Finance

Capital Share Definition

Published: October 23, 2023

Learn about the definition of capital share in finance and its importance in investment decisions. Find out how capital shares can contribute to your financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Capital Share Definition: Exploring the Basics of Finance

Finance can be an intimidating subject for many, but understanding its key concepts is crucial for anyone looking to manage their personal finances effectively. One such foundational concept is capital shares. In this blog post, we will delve into the capital share definition, its importance, and how it relates to your financial well-being.

Key Takeaways:

- Capital shares represent ownership in a company or investment fund.

- Investors who hold capital shares are entitled to receive a portion of the company’s profits and assets.

What is Capital Share?

Let’s start by answering the question: what exactly is capital share? In simple terms, capital shares are the units of ownership that individuals or entities hold in a company or an investment fund. These shares often represent a claim on the company’s profits and assets. When you invest in a company, you are essentially purchasing a portion of its capital shares.

Capital shares are a vital component of financial markets and provide individuals with an opportunity to participate in a company’s growth and success. By investing in capital shares, you become a part-owner of the company, sharing in its profits and potentially benefiting from any increase in the value of the shares over time.

Why Are Capital Shares Important?

The importance of capital shares extends beyond simply owning a piece of a company. Here are a few reasons why understanding and investing in capital shares is essential for your financial well-being:

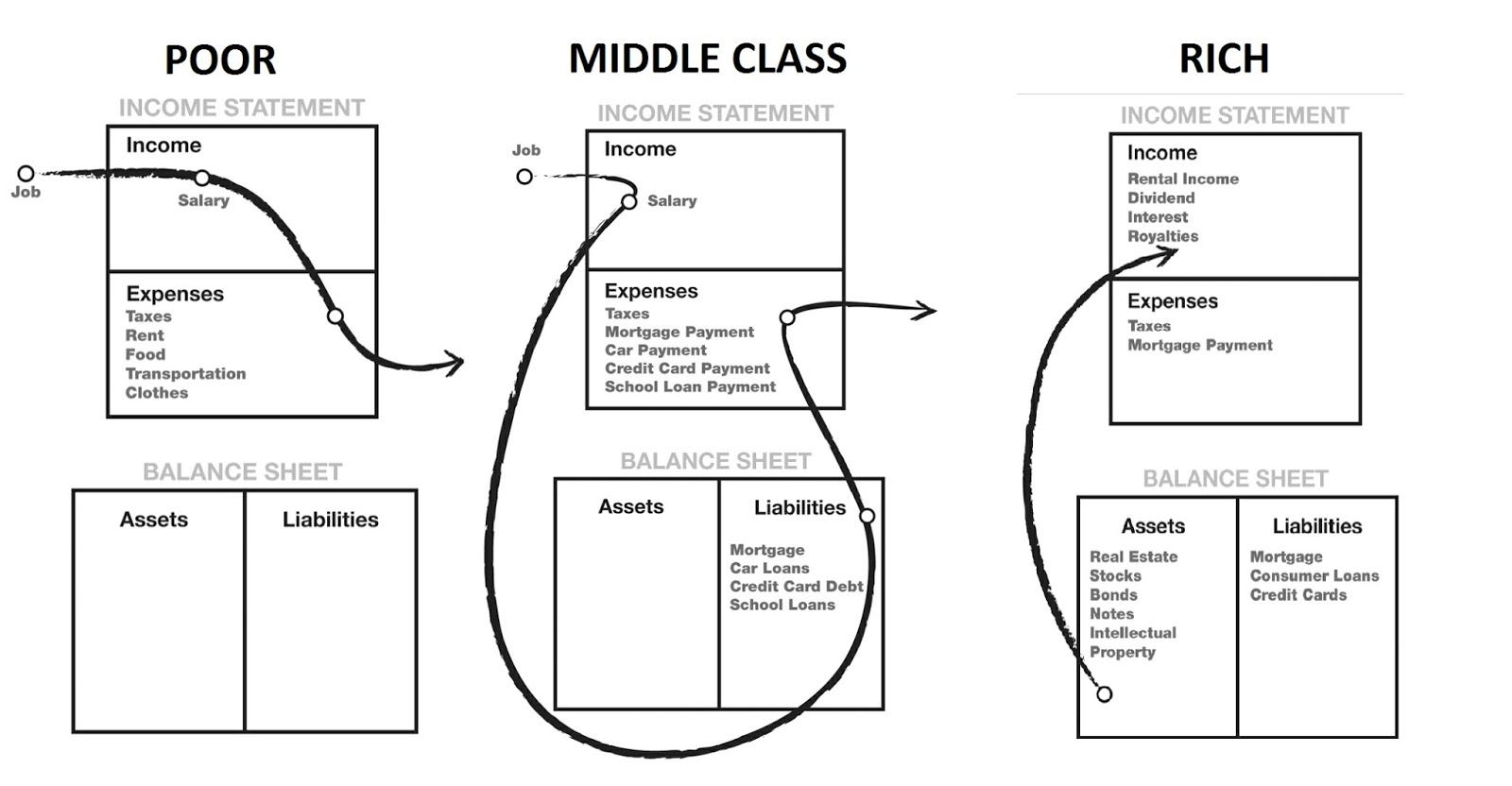

- Diversification: Investing in capital shares allows you to diversify your investment portfolio. By spreading your investments across different companies and industries, you can reduce the risk of financial loss.

- Income Generation: Capital shares can provide a source of regular income. Many companies distribute a portion of their profits as dividends to shareholders, allowing you to earn passive income over time.

- Long-Term Wealth Creation: Investing in capital shares presents an opportunity for long-term wealth creation. As a company grows and becomes more profitable, the value of its shares can increase, resulting in capital gains for shareholders.

- Corporate Influence: By holding capital shares, you may have certain voting rights in a company’s decision-making processes. This can provide you with a voice and influence in the direction and policies of the company.

Conclusion

Understanding the capital share definition and its significance is a crucial step towards gaining financial knowledge and making informed investment decisions. By investing in capital shares, you not only become a part-owner of a company but also open doors to potential growth and income opportunities.

So, whether you are a novice investor or someone looking to expand their financial portfolio, consider exploring the world of capital shares and harnessing their potential for your financial well-being.