Home>Finance>Bearer Bond: Definition, How It Works, And Why They’re Valuable

Finance

Bearer Bond: Definition, How It Works, And Why They’re Valuable

Published: October 15, 2023

Learn about bearer bonds, their definition, how they work, and why they hold value in the world of finance. Find out more!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Intrigue of Bearer Bonds: Understanding Their Definition, Function, and Value

In the world of finance, there are various investment instruments that quite literally hold value. One such instrument is the bearer bond, a fascinating financial tool that has its own unique allure. But what exactly is a bearer bond, how does it work, and why are they considered valuable? Let’s dive into the fascinating world of bearer bonds to elucidate their intricacies.

Key Takeaways:

- A bearer bond is a debt instrument that is owned by the holder (or bearer) of the physical certificate, allowing them to claim principal and interest payments.

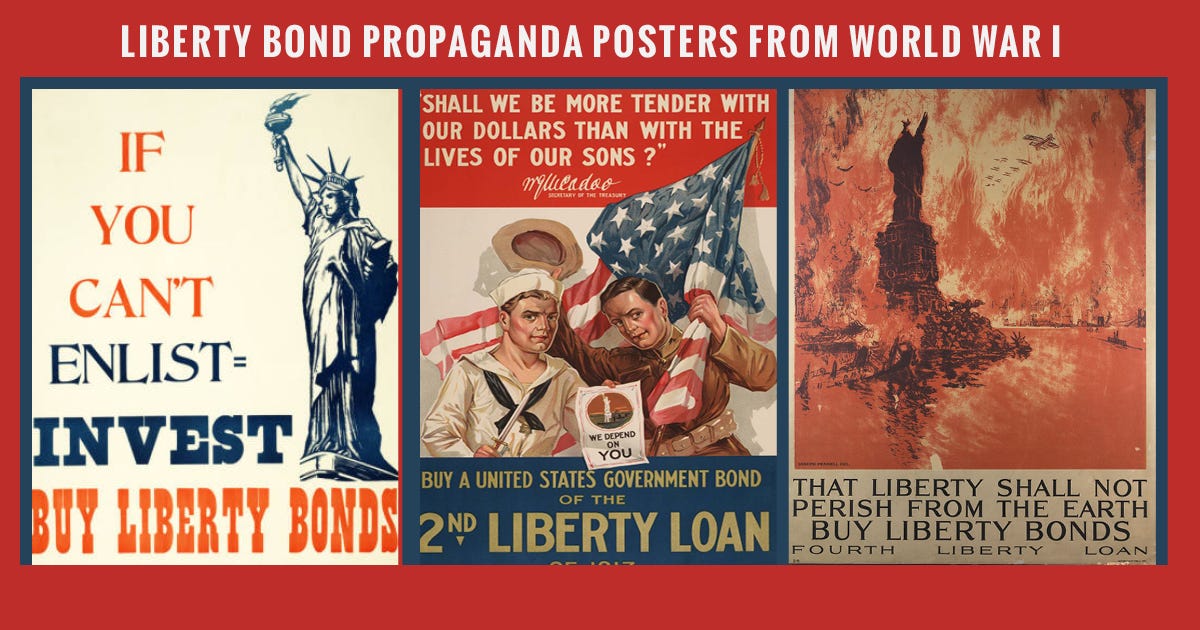

- Bearer bonds used to be prevalent but have become rare due to improvements in technology and concerns of anonymity encouraging illegal activities.

