Finance

How To Simulate Credit Score On Credit Karma

Published: October 22, 2023

Learn how to simulate your credit score on Credit Karma and manage your finances effectively. Get valuable insights and track your progress with this helpful finance tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- What Is Credit Karma?

- Sign Up for a Credit Karma Account

- Setting Up Credit Simulation on Credit Karma

- Enter Your Financial Information

- Simulating Different Credit Scenarios

- Viewing Your Simulated Credit Score

- Utilizing Credit Karma’s Additional Features

- Final Thoughts

Introduction

Welcome to the world of credit scores, where a three-digit number can have a significant impact on your financial life. Whether you are looking to buy a house, finance a car, or even apply for a credit card, your credit score plays a pivotal role in determining your eligibility and interest rates. It serves as a measure of your creditworthiness and provides lenders with an idea of how likely you are to repay your debts.

Understanding and improving your credit score can seem like a daunting task, but thanks to innovative online tools like Credit Karma, the process has become much simpler. Credit Karma provides users with free access to their credit scores and credit reports, along with a range of educational resources to help them manage their financial health. One of the standout features of Credit Karma is the ability to simulate credit scores, allowing users to visualize how different financial decisions and actions can impact their creditworthiness.

In this article, we will take a closer look at how you can simulate credit scores on Credit Karma. By utilizing this feature, you can gain valuable insights into the potential effects of various financial choices and see how they might influence your creditworthiness. So, let’s dive in and explore the world of credit score simulation with Credit Karma!

Understanding Credit Scores

Before we delve into the intricacies of simulating credit scores on Credit Karma, it’s essential to have a solid understanding of what credit scores are and how they are calculated.

