Finance

Bank Letter Of Credit Policy Definition

Modified: February 21, 2024

Learn the definition and importance of a bank letter of credit policy in finance, ensuring accurate and secure transactions. Enhance your understanding of this crucial financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Bank Letter of Credit Policy

Welcome to our Finance category, where we dive deep into various financial topics. Today, we are going to explore the intricate world of Bank Letter of Credit policies. If you’ve ever wondered what a Bank Letter of Credit is and how it works, you’re in the right place. In this article, we’ll break down the definition, purpose, and key aspects of a Bank Letter of Credit policy.

Key Takeaways:

- A Bank Letter of Credit is a financial instrument used by importers and exporters to facilitate international trade transactions.

- It provides a guarantee to the seller that they will receive payment, as long as they meet certain conditions specified in the letter of credit.

Now, let’s delve into the details of what a Bank Letter of Credit policy entails:

What is a Bank Letter of Credit?

A Bank Letter of Credit is a written agreement issued by a banking institution on behalf of a buyer (importer) to guarantee payment to a seller (exporter) for goods or services rendered. It provides a level of security and trust in global trade by ensuring that the seller will receive payment as long as they fulfill the terms and conditions set forth in the letter of credit.

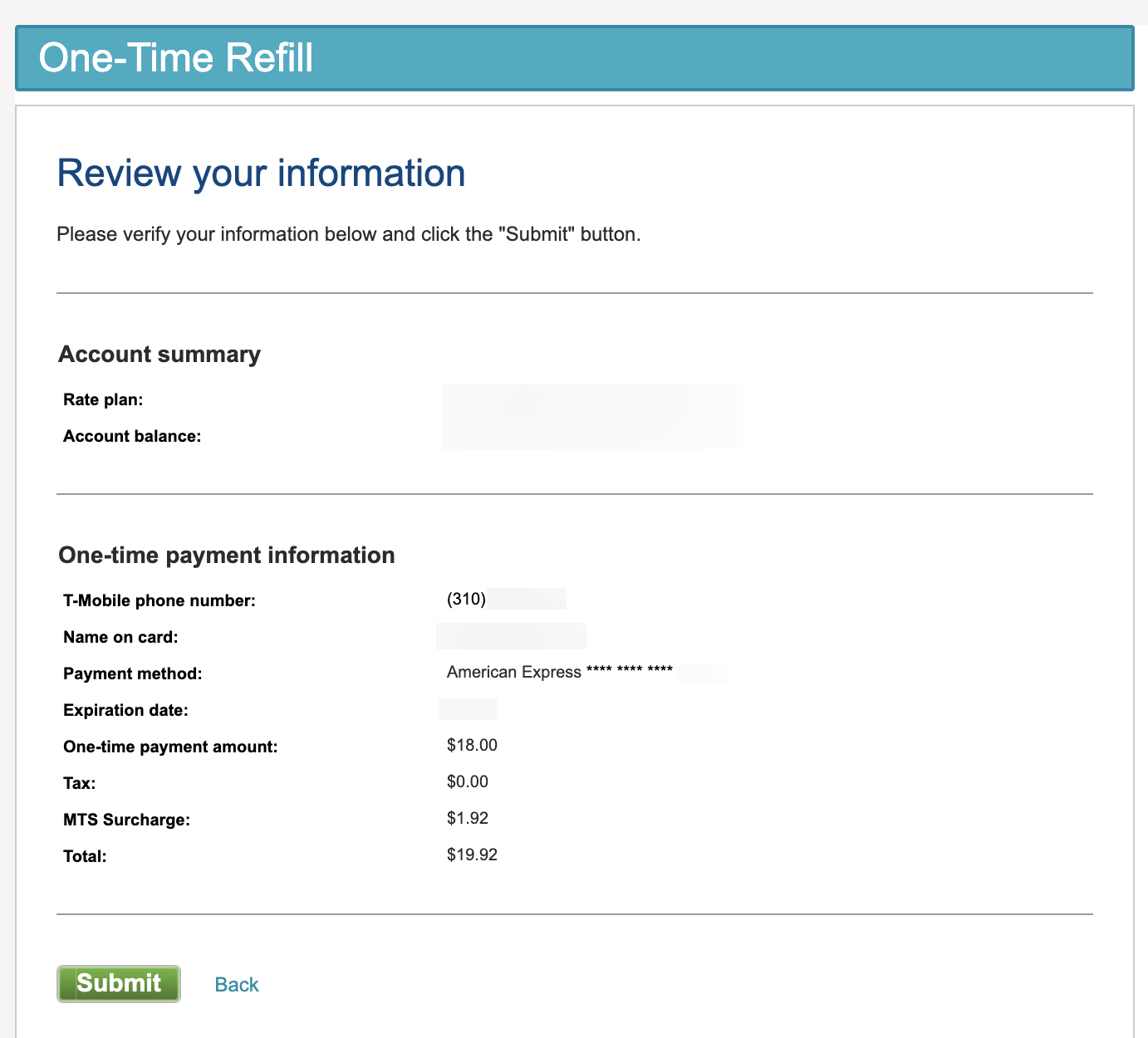

How Does a Bank Letter of Credit Work?

When a buyer and seller agree to use a Bank Letter of Credit, the buyer’s bank guarantees to make payment to the seller’s bank upon the completion of certain agreed-upon conditions. These conditions typically include providing the required documentation, such as proof of shipment or delivery, invoices, and certificates of origin.

Once the seller has fulfilled these conditions, they can present the necessary documents to their own bank, which then forwards them to the buyer’s bank. The buyer’s bank will review the documentation and, assuming everything is in order, will release payment to the seller. This process helps reduce the risk for both parties involved, providing security and confidence in international trade transactions.

Key Benefits of Bank Letter of Credit Policies

Bank Letter of Credit policies offer several advantages for both buyers and sellers engaged in international trade:

- Risk Mitigation: The letter of credit gives sellers confidence that they will receive payment, reducing the risk of non-payment.

- Flexibility: Letters of credit can be tailored to meet the specific needs of a trade transaction, allowing for customization based on the buyer and seller’s requirements.

- Global Acceptance: Bank Letter of Credit policies are accepted around the world, making them a widely recognized and trusted payment method in international trade.

- Documentation Control: The letter of credit provides a framework for specifying the required documentation, ensuring proper compliance with trade regulations.

- Trade Financing: Letters of credit can be used as collateral for financing, allowing businesses to access funds during the trade process.

Conclusion

In summary, a Bank Letter of Credit is an important financial tool that facilitates secure international trade transactions. By providing a guarantee of payment, it helps mitigate risk and build trust between buyers and sellers. Whether you are an importer or exporter, understanding the Bank Letter of Credit policy can help you navigate the complexities of global trade and ensure smooth transactions.

If you would like more information on Bank Letter of Credit policies or have any finance-related questions, feel free to reach out to us. We’d be happy to assist you!