Finance

What Are Cash Flow Assets

Published: December 20, 2023

Discover the importance of cash flow assets in the world of finance and how they can help you achieve financial stability and growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where the pursuit of wealth and financial freedom often takes center stage. As you embark on this journey, one concept that you’ll frequently encounter is cash flow assets. Understanding what cash flow assets are, how they work, and their importance in building wealth is crucial for any savvy investor or individual seeking financial prosperity.

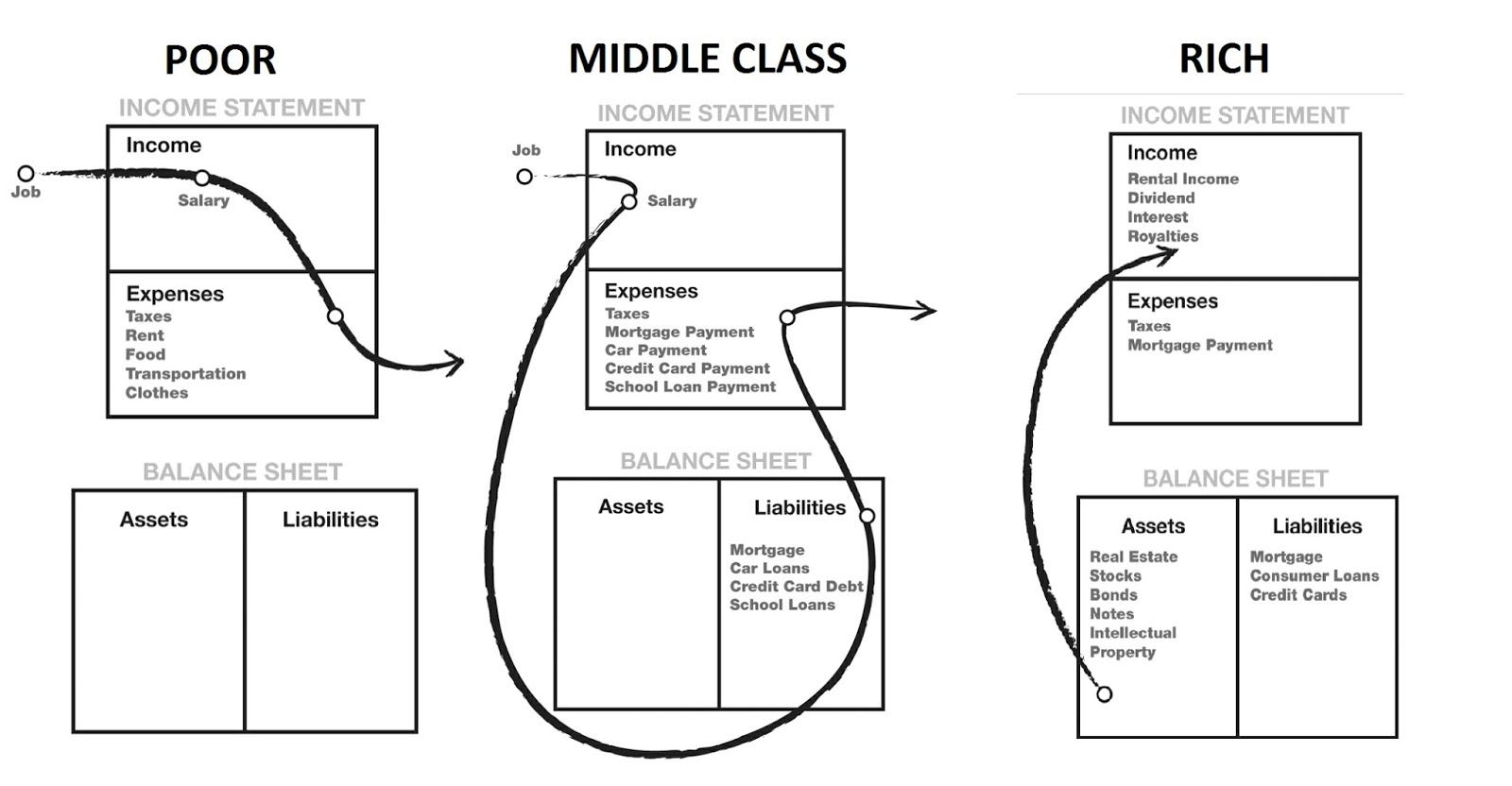

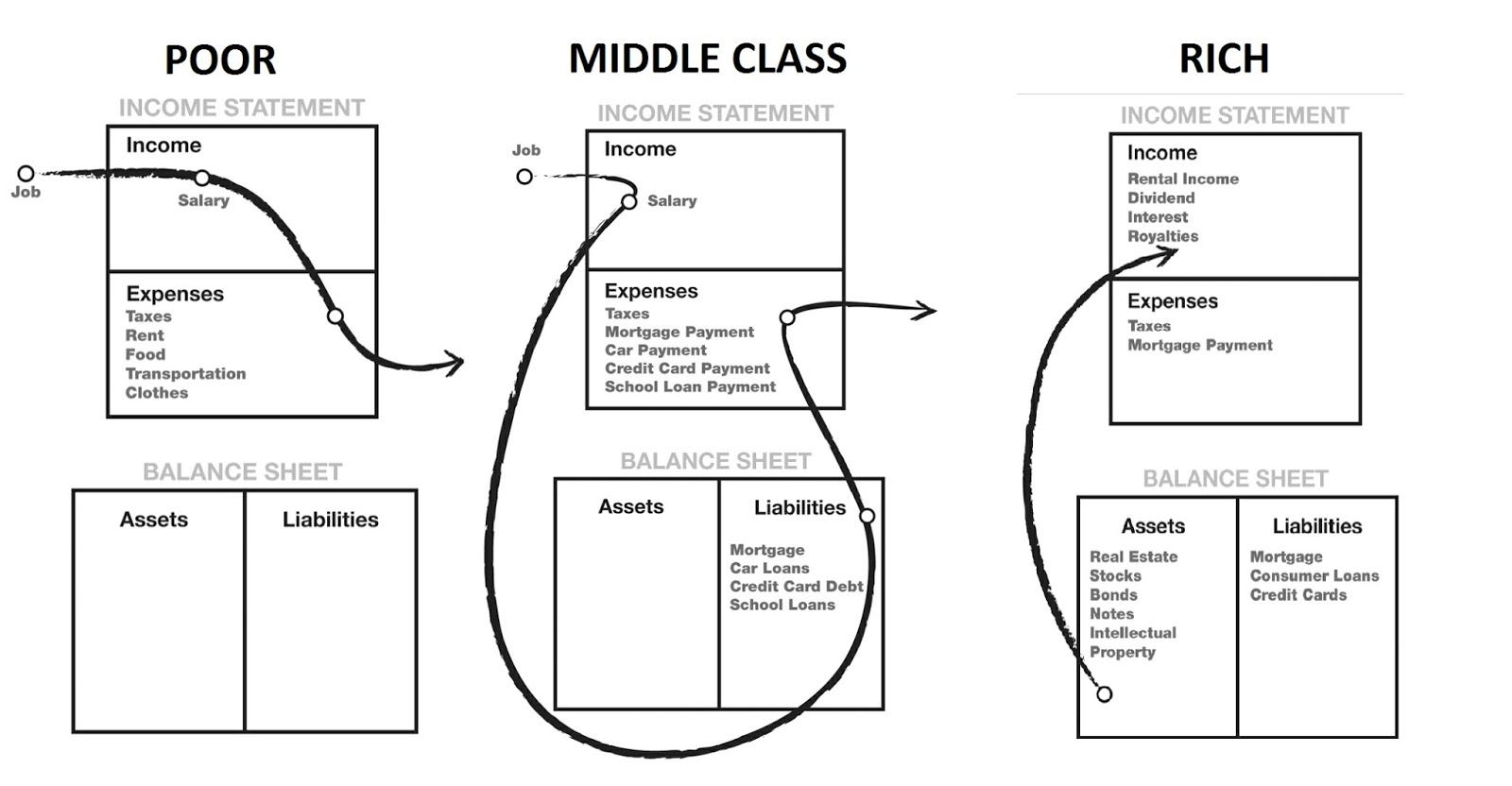

Cash flow assets are an essential component of any well-diversified investment portfolio. Unlike traditional assets such as stocks or bonds, which primarily generate returns through appreciation, cash flow assets provide a consistent stream of income over time. These assets can come in various forms, including real estate properties, dividend stocks, rental properties, bonds, or even royalties from creative works.

