Home>Finance>Who Was The Bank For Alexander’s Department Stores Pension Funds?

Finance

Who Was The Bank For Alexander’s Department Stores Pension Funds?

Published: January 23, 2024

Discover the trusted bank for Alexander's Department Stores pension funds and ensure financial security. Find expert financial advice and solutions for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the intriguing world of finance and retail history! In this article, we will delve into the captivating story of Alexander's Department Stores and their pension funds. This journey will take us through the annals of time, exploring the evolution of this esteemed establishment and the financial management of its pension funds. Join us as we uncover the pivotal role played by a prominent bank in safeguarding the future of Alexander's Department Stores' retirees.

The tale of Alexander's Department Stores is a tapestry woven with the threads of ambition, innovation, and resilience. As we embark on this exploration, we will witness the growth and transformation of a retail empire that left an indelible mark on the fabric of American commerce. From its humble beginnings to its zenith, Alexander's Department Stores stood as a beacon of quality, service, and community.

Amidst the triumphs and tribulations of the retail landscape, the prudent management of pension funds emerged as a cornerstone of stability and security for the dedicated employees of Alexander's Department Stores. This crucial aspect of financial planning not only reflects the company's commitment to its workforce but also underscores the foresight and responsibility inherent in safeguarding the future well-being of employees post-retirement.

Our narrative will also shine a spotlight on the pivotal role of a distinguished financial institution in overseeing and nurturing the pension funds of Alexander's Department Stores. This partnership between the retail giant and the esteemed bank underscores the trust, diligence, and expertise required to steward pension funds effectively.

As we navigate through the enthralling saga of Alexander's Department Stores and their pension funds, we will unravel a compelling tale of financial prudence, institutional collaboration, and the enduring legacy of a retail empire. Join us as we venture into the captivating realm where commerce meets finance, and where the past intertwines with the present to shape the future.

