Finance

What Is Risk Assessment In Audit

Published: January 15, 2024

Learn about risk assessment in audit and its significance in the field of finance. Gain insights into the process of evaluating potential risks and ensuring financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Risk Assessment in Audit

- Importance of Risk Assessment in Audit

- Objectives of Risk Assessment in Audit

- Process of Risk Assessment in Audit

- Techniques used in Risk Assessment in Audit

- Factors considered in Risk Assessment in Audit

- Benefits of Risk Assessment in Audit

- Challenges and Limitations of Risk Assessment in Audit

- Conclusion

Introduction

Risk assessment is a critical component in the field of audit. It provides auditors with a systematic approach to identify, analyze, and evaluate potential risks that could impact the accuracy and reliability of financial statements. By assessing risks, auditors are able to focus their efforts on areas that are most susceptible to misstatement, allowing for a more efficient and effective audit process.

In simple terms, risk assessment is the process of identifying and evaluating the probability and impact of uncertainties that could have an adverse effect on the financial statements. These uncertainties can arise from various sources, such as internal control deficiencies, fraud, errors, changes in economic conditions, or industry-specific risks.

Effective risk assessment enables auditors to gain a deeper understanding of the business environment, internal controls, and key processes and transactions. This understanding helps auditors to tailor their audit procedures to address the specific risks faced by the organization, ensuring that the audit is focused on areas that matter the most.

Risk assessment is not a one-time activity; it is an ongoing process that should be performed at the beginning of an audit engagement and continuously updated throughout the audit. It requires the application of professional judgment and the use of various techniques and tools to identify and assess risks.

Overall, risk assessment plays a crucial role in ensuring the quality and reliability of financial statements. It provides auditors with a solid foundation to plan and execute an effective audit, ultimately enhancing the level of confidence and trust in the information disclosed by organizations.

Definition of Risk Assessment in Audit

Risk assessment in audit refers to the systematic process of identifying, analyzing, and evaluating potential risks that could impact the accuracy and integrity of financial statements. It involves assessing the probability and impact of uncertainties that could lead to material misstatements in the financial information. The purpose of risk assessment is to enable auditors to effectively plan and execute their audit procedures, ensuring that the audit is focused on areas with the highest level of risk.

During risk assessment, auditors gather information about the organization’s internal controls, key processes, and external factors that may affect the financial statements. They analyze this information to identify risks that could result in errors, fraud, or misstatements. These risks can be categorized into inherent risks, control risks, and detection risks.

Inherent risks are risks that arise from the nature of the organization’s business and industry. They include factors such as competition, technological changes, regulatory changes, and economic conditions that may impact the financial statements. Control risks, on the other hand, are risks associated with the effectiveness of the organization’s internal controls. Auditors assess the design and implementation of these controls to determine the likelihood of errors or fraud going undetected. Detection risks are the risks that the audit procedures fail to detect misstatements or errors in the financial statements.

By conducting a comprehensive risk assessment, auditors are able to gain a better understanding of the risks specific to the organization and tailor their audit procedures accordingly. This ensures that the audit is focused on areas that are most susceptible to material misstatement. It also helps auditors allocate their resources efficiently, saving time and effort in areas of lower risk.

It is important to note that risk assessment is an ongoing process and should be continually updated throughout the audit engagement. As auditors gather more information and perform additional procedures, they may identify new risks or reassess existing ones, allowing for a more accurate and comprehensive assessment of risk.

Importance of Risk Assessment in Audit

Risk assessment is of utmost importance in the field of audit due to the following key reasons:

- Efficient allocation of resources: By conducting a thorough risk assessment, auditors can allocate their resources effectively. They can focus their efforts and resources on areas that have the highest likelihood of material misstatement, ensuring that the audit procedures are tailored to address specific risks. This helps auditors optimize their time and resources, leading to a more efficient and cost-effective audit process.

- Enhanced audit planning: Risk assessment plays a crucial role in the planning phase of an audit. It helps auditors gain a comprehensive understanding of the organization’s business environment, internal controls, and key processes. This understanding aids in the development of a well-designed audit plan that identifies the areas of highest risk and the appropriate audit procedures to address those risks. Effective planning based on risk assessment enables auditors to perform their audits more effectively and identify potential issues early on.

