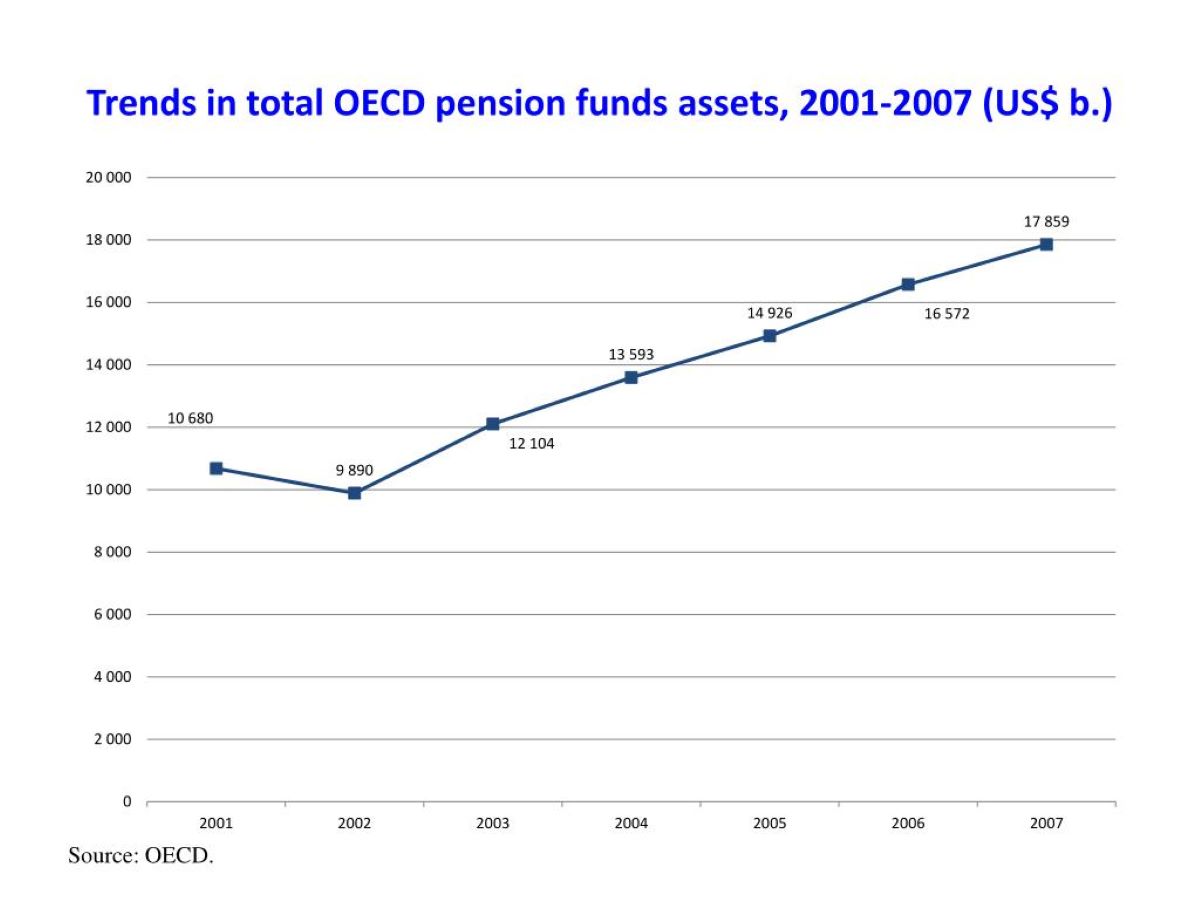

Another key purpose of Article 3 pension funds is to harness the power of compounding returns, leveraging the potential for exponential growth in the value of the fund over time. Through strategic investment allocations and the reinvestment of dividends and capital gains, participants can capitalize on the compounding effect, allowing their retirement savings to flourish and expand organically.

Moreover, these pension funds serve as a cornerstone of retirement planning, offering participants the opportunity to diversify their investments across various asset classes and securities. This diversification not only enhances the potential for long-term growth but also helps mitigate risk by spreading investments across different market sectors, thereby bolstering the overall resilience of the retirement portfolio.