History of Alexander’s Department Stores

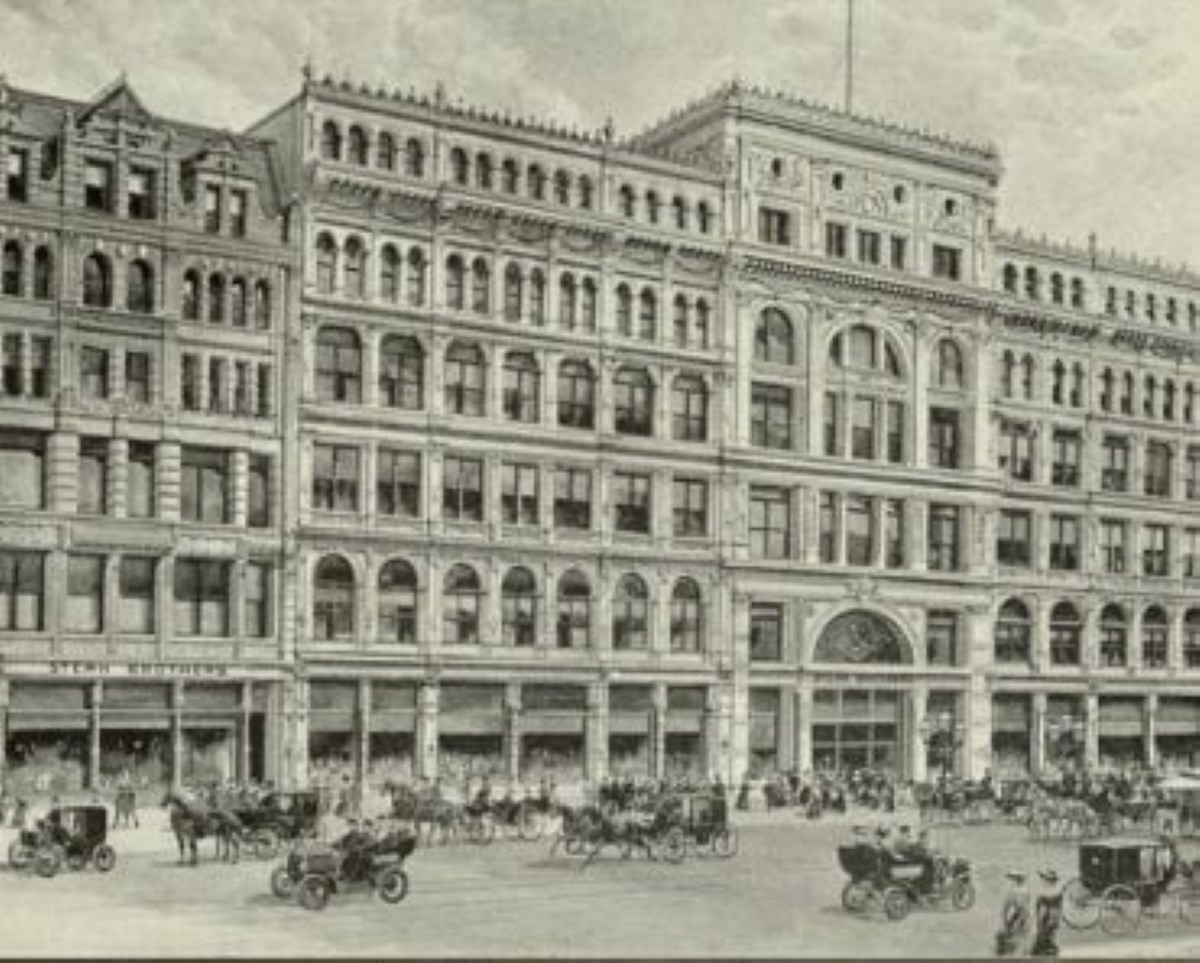

The saga of Alexander’s Department Stores traces its origins to the bustling streets of New York City in the early 1920s. Founded by the visionary entrepreneur George Farkas, Alexander’s rapidly burgeoned from a modest retail venture into a revered cornerstone of the city’s commercial landscape. With a steadfast commitment to offering quality merchandise and unparalleled customer service, Alexander’s swiftly garnered a loyal patronage, propelling its ascent to eminence.

Amidst the ebb and flow of economic tides, Alexander’s Department Stores exhibited a remarkable resilience, adapting to the evolving demands of consumers while upholding its unwavering dedication to excellence. The establishment’s expansion into multiple locations across New York City solidified its status as a preeminent retail institution, renowned for its diverse array of products and a superlative shopping experience.

Throughout its storied history, Alexander’s Department Stores became synonymous with innovation, introducing pioneering concepts such as suburban shopping centers that revolutionized the retail landscape. This trailblazing spirit not only propelled the brand to new heights of success but also left an indelible imprint on the fabric of American commerce.

However, the annals of Alexander’s Department Stores also bore witness to the winds of change, as the company navigated through various transitions and restructurings. Despite the challenges posed by shifting market dynamics, the legacy of Alexander’s endures as a testament to the enduring spirit of enterprise, adaptability, and a commitment to serving the community.

As we reflect on the illustrious history of Alexander’s Department Stores, we are reminded of its profound impact on the retail landscape and the enduring legacy it has bequeathed to future generations. The tale of Alexander’s serves as a poignant reminder of the enduring virtues of vision, resilience, and innovation, which continue to inspire and resonate in the annals of American commerce.

Pension Funds Management

The management of pension funds holds a pivotal role in the realm of corporate finance, serving as a cornerstone of employee welfare and financial planning. For companies like Alexander’s Department Stores, the prudent management of pension funds is not only a fiduciary responsibility but also a testament to their commitment to the long-term well-being of their workforce.

At the heart of pension funds management lies the imperative to safeguard the financial security of employees post-retirement. This entails astute investment strategies, diligent oversight, and a judicious approach to risk management. By diligently allocating funds into diversified portfolios, companies aim to ensure the sustainability and growth of pension assets, thereby fulfilling their obligation to retirees.

Effective pension funds management also demands a keen understanding of regulatory compliance and fiduciary duties. Companies must navigate a complex landscape of legal and financial regulations, ensuring that pension funds are administered in accordance with the highest standards of governance and transparency.

