Finance

Benefits Payable Exclusion Definition

Published: October 15, 2023

Learn the definition of benefits payable exclusion in finance and understand how it impacts your financial plans.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Definition of Benefits Payable Exclusion

Welcome to our “FINANCE” category, where we delve into the complexities of various financial concepts. Today, we are going to shed some light on the definition of Benefits Payable Exclusion. If you’ve ever wondered what this term means and how it impacts your financial journey, you’re in the right place. Let’s dive in and unravel the mystery!

Key Takeaways:

- Benefits Payable Exclusion refers to expenses or benefits that are not included in the calculation of an individual’s tax liability.

- By understanding and utilizing Benefits Payable Exclusion, individuals can minimize their tax burden and maximize their financial well-being.

Now that we have our key takeaways, let’s explore the concept of Benefits Payable Exclusion in more detail.

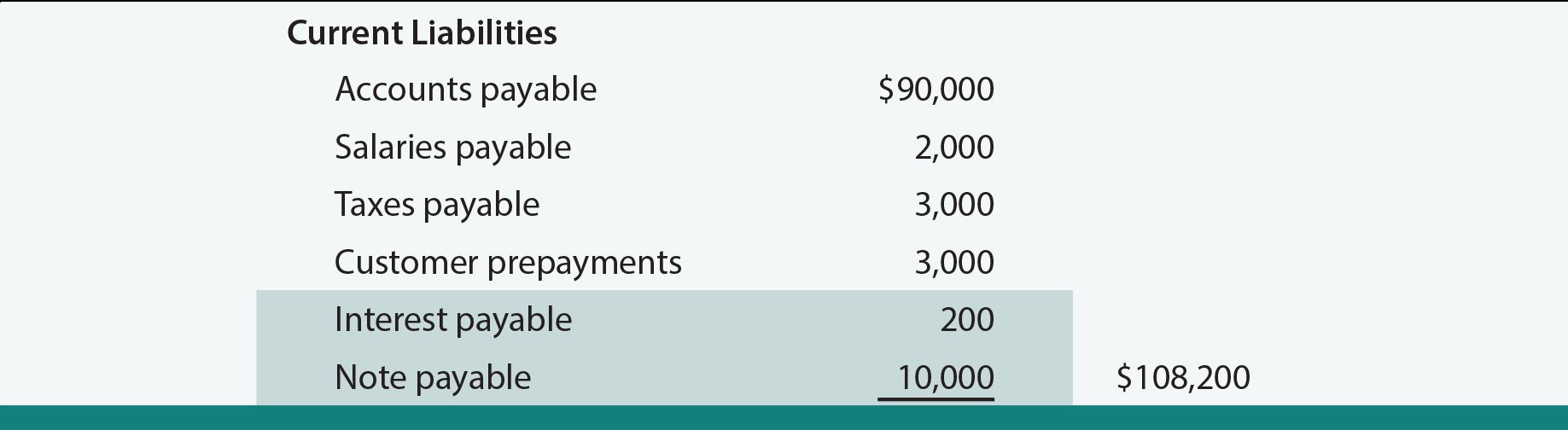

Benefits Payable Exclusion is an important aspect of the financial landscape that affects individuals across various sectors. It refers to specific types of expenses or benefits that are not taken into account when calculating an individual’s tax liability. These excluded benefits can vary depending on the country and specific tax laws in place. By excluding certain benefits from taxation, individuals can reduce their overall tax burden.

One common example of Benefits Payable Exclusion is employer-provided health insurance. In many countries, the value of health insurance coverage provided by an employer is not considered taxable income. This exclusion helps individuals save money by lowering their tax liability.

The Benefits Payable Exclusion can also encompass other benefits such as government-provided social security benefits, disability benefits, retirement plan contributions, and more. These exclusions are designed to provide individuals with financial support and security while reducing their taxable income.

So how does the Benefits Payable Exclusion work in practice?

When an individual files their taxes, they typically report their income and any taxable benefits. However, benefits that fall under the Benefits Payable Exclusion definition are not included in this calculation. They are completely excluded from the tax liability, providing individuals with increased financial flexibility and savings.

In some cases, individuals may need to meet specific criteria or conditions to qualify for Benefits Payable Exclusion. It is essential to be aware of the applicable regulations and guidelines to ensure that you can take advantage of the exclusions available to you.

As with any financial concept, it’s crucial to consult with a professional to fully understand the Benefits Payable Exclusion and how it applies to your individual circumstances. A financial advisor or tax professional can provide personalized advice and guide you through the process, ensuring that you make the most of the available exclusions.

To summarize, Benefits Payable Exclusion is a powerful tool that allows individuals to minimize their tax burden and maximize their financial well-being. By leveraging this exclusion, individuals can take advantage of various tax benefits and save money. Remember to research and consult with experts to fully understand the exclusions that apply to you and make informed financial decisions.

Thank you for joining us on this exploration of Benefits Payable Exclusion. Stay tuned for more informative and captivating articles in our “FINANCE” category!