Ultimately, the purpose of Article 3 pension funds extends beyond the accumulation of wealth; it encompasses the cultivation of financial empowerment, resilience, and peace of mind for individuals as they transition into the next chapter of their lives. By providing a structured and efficient avenue for retirement savings, these funds lay the groundwork for a secure and dignified retirement, empowering participants to embrace their future with confidence and optimism.

Eligibility for Article 3 Pension Funds

Eligibility for participation in Article 3 pension funds is contingent upon various factors, including an individual’s employment status, the policies of their employer, and the specific provisions outlined in the retirement plan. Typically, employees who meet certain criteria established by their employers, such as length of service or job classification, are eligible to enroll in these pension funds.

Employers play a pivotal role in determining the eligibility requirements for participation in Article 3 pension funds. While some employers extend the opportunity to all employees, others may impose specific criteria, such as a minimum tenure of service or a minimum number of hours worked per week, before employees become eligible to enroll in the pension plan.

Additionally, certain industries or sectors may have unique eligibility standards for participation in Article 3 pension funds. For example, unionized workforces may negotiate eligibility criteria as part of collective bargaining agreements, outlining the terms under which employees can access and contribute to the pension fund.

It is important for employees to familiarize themselves with the eligibility criteria established by their employers and the specific provisions of the pension plan to determine when they qualify to enroll in the fund. Understanding these requirements empowers employees to proactively engage in retirement planning and take advantage of the benefits offered through Article 3 pension funds.

Furthermore, employees who transition between jobs or employers should assess the eligibility criteria of their new employer’s pension plan to ensure a seamless continuation of their retirement savings strategy. The portability of Article 3 pension funds allows participants to maintain their accrued benefits and continue making contributions even after changing employers, provided they meet the eligibility requirements of the new plan.

Ultimately, eligibility for Article 3 pension funds hinges on a combination of employer-determined criteria, industry-specific considerations, and the individual’s commitment to actively participate in their retirement savings journey. By understanding and fulfilling the eligibility requirements, employees can harness the potential of these pension funds to fortify their financial security and pave the way for a rewarding retirement.

Contributions to Article 3 Pension Funds

Contributions to Article 3 pension funds form the cornerstone of participants’ retirement savings strategy, serving as the financial fuel that propels the growth and sustainability of the fund. These contributions encompass both employee-funded allocations and potential employer matching contributions, collectively shaping the trajectory of the fund’s value and the participant’s long-term financial security.

Employees have the opportunity to make contributions to their Article 3 pension funds through payroll deductions, allowing for a seamless and systematic approach to saving for retirement. These contributions are typically calculated as a percentage of the employee’s salary, providing a flexible and adjustable mechanism for individuals to allocate a portion of their earnings toward their retirement savings.

One of the compelling advantages of Article 3 pension funds is the potential for employer matching contributions. Many employers offer to match a portion of the employee’s contributions, effectively amplifying the growth of the fund. This matching contribution represents a valuable incentive for employees to maximize their retirement savings, as it augments the overall value of the fund without necessitating additional financial outlay on the part of the employee.

It is essential for participants to leverage the opportunity of employer matching contributions to optimize the growth of their pension funds. By contributing at least the minimum amount required to unlock the full extent of the employer match, individuals can capitalize on this added benefit, harnessing its potential to bolster the long-term value of their retirement savings.

Moreover, Article 3 pension funds often empower participants to adjust their contribution levels based on their evolving financial circumstances and retirement goals. This flexibility allows individuals to align their contributions with changes in income, expenses, and overarching financial objectives, ensuring that their retirement savings strategy remains dynamic and responsive to their needs.

As participants contribute to their Article 3 pension funds over the course of their careers, the cumulative effect of these contributions, coupled with potential investment gains, lays the groundwork for a robust and sustainable retirement portfolio. By prioritizing consistent and meaningful contributions, individuals can fortify their financial security and cultivate a pathway to a rewarding retirement.