- Increased reliability of financial statements: Conducting risk assessment allows auditors to identify potential risks that could lead to material misstatements in the financial statements. By addressing these risks through appropriate audit procedures, auditors enhance the reliability and accuracy of the financial statements. This, in turn, boosts stakeholder confidence in the information disclosed by the organization, promoting transparency and trust in the financial reporting process.

- Improved fraud detection: Risk assessment helps auditors identify potential fraud risks within an organization. By examining the organization’s internal controls, auditors can assess the effectiveness of fraud prevention and detection measures. They can identify areas where there is a higher likelihood of fraudulent activities occurring and design audit procedures to uncover any fraudulent transactions. This proactive approach to fraud detection enhances the organization’s overall risk management process.

- Compliance with auditing standards: Risk assessment is a fundamental requirement of auditing standards. Professional auditing standards, such as the International Standards on Auditing (ISAs), mandate the evaluation of risks in order to appropriately plan and execute an audit. Complying with these standards ensures that auditors are conducting their engagements in accordance with established guidelines and best practices, leading to consistent and reliable audit outcomes.

In summary, risk assessment is essential in audit as it allows auditors to optimize their resources, enhance audit planning, improve the reliability of financial statements, detect fraud, and comply with professional auditing standards. By effectively identifying and addressing risks, auditors can provide valuable insights and assurance to stakeholders, fostering transparency and trust in the financial reporting process.

Objectives of Risk Assessment in Audit

The primary objectives of risk assessment in audit are to:

- Identify potential risks: The first objective of risk assessment is to identify potential risks that may impact the accuracy and reliability of financial statements. Auditors must evaluate various factors, such as the organization’s business environment, industry-specific risks, internal control deficiencies, and economic conditions, to identify areas of potential vulnerability to misstatement or fraud.

- Evaluate the significance of risks: Once potential risks are identified, the next objective is to assess the significance of these risks. Auditors analyze the likelihood and potential impact of each risk to determine the level of risk exposure. This evaluation allows auditors to prioritize risks and allocate resources accordingly, focusing on areas of higher risk that may have a more significant impact on the financial statements.

- Design appropriate audit procedures: Risk assessment helps in designing and implementing appropriate audit procedures. By understanding the specific risks faced by the organization, auditors can tailor their audit procedures to address those risks effectively. This includes determining the nature, timing, and extent of audit procedures to provide reasonable assurance that material misstatements are detected and addressed.

- Enhance audit planning: Risk assessment is a critical component of audit planning. It provides auditors with valuable insights to develop a well-structured audit plan. By considering the identified risks, auditors can allocate their resources efficiently, determine the necessary skills and expertise required for the engagement, and establish the timeframe for completing the audit procedures.

- Improve overall risk management: Risk assessment in audit can also contribute to the organization’s overall risk management process. By identifying and assessing risks, auditors can provide recommendations to management on strengthening internal controls, mitigating risks, and improving operational efficiency. This assists the organization in proactively managing risks and minimizing the likelihood of future misstatements or fraudulent activities.

Overall, the objectives of risk assessment in audit are to identify and evaluate potential risks, prioritize them based on significance, design appropriate audit procedures, enhance audit planning, and contribute to the organization’s risk management efforts. By achieving these objectives, auditors can provide stakeholders with the assurance that financial statements are reliable, accurate, and free from material misstatement.

Process of Risk Assessment in Audit

The process of risk assessment in audit involves several steps and considerations to ensure a comprehensive evaluation of potential risks. The following outlines the typical process of risk assessment:

- Obtain an understanding of the organization: Auditors begin by gaining a thorough understanding of the organization’s industry, business environment, key processes, and internal controls. This includes reviewing relevant documentation, conducting interviews with management and staff, and performing analytical procedures to identify key risk areas.

- Identify inherent risks: Auditors then identify and assess inherent risks that may arise from external factors, such as changes in economic conditions, technological advancements, or regulatory changes. These risks are independent of the organization’s internal controls and may impact the financial statements.

