Finance

Bank Insurance Fund (BIF) Definition

Published: October 13, 2023

Learn about the Bank Insurance Fund (BIF) in finance, its definition, and its crucial role in protecting depositors' funds.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Bank Insurance Fund (BIF)

Welcome to our Finance blog series! In today’s post, we will be delving into the intriguing world of the Bank Insurance Fund (BIF). If you’ve ever wondered what the BIF is and how it works, you’re in the right place. Let’s dive in and explore what this fund is all about.

Key Takeaways

- The Bank Insurance Fund (BIF) is a fund that ensures the stability and confidence of the U.S. banking system by providing deposit insurance coverage to depositors.

- BIF is managed by the Federal Deposit Insurance Corporation (FDIC) and helps protect individual deposit accounts in member banks up to a certain limit.

What is the Bank Insurance Fund (BIF)?

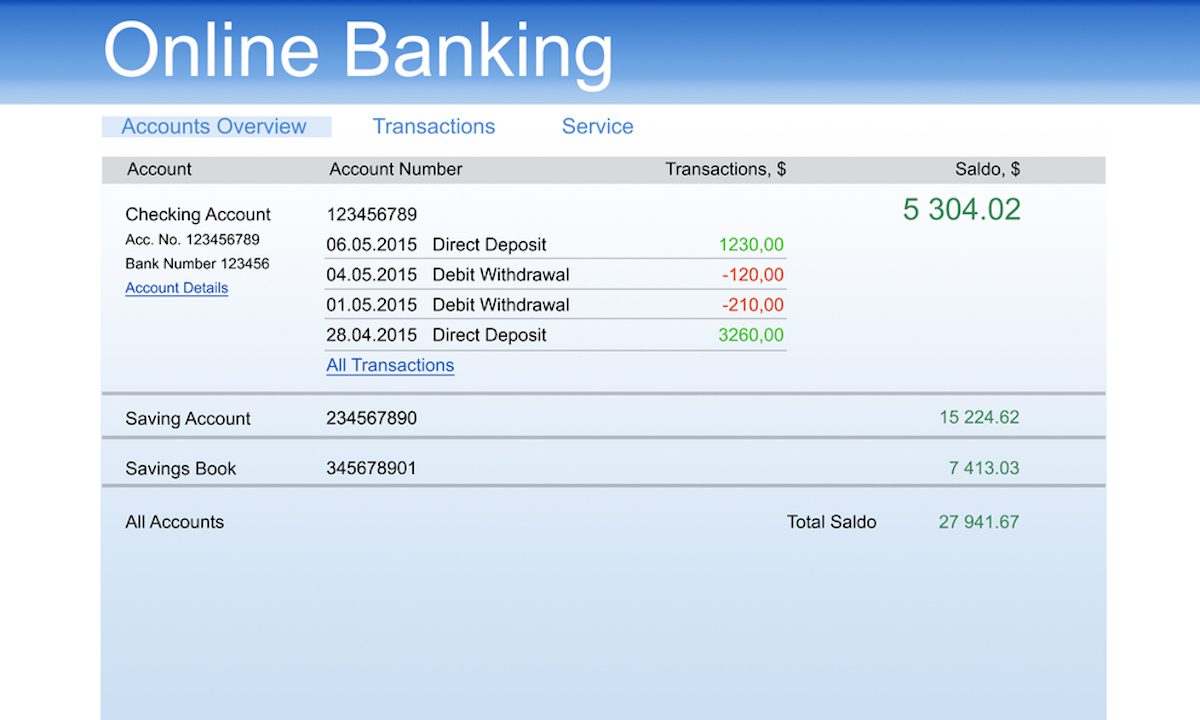

The Bank Insurance Fund (BIF) is one of two funds managed by the Federal Deposit Insurance Corporation (FDIC) to protect depositors in case of a bank failure. It plays a critical role in maintaining public confidence in the U.S. banking system.

The primary objective of the BIF is to ensure that depositors have access to their insured deposits even if a bank becomes insolvent or fails. This fund provides deposit insurance coverage up to a certain limit, protecting individual deposit accounts in member banks.

When you deposit money in a member bank, your funds are insured by the BIF. This means that in the event of a bank failure, the BIF will step in to protect your deposits, subject to the insurance limit.

How does the Bank Insurance Fund (BIF) work?

The BIF is funded through insurance premiums paid by member banks. These premiums are calculated based on the amount of insured deposits held by each bank and the overall health of the banking industry.

If a bank fails, the FDIC takes over as receiver and begins the process of liquidating the bank’s assets. The FDIC uses the funds collected from insurance premiums, including those from the BIF, to repay depositors’ insured deposits.

It’s important to note that the BIF only covers insured deposits, which include deposits such as savings accounts, certificates of deposit (CDs), and checking accounts. It does not cover other financial instruments like stocks, bonds, or mutual funds.

In the unlikely event that a bank failure exhausts the BIF funds, the FDIC has additional authority to borrow money from the U.S. Treasury to protect depositors. This further strengthens the safeguards provided by the BIF.

Conclusion

The Bank Insurance Fund (BIF) is a crucial component of the U.S. banking system, providing peace of mind to depositors across the country. Through effective management and funding by the FDIC, the BIF ensures the stability and confidence of the banking system, protecting depositors’ insured funds in case of bank failures.

Next time you visit your local bank, remember that your deposits are protected by the Bank Insurance Fund (BIF), keeping your hard-earned money safe and secure!