Home>Finance>Bell Curve Definition: Normal Distribution Meaning Example In Finance

Finance

Bell Curve Definition: Normal Distribution Meaning Example In Finance

Published: October 15, 2023

Learn the meaning and example of normal distribution, also known as the bell curve, in the context of finance. Understand its significance and application

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Bell Curve in Finance: Understanding Normal Distribution and Its Impact

Finance is a fascinating field that deals with managing money, investments, and financial risks. To make informed decisions, finance professionals often rely on statistical tools and concepts, and one such concept is the Bell Curve or Normal Distribution. In this blog post, we will delve into the definition, meaning, and examples of the Bell Curve, and explore its relevance in the world of finance.

Key Takeaways:

- The Bell Curve, also known as the Normal Distribution, is a statistical model representing a symmetrical and bell-shaped curve.

- It is widely used in finance to understand probability and risk, and to analyze data, such as stock returns or credit scores.

Understanding the Bell Curve

The Bell Curve, also referred to as the Normal Distribution, is a mathematical concept that describes the distribution of a random variable with a symmetrical and bell-shaped curve. It is characterized by its perfectly symmetrical shape, with the highest point at the mean (average) of the data. The curve gradually slopes downwards on either side, representing the decreasing probability of extreme values.

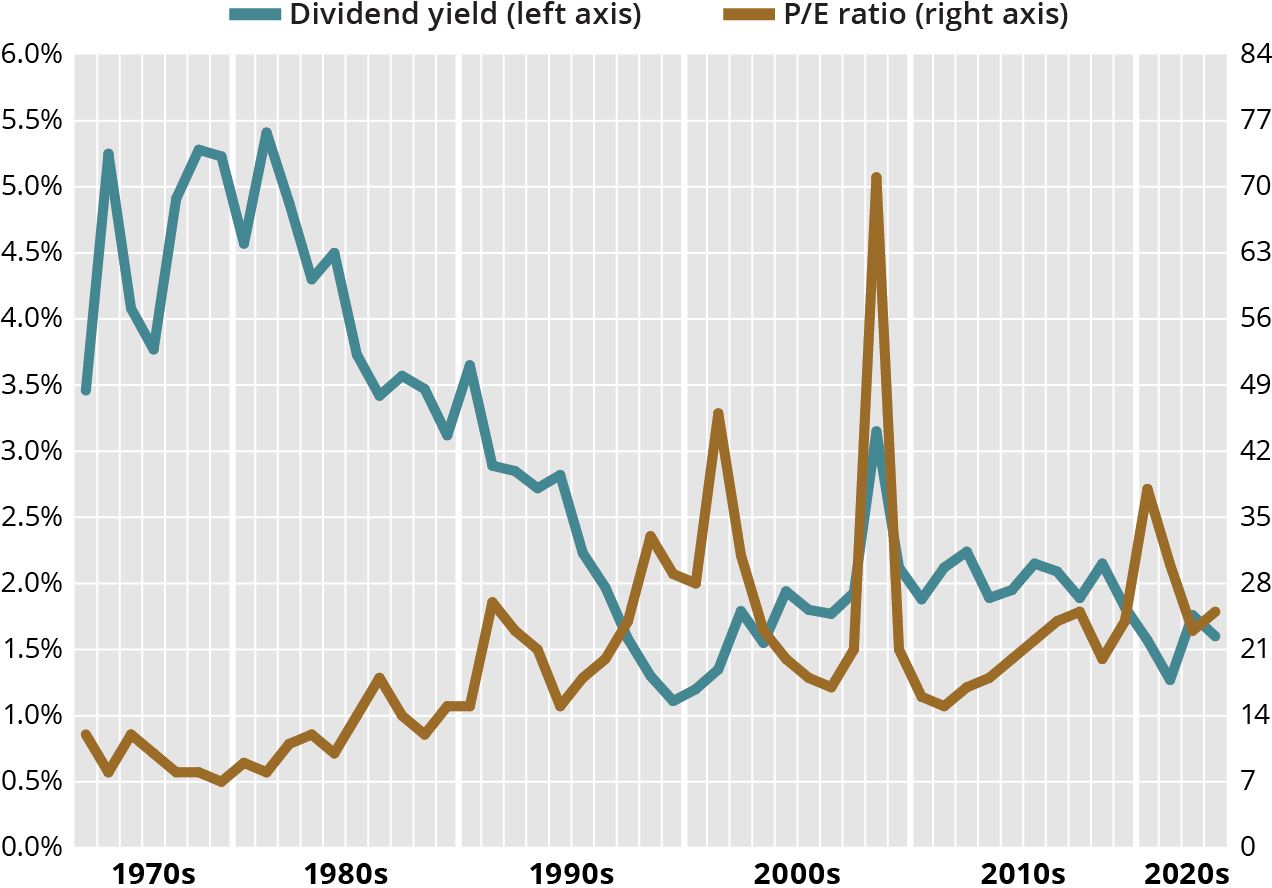

But why is the Bell Curve so relevant in finance? Well, it is because many financial phenomena follow a normal distribution. For example, stock returns, when graphed over a long period, often resemble a bell curve. Understanding this distribution allows finance professionals to make more accurate predictions and informed decisions.

Implications in Finance

The Bell Curve’s significance in finance lies in its ability to help analyze and interpret financial data. By understanding the characteristics and properties of a normal distribution, finance professionals can gain insights and make meaningful conclusions. Let’s explore some of the important implications:

- Risk Analysis: In finance, risk assessment is crucial for investors and financial institutions. By utilizing the Bell Curve, finance professionals can determine the probability of different outcomes and assess risk. For instance, they can calculate the probability of a stock losing or gaining a certain amount within a specific time frame.

- Asset Pricing: Normal Distribution theory plays a pivotal role in asset pricing models. One such popular model is the Black-Scholes-Merton model, which uses the Bell Curve to determine the fair value of options. This model assumes that asset prices follow a log-normal distribution, allowing investors to estimate option prices accurately.

- Credit Scoring: Banks and financial institutions often rely on the Bell Curve to evaluate credit risk. By analyzing credit scores using a normal distribution, lenders can categorize borrowers into different risk groups, set interest rates, and determine loan approvals.

These are just a few examples of how the Bell Curve impacts finance. Its widespread application demonstrates its significance in various financial aspects, including risk management, pricing models, and credit assessments.

In Conclusion

The Bell Curve, or Normal Distribution, is a foundational concept in finance. Its symmetrical and bell-shaped curve helps finance professionals analyze data, assess risk, and make informed decisions. By understanding the implications of the Bell Curve in finance, you can enhance your understanding of statistical tools and concepts used in the financial field. So, the next time you encounter data in finance, remember the ubiquitous presence of the Bell Curve and its invaluable insights.