The key distinction of cash flow assets lies in their ability to generate ongoing income, making them a powerful tool for building wealth. While capital gains from traditional assets can be volatile and unpredictable, the steady income stream from cash flow assets provides stability and acts as a reliable source of passive income.

In this article, we will explore the world of cash flow assets, examining their definition, providing examples, discussing their benefits, and highlighting the considerations and risks associated with investing in them. By the end, you will have a solid understanding of how cash flow assets can be leveraged to create a sustainable source of income and achieve your financial goals.

Definition of Cash Flow Assets

Cash flow assets are financial instruments or investments that generate regular and predictable income over time. Unlike traditional assets that rely on the appreciation of capital value, cash flow assets generate returns through the consistent flow of cash into the investor’s pocket.

These assets can take various forms, such as rental properties, dividend-paying stocks, interest-bearing bonds, business ventures, or even intellectual property rights. The commonality among them is their ability to produce a steady stream of income, often on a recurring basis.

For example, a rental property can be considered a cash flow asset because it generates rental income from tenants on a monthly basis. Similarly, dividend-paying stocks provide shareholders with regular dividend payments as a share of the company’s profits. Bonds pay periodic interest payments to bondholders, and intellectual property rights can generate royalties from licensing agreements or copyrights.

Cash flow assets are an attractive investment option for individuals seeking passive income. They provide a consistent cash inflow that can supplement or replace earned income, leading to financial independence and the opportunity to grow wealth over time. By diversifying investment portfolios with cash flow assets, investors can create a reliable source of income and offset the risks associated with other investment strategies that may rely solely on capital appreciation.

It’s important to differentiate cash flow assets from capital appreciation assets. While capital appreciation assets, such as stocks or real estate properties that appreciate in value over time, can also generate wealth, their returns are primarily realized upon sale or liquidation. In contrast, cash flow assets deliver regular income regardless of their market value, making them particularly suitable for investors looking for ongoing cash flow and financial stability.

When evaluating cash flow assets, certain factors should be considered, such as the quality and stability of the income stream, the reliability of the underlying asset, and the potential for growth or improvement. Understanding the nature of cash flow assets is essential for investors to make informed decisions and choose investments that align with their financial goals and risk tolerance.

Examples of Cash Flow Assets

Cash flow assets encompass a wide range of investment opportunities that generate consistent income. Here are some prime examples of cash flow assets:

- Rental Properties: Owning residential or commercial properties and renting them out to tenants is a popular cash flow asset. Rental income provides a steady stream of cash flow, allowing investors to profit from real estate investments.

- Dividend-Paying Stocks: Certain publicly traded companies distribute a portion of their profits to their shareholders in the form of dividends. Investing in these stocks gives you the opportunity to earn regular dividend payments, making them an attractive cash flow asset.

- Interest-Bearing Bonds: Bonds issued by governments, municipalities, or corporations pay periodic interest to bondholders. These fixed-income securities provide a predictable income stream and are considered a staple cash flow asset in many investment portfolios.

- Business or Partnership Ventures: Investing in or owning a business that generates consistent income can be a lucrative cash flow asset. Whether it is a partnership in a law firm, a franchise, or a profitable online business, the cash flow from the business contributes to your overall income.

- Royalties: Holding intellectual property rights, such as patents, trademarks, or copyrights, can generate passive income through royalties. Licensing agreements or sales of creative works can provide ongoing cash flow without requiring active involvement on the part of the rights holder.

- Peer-to-Peer Lending: Participating in peer-to-peer lending platforms allows individuals to lend money to others in exchange for an interest payment. This form of investment acts as a cash flow asset, as borrowers repay the loan with interest over time.

- Annuities: Annuities are financial products that offer a fixed stream of income over a predetermined period or for the rest of an individual’s life. By investing a lump sum or making periodic payments into an annuity, individuals can secure regular cash flow for retirement or other financial goals.

These examples illustrate the diverse range of cash flow assets available to investors. Each asset class has its own risk profile, potential rate of return, and unique considerations. It’s important to conduct thorough research and analysis, seeking guidance from financial professionals when necessary, to make informed investment decisions based on your financial goals and risk tolerance.