Investment Options in Article 3 Pension Funds

Article 3 pension funds offer participants a diverse array of investment options, empowering individuals to tailor their retirement savings strategy to align with their risk tolerance, financial goals, and time horizon. These investment options encompass a spectrum of asset classes and securities, allowing participants to construct a well-balanced and diversified portfolio within the framework of their pension fund.

One of the primary investment options available within Article 3 pension funds is the inclusion of equity securities, such as individual stocks and equity mutual funds. These investments offer the potential for long-term capital appreciation and dividend income, providing participants with exposure to the dynamic and often lucrative world of stock market investments.

Bonds and fixed-income securities represent another vital component of the investment options within Article 3 pension funds. These instruments offer a more conservative and income-oriented avenue for participants to allocate a portion of their retirement savings, providing stability and regular interest payments within the investment portfolio.

Furthermore, many Article 3 pension funds feature the inclusion of mutual funds and exchange-traded funds (ETFs), which offer diversified exposure to a broad range of securities across various market sectors and asset classes. This diversification can enhance the resilience of the investment portfolio and mitigate risk by spreading investments across multiple underlying assets.

Additionally, some pension funds may offer participants the opportunity to allocate a portion of their contributions to alternative investments, such as real estate investment trusts (REITs), commodities, or international securities. These alternative investments can introduce a layer of diversification and potential growth opportunities, further enriching the investment landscape within the pension fund.

Participants in Article 3 pension funds have the flexibility to adjust their investment allocations over time, allowing them to recalibrate their portfolio in response to changing market conditions, personal financial objectives, and evolving risk preferences. This adaptability enables individuals to proactively manage and optimize their retirement savings strategy, ensuring that it remains aligned with their overarching financial goals.

By leveraging the diverse investment options available within Article 3 pension funds, participants can construct a well-rounded and resilient portfolio that embodies their unique risk profile and long-term financial aspirations. This strategic approach to investment allocation within pension funds can lay the groundwork for sustained growth and stability, fostering the potential for a rewarding and secure retirement.

Withdrawal and Distribution of Article 3 Pension Funds

Withdrawal and distribution of Article 3 pension funds are governed by specific guidelines and regulations aimed at ensuring the orderly and efficient disbursement of retirement savings to participants as they transition into their post-employment years. Understanding the mechanisms and options for withdrawing and distributing funds from Article 3 pension accounts is essential for participants to navigate this critical phase of their retirement planning.

Upon reaching the eligible retirement age, participants in Article 3 pension funds may commence the withdrawal of funds through various distribution options. One common method is the lump-sum distribution, which allows participants to receive the entire value of their pension fund in a single payment. This option provides immediate access to the accumulated retirement savings, enabling individuals to deploy the funds according to their financial needs and objectives.

Alternatively, participants may opt for periodic or systematic withdrawals, wherein they receive regular disbursements from their pension fund at predetermined intervals, such as monthly or quarterly payments. This approach can provide a steady stream of income throughout retirement, helping to sustain the participant’s financial well-being over an extended period.

Another distribution option available to participants is the purchase of an annuity, which entails converting a portion or the entirety of the pension fund into a stream of guaranteed income payments, often spanning the participant’s lifetime. Annuities offer a valuable avenue for securing a dependable source of retirement income, shielding participants from the risk of outliving their savings and providing financial stability in their later years.

Furthermore, some Article 3 pension funds may offer the flexibility for participants to defer the withdrawal of funds beyond the standard retirement age, allowing for continued growth and potential tax advantages within the pension account. This deferral can be advantageous for individuals who seek to optimize the value of their retirement savings and maximize the benefits of tax-deferred growth.

It is important for participants to consider the tax implications and potential penalties associated with early or non-standard withdrawals from Article 3 pension funds, as premature distributions may incur tax liabilities and penalties. Understanding the regulations governing withdrawals and distributions is crucial for making informed decisions that align with the participant’s financial circumstances and retirement objectives.

Ultimately, the withdrawal and distribution phase of Article 3 pension funds represents a pivotal juncture in participants’ retirement planning journey. By carefully evaluating the available distribution options and aligning them with their financial goals, participants can navigate this transition with confidence and pave the way for a secure and fulfilling retirement.

