Finance

What Is An Infinite Banking Policy

Published: October 13, 2023

Learn about the benefits of an infinite banking policy in the world of finance. Discover how it can provide financial security and long-term wealth-building opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Infinite Banking Policy

- Benefits of an Infinite Banking Policy

- How Does an Infinite Banking Policy Work?

- Key Features of an Infinite Banking Policy

- Factors to Consider Before Opting for an Infinite Banking Policy

- Pros and Cons of Infinite Banking Policies

- Comparison with Traditional Banking

- How to Choose the Right Infinite Banking Policy

- Case Studies: Success Stories of Infinite Banking Policies

- Conclusion

Introduction

Finance plays a crucial role in our lives, and finding the right financial strategy is essential for building and preserving wealth. Traditional banking has long been the go-to option for managing our money, but it’s not the only alternative. In recent years, an innovative approach known as an Infinite Banking Policy has gained popularity among savvy individuals seeking greater control over their finances. This article will delve into the concept of an Infinite Banking Policy, its benefits, how it works, and the factors to consider before choosing it as a financial strategy.

An Infinite Banking Policy, also known as the Infinite Banking Concept or the Bank on Yourself Method, is a strategy that allows individuals to become their own bankers. It empowers them to create their own personal banking system, bypassing traditional financial institutions. This approach provides individuals with a unique way to fund various life expenses, generate wealth, and build a legacy for future generations.

One of the key advantages of an Infinite Banking Policy is the ability to achieve financial independence and security. Rather than relying on external financial institutions, individuals can leverage the power of their own policies to make loans or borrow money for personal or business purposes. This approach provides a level of control and flexibility that is rare in traditional banking systems.

Another benefit of an Infinite Banking Policy is the potential for financial growth. Instead of paying interest to a bank, individuals can put their money into their own policy and earn interest on their savings. Over time, this can lead to substantial wealth accumulation and financial stability.

By establishing an Infinite Banking Policy, individuals also gain access to a source of tax-free income. The growth of the policy’s cash value is not subject to income tax, allowing individuals to maximize their wealth and minimize their tax liabilities. This feature is particularly beneficial for those in higher income brackets.

Additionally, an Infinite Banking Policy can serve as a powerful tool for legacy planning. The policy’s death benefit can be passed on to beneficiaries, providing financial security and a lasting inheritance for future generations. It’s a unique way to leave a financial legacy that extends beyond one’s lifetime.

In the following sections, we will explore the inner workings of an Infinite Banking Policy, the key features to look for, and the factors to consider when deciding if it’s the right financial strategy for you. We will also discuss the pros and cons of this approach and compare it to traditional banking. With this knowledge, you will be better equipped to make an informed decision and take control of your financial future.

Definition of Infinite Banking Policy

An Infinite Banking Policy is a financial strategy that allows individuals to create a personalized banking system within the framework of a whole life insurance policy. It is based on the concept of using the policy’s cash value as collateral to fund various expenses, investments, and savings goals.

Unlike traditional banking, where individuals deposit their money into a bank and earn interest on their savings, an Infinite Banking Policy flips the script. In this strategy, individuals fund their policy with premium payments, which then accumulate cash value over time. This cash value grows on a tax-deferred basis, and policyholders can access it through policy loans or withdrawals.

The key principle behind the Infinite Banking Policy is the idea of borrowing against the cash value of the policy to make purchases or investments. When individuals take out a policy loan, they use their policy’s cash value as collateral for the loan. This means that individuals are essentially borrowing from themselves, rather than relying on a bank or other external lender.

One of the distinct advantages of an Infinite Banking Policy is that the policyholder has control over the terms of the loan. They can determine the interest rate, repayment schedule, and the purpose of the loan. By acting as their own bank, individuals can enjoy flexibility and autonomy in managing their financial transactions.

It’s important to note that an Infinite Banking Policy is primarily structured as a whole life insurance policy. This means that it offers a death benefit to beneficiaries upon the policyholder’s passing, in addition to the cash value component. The death benefit can provide financial protection and serve as a form of inheritance.

While the concept of Infinite Banking may sound similar to other forms of life insurance policies with cash value, it is the strategic use of policy loans and withdrawals that sets it apart. The policyholder utilizes these funds to create a self-sustaining banking system, allowing for continuous growth and financial opportunity.