The Definition of a Bearer Bond

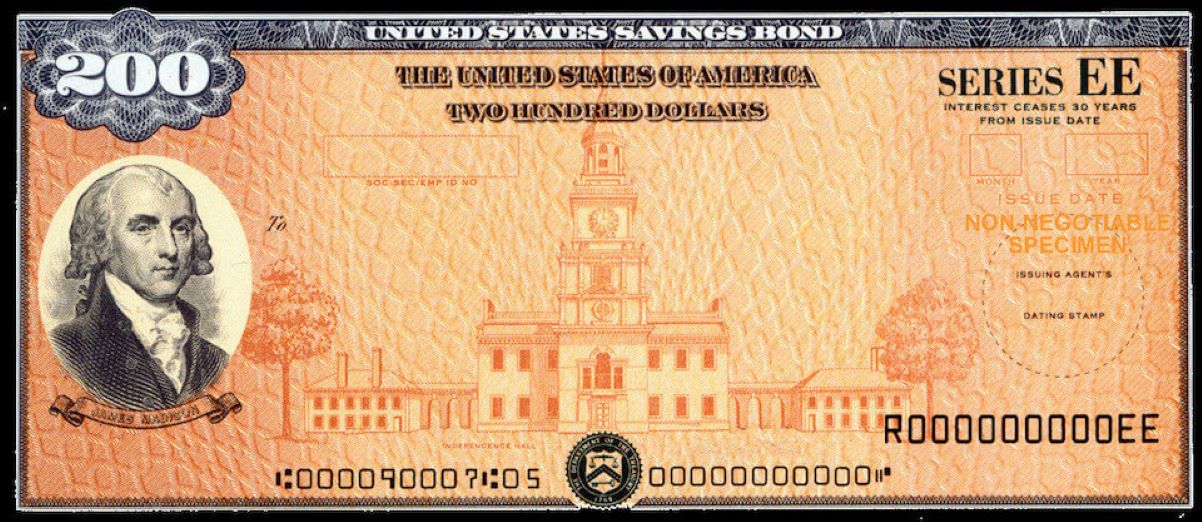

A bearer bond is a type of debt instrument that is not registered in the owner’s name. Instead, it is owned by the holder (or bearer) of the physical certificate itself. The bond represents a promise by the issuer to repay the principal amount at maturity and makes periodic interest payments to the holder.

Unlike other types of bonds, bearer bonds do not have a record of ownership. Instead, they are considered negotiable instruments, meaning that they can be bought, sold, or transferred by simply physically handing over the bond itself. This gives the holder a certain level of anonymity, as the bond does not contain any personal information linking it to the owner.

How Bearer Bonds Work

Bearer bonds work in a straightforward manner:

- Issuer: A company, government, or other institution issues the bearer bond, promising to repay the principal amount plus interest at maturity.

- Purchase: The bearer bond is initially purchased by an individual or entity, typically through a broker or a financial institution.

- Owning and Trading: Since the bearer bond is a physical certificate, the owner has physical possession of it. The owner can hold onto the bond until maturity or decide to sell or transfer it to another individual, who can then become the new holder.

- Interest Payments: Periodically, the issuer pays interest to the holder of the bearer bond. These payments can be made through coupons attached to the certificate or through electronic means, depending on the specific bond.

- Maturity: At the bond’s maturity date, the issuer repays the principal amount to the holder.

It is important to note that due to changes in technology and concerns about money laundering and other illegal activities, bearer bonds have become increasingly rare. In fact, many countries have phased out their use entirely or imposed stringent regulations on their issuance.

The Value of Bearer Bonds

The value of bearer bonds lies in several factors:

- Flexibility: Since bearer bonds do not have registered ownership, they can be easily transferred, making them highly liquid and versatile financial instruments.

- Anonymity: The lack of personal information attached to bearer bonds provides a level of anonymity for the holder, making them attractive to those who value privacy.

- Inflation Protection: Bearer bonds typically offer fixed interest rates that can act as a hedge against inflation.

However, it is important to consider the risks associated with bearer bonds. If the physical certificate is lost, stolen, or destroyed, it could result in the loss of the bond’s value. Additionally, the lack of transparency and regulatory oversight can make bearer bonds more susceptible to fraud or illegal activities.

While bearer bonds may have lost their prominence in today’s financial landscape, they continue to remain intriguing due to their historical significance and association with secrecy. Understanding their definition, function, and value provides us with a glimpse into the evolution of financial instruments and their role in shaping the world of finance.