Tax Implications of Article 3 Pension Funds

The tax implications of Article 3 pension funds play a significant role in shaping the overall financial landscape for participants, influencing the accumulation, growth, and eventual distribution of retirement savings. Understanding the tax considerations associated with these pension funds is essential for participants to optimize their retirement planning and make informed decisions regarding contributions, investment strategies, and withdrawals.

Contributions made to Article 3 pension funds are typically tax-deferred, meaning that the funds allocated to the pension account are deducted from the participant’s taxable income in the year of contribution. This tax deferral mechanism provides an immediate advantage by reducing the participant’s current tax liability, allowing for the potential growth of the retirement savings on a tax-advantaged basis.

Moreover, the investment earnings and capital gains generated within Article 3 pension funds are generally tax-deferred, enabling the funds to grow and compound without incurring annual tax obligations on the accrued gains. This tax-deferred growth can significantly enhance the long-term value of the pension fund, amplifying the potential for sustained wealth accumulation over the participant’s career.

As participants approach the distribution phase of their Article 3 pension funds, the tax implications become a critical consideration. Withdrawals from the pension account are typically subject to income tax at the ordinary tax rates applicable in the year of distribution. The taxation of these withdrawals is contingent upon the participant’s tax bracket at the time of distribution, potentially influencing the net amount received from the pension fund.

Furthermore, the timing and method of withdrawals from Article 3 pension funds can impact the tax liabilities associated with the distributions. Lump-sum withdrawals may result in a substantial tax obligation in the year of distribution, while periodic or systematic withdrawals can spread the tax liability over multiple years, potentially mitigating the impact on the participant’s overall tax situation.

Participants who opt to purchase annuities with a portion of their Article 3 pension funds can benefit from a tax-efficient stream of income, as a portion of each annuity payment may be considered a tax-free return of the participant’s initial investment. This tax treatment can enhance the after-tax value of the annuity payments, providing a compelling avenue for securing retirement income.

It is imperative for participants to consult with tax advisors or financial professionals to gain a comprehensive understanding of the tax implications associated with Article 3 pension funds. By proactively managing the tax considerations throughout the lifecycle of their pension accounts, participants can optimize the tax efficiency of their retirement savings and navigate the distribution phase with clarity and confidence.

Conclusion

Article 3 pension funds stand as a cornerstone of retirement planning, offering participants a versatile and structured avenue to accumulate and nurture their financial resources for the post-employment years. The comprehensive framework of these pension funds, encompassing eligibility criteria, contributions, investment options, and tax implications, provides a robust foundation for individuals to fortify their financial security and cultivate a pathway to a rewarding retirement.

By delving into the intricacies of Article 3 pension funds, participants can harness the potential of these retirement vehicles to proactively save and invest for their future. The flexibility and diversity of investment options within these funds empower individuals to tailor their retirement savings strategy to align with their risk tolerance, financial objectives, and time horizon, ensuring a well-rounded and resilient portfolio that embodies their unique financial aspirations.

Moreover, the tax-deferred nature of contributions and investment earnings within Article 3 pension funds offers a compelling advantage, allowing participants to optimize the growth of their retirement savings on a tax-advantaged basis. Understanding the tax implications associated with the distribution phase of these funds is crucial for participants to navigate this critical juncture with clarity and foresight, ensuring that they maximize the tax efficiency of their retirement income.

As participants progress through their careers and approach the retirement horizon, the withdrawal and distribution options available within Article 3 pension funds present a pivotal opportunity to convert their accumulated savings into a sustainable and dependable source of retirement income. By evaluating the various distribution methods and aligning them with their financial goals, participants can transition into retirement with confidence, knowing that their pension funds are poised to support their post-employment lifestyle.

In conclusion, Article 3 pension funds epitomize the essence of proactive and strategic retirement planning, offering a dynamic and comprehensive framework for individuals to cultivate financial resilience and security. By embracing the multifaceted opportunities and considerations embedded within these pension funds, participants can embark on their retirement journey with optimism and assurance, knowing that their diligent efforts in saving and investing have laid the groundwork for a fulfilling and dignified retirement.