- Evaluate internal control effectiveness: Auditors evaluate the design and implementation of the organization’s internal controls to assess control risks. This involves gaining an understanding of the controls in place, performing tests of control effectiveness, and identifying control deficiencies that may increase the risk of material misstatement.

- Assess detection risks: Auditors assess detection risks, which refer to the risk that the audit procedures fail to detect material misstatements. This assessment takes into consideration the nature, timing, and extent of audit procedures and the auditor’s reliance on internal controls.

- Determine materiality thresholds: Materiality thresholds are established to determine the level of misstatement that could have a significant impact on the financial statements. Auditors consider both qualitative and quantitative factors in setting the materiality thresholds.

- Rank and prioritize risks: Auditors rank and prioritize the identified risks based on their significance and likelihood of occurrence. This step helps auditors focus their audit procedures on areas of higher risk, ensuring that the most critical risks are properly addressed.

- Design audit procedures: Based on the assessed risks, auditors design and implement appropriate audit procedures. These procedures may include substantive procedures, such as detailed testing of transactions and balances, as well as tests of controls to evaluate the effectiveness of the organization’s internal controls.

- Continual monitoring and reassessment: Risk assessment is an ongoing process. Auditors continuously monitor and reassess risks throughout the audit engagement as they gather more information and perform additional procedures. This allows for a dynamic and comprehensive assessment of risk.

By following this process, auditors are able to systematically identify, evaluate, and prioritize risks to effectively plan and execute their audit procedures. This ensures that the audit is focused on areas of greatest risk, enhancing the accuracy and reliability of the financial statements.

Techniques used in Risk Assessment in Audit

During the risk assessment process in audit, various techniques are employed to effectively identify, assess, and prioritize risks. These techniques enable auditors to gain a comprehensive understanding of the organization and its potential vulnerabilities. The following are some commonly used techniques in risk assessment:

- Interviews: Auditors conduct interviews with key personnel, including management and staff across different levels of the organization. These interviews provide valuable insights into the organization’s operations, processes, and controls. They help identify risks associated with specific activities and allow auditors to assess the adequacy and effectiveness of control measures.

- Review of documentation: Auditors review relevant documentation, such as financial statements, internal policies and procedures, risk management frameworks, and control manuals. This review helps auditors understand the organization’s control environment, identify areas of potential risk, and assess the design and implementation of internal controls.

- Analytical procedures: Analytical procedures involve the comparison of financial and non-financial data to identify unusual trends, patterns, or anomalies. By analyzing key ratios, industry benchmarks, and historical data, auditors can detect potential risks or areas requiring further investigation.

- Observation: Auditors observe the organization’s operations and activities to gain firsthand knowledge of the control environment. They assess the adherence to established policies and procedures, identify potential control weaknesses, and determine areas where there may be a higher risk of misstatement or fraud.