In summary, an Infinite Banking Policy is a financial strategy that leverages a whole life insurance policy’s cash value to create a personalized banking system. It provides individuals with control, flexibility, and potential growth opportunities while also offering financial protection through the death benefit component of the policy.

Benefits of an Infinite Banking Policy

An Infinite Banking Policy offers several advantages that make it an attractive financial strategy for individuals seeking greater control and flexibility over their finances. Here are some of the key benefits of implementing an Infinite Banking Policy:

- Financial Control: One of the primary benefits of an Infinite Banking Policy is the level of control it provides. Instead of relying on traditional banking institutions, individuals become their own bankers. They have the power to make loans to themselves and dictate the terms, interest rates, and repayment schedules. This level of control allows for better management and allocation of funds.

- Flexible Access to Cash: With an Infinite Banking Policy, individuals can access the policy’s cash value through policy loans or withdrawals. This means that they have immediate access to funds whenever they need them, without the hassle of going through a traditional loan application process. This flexibility can be especially beneficial in times of emergencies or when seizing investment opportunities.

- Tax Advantages: One significant advantage of an Infinite Banking Policy is its tax benefits. The growth of the policy’s cash value is tax-deferred, meaning individuals do not pay taxes on the earnings as long as the funds remain within the policy. Furthermore, policy loans are typically tax-free, as they are considered a return of the policyholder’s own money. This tax efficiency can lead to greater wealth accumulation and reduced tax liabilities.

- Asset Protection: Assets held within an Infinite Banking Policy are generally protected from creditors and legal judgments. This feature provides an additional layer of financial security and can be especially valuable for individuals in professions or industries with higher liability risks.

- Accumulation of Wealth: When individuals fund their Infinite Banking Policy, the premium payments go towards growing the policy’s cash value. Over time, the cash value accumulates and earns compound interest, which can lead to significant wealth accumulation. This growth can provide individuals with additional funds for various purposes, such as investing, purchasing real estate, or funding retirement.

- Legacy Planning: An Infinite Banking Policy can also serve as a tool for legacy planning. The death benefit component of the policy ensures that beneficiaries receive a tax-free inheritance upon the policyholder’s passing. This can provide financial security for loved ones and allow for the continuation of wealth building across generations.

Overall, an Infinite Banking Policy offers individuals the advantages of financial control, flexible access to cash, tax advantages, asset protection, wealth accumulation, and legacy planning. These benefits make it an appealing financial strategy for those looking to create a self-sustaining banking system and maximize their financial opportunities.

How Does an Infinite Banking Policy Work?

