Finance

How To Get Bearer Bonds

Published: October 14, 2023

Learn the ins and outs of bearer bonds and explore their role in finance. Discover how to acquire and utilize these valuable investment instruments for greater financial growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of bearer bonds! In the realm of finance, bearer bonds have long held a mystique, conjuring images of secret transactions and hidden fortunes. But what exactly are bearer bonds, and how can you get your hands on them?

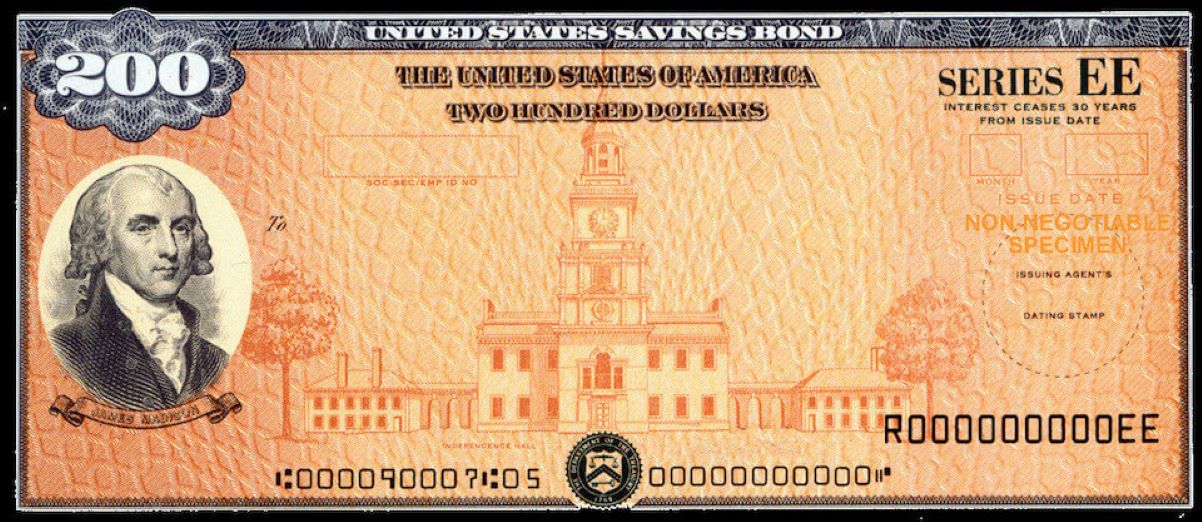

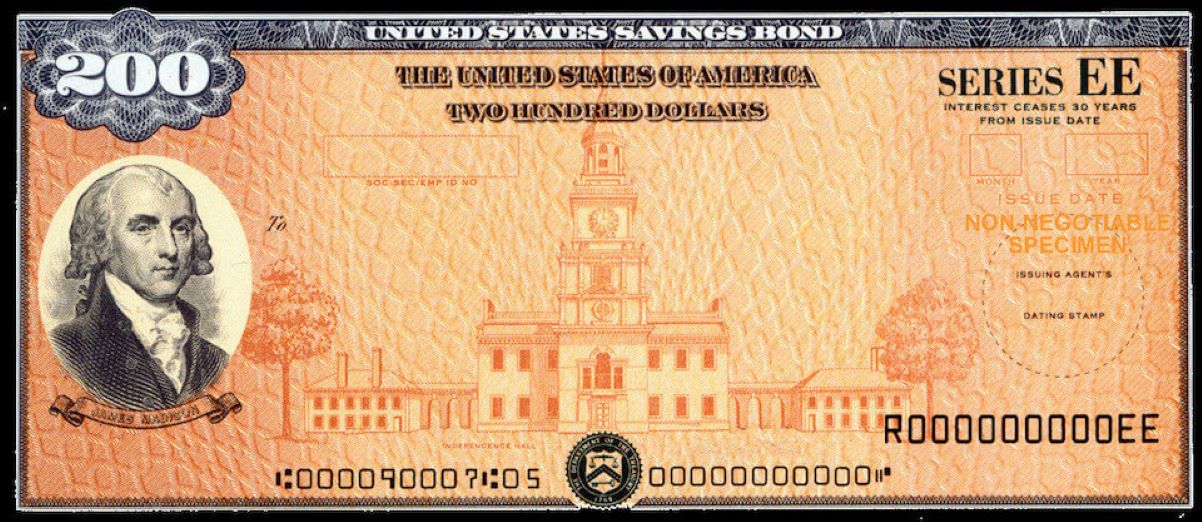

Bearer bonds, also known as coupon bonds or bearer debentures, are a type of fixed-income security. Unlike traditional bonds, which are registered in the name of a specific owner, bearer bonds are unregistered and are physically possessed by whoever holds them. The bondholder is entitled to the principal amount and periodic interest payments, which are typically represented by detachable coupons.

The allure of bearer bonds lies in their anonymity and portability. This makes them attractive to investors who value privacy and flexibility in managing their investments. However, due to their unique characteristics, bearer bonds also carry certain risks and require careful consideration before pursuing this avenue.

In this article, we will delve into the world of bearer bonds, exploring their benefits and risks, as well as the steps you can take to obtain them. We will also touch on the legal considerations associated with these bonds.

So, whether you are a seasoned investor or simply curious about alternative investment options, let’s uncover the captivating world of bearer bonds and discover how you can join the ranks of bondholders who have embraced this unique financial instrument.

What Are Bearer Bonds?

Bearer bonds, also known as coupon bonds or bearer debentures, are a type of fixed-income security that operates differently from traditional registered bonds. Unlike registered bonds, which are linked to a specific owner through a registration process, bearer bonds are unregistered and are physically possessed by the bondholder.

Bearer bonds are typically issued in paper form and consist of two main components: the principal amount and periodic interest payments. The principal amount represents the face value of the bond and is the amount that will be repaid to the bondholder at maturity. The interest payments, usually semi-annual or annual, are provided in the form of detachable coupons attached to the bond certificate. These coupons can be submitted to the issuer for redemption during specific payment periods.