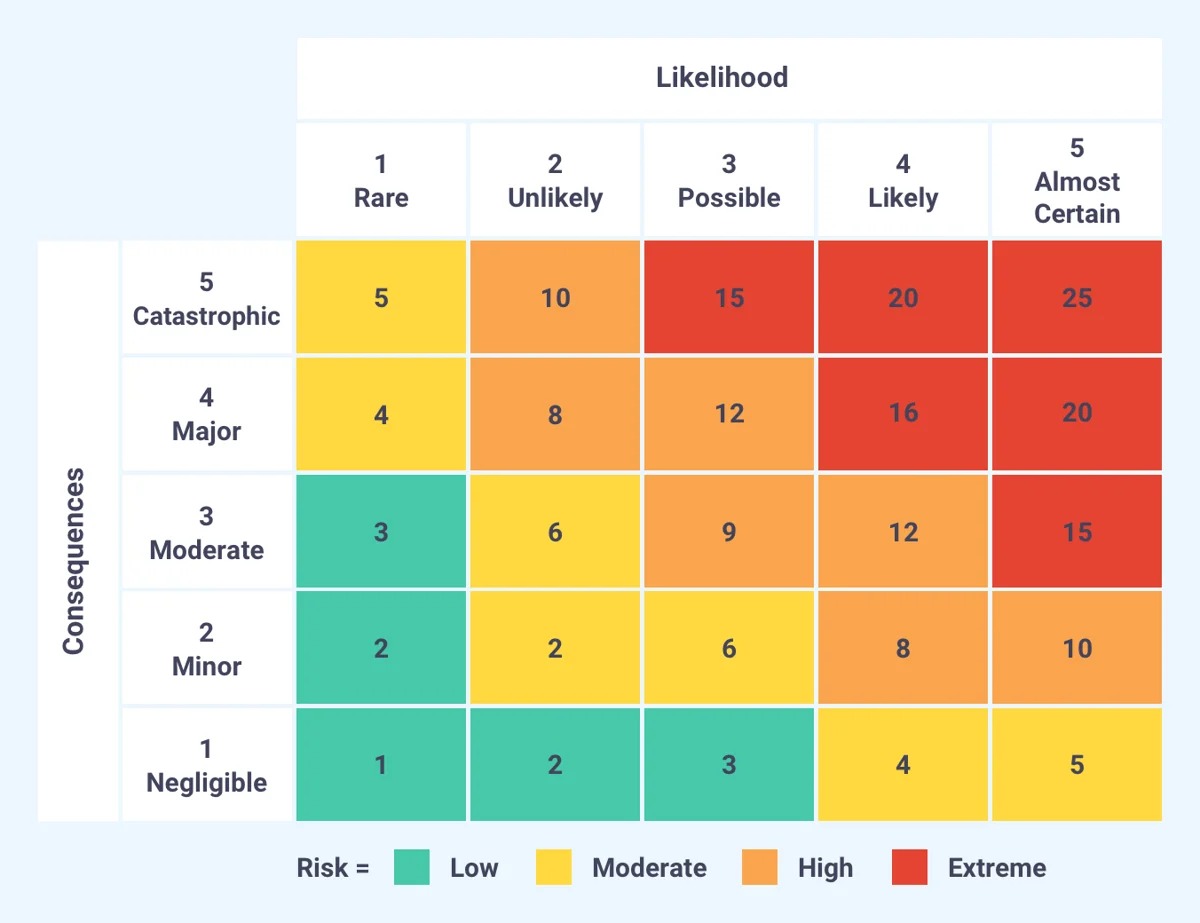

- Risk matrix analysis: A risk matrix is a visual representation that helps auditors assess and prioritize risks based on their likelihood and impact. Risks are mapped on a matrix, allowing auditors to identify high-risk areas that require more attention and resources. This technique helps auditors allocate their efforts effectively.

- Industry benchmarking: Auditors compare the organization’s performance and risk profile against industry benchmarks and best practices. This technique helps identify industry-specific risks and assess the organization’s relative position in terms of risk exposure.

- Data analytics: Auditors utilize data analytics tools and techniques to analyze large volumes of data and identify potential anomalies, patterns, or trends that may indicate risks. This approach allows auditors to identify outliers, unusual transactions, or potential control deficiencies that may require further investigation.

By employing these techniques, auditors can effectively identify, assess, and prioritize risks during the risk assessment process. Each technique provides a unique perspective and contributes to a comprehensive understanding of the organization’s risk landscape. It allows auditors to tailor their audit procedures to address specific risks and enhance the reliability and accuracy of the audit process.

Factors considered in Risk Assessment in Audit

When conducting risk assessment in audit, several factors are taken into consideration to identify, assess, and prioritize risks effectively. These factors provide auditors with valuable insights into the organization’s risk profile and help them determine the areas that require more attention. The following are some key factors considered in risk assessment:

- Industry-specific risks: Auditors analyze the unique risks associated with the organization’s industry. These risks can include regulatory changes, technological advancements, competitive pressures, and economic conditions that may impact the financial statements. Understanding these industry-specific risks is crucial for assessing the overall risk exposure of the organization.

- Internal control environment: Auditors assess the effectiveness of the organization’s internal controls in mitigating risks. They evaluate controls related to financial reporting, IT systems, operations, and compliance to gain assurance that adequate control measures are in place. The assessment of internal controls helps auditors identify control weaknesses that may result in material misstatements or fraudulent activities.