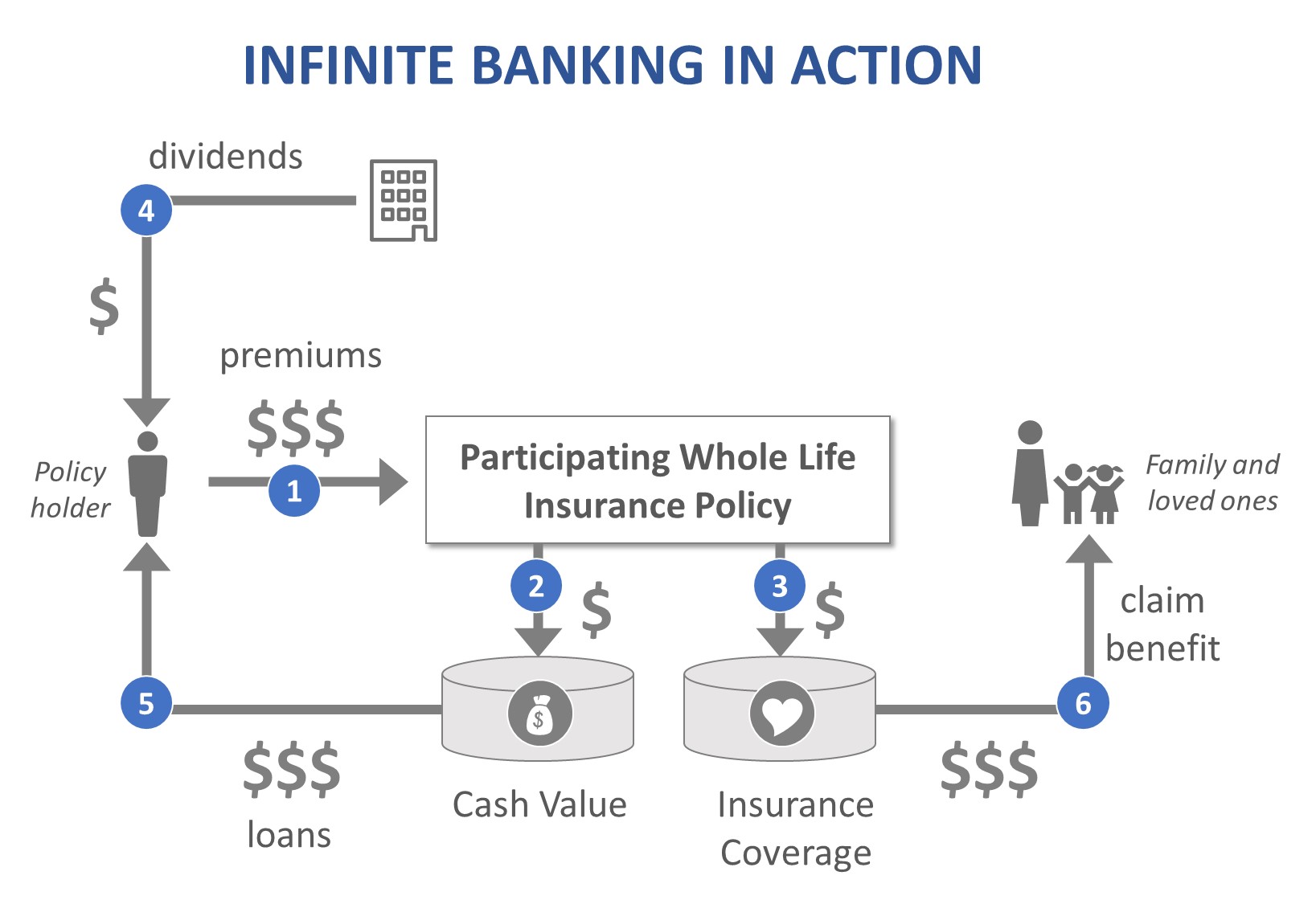

An Infinite Banking Policy operates on the foundation of a whole life insurance policy. Here is a step-by-step breakdown of how it works:

- Purchase a Whole Life Insurance Policy: To implement an Infinite Banking Policy, individuals first need to purchase a whole life insurance policy from a reputable insurance provider. This policy will have a death benefit component and a cash value component.

- Pay Premiums: Once the whole life insurance policy is in place, individuals will need to make regular premium payments to fund the policy. These premium payments go towards covering the cost of insurance coverage and building the policy’s cash value.

- Accumulation of Cash Value: Over time, the premium payments accumulate and contribute to the growth of the policy’s cash value. The cash value grows on a tax-deferred basis, meaning it can accumulate without incurring immediate tax liabilities.

- Accessing the Cash Value: Once the cash value has accumulated, individuals can access it through policy loans or withdrawals. Policy loans allow individuals to borrow against the cash value of their policy, using it as collateral. Policy loans typically have favorable interest rates and flexible repayment terms.

- Flexible Use of Funds: The funds obtained through policy loans can be used for various purposes. Individuals can use the funds to finance personal expenses, invest in businesses, pay for education expenses, or even purchase real estate. The flexibility of utilizing the funds is one of the key advantages of an Infinite Banking Policy.

- Repaying the Policy Loan: When individuals take out a policy loan, they are required to repay the loan amount along with the interest. This repayment process is crucial to maintaining the integrity of the Infinite Banking system. The repayment amount and schedule are determined by the policyholder, offering them the opportunity to strategically manage their finances.

- Continued Growth and Legacy Planning: As the policyholder continues to make premium payments, the cash value of the policy grows, providing the potential for ongoing wealth accumulation. Furthermore, in the event of the policyholder’s passing, the death benefit component of the policy is paid out to the beneficiaries, providing financial security and serving as a form of inheritance.

It’s important to note that implementing an Infinite Banking Policy requires careful planning and consideration. Working with a qualified financial professional who specializes in this strategy can provide valuable guidance and help tailor the policy to fit individual goals and needs.

Overall, an Infinite Banking Policy works by leveraging a whole life insurance policy’s cash value as a source of funds for various financial needs. It offers individuals the opportunity to become their own bankers, accessing and controlling their money in a way that aligns with their financial objectives.

