Home>Finance>Issued Shares: Definition, Example, Vs. Outstanding Shares

Finance

Issued Shares: Definition, Example, Vs. Outstanding Shares

Published: December 14, 2023

Learn about the definition and example of issued shares, and understand the difference between issued shares and outstanding shares in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Issued Shares: Definition, Example, vs. Outstanding Shares

Are you looking to understand the concept of issued shares and how they fit into the world of finance? Look no further! In this blog post, we will dive into the definition of issued shares, provide an example to help clarify the concept, and differentiate them from outstanding shares. By the end, you’ll have a solid understanding of these fundamental aspects of finance.

Key Takeaways:

- Issued shares refer to the total number of shares that a company has authorized to sell to its shareholders.

- Outstanding shares are the shares that have been issued to investors and are currently held by them.

What are Issued Shares?

Issued shares, also known as authorized shares or subscribed shares, are the total number of shares that a company is allowed to sell to its shareholders. These shares are created by a company’s board of directors and can be bought by investors either in a public offering or through private placements.

When a company decides to go public and issue shares to raise capital, it determines the number of shares it wants to authorize. For example, let’s say Company XYZ decides to authorize 1 million shares. This means that there are 1 million issued shares available for sale to potential investors.

Example of Issued Shares

To understand how issued shares work, let’s consider the case of Company ABC. Company ABC is a startup that recently completed its initial public offering (IPO). In the IPO, the company issued 10,000,000 shares to investors who purchased them at the offering price.

These 10,000,000 shares represent the issued shares of Company ABC. They came into existence when the company’s board of directors authorized their creation specifically for the IPO. Investors who bought these shares now hold a stake in the company and become shareholders.

Issued Shares vs. Outstanding Shares

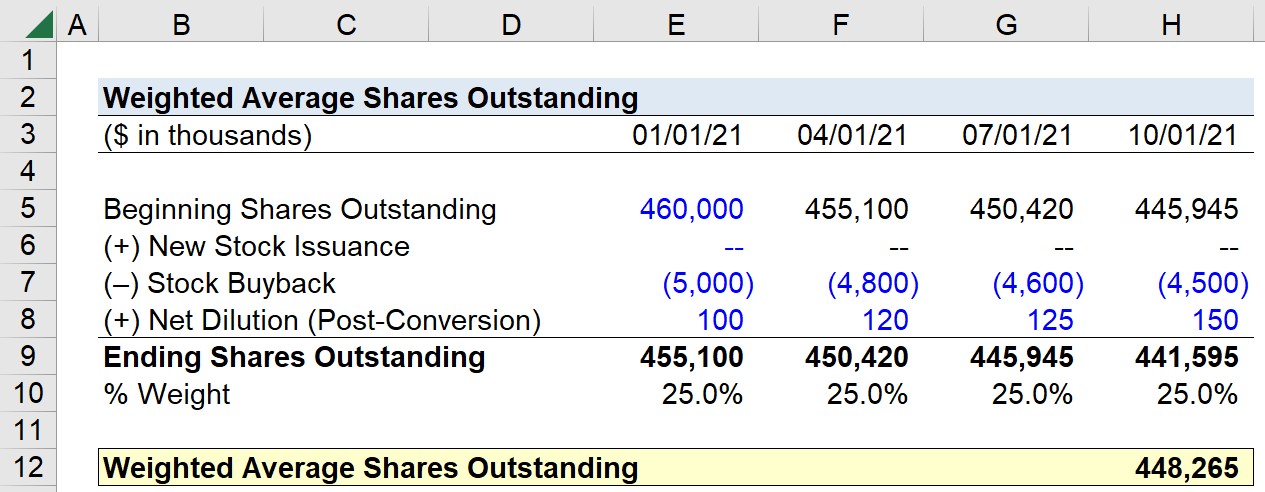

Issued shares should not be confused with outstanding shares. While issued shares represent the total number of shares authorized for sale by a company, outstanding shares are the shares that have been issued to investors and are currently held by them.

Let’s go back to our example of Company ABC. After the IPO, some investors decided to sell their shares on the stock market, while others held onto their shares. The shares held by the investors who did not sell them are called outstanding shares. The company is considered publicly traded and the outstanding shares represent the ownership of the company’s stock by investors.

In summary:

- Issued shares: The total number of shares a company has authorized for sale.

- Outstanding shares: The shares that have been issued to investors and are currently held by them.

Understanding the difference between issued shares and outstanding shares is crucial for investors, as it provides them with insights into the ownership structure of a company and its market value.

Now that you have a good understanding of issued shares and how they relate to outstanding shares, you can confidently navigate the world of finance with this valuable knowledge!