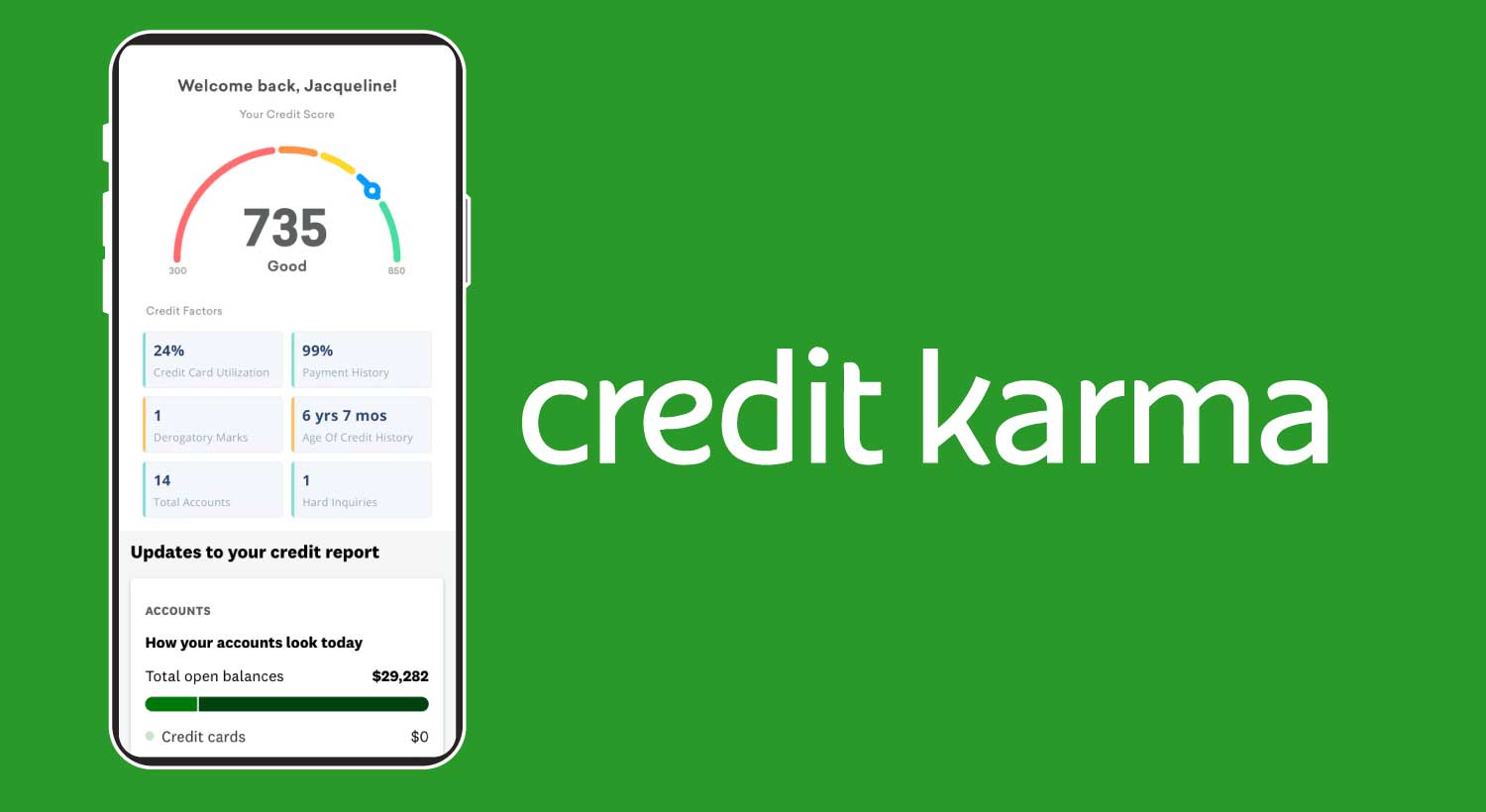

A credit score is a numerical representation of an individual’s creditworthiness. It is a tool used by lenders to determine the likelihood that a borrower will repay their debts on time. The most commonly used credit scoring models are the FICO Score and VantageScore. These scores range from 300 to 850, with a higher score indicating a lower credit risk.

Several factors contribute to the calculation of a credit score:

- Payment history: This factor accounts for the largest portion of your credit score. It reflects your history of making timely payments on credit accounts, such as loans, credit cards, and mortgages.

- Credit utilization: This refers to the amount of credit you are using compared to your available credit limits. It is recommended to keep your credit utilization below 30% to maintain a good credit score.

- Length of credit history: The length of time you have held credit accounts impacts your credit score. A longer credit history shows lenders that you have a track record of managing credit responsibly.

- Credit mix: Having a diverse range of credit accounts, such as credit cards, loans, and mortgages, can positively influence your credit score.

- New credit inquiries: Opening multiple credit accounts simultaneously or frequently applying for new credit can negatively impact your credit score.

By understanding how these factors contribute to your credit score, you can make informed decisions to improve and maintain a healthy credit profile.

What Is Credit Karma?

Credit Karma is a popular online platform that provides users with free access to their credit scores, credit reports, and a range of financial tools and resources. Founded in 2007, Credit Karma has grown to become a trusted source of financial information and guidance for millions of users.