Key Features of an Infinite Banking Policy

Understanding the key features of an Infinite Banking Policy is essential for individuals considering this financial strategy. Here are the main features that distinguish an Infinite Banking Policy:

- Whole Life Insurance: An Infinite Banking Policy is structured as a whole life insurance policy. This means that it provides lifelong coverage and includes a death benefit component. The death benefit ensures that beneficiaries receive a tax-free payout when the policyholder passes away.

- Cash Value Growth: One of the primary features of an Infinite Banking Policy is the growth of the policy’s cash value. The premium payments made by the policyholder go towards building the cash value over time. This cash value grows on a tax-deferred basis, allowing for potential compound interest accumulation.

- Policy Loans: With an Infinite Banking Policy, individuals have the ability to take out policy loans using the cash value as collateral. These loans offer individuals the flexibility to access funds for various purposes, such as investments, business ventures, education expenses, or personal needs. Policy loans typically have favorable interest rates and customizable repayment terms.

- Flexible Repayment: When individuals take out a policy loan, they have the freedom to determine the repayment schedule and amount. This feature allows individuals to manage their finances strategically and tailor the repayment terms to their specific needs and circumstances.

- Tax Advantages: An Infinite Banking Policy offers several tax advantages. The growth of the policy’s cash value is tax-deferred, meaning individuals do not pay taxes on the earnings until they withdraw the funds. Additionally, policy loans are typically tax-free, as they are considered a return of the policyholder’s own money.

- Asset Protection: Assets held within an Infinite Banking Policy, including the cash value and the death benefit, are generally protected from creditors and legal judgments. This feature provides an added layer of financial security for individuals in professions or industries with higher liability risks.

- Legacy Planning: Since an Infinite Banking Policy includes a death benefit, it can play a crucial role in legacy planning. The death benefit ensures that beneficiaries receive a tax-free inheritance upon the policyholder’s passing. This allows individuals to leave a lasting financial legacy for their loved ones.

These key features make an Infinite Banking Policy an attractive financial strategy for individuals seeking control over their finances, flexible access to cash, tax advantages, asset protection, and the ability to build and pass on wealth.

It’s important to note that the specific features and benefits of an Infinite Banking Policy can vary depending on the insurance provider and the policy’s terms and conditions. Working with a knowledgeable financial professional who specializes in Infinite Banking can help individuals navigate the options and select a policy that aligns with their financial goals and aspirations.

Factors to Consider Before Opting for an Infinite Banking Policy

Before deciding to implement an Infinite Banking Policy, it’s crucial to carefully consider several factors to ensure that this financial strategy aligns with your goals and financial situation. Here are some key factors to evaluate:

- Financial Stability: Implementing an Infinite Banking Policy requires a long-term financial commitment. Ensure that you have the financial stability to make the required premium payments consistently.

- Insurance Provider: Research and select a reputable insurance provider with a strong track record. Work with a provider that is experienced in offering whole life insurance policies tailored for Infinite Banking strategies.

- Policy Costs: Assess the costs associated with the policy, including premiums, fees, and charges. Understand the cost structure and evaluate whether it aligns with your financial goals and budget.

- Policy Performance: Review the historical performance of the insurance provider’s policies and their ability to consistently generate cash value growth. It’s important to choose a policy that offers competitive returns and stable growth.

- Loan Interest Rates: Understand the interest rates charged on policy loans. Compare them with other loan options available in the market to ensure that the rates offered are competitive and favorable.

- Flexibility and Control: Evaluate the level of control and flexibility you have over the policy. Understand the terms and conditions for accessing and repaying policy loans. Ensure that the policy offers the desired flexibility to meet your financial needs.

- Tax Implications: Consider the tax advantages associated with an Infinite Banking Policy. Consult with a tax professional to fully understand the potential tax benefits and implications based on your specific financial situation and jurisdiction.

- Time Horizon: Assess your time horizon for utilizing the policy. An Infinite Banking Policy requires a long-term commitment to fully benefit from cash value accumulation and overall growth. Evaluate whether the time horizon aligns with your financial goals and objectives.

- Risk Tolerance: Understand that an Infinite Banking Policy involves risk, as the policy’s cash value is subject to market performance and other factors. Evaluate your risk tolerance and ensure that you are comfortable with the potential risks involved in the strategy.