- Management integrity: The integrity and ethical behavior of management are essential factors in risk assessment. The auditors consider the tone set by management, their commitment to financial reporting quality, and their attitude towards internal controls. The integrity and competency of management play a significant role in the risk environment of the organization.

- Historical financial performance: Auditors analyze the organization’s historical financial performance and trends. They compare key financial ratios, such as liquidity, profitability, and solvency, over time to identify any unusual patterns or fluctuations. Significant changes in financial performance can indicate potential risks that need to be further investigated.

- External factors: Auditors consider external factors such as changes in economic conditions, industry regulations, geopolitical events, and market dynamics. These external factors can have a significant impact on the organization’s risk profile and financial statements. By assessing these external factors, auditors can identify potential risks that may affect the organization’s financial reporting.

- Past audit findings: Auditors review the findings from previous audits to evaluate if the identified risks have been appropriately addressed and mitigated. Previous audit findings can provide insight into recurring issues or areas where improvements are needed. They help auditors focus on areas of higher risk and assess whether the organization has effectively implemented corrective measures.

- Changes in the organization: Auditors consider any significant changes within the organization, such as acquisitions, divestitures, reorganizations, or changes in key personnel. These changes can introduce new risks or impact existing risk profiles. Assessing the implications of these changes helps auditors identify emerging risks that require attention.

By considering these factors, auditors are able to gain a comprehensive understanding of the organization’s risk landscape. This understanding allows them to identify and prioritize risks that may impact the accuracy and reliability of the financial statements. By addressing these risks, auditors can provide stakeholders with the assurance that the financial statements are of high quality and free from material misstatement.

Benefits of Risk Assessment in Audit

Risk assessment plays a crucial role in the audit process, providing numerous benefits to both auditors and organizations. The following are some key benefits of conducting risk assessment in audit:

- Enhanced audit effectiveness: Risk assessment enables auditors to identify and focus on areas of higher risk, ensuring that audit procedures are targeted and thorough. By understanding the specific risks faced by the organization, auditors can tailor their procedures to address those risks effectively, improving the overall effectiveness and efficiency of the audit process.

- Improved audit planning: Risk assessment helps auditors develop a well-structured audit plan. By analyzing potential risks, auditors can allocate their resources appropriately, determine the necessary skills and expertise required, and establish the timeframe for conducting the audit. This proactive approach to audit planning ensures that audits are well-prepared and executed efficiently.

- Increased reliability of financial statements: Through risk assessment, auditors are able to identify potential risks that could lead to material misstatements in the financial statements. By addressing these risks through appropriate audit procedures, auditors enhance the reliability and accuracy of the financial statements. This provides stakeholders with increased confidence in the financial information disclosed by the organization.

- Better fraud detection: Risk assessment helps auditors identify areas of higher susceptibility to fraud within an organization. By evaluating the design and implementation of internal controls, auditors can assess the effectiveness of fraud prevention and detection measures. This proactive approach to fraud detection helps identify and mitigate potential fraudulent activities, improving the overall risk management process.

- Optimized resource allocation: Risk assessment allows auditors to allocate their resources effectively. By focusing on areas of higher risk, auditors can allocate their time and effort appropriately, saving resources in areas of lower risk. This optimization of resources ensures that audits are performed efficiently and effectively.

- Compliance with auditing standards: Risk assessment is a fundamental requirement of auditing standards. By conducting risk assessment, auditors ensure compliance with professional auditing standards such as the International Standards on Auditing (ISAs). Complying with these standards ensures that audits are conducted in accordance with established guidelines and best practices, enhancing the consistency and quality of audit outcomes.

- Proactive risk management: Risk assessment in audit contributes to the overall risk management efforts of the organization. By identifying and assessing risks, auditors can provide recommendations to management on strengthening internal controls, improving processes, and mitigating risks. This proactive approach supports the organization in effectively managing risks and minimizing the likelihood of future misstatements or fraudulent activities.

In summary, the benefits of risk assessment in audit include increased audit effectiveness, improved audit planning, enhanced reliability of financial statements, better fraud detection, optimized resource allocation, compliance with auditing standards, and proactive risk management. By incorporating risk assessment into the audit process, auditors can provide valuable insights and assurance to stakeholders, promoting transparency and trust in the financial reporting process.