Benefits of Cash Flow Assets

Investing in cash flow assets offers a multitude of benefits that contribute to financial stability, wealth creation, and long-term prosperity. Here are some key advantages of incorporating cash flow assets into your investment strategy:

- Regular and Predictable Income: Cash flow assets provide a consistent stream of income, allowing you to rely on regular payments to cover expenses or reinvest for further growth. This can provide a sense of financial security and stability.

- Passive Income Generation: Cash flow assets allow you to earn passive income, which means you don’t have to actively work for every dollar earned. This provides the freedom to pursue other interests and opportunities while your investments continue to generate income.

- Diversification: Cash flow assets offer a way to diversify your investment portfolio beyond traditional assets. By spreading your investments across different asset classes, you can reduce risk and increase potential returns. Cash flow assets often have a low correlation with other investments, enabling you to mitigate volatility and protect your overall portfolio.

- Inflation Hedge: Certain cash flow assets, such as real estate properties or inflation-adjusted bonds, can act as a hedge against inflation. As prices rise, rental income, dividends, or interest payments associated with these assets tend to increase as well, helping to preserve your purchasing power over time.

- Wealth Creation and Growth: Cash flow assets have the potential to generate significant wealth over the long term. With consistent income and potential for compounding, these assets can contribute to wealth accumulation and financial independence.

- Opportunities for Reinvestment: The regular income from cash flow assets provides opportunities for reinvestment. You can reinvest the generated income into additional cash flow assets, further growing your portfolio and increasing your overall income potential.

- Financial Flexibility and Freedom: Building a portfolio of cash flow assets can provide financial independence and flexibility. As your income from these assets grows, you may have the option to retire early, pursue your passions, or enjoy a higher quality of life.

By incorporating cash flow assets into your investment strategy, you can take advantage of these benefits and create a solid foundation for your financial well-being. However, it’s important to conduct thorough research, seek professional advice, and carefully evaluate each asset’s risks and rewards to make informed investment decisions aligned with your financial goals.

Risks and Considerations of Cash Flow Assets

While cash flow assets offer numerous benefits, it’s important to be aware of the risks and considerations associated with investing in them. Understanding these factors can help you make informed investment decisions and manage your portfolio effectively. Here are some key risks and considerations to keep in mind:

- Market and Economic Conditions: Cash flow assets, like any other investment, can be influenced by market fluctuations and economic conditions. Changes in interest rates, shifts in demand for rental properties, or economic downturns can impact the performance of cash flow assets and the income they generate.

- Risk of Default: Some cash flow assets, such as bonds or peer-to-peer lending, carry the risk of default. Borrowers may fail to repay their loans, leading to potential loss of income or principal. It’s crucial to assess the creditworthiness of the borrowers or issuers when considering these assets.

- Operational and Management Risks: Certain cash flow assets, such as rental properties or business ventures, require active management. Challenges such as tenant turnover, property maintenance, or business disruptions can affect the cash flow and require time, effort, and resources to address effectively.

- Regulatory and Legal Considerations: Cash flow assets can be subject to various regulations and legal requirements. It’s important to understand and comply with local laws, zoning regulations, tax obligations, and other legal considerations relating to the specific asset class you are investing in.

- Illiquidity: Some cash flow assets can be illiquid, meaning they cannot be easily converted into cash. For example, selling a real estate property may take time and incur transaction costs. It’s crucial to consider your liquidity needs and have a long-term investment horizon when investing in illiquid assets.

- Asset-Specific Risks: Each cash flow asset has its own unique set of risks. Real estate investments may be vulnerable to property market fluctuations or unexpected expenses. Dividend stocks can be affected by changes in company fundamentals or industry trends. Evaluate the specific risks associated with each asset class before investing.

- Tax Implications: Cash flow from various assets can have different tax implications. It’s essential to understand the tax laws governing the specific asset class and consult with a tax professional to optimize your tax strategy and ensure compliance.

As with any investment, diversification is key. Allocating your investments across different cash flow assets can help mitigate some of these risks by spreading your exposure. Regularly monitoring and evaluating your portfolio’s performance, staying informed about market conditions, and adjusting your investment strategy as needed can also help manage the risks associated with cash flow assets.