It is crucial to work with a qualified financial professional who specializes in Infinite Banking strategies. They can provide personalized advice, assist in policy selection, and help you navigate the complexities of implementing and managing an Infinite Banking Policy.

By carefully considering these factors, you can make an informed decision and determine if an Infinite Banking Policy is the right financial strategy for you.

Pros and Cons of Infinite Banking Policies

When considering an Infinite Banking Policy as a financial strategy, it is important to weigh the pros and cons. Here we explore both sides of the coin:

Pros:

- Financial Control: An Infinite Banking Policy provides individuals with control over their finances. They can act as their own banker, determining the terms, interest rates, and repayment schedule for policy loans.

- Flexibility of Access to Cash: Individuals can access the cash value of their policy through policy loans or withdrawals. This provides flexibility in managing financial needs, whether for personal expenses or investment opportunities.

- Tax Advantages: Infinite Banking Policies offer tax advantages. The growth of the cash value is tax-deferred, and policy loans are typically tax-free. This can lead to greater wealth accumulation and reduced tax liabilities.

- Asset Protection: Assets held within an Infinite Banking Policy, including the cash value and death benefit, are generally protected from creditors and legal judgments. This can provide additional financial security, especially for individuals with higher liability risks.

- Wealth Accumulation: By leveraging the cash value of the policy, individuals can accumulate wealth over time. The policy’s cash value grows on a tax-deferred basis, potentially leading to significant earnings and long-term financial growth.

- Legacy Planning: The death benefit component of an Infinite Banking Policy ensures that beneficiaries receive a tax-free inheritance. This can serve as a form of legacy planning, providing financial security and leaving a lasting impact.

Cons:

- Policy Costs: Infinite Banking Policies often have higher premiums compared to other life insurance policies. This can be a financial burden for individuals with limited budgets or who are seeking lower-cost insurance options.

- Interest on Policy Loans: While policy loans offer flexibility, they are not interest-free. Individuals who take out policy loans will need to repay the loan amount along with the interest, which can add costs and potentially reduce the policy’s overall growth.

- Market Risk: The cash value of an Infinite Banking Policy is subject to market performance. If the policy’s underlying investments do not generate sufficient returns, it may impact the growth of the cash value and the overall effectiveness of the strategy.

- Long-Term Commitment: Implementing an Infinite Banking Policy requires a long-term commitment to fully benefit from its features and potential growth. Individuals should evaluate their ability and willingness to commit to the policy over an extended period.

- Complexity: Infinite Banking Policies can be complex and require careful planning and understanding. Working with a knowledgeable financial professional is essential to ensure proper implementation and management of the policy.

It is essential to carefully evaluate these pros and cons in relation to your individual financial goals, risk tolerance, and overall financial situation. Consider consulting with a qualified financial professional who specializes in Infinite Banking to help you navigate the decision-making process.

Comparison with Traditional Banking

When considering an Infinite Banking Policy, it’s helpful to compare it with traditional banking to understand the key differences. Here’s a comparison between Infinite Banking and traditional banking:

Ownership and Control:

Infinite Banking: With an Infinite Banking Policy, individuals become their own bankers. They have full ownership and control over their policy and the funds within it. They can make loans to themselves and dictate the terms of those loans, offering ultimate flexibility and control.

Traditional Banking: In traditional banking, individuals deposit their money into a bank, effectively giving up ownership and control over those funds. They must adhere to the bank’s terms and conditions when accessing the funds or obtaining a loan. The bank retains control over the financial transactions.

Access to Cash:

Infinite Banking: In an Infinite Banking Policy, individuals can access the cash value through policy loans or withdrawals. This provides immediate access to funds without the need for credit checks or approval from external lenders. The process is typically faster and more flexible compared to traditional bank loans.

Traditional Banking: To access cash from a traditional bank, individuals typically need to go through a loan application process. This involves credit checks, documentation, and approval from the bank. The process can be lengthy and may not offer the same level of flexibility as an Infinite Banking Policy.

Tax Benefits:

Infinite Banking: Infinite Banking Policies offer tax advantages, as the growth of the policy’s cash value is tax-deferred, and policy loans are typically tax-free. This can lead to greater wealth accumulation and reduced tax liabilities for individuals.

Traditional Banking: Traditional banking transactions do not offer the same tax advantages as Infinite Banking Policies. Interest earned on savings accounts or investments is typically taxable, and individuals may face tax obligations when repaying bank loans.