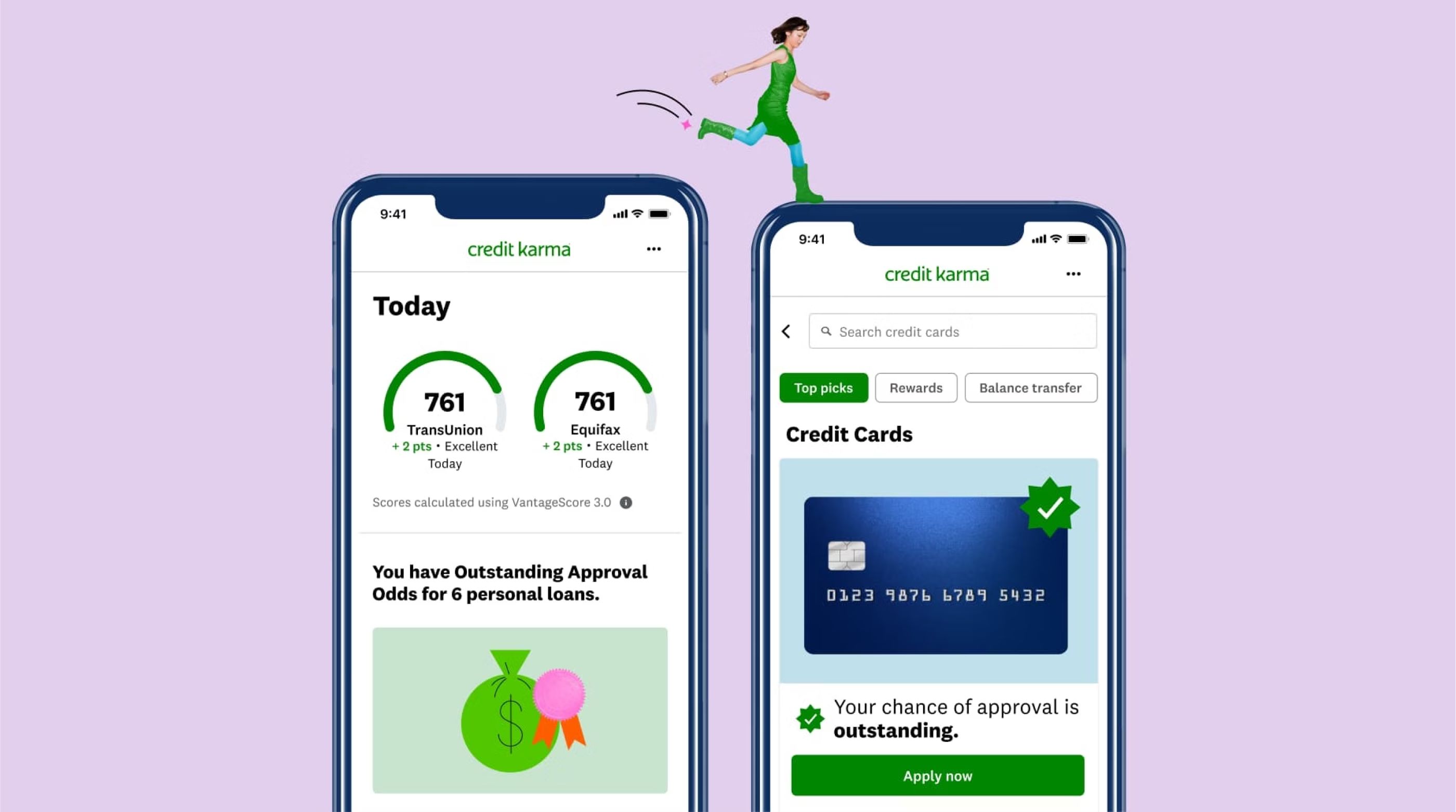

One of the standout features of Credit Karma is its ability to provide users with credit scores from both the TransUnion and Equifax credit bureaus. This comprehensive view allows users to get a holistic picture of their creditworthiness. In addition to credit scores, Credit Karma also provides detailed credit reports, which include information on open accounts, payment history, credit inquiries, and more.

Beyond credit scores and reports, Credit Karma offers an array of tools and features to help users make informed financial decisions. These include:

- Financial education: Credit Karma provides a wealth of educational resources, articles, and guides to help users better understand credit, budgeting, and personal finance.

- Free tax filing: Credit Karma offers free tax preparation and filing services, simplifying the process of filing taxes and potentially saving users money.

- Personalized recommendations: Based on users’ credit profiles and financial goals, Credit Karma provides personalized recommendations for credit cards, loans, and other financial products.

- Credit monitoring: Credit Karma’s credit monitoring service alerts users to any changes in their credit profile, such as new accounts, credit inquiries, or potential fraud.