It’s important to conduct thorough due diligence, seek professional advice, and carefully assess the risks and rewards of each cash flow asset before making investment decisions. By understanding the potential risks and taking appropriate measures to manage them, you can build a well-rounded portfolio of cash flow assets that align with your financial goals and risk tolerance.

How to Invest in Cash Flow Assets

Investing in cash flow assets requires careful planning and consideration. Here are some steps to help you get started:

- Define Your Financial Goals: Start by defining your financial goals and objectives. Determine the level of income you wish to generate and the time horizon for achieving those goals. This will help guide your investment decisions and asset selection.

- Evaluate Risk Tolerance: Assess your risk tolerance and investment preferences. Consider factors such as your age, investment experience, and overall financial situation. This will help determine your comfort level with different types of cash flow assets and the level of risk you are willing to take.

- Conduct Research: Thoroughly research different asset classes and cash flow opportunities to identify the ones that align with your goals and risk profile. Consider factors such as historical performance, market trends, potential risks, and future growth prospects. Utilize online resources, financial publications, and consult with professionals to gather comprehensive information.

- Seek Professional Guidance: Consulting with financial advisors, real estate professionals, or securities brokers can provide valuable insights into investing in cash flow assets. They can help you navigate complex investment landscapes, provide personalized advice, and assist in creating a diversified portfolio that suits your specific needs.

- Diversify Your Portfolio: Spread your investments across different types of cash flow assets to reduce risk and maximize potential returns. Consider a mix of real estate properties, dividend-paying stocks, bonds, and other opportunities that align with your investment strategies and goals.

- Perform Due Diligence: Before investing, thoroughly evaluate each cash flow asset. Analyze financial statements, assess the property condition, review the historical performance, and understand the income potential and associated risks. Consider working with professionals for property inspections, financial analysis, or legal reviews.

- Manage and Monitor: Regularly monitor your cash flow assets to ensure they continue to generate the expected income. Stay informed about market conditions, rental or dividend payments, and any changes that could impact the cash flow. Make necessary adjustments to your portfolio over time to optimize your returns.

- Stay Educated: Continuously educate yourself about cash flow assets, investment strategies, and market trends. Attend seminars, read books, follow industry experts, and stay up-to-date on financial news. This knowledge will empower you to make informed investment decisions and adapt to changing market conditions.

Remember that investing in cash flow assets requires patience and a long-term perspective. It’s essential to approach investments with a realistic outlook, understanding that income may fluctuate over time and that not all cash flow assets will perform equally. Regularly review and reassess your investment portfolio to ensure it aligns with your changing financial goals and risk tolerance.

By following these steps and putting in the necessary effort and due diligence, you can effectively invest in cash flow assets and create a sustainable stream of income, ultimately working towards achieving your financial objectives.

Conclusion

Cash flow assets play a crucial role in building wealth, generating passive income, and achieving financial independence. These assets offer a consistent stream of income, reducing reliance on unpredictable market fluctuations and providing stability in a well-diversified investment portfolio.

By investing in cash flow assets such as rental properties, dividend-paying stocks, interest-bearing bonds, business ventures, or intellectual property, individuals can secure regular income that contributes to long-term financial stability and growth. The benefits of cash flow assets include regular and predictable income, passive income generation, diversification, inflation hedging, wealth creation and growth, opportunities for reinvestment, and financial flexibility.

However, investing in cash flow assets is not without risks and considerations. Market and economic conditions, risk of default, operational and management risks, regulatory and legal considerations, illiquidity, asset-specific risks, and tax implications are factors that must be carefully evaluated. Conducting thorough research, seeking professional advice, and considering risk management strategies are essential in mitigating these risks.

To invest in cash flow assets, it is recommended to define your financial goals, evaluate your risk tolerance, conduct thorough research, seek professional guidance, diversify your portfolio, perform due diligence, and stay educated about market trends. Regular monitoring and adjustments are necessary to ensure the assets continue to generate expected income and align with changing financial objectives.

In conclusion, cash flow assets provide an excellent opportunity for individuals to generate consistent income and work towards their financial goals. By carefully selecting and managing these assets, investors can enjoy the benefits of passive income, diversification, and long-term wealth creation. With proper planning, research, and a well-rounded investment strategy, cash flow assets can become an integral part of your journey towards financial prosperity.