One of the key characteristics of bearer bonds is the anonymity they provide to bondholders. Since the bonds are not registered in any specific name, ownership can easily be transferred by physically handing over the bond certificate. This level of privacy makes bearer bonds particularly attractive to investors who value discretion in their financial affairs.

An additional advantage of bearer bonds is their portability. The physical nature of these bonds allows investors to hold and transport them easily, providing flexibility in managing and trading their investments. This can be especially beneficial for those who want to diversify their portfolios or take advantage of investment opportunities in different markets.

Bearer bonds are typically issued by government entities, municipalities, and corporations. They are often used by governments to raise capital for various projects or to fund budget deficits. For corporations, bearer bonds can be a means of accessing financing outside of the traditional banking system.

It’s important to note that bearer bonds have become less common in recent years due to regulatory changes and advancements in financial technology. Many countries have phased out or restricted the issuance of bearer bonds due to concerns about money laundering, tax evasion, and other illicit activities.

Now that we have a basic understanding of bearer bonds, let’s explore the benefits they offer and why investors may consider adding them to their investment portfolios.

The Benefits of Bearer Bonds

Bearer bonds offer several advantages that make them enticing to certain investors. Let’s explore some of the key benefits:

- Privacy and Anonymity: One of the biggest draws of bearer bonds is the privacy they provide. Since these bonds are unregistered and can be physically possessed, the identity of the bondholder remains confidential. This confidentiality can be appealing to individuals and organizations who prefer to keep their financial affairs private.

- Portability and Flexibility: Bearer bonds, being physical documents, offer a high level of portability. Investors can easily transfer and transport these bonds without any need for complicated paperwork or third-party involvement. This flexibility allows investors to take advantage of investment opportunities in different markets and diversify their portfolios with ease.