Challenges and Limitations of Risk Assessment in Audit

While risk assessment is a crucial component of the audit process, it is not without its challenges and limitations. It is important to recognize and address these challenges to ensure the effectiveness and reliability of the risk assessment process. The following are some key challenges and limitations of risk assessment in audit:

- Subjectivity of judgment: Risk assessment heavily relies on professional judgment. Assessing and prioritizing risks can be subjective, as it requires auditors to make judgments based on their understanding of the organization, industry, and external factors. These subjective judgments can vary among auditors, potentially leading to inconsistencies in the risk assessment process.

- Uncertainty and complexity: The future is inherently uncertain, making it difficult to accurately predict and assess risks. The complexity of modern business operations and the dynamic nature of the business environment add further challenges to risk assessment. Unforeseen risks or the interconnectedness of risks may emerge, requiring auditors to continually adapt their assessments throughout the audit process.

- Limited reliance on internal controls: Risk assessment heavily relies on the effectiveness of an organization’s internal controls. However, auditors cannot solely rely on internal controls for risk mitigation. The presence of control weaknesses, management override, collusion, or human error can limit the effectiveness of controls and increase the risk of material misstatement.

- Lack of historical data: Risk assessment often requires the analysis of historical financial data and trends. However, newly established organizations or entities with limited operating history may lack sufficient historical data for accurate risk assessment. This limitation may make it challenging to assess risks effectively, requiring auditors to rely on other sources of information or industry benchmarks.

- Inherent limitations of audit procedures: Audit procedures have inherent limitations in detecting errors or fraudulent activities, especially those involving management collusion or sophisticated fraud schemes. Despite risk assessment, there is always a possibility that some risks and material misstatements may go undetected during the audit process.

- Time and resource constraints: Conducting a comprehensive risk assessment can be time-consuming and resource-intensive. Auditors may face constraints in terms of available resources, client deadlines, or budget limitations, which can impact the depth and scope of the risk assessment process. Balancing these limitations with the need for a thorough risk assessment can be a challenge.

- Reliance on management representation: Risk assessment involves obtaining information from management, which may introduce a potential bias. Auditors rely on management’s representation of risks, controls, and potential issues, which may not always provide a complete or accurate picture. This reliance on management increases the importance of professional skepticism and the need for corroborating evidence.

Despite these challenges and limitations, auditors can mitigate their impact by leveraging their professional judgment, adopting a risk-based approach, continually updating their risk assessment throughout the audit engagement, and performing additional procedures to address areas of higher risk. By acknowledging these challenges and addressing them proactively, auditors can enhance the effectiveness and reliability of the risk assessment process in audit engagements.

Conclusion

Risk assessment is a vital component of the audit process, enabling auditors to identify, assess, and prioritize risks that could impact the accuracy and reliability of financial statements. It plays a crucial role in enhancing audit effectiveness, improving audit planning, and increasing the overall reliability of the financial reporting process. By conducting risk assessment, auditors can allocate their resources efficiently, tailor their audit procedures to address specific risks, and provide stakeholders with the assurance that the financial statements are of high quality.

While risk assessment has its challenges and limitations, such as subjectivity of judgment, complexity, and reliance on internal controls, auditors can mitigate these challenges through a thorough and systematic approach. The use of techniques such as interviews, documentation review, data analytics, and industry benchmarking helps auditors gain a comprehensive understanding of the organization’s risk profile and improve the effectiveness of risk assessment.

Furthermore, risk assessment supports proactive risk management efforts, contributing to the overall risk mitigation and control environment of the organization. By identifying areas of vulnerability, auditors can provide valuable recommendations to management to strengthen internal controls and minimize potential risks.

In conclusion, risk assessment is a fundamental and necessary process in audit engagements. It ensures that audits are efficient, effective, and focused on areas of highest risk. By addressing risks and providing stakeholders with the assurance of reliable financial statements, risk assessment plays a critical role in maintaining the transparency and trustworthiness of the financial reporting process.