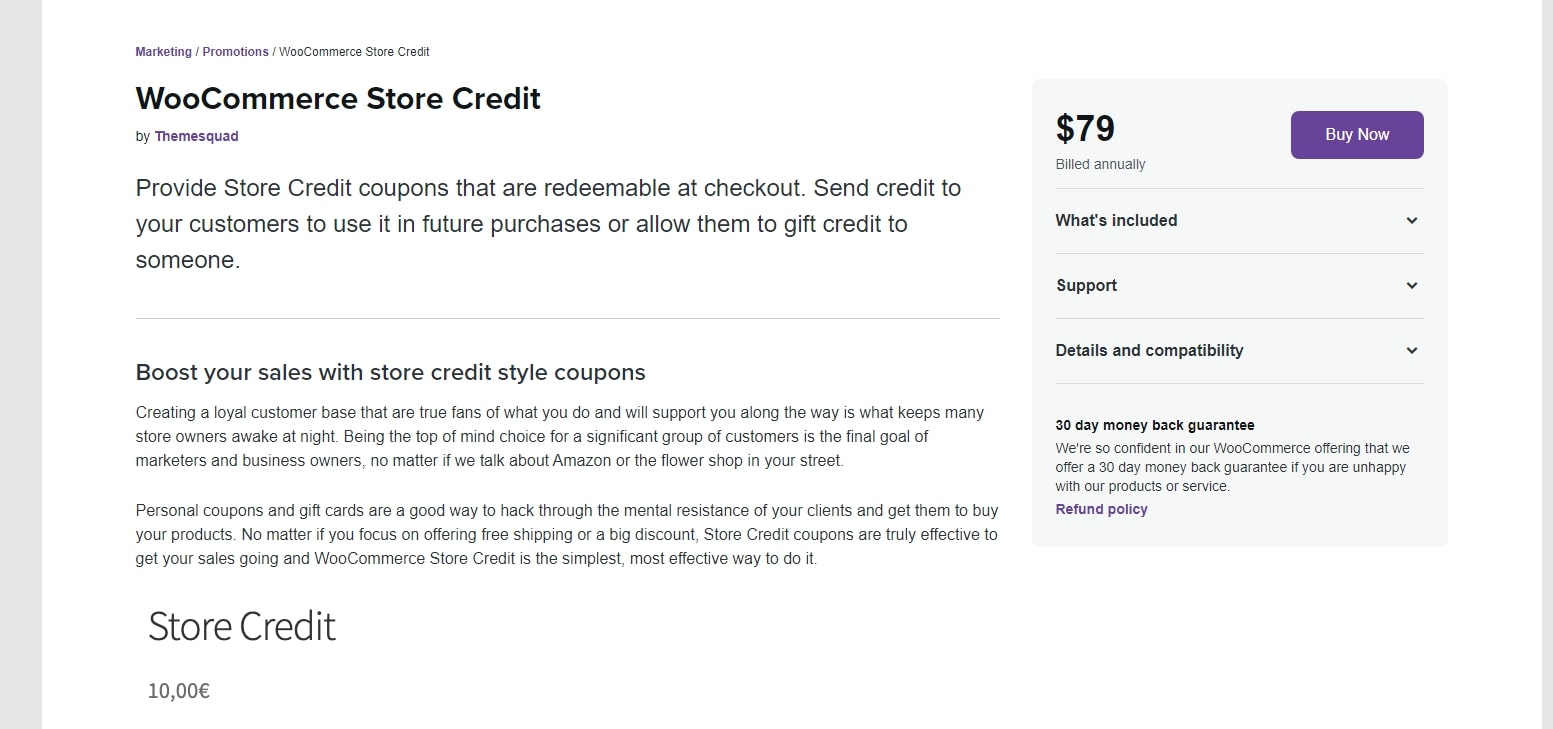

Home>Finance>Claims Reserve: Definition In Insurance, Purpose, And Example

Finance

Claims Reserve: Definition In Insurance, Purpose, And Example

Published: October 27, 2023

Discover the definition, purpose, and example of claims reserve in insurance. Explore how claims reserves impact the financial stability of insurance companies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Claims Reserve: Definition in Insurance, Purpose, and Example

Welcome to our Finance category blog post where we delve into important topics that can greatly impact your financial well-being. In today’s discussion, we will be focusing on claims reserve in the insurance industry. If you’ve ever wondered what claims reserves are, how they are calculated, and why they are crucial for insurance companies, then you’ve come to the right place. Let’s dive in and explore all the essential aspects of claims reserves!

Key Takeaways:

- Claims reserves are funds set aside by insurance companies to cover potential future claims.

- These reserves are calculated based on actuarial analysis and historical data to ensure adequate funds are available to meet claim obligations.

So, what exactly are claims reserves?

Claims reserves are funds set aside by insurance companies to cover potential future claims. These reserves act as a financial safety net, ensuring that insurance companies have enough money to fulfill their obligations in the event of policyholder claims. Essentially, they serve as a cushion to provide the necessary funds when claims arise.

How are claims reserves calculated?

Calculating claims reserves involves a meticulous process that requires actuarial analysis and consideration of historical data. Insurance companies rely on the expertise of actuaries to estimate potential future claims and the associated costs. Actuaries use complex mathematical models to project the likelihood of claims and the financial impact they may have on the company. By analyzing past claims patterns, the industry’s overall historical data, and other relevant factors, actuaries help determine the appropriate level of reserves needed to cover future claims.

What is the purpose of claims reserves?

Claims reserves have multiple purposes within the insurance industry:

- Financial Stability: Claims reserves provide financial stability to insurance companies by ensuring they have adequate funds to pay out future claims. This stability is essential for the long-term viability and solvency of insurance companies, allowing them to honor their policyholder commitments.

- Regulatory Compliance: Insurance companies are subject to strict regulations and requirements imposed by insurance regulators. Adequate claims reserves play a crucial role in complying with these regulations, demonstrating the insurer’s ability to meet its financial obligations.

- Customer Confidence: Policyholders rely on insurance companies to fulfill their claims promptly and efficiently. By maintaining sufficient claims reserves, insurance companies instill confidence in their customers that they can meet their financial obligations when the need arises.

Example:

Let’s consider an example to illustrate how claims reserves work. Imagine an auto insurance company that has received 10,000 policy premiums in a given year, amounting to $10 million. Based on historical data and actuarial analysis, the insurance company estimates that it may face $2 million in claims from these policies during the year. To ensure they have adequate funds to cover these claims, the insurer sets aside $2 million as claims reserves. This reserve acts as a guarantee that the insurance company can pay out the expected claims.

It is important to note that claims reserves can be categorized based on different factors like product lines, geographical regions, or types of policies. This categorization helps insurance companies prioritize their reserves for precise claims obligations.

Understanding claims reserves is vital for policyholders, insurance companies, and regulatory bodies alike. It highlights the financial stability and responsibility of insurance providers, ensuring they are well-prepared to meet their obligations to policyholders in times of need.

- Key Takeaway 1: Claims reserves are funds set aside by insurance companies to cover future claims.

- Key Takeaway 2: Calculating claims reserves involves actuarial analysis and historical data.

Thank you for joining us in this discussion on claims reserves in insurance. We hope that you now have a better understanding of their importance and how they function within the insurance industry.