Finance

Clearing House Funds Definition

Published: October 28, 2023

Learn about the finance industry term "clearing house funds" and how it impacts financial transactions and settlements. Enhance your understanding of finance with our comprehensive definition.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Clearing House Funds

Welcome to the world of finance! Today, we’re diving into the fascinating topic of Clearing House Funds. If you’ve ever wondered what this term means or how it relates to the financial world, you’ve come to the right place. In this blog post, we’ll demystify Clearing House Funds and provide you with valuable insights. So, let’s get started!

Key Takeaways:

- Clearing House Funds are a mechanism used in financial markets to facilitate the settlement of trades and payments between various institutions.

- These funds act as a central intermediary, ensuring the smooth flow of funds between buyers and sellers, reducing counterparty risk in the process.

What are Clearing House Funds?

Clearing House Funds are an essential component of financial systems worldwide. In simple terms, a Clearing House acts as a middleman between buyers and sellers in financial transactions. The primary purpose is to mitigate risk and streamline the settlement process.

When investors or traders engage in financial activities such as buying or selling stocks, bonds, or derivatives, it involves multiple parties. These parties may not have a direct relationship with each other, leading to a potential risk that one party may default on their payment obligations.

Here’s where Clearing House Funds step in. They provide a neutral ground where transactions can be settled securely. When a trade takes place, the Clearing House becomes the buyer to every seller and the seller to every buyer. By becoming the counterparty to every transaction, it ensures that funds are properly transferred from the buyer to the seller, reducing the risk of default.

Clearing House Funds play a crucial role in maintaining financial stability and confidence in the market. Through their efficient settlement processes, they promote transparency, reduce counterparty risk, and provide a forum for resolving disputes.

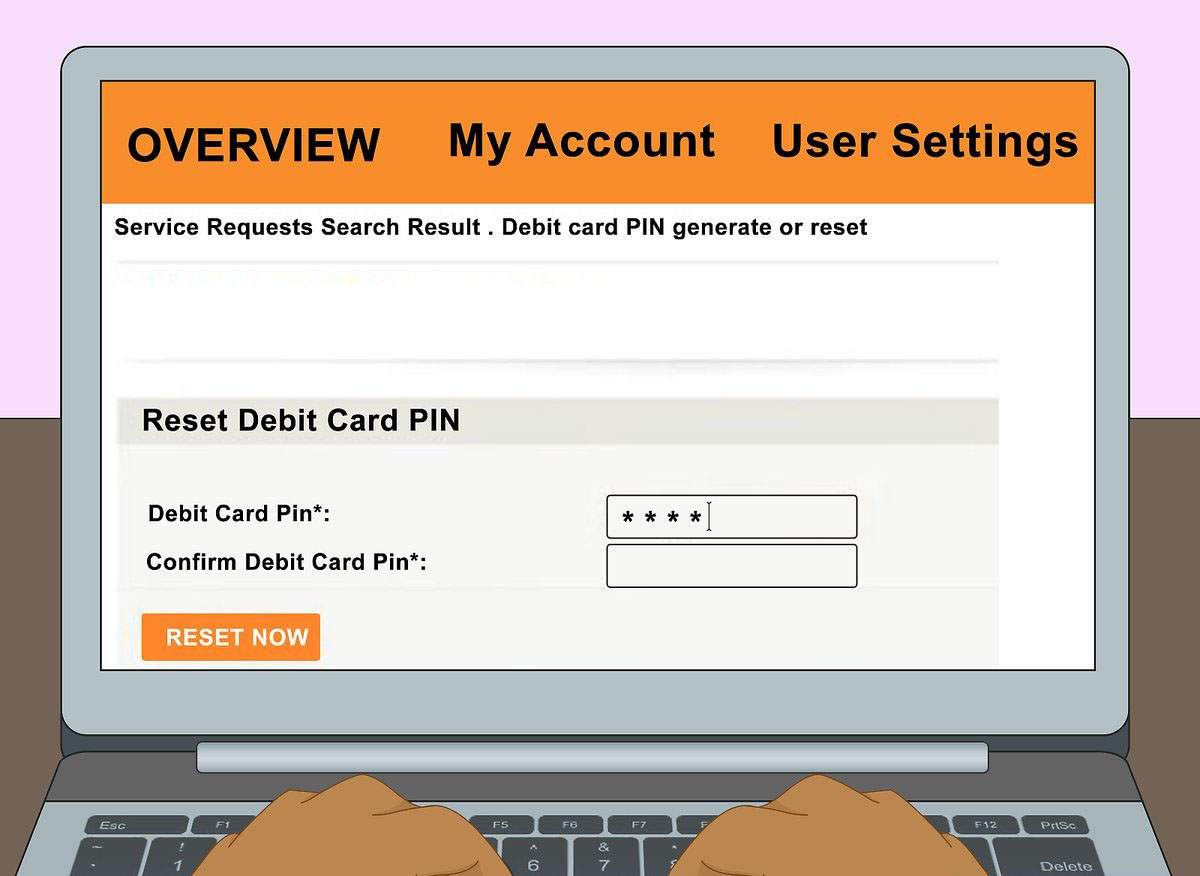

How do Clearing House Funds Work?

To understand how Clearing House Funds work, let’s walk through a simplified example:

- An investor wants to buy shares of a company through their broker.

- The broker sends the buy order to the exchange, where it is matched with a sell order from another investor.

- Once the trade is matched, the Clearing House steps in and becomes the buyer to the seller and the seller to the buyer.

- The Clearing House then settles the trade by transferring funds from the buyer’s account to the seller’s account. This ensures that both parties receive the agreed-upon funds.

- In case either party defaults, the Clearing House guarantees the payment, assuming the counterparty risk.

By acting as an intermediary, Clearing House Funds reduce the need for direct relationships between buyers and sellers. This simplifies the settlement process and allows for efficient transactions on a large scale.

Benefits of Clearing House Funds

Clearing House Funds offer several benefits to the financial ecosystem:

- Risk Mitigation: By assuming the counterparty risk, Clearing Houses help mitigate potential defaults and ensure the smooth functioning of financial markets.

- Efficiency: Clearing House Funds streamline the settlement process, reducing the time and costs associated with individual trade settlements.

- Transparency: Through their mechanisms and reporting requirements, Clearing Houses provide transparency and visibility into the flow of funds within the financial system.

- Dispute Resolution: In case of disputes, Clearing Houses serve as a neutral party and provide mechanisms for resolving conflicts between participants.

Understanding Clearing House Funds is essential for anyone involved in financial markets. Whether you’re a trader, investor, or simply curious about how the financial system operates, having knowledge of Clearing House Funds can provide valuable insights.

So, the next time you come across the term Clearing House Funds, you’ll have a better understanding of its significance and the role it plays in the world of finance.