- Credit score simulation: This feature allows users to simulate how different financial actions or decisions might impact their credit scores, giving them insights into potential outcomes.

Overall, Credit Karma aims to empower individuals to take control of their financial lives by providing them with the tools and information they need to make informed decisions. Its user-friendly interface and comprehensive array of features make it a valuable resource for individuals seeking to improve their financial health.

Sign Up for a Credit Karma Account

To start simulating credit scores on Credit Karma, you’ll first need to sign up for an account. The process is quick, easy, and completely free. Here’s how to get started:

- Visit the Credit Karma website: Head to the official Credit Karma website at www.creditkarma.com.

- Create an account: Click on the “Sign Up” button on the homepage. You’ll be prompted to provide some basic information, including your email address and a password of your choice. Once you’ve filled in the required fields, click “Join Credit Karma” to proceed.

- Verify your email address: After completing the sign-up form, Credit Karma will send a verification email to the address you provided. Open the email and click on the verification link to confirm your account.

- Provide additional information: To access your credit scores and reports, Credit Karma will ask for some additional details to verify your identity. This may include providing your full name, date of birth, social security number (SSN), and address. Rest assured that Credit Karma takes privacy and security seriously, utilizing encryption and other measures to protect your personal information.

- Answer the security questions: As an added layer of security, Credit Karma may ask you a series of security questions based on your credit history or public records. Answer these questions to verify your identity.

Once you’ve completed these steps, congratulations! You are now a registered user of Credit Karma and can access a wealth of financial information and tools, including the credit score simulation feature.

It’s important to note that Credit Karma is available for individuals aged 18 and above and currently serves users in the United States and Canada. If you are outside these regions, alternative credit monitoring and reporting services may be available to you.

Setting Up Credit Simulation on Credit Karma

Now that you have a Credit Karma account, it’s time to explore the credit simulation feature. This powerful tool allows you to experiment with different financial scenarios and see how they may impact your credit scores. Follow these steps to set up credit simulation on Credit Karma:

- Log in to your Credit Karma account: Visit the Credit Karma website and sign in using the email address and password associated with your account.

- Navigate to the credit simulation feature: Once logged in, look for the “Tools” section in the top navigation bar. Click on “Credit Simulator” to access the simulation feature.

- Understand your current credit profile: Before you begin simulating credit scores, it’s essential to have a clear understanding of your current credit profile. Review your credit scores, reports, and any other relevant information provided by Credit Karma. This will serve as the baseline for your simulations.

- Select the credit factors to simulate: Credit Karma offers various credit factors that you can simulate to see their impact on your credit scores. These factors may include opening or closing accounts, making on-time payments, increasing or decreasing credit utilization, and more. Choose the factor you want to simulate and proceed to the next step.

- Enter the necessary details: For each simulated credit factor, Credit Karma will prompt you to provide specific details. For example, if you’re simulating the impact of opening a new credit card, you’ll need to enter details such as the credit limit, annual fee, and expected monthly spending. Fill in all the required information accurately.

- Review the simulation results: After entering the necessary details, Credit Karma will generate the simulated credit score based on the provided information. Take the time to review the results and understand how the simulated credit factor influences your score.

- Experiment with different scenarios: The beauty of the credit simulation feature is its flexibility. You can experiment with multiple scenarios by simulating different credit factors or adjusting the variables. This allows you to gain insights into various financial decisions and actions before actually making them.

Using Credit Karma’s credit simulation feature empowers you to make more informed decisions regarding your credit and finances. However, keep in mind that the simulated scores provided by Credit Karma are estimates and may not precisely reflect any actual changes to your credit profile.

Now that you know how to set up credit simulation on Credit Karma, let’s move on to the next step: simulating different credit scenarios.

Enter Your Financial Information

Once you have accessed the credit simulation feature on Credit Karma, the next step is to enter your financial information. This step involves providing specific details and variables related to the credit factor you want to simulate. Here’s how to enter your financial information:

- Choose the credit factor: Select the specific credit factor you want to simulate from the available options provided by Credit Karma. For example, if you want to simulate the impact of increasing your credit card utilization, select the corresponding factor.