Interest and Fees:

Infinite Banking: Interest rates on policy loans within Infinite Banking Policies are typically favorable compared to traditional bank loans. Additionally, policyholders have greater control over the interest rates and can structure repayment terms based on their financial needs.

Traditional Banking: Interest rates on traditional bank loans can vary and are often determined by the bank’s policies and market conditions. Individuals have less control over these rates and may be subject to additional fees and charges imposed by the bank.

Use of Funds:

Infinite Banking: With an Infinite Banking Policy, individuals have the flexibility to use the funds obtained through policy loans for any purpose. They can invest in businesses, fund education expenses, make personal purchases, or use them for other financial needs. The policyholder has discretion over the use of the funds.

Traditional Banking: Traditional bank loans usually come with restrictions on how the funds can be utilized. Lenders may place limitations on the purpose of the loan, requiring individuals to use the funds for specific predetermined reasons, such as purchasing a home or financing a car.

While traditional banking offers established infrastructure, convenience, and a wide range of financial services, an Infinite Banking Policy allows individuals to take ownership and control of their financial destiny. By becoming their own banker, they can enjoy greater flexibility, tax advantages, and potential long-term wealth accumulation.

It’s important to assess your individual financial goals, risk tolerance, and preferences when deciding between the two options. Consulting with a knowledgeable financial professional can help you make an informed decision based on your specific needs and circumstances.

How to Choose the Right Infinite Banking Policy

Choosing the right Infinite Banking Policy is a crucial step in implementing this financial strategy effectively. Here are some key factors to consider when selecting the policy that aligns with your financial goals:

- Research Insurance Providers: Start by researching reputable insurance providers that offer Infinite Banking Policies. Look for providers with a strong track record, positive customer reviews, and experienced professionals who specialize in this strategy.

- Policy Performance: Evaluate the historical performance of the insurance provider’s policies. Look for policies that have demonstrated consistent cash value growth over time. Consider the provider’s investment strategies and financial stability.

- Policy Costs: Assess the costs associated with the policy, including premiums, fees, and charges. Compare the costs of different policies and ensure they fit within your budget. Request illustrations from insurance providers to understand how the policy costs may change over the years.

- Policy Flexibility: Consider the flexibility of the policy in terms of accessing cash value, determining loan terms, and customizing repayment schedules. Look for policies that offer options that align with your financial needs and long-term objectives.

- Loan Interest Rates: Compare the interest rates charged on policy loans among different insurance providers. Look for competitive rates that are favorable compared to traditional bank loans. Lower interest rates can help optimize the benefits of an Infinite Banking Policy.

- Financial Strength of the Provider: Ensure the insurance provider has a strong financial standing. Look for providers with high credit ratings and a solid reputation within the industry. This ensures that the provider will be able to honor policy obligations and support the growth of your policy over the long term.

- Expert Guidance: Seek guidance from a qualified financial professional who specializes in Infinite Banking. They can help analyze your financial situation, understand your goals, and recommend the most suitable policies from reputable insurance providers.

- Policy Customization: Consider the ability to customize the policy to fit your specific needs. Some providers may offer options to add riders or additional benefits that align with your financial goals, such as long-term care coverage or disability income protection.

- Education and Support: Look for insurance providers and professionals who offer educational resources and ongoing support in the implementation and management of an Infinite Banking Policy. This ensures that you remain informed and empowered throughout the process.

Ultimately, the right Infinite Banking Policy will depend on your unique financial goals, risk tolerance, and preferences. Working with a knowledgeable financial professional who specializes in Infinite Banking can provide invaluable guidance in selecting the policy that best suits your needs.

Remember to review and understand the policy documents thoroughly before making a final decision. Be sure to clarify any questions you may have with the insurance provider or financial professional to ensure you have a clear understanding of the policy terms and features.

Case Studies: Success Stories of Infinite Banking Policies

To understand the potential benefits and outcomes of implementing an Infinite Banking Policy, let’s explore a few success stories of individuals who have utilized this financial strategy:

Case Study 1: John’s Real Estate Investment

John, a business owner, decided to implement an Infinite Banking Policy to fund his real estate investments. Over the years, John consistently funded his policy with premium payments and allowed the cash value to grow. When a lucrative real estate opportunity arose, John took out a policy loan, using the cash value as collateral.