Moreover, the communication of pension benefits to employees is an integral facet of pension funds management. Transparent and comprehensive disclosure of retirement benefits fosters trust and confidence among employees, underscoring the company’s commitment to their financial well-being beyond their tenure of service.

As we delve into the realm of pension funds management, we encounter a confluence of financial acumen, regulatory diligence, and a profound sense of stewardship. The effective management of pension funds not only reflects a company’s financial prudence but also epitomizes its dedication to honoring the contributions and dedication of its employees.

The Bank for Alexander’s Department Stores Pension Funds

Amidst the intricate tapestry of pension funds management, the role of a trusted financial institution is paramount. For Alexander’s Department Stores, the stewardship of their pension funds found a steadfast ally in the form of a distinguished bank, whose expertise and integrity fortified the financial security of the company’s retirees.

The partnership between Alexander’s Department Stores and this esteemed bank was not merely transactional but emblematic of a shared commitment to prudence, reliability, and foresight. The bank’s role extended beyond the conventional realms of financial custodianship, encompassing strategic investment counsel, risk mitigation, and regulatory compliance.

Through astute financial acumen and a nuanced understanding of market dynamics, the bank steered the pension funds towards prudent investment avenues, seeking to optimize returns while mitigating risk. This approach not only safeguarded the sustainability of the pension assets but also exemplified the bank’s dedication to the long-term prosperity of the retirees.

Furthermore, the bank’s rigorous adherence to regulatory standards and fiduciary responsibilities instilled a sense of confidence and assurance in the management of pension funds. By upholding the highest benchmarks of transparency and governance, the bank fortified the trust reposed in it by Alexander’s Department Stores and its employees.

Moreover, the bank played a pivotal role in communicating the intricacies of pension fund management to the employees of Alexander’s, fostering a culture of financial literacy and empowerment. Through educational initiatives and transparent disclosures, the bank endeavored to demystify the complexities of pension planning, empowering employees to make informed decisions about their retirement futures.

The collaboration between Alexander’s Department Stores and this venerable bank stands as a testament to the symbiotic relationship between corporate stewardship and financial prudence. Together, they wove a narrative of diligence, trust, and foresight, ensuring that the pension funds stood as a bulwark of financial security for the dedicated employees of Alexander’s Department Stores.

Conclusion

As we draw the curtains on our exploration of Alexander’s Department Stores and their pension funds, we are imbued with a profound appreciation for the intertwining realms of commerce, finance, and human welfare. The journey through the annals of this esteemed retail establishment has illuminated the indomitable spirit of enterprise, innovation, and resilience that defined its legacy.

At the heart of Alexander’s enduring impact lies the unwavering commitment to its workforce, exemplified through the prudent management of pension funds. The company’s dedication to the long-term financial security of its employees underscores the ethos of responsibility and care that permeated its corporate stewardship.

Moreover, the partnership with a venerable bank in overseeing the pension funds epitomizes the harmonious synergy between institutional trust and financial prudence. Through astute investment counsel, regulatory diligence, and transparent communication, the bank fortified the foundation of financial security upon which the retirees of Alexander’s Department Stores could rely.

As we reflect on this captivating narrative, we are reminded that the legacy of Alexander’s Department Stores transcends the realm of commerce, resonating as a testament to the enduring values of integrity, dedication, and foresight. The saga of its pension funds management stands as a beacon of corporate responsibility, underscoring the profound impact that conscientious financial stewardship can impart on the lives of employees.

In the ever-evolving landscape of commerce and finance, the tale of Alexander’s Department Stores serves as a timeless parable, reminding us that the true measure of an institution’s legacy lies not only in its commercial triumphs but also in its steadfast commitment to the well-being of those who contributed to its prosperity.

As we bid adieu to this captivating narrative, we carry with us the enduring lessons of prudence, partnership, and the profound significance of pension funds management in shaping the future well-being of employees. The legacy of Alexander’s Department Stores and the guardianship of its pension funds stand as a testament to the enduring bond between corporate stewardship and employee welfare, weaving a legacy that transcends the boundaries of time and commerce.