- Enter the relevant details: Credit Karma will prompt you to enter the necessary information based on the selected credit factor. The details required may vary depending on the factor, but some common examples include credit limits, balances, payment amounts, and due dates. Fill in the information accurately to ensure accurate simulation results.

- Consider different scenarios: Credit Karma allows you to experiment with different scenarios by adjusting the variables. For example, you can simulate the impact of making either the minimum payment or a larger payment to see how it affects your credit score. This flexibility in entering financial information enables you to understand the potential outcomes of various actions and choices.

- Review the entered information: Before proceeding with the simulation, take a moment to review the financial information you entered. Ensure that all the details are correct, as any inaccuracies may lead to inaccurate simulation results.

- Proceed with the simulation: Once you are satisfied with the entered information, proceed to run the simulation. Credit Karma will process the data and generate a simulated credit score based on the provided financial information.

It’s important to note that the accuracy of the simulation results heavily relies on the accuracy of the financial information entered. Therefore, it’s crucial to double-check the details and ensure they align with your actual financial situation.

By entering your financial information accurately and experimenting with different scenarios, you can gain valuable insights into the potential impact of various financial actions on your credit score. This knowledge can help you make more informed decisions and take steps to improve your creditworthiness.

Next, let’s explore how you can view your simulated credit score on Credit Karma.

Simulating Different Credit Scenarios

One of the key benefits of using Credit Karma’s credit simulation feature is the ability to experiment with different credit scenarios. By simulating various financial actions and choices, you can gauge their potential impact on your credit score. Here’s how you can simulate different credit scenarios on Credit Karma:

- Choose the credit factor: Select the specific credit factor you want to simulate from the available options provided by Credit Karma. This could include actions such as opening a new credit card, paying off a loan, or applying for a mortgage.

- Enter the relevant details: Based on the selected credit factor, provide the necessary financial information to simulate the scenario. This may include details like the new credit limit, loan payment amount, or interest rate.

- Run the simulation: Once you have entered the required information, run the simulation to view the potential impact on your credit score. Credit Karma’s algorithm will analyze the data and generate a simulated credit score based on the provided scenario.

- Compare different scenarios: To make the most of the credit simulation feature, try simulating multiple scenarios. Change the variables or experiment with different credit factors to see how each one affects your credit score. This will give you a comprehensive understanding of the potential outcomes of various financial decisions.

- Analyze the results: After each simulation, carefully review the results and take note of how your credit score may change. Pay attention to any significant improvements or declines in your score. This will help you make more informed decisions and strategically plan your financial actions.

- Learn from the simulations: The purpose of credit simulations is to provide you with valuable insights into your creditworthiness. It’s an opportunity to better understand how different factors and choices can impact your credit score. Use the simulations as a learning tool to enhance your financial literacy and make informed decisions in the future.

By simulating different credit scenarios on Credit Karma, you can gain a deeper understanding of how your financial choices may affect your credit score. This empowers you to make informed decisions and take actions that will positively impact your creditworthiness.

Now, let’s explore how you can view your simulated credit score on Credit Karma.

Viewing Your Simulated Credit Score

After running a credit simulation on Credit Karma, you’ll be able to view your simulated credit score. This score provides an estimate of how your creditworthiness may be impacted based on the scenario you simulated. Here’s how you can view your simulated credit score on Credit Karma:

- Access the simulation results: Once the simulation process is complete, Credit Karma will display the results on your screen. You may see a summary of the simulated credit factor and its impact on your credit score, along with any other relevant information.

- Review the changes: Take the time to review the changes in your simulated credit score compared to your baseline score. Note any improvements or declines and pay attention to the factors that influenced these changes. This information can be valuable for understanding the potential consequences of your financial decisions.