- No Need for Bank Accounts: Unlike registered bonds, bearer bonds do not require an investor to have a bank account or go through the process of opening one. This can be beneficial for individuals or entities who may not have access to traditional banking services or who prefer to keep their financial dealings separate from their banking activities.

- Potential Tax Advantages: Depending on the jurisdiction, bearer bonds may offer certain tax advantages. Some countries do not levy taxes on interest earned from bearer bonds, making them an attractive option for investors seeking tax-efficient investments.

- Global Investment Opportunities: Bearer bonds can be issued by various entities, including governments, municipalities, and corporations from different countries. This allows investors to access a wide range of global investment opportunities and potentially benefit from different economic conditions and interest rate differentials.

While bearer bonds offer these advantages, it’s important to be aware of the associated risks. In the next section, we will explore the risks involved in investing in bearer bonds to help you make informed decisions.

Understanding the Risks Associated with Bearer Bonds

While bearer bonds offer certain benefits, it’s essential to understand the risks associated with investing in them. Here are some important considerations:

- Loss or Theft: Bearer bonds are physical documents, which means there is a risk of loss or theft. Unlike registered bonds, where ownership can be easily tracked and verified, if a bearer bond is lost or stolen, it can be challenging to recover or prove ownership. Therefore, ensuring the safekeeping of bearer bonds is crucial.

- Lack of Income Documentation: Bearer bonds are unregistered, which means there is no official record of the income received from these bonds. This can complicate tax reporting and compliance, especially in jurisdictions where financial institutions are required to report income generated by certain financial instruments.

- Counterfeit Risk: Bearer bonds, being physical documents, are susceptible to counterfeiting. Investors need to be vigilant and ensure that they are dealing with legitimate bonds issued by reputable entities. Verifying the authenticity of bearer bonds can be challenging, and investors may need to rely on expert advice or engage with trusted financial institutions.

- Liquidity and Marketability: Bearer bonds are not as liquid or easily marketable as registered bonds. Finding buyers for bearer bonds can be more challenging, and the transaction process may not be as seamless as it is with registered bonds. Therefore, investors need to consider the potential difficulty and cost of selling their bearer bonds if they need to access their invested capital before the bond’s maturity.

- Regulatory Restrictions: Many countries have imposed regulatory restrictions on bearer bonds due to concerns regarding illegal activities like money laundering and tax evasion. As a result, the issuance and trading of bearer bonds may be limited or prohibited in certain jurisdictions. Investors need to be aware of the legal and regulatory landscape surrounding bearer bonds before investing.

It’s important to thoroughly evaluate these risks and assess whether the potential benefits of bearer bonds outweigh the associated challenges for your investment objectives and risk tolerance. Now that we’ve explored the risks, let’s move on to the next section and discover how you can obtain bearer bonds.

How to Obtain Bearer Bonds

Obtaining bearer bonds can be a unique process compared to traditional investment instruments. While they may not be as readily available as they once were, there are still avenues through which investors can acquire bearer bonds. Here are some common methods:

- Secondary Market: The secondary market is often the primary source for acquiring bearer bonds. Investors can search for individuals or financial institutions that are looking to sell their bearer bonds. It is important to do thorough research and due diligence to ensure the legitimacy of the bonds and the credibility of the sellers.

- Auctions: Bearer bonds may occasionally be available at auctions, particularly those featuring collectible or rare financial instruments. These auctions can provide an opportunity to acquire unique or historical bearer bonds, but buyers should be prepared for potential competition and ensure they understand the terms and conditions of the auction.

- Private Placements: In some cases, issuers may offer bearer bonds through private placements. These placements are typically offered to a select group of investors and may require a larger investment amount. It is important to review the terms and conditions of the private placement and assess the financial health and reputation of the issuer before participating.

- Financial Institutions: Certain financial institutions may offer bearer bonds as part of their investment offerings. These institutions may have access to a variety of bonds, including bearer bonds, which they can offer to eligible investors. Engaging with reputable financial institutions can provide a more secure and regulated means of acquiring bearer bonds.