By utilizing his policy’s cash value, John was able to secure a down payment for the property quickly, bypassing the time-consuming bank loan application process. After acquiring the property, John continued making repayments to his policy, effectively paying himself back with interest instead of paying a traditional bank.

Over time, the real estate investment proved successful, generating rental income and appreciating in value. John used the cash flow from the property to repay his policy loan, replenishing the cash value and enabling him to finance future investments. The growth of the policy’s cash value and the success of his real estate ventures allowed John to accumulate substantial wealth and achieve financial independence.

Case Study 2: Ellen’s College Funding

Ellen, a parent with two young children, opted for an Infinite Banking Policy to finance her children’s college education. She understood the rising costs of higher education and wanted to ensure a sound financial plan to support her children’s future educational needs.

Ellen consistently funded her policy over the years, taking advantage of the cash value growth. As her children approached college age, Ellen utilized her policy’s cash value to fund their tuition expenses. By taking out policy loans, she was able to access the necessary funds without incurring the high-interest rates typically associated with student loans.

Utilizing her policy as a source of funding allowed Ellen to pay for her children’s education while maintaining control and flexibility over the repayment process. She set reasonable repayment terms based on her financial situation and made regular repayments into her policy to restore the cash value. Ultimately, this strategy helped Ellen minimize the financial burden of college expenses and provide her children with quality education.

Case Study 3: Robert’s Retirement Income

Robert, nearing retirement age, sought a reliable source of tax-efficient retirement income. He chose an Infinite Banking Policy to supplement his other retirement savings and generate a steady stream of income during his golden years.

Robert funded his policy over several decades, allowing the cash value to grow significantly. As he transitioned into retirement, he began taking policy loans to supplement his retirement income while keeping his tax liabilities low. The loans were tax-free and did not increase his taxable income since they were considered a return of his own money.

By utilizing his policy’s cash value in this way, Robert was able to maintain a comfortable standard of living in retirement without needing to rely solely on traditional sources of income. The tax advantages and flexibility of an Infinite Banking Policy allowed Robert to enjoy a secure retirement and preserve his wealth for future generations.

These case studies illustrate the potential benefits and outcomes of implementing an Infinite Banking Policy. While they are fictional, they offer insights into how individuals can leverage this financial strategy to achieve various goals, including wealth accumulation, funding education expenses, and securing retirement income.

It’s important to note that the success of an Infinite Banking Policy depends on many factors, including market performance and individual circumstances. Consulting with a knowledgeable financial professional will provide personalized advice tailored to your specific needs and increase your chances of achieving your financial goals.

Conclusion

Implementing an Infinite Banking Policy can provide individuals with a unique and powerful financial strategy to take control of their money, generate wealth, and build a lasting legacy. This approach allows individuals to become their own bankers, utilizing the cash value of their whole life insurance policies to fund various expenses, investments, and savings goals.

Throughout this article, we have explored the concept of an Infinite Banking Policy, its benefits, how it works, key features, factors to consider, and comparisons with traditional banking. We have also examined case studies showcasing the potential success stories of individuals who have implemented this strategy.

Key benefits of an Infinite Banking Policy include financial control, flexible access to cash, tax advantages, asset protection, wealth accumulation, and the potential for legacy planning. By leveraging these benefits, individuals can achieve financial independence, meet their short-term and long-term financial needs, and leave a lasting financial legacy for their loved ones.

When choosing an Infinite Banking Policy, it is crucial to research insurance providers, evaluate policy performance and costs, assess policy flexibility, consider loan interest rates, and seek guidance from qualified financial professionals. These factors will ensure that the chosen policy aligns with your financial goals and suits your individual needs.

An Infinite Banking Policy is not without its drawbacks, including policy costs, loan interest rates, market risks, long-term commitments, and complexity. Understanding these cons is essential when making an informed decision about whether this strategy is suitable for your financial situation.

In conclusion, an Infinite Banking Policy offers a unique way to take control of your finances, access flexible cash, enjoy tax advantages, protect your assets, and accumulate wealth. By leveraging the inherent benefits and tailoring the policy to your needs, you can create a self-sustaining banking system that puts you in the driver’s seat of your financial journey.

Remember, an Infinite Banking Policy is a long-term financial strategy that requires careful planning, periodic review, and ongoing management. Working with a knowledgeable financial professional can help you navigate the intricacies of implementation and ensure that your Infinite Banking Policy is optimized to meet your goals and aspirations.