- Analyze the details: Dig deeper into the simulated credit score results and examine the details provided by Credit Karma. Look for specific factors or variables that affected your score the most. For example, if simulating the impact of increasing credit card utilization, you might find that a higher utilization rate resulted in a lower credit score.

- Gather insights: Use the simulated credit score as a learning opportunity. Reflect on how different financial actions and choices can influence your creditworthiness. Consider the impact of various scenarios and use the insights gained to make more informed decisions in the future.

- Take action if necessary: If the simulation results reveal areas for improvement in your credit score, use them as a roadmap for taking necessary action. For example, if the simulation shows that paying off a loan can significantly boost your score, consider strategizing ways to pay down your debt more aggressively.

Remember that while the simulated credit score provides valuable insights, it is an estimate and may not reflect the actual changes to your credit profile. However, it serves as a useful tool for understanding potential outcomes and planning your financial actions accordingly.

By viewing your simulated credit score on Credit Karma, you can make more informed decisions and take steps to improve your creditworthiness. Now, let’s explore some of the additional features that Credit Karma offers.

Utilizing Credit Karma’s Additional Features

While Credit Karma’s credit simulation feature is undoubtedly valuable, the platform offers a range of additional features to further enhance your financial well-being. Here are some of the key features you can utilize:

- Credit Monitoring: Credit Karma provides free credit monitoring services that can help you stay on top of any changes to your credit profile. You’ll receive alerts about new accounts, credit inquiries, and potential fraudulent activity, allowing you to take quick action if necessary.

- Financial Education: Credit Karma is committed to empowering users with financial knowledge. Explore their vast collection of articles, guides, and resources to enhance your understanding of credit, personal finance, and budgeting. The more you educate yourself, the better equipped you’ll be to make informed financial decisions.

- Personalized Recommendations: Based on your credit profile and financial goals, Credit Karma provides tailored recommendations for credit cards, loans, and other financial products. Using their recommendation engine, you can explore offers that may be the best fit for your needs and credit profile.

- Free Tax Filing: Credit Karma offers free tax preparation and filing services, allowing you to easily navigate through the tax season. Their user-friendly platform guides you through the process and ensures that you maximize your deductions while staying compliant with tax regulations.

- Community Forums: Engage with other Credit Karma members in the community forums. Ask questions, share experiences, and gain insights from a supportive community of individuals who are on their own financial journeys.

By taking advantage of these additional features, you can maximize the benefits of your Credit Karma account. Whether it’s staying informed about changes in your credit profile, expanding your financial knowledge, finding the right financial products, or seeking guidance from fellow users, Credit Karma provides a comprehensive platform to support your financial well-being.

As you explore Credit Karma’s additional features, keep in mind that the platform is continually evolving and updating its offerings. Stay connected and be on the lookout for new tools and resources that can further enhance your financial journey.

Now that we have explored the various features of Credit Karma, let’s wrap up with some final thoughts.

Final Thoughts

Credit Karma offers users a powerful set of tools and resources to understand, monitor, and improve their credit scores. The credit simulation feature, in particular, allows you to visualize the potential impact of different financial decisions on your creditworthiness. By simulating various scenarios, you can make more informed choices and take control of your financial future.

However, it’s important to remember that while Credit Karma provides valuable insights, the simulated credit scores are estimations and may not precisely reflect the actual changes to your credit profile. Use them as a guide to understand the potential outcomes, but always verify your actual credit score with the official credit bureaus.

Beyond the credit simulation feature, Credit Karma offers additional tools such as credit monitoring, financial education, personalized recommendations, free tax filing, and a thriving community forum. These features work together to provide a comprehensive platform for managing and improving your finances.

As you embrace Credit Karma and its features, remember to continue practicing good financial habits. Pay your bills on time, keep your credit utilization low, regularly review your credit reports, and strive for responsible financial management.

By using Credit Karma as a trusted resource and incorporating sound financial practices, you can journey towards better credit health and a stronger financial future.