It is crucial to consult with financial professionals or investment advisors experienced in bearer bonds before pursuing any of these methods. They can provide valuable guidance and help navigate the complexities involved in acquiring bearer bonds.

Before proceeding with any transaction, conduct thorough research on the issuer, carefully review the terms and conditions of the bond, and consider consulting legal and tax professionals to ensure compliance with relevant laws and regulations.

Now that you have an understanding of how to obtain bearer bonds, let’s briefly explore the legal considerations associated with these unique financial instruments.

Legal Considerations for Bearer Bonds

Bearer bonds come with various legal considerations that investors should be aware of before investing. It is essential to understand the legal framework surrounding these investments to ensure compliance and protect your interests. Here are some key legal considerations:

- Regulatory Restrictions: Bearer bonds are subject to regulations that vary from country to country. Some jurisdictions have imposed restrictions or have even completely banned the issuance and trading of bearer bonds. It is important to understand and comply with the laws and regulations of the jurisdiction in which you are buying or selling bearer bonds.

- Taxation: Bearer bonds may have specific tax implications depending on the jurisdiction. Some countries impose taxes on interest income earned from bearer bonds, while others may provide tax advantages. It is crucial to consult with tax professionals to understand the tax obligations and benefits associated with bearer bonds in your specific situation.

- Reporting Requirements: It is important to be aware of any reporting requirements associated with owning bearer bonds. In some jurisdictions, ownership or transactions involving bearer bonds may need to be reported to regulatory authorities. Non-compliance with reporting requirements can result in penalties or legal consequences.

- Authentication and Verification: Due to the risk of counterfeiting, verifying the authenticity of bearer bonds is essential. Engaging with trusted financial institutions or seeking expert advice can help ensure that the bonds are legitimate. It may also be beneficial to familiarize yourself with the security features and verification processes associated with bearer bonds.

- Legal Documentation: When acquiring bearer bonds, it is crucial to pay attention to the legal documentation involved. This includes reviewing the terms and conditions of the bond, understanding the rights and obligations of the bondholder, and ensuring that the transfer of ownership is properly documented and legally valid.

Given the complexities and legal considerations associated with bearer bonds, it is advisable to consult legal professionals who specialize in securities law or investment transactions. They can provide guidance and ensure that you navigate the legal landscape effectively.

Now, let’s summarize what we have covered in this article.

Conclusion

Bearer bonds offer a unique investment opportunity for those seeking privacy, flexibility, and global investment options. However, it is important to approach these investments with caution and fully understand the associated benefits and risks.

In this article, we explored what bearer bonds are and how they differ from traditional registered bonds. We discussed the advantages of bearer bonds, including the privacy and anonymity they provide, their portability and flexibility, the potential tax advantages, and the access to global investment opportunities.

We also discussed the risks inherent to bearer bonds, such as the risk of loss or theft, the lack of income documentation, the counterfeit risk, and the potential liquidity challenges. Understanding these risks is crucial in making informed investment decisions.

To obtain bearer bonds, various methods such as the secondary market, auctions, private placements, or engaging with financial institutions can be considered. However, it is important to conduct thorough research, exercise due diligence, and seek professional advice before entering into any transactions.

Furthermore, we explored the legal considerations associated with bearer bonds, including regulatory restrictions, taxation implications, reporting requirements, authentication and verification processes, and the importance of proper legal documentation. Complying with the legal framework surrounding bearer bonds is essential to protect your investment and ensure compliance with applicable laws and regulations.

In conclusion, while bearer bonds have become less common due to regulatory changes and advancements in financial technology, they still offer unique investment opportunities for those who value privacy and flexibility in their financial affairs. However, it is crucial to approach these investments with careful consideration, seek expert guidance, and stay updated on the legal landscape.

Remember, investing in bearer bonds should be done with a thorough understanding of their characteristics, risks, and legal considerations. By doing so, you can navigate this fascinating world of bearer bonds and potentially reap the benefits they offer.