Home>Finance>When You Get Married, Do Your Credit Scores Combine?

Finance

When You Get Married, Do Your Credit Scores Combine?

Modified: March 10, 2024

Learn how getting married can affect your credit scores and find out if they combine or remain separate. Discover the financial implications of marriage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Getting married is an exciting milestone in life, where two individuals join together in love and partnership. As you embark on this journey together, you may be wondering how your financial lives will be affected. One common question that arises is whether your credit scores will combine when you get married.

Understanding credit scores is essential in order to navigate the financial aspects of marriage. Credit scores are numerical representations of an individual’s creditworthiness and financial history. They play a crucial role in determining loan approvals, interest rates, and other financial opportunities.

Credit scores are calculated by credit reporting agencies based on various factors, such as payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. These scores range from 300 to 850, with higher scores indicating a lower credit risk.

When two individuals get married, their credit scores do not automatically combine. Each person maintains their own credit score, which reflects their individual financial behaviors and history prior to marriage. However, certain financial activities and decisions as a married couple can indirectly impact each person’s credit score.

In this article, we will explore the relationship between marriage and credit scores, including the impact of joint accounts, sharing credit cards, obtaining a mortgage, and maintaining separate credit scores. We will also provide tips on how to improve and manage your credit scores as a married couple.

By understanding how marriage can influence credit scores, you can make informed financial decisions and work together to achieve your goals as a couple.

Understanding Credit Scores

Before delving into the impact of marriage on credit scores, it is important to have a clear understanding of what credit scores are and how they are calculated. Credit scores are numerical representations of an individual’s creditworthiness and financial history. They serve as a measure for lenders to assess the risk associated with extending credit to a borrower.

Credit scores are calculated by credit reporting agencies, such as Equifax, Experian, and TransUnion, using proprietary algorithms that take into account various factors. These factors include:

- Payment History: This is the most significant factor in determining credit scores. It reflects whether you have consistently made payments on time or if you have a history of late or missed payments.

- Credit Utilization: This factor considers the amount of credit you have available and how much of it you are currently using. It is recommended to keep your credit utilization below 30% to maintain a healthy credit score.

- Length of Credit History: The length of your credit history is taken into account, including the age of your oldest and newest accounts, as well as the average age of all your accounts.

- Types of Credit: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact your credit score.

- Recent Credit Inquiries: Applications for new credit can temporarily lower your credit score, so it’s important to be mindful of how often you apply for credit.

Credit scores typically range from 300 to 850, with higher scores indicating a lower credit risk. A higher credit score can lead to more favorable loan terms, lower interest rates, and increased access to financial opportunities.

When you get married, your credit score remains separate and does not merge with your spouse’s credit score. Each individual maintains their own credit history and score, which reflects their personal financial behavior.

Now that we have a foundation of understanding credit scores, let’s explore how marriage can indirectly impact these scores.

How Credit Scores are Calculated

The calculation of credit scores is a complex process that involves multiple factors and algorithms. While the exact formulas used by credit reporting agencies are proprietary and not publicly disclosed, we can still gain a general understanding of how credit scores are calculated.

The most widely used credit scoring model is the FICO score, which was developed by the Fair Isaac Corporation. Although there are other scoring models like VantageScore, we will focus on FICO since it is the most commonly used.

The FICO score takes into account several factors to determine an individual’s creditworthiness. These factors include:

- Payment History: This factor carries the most weight in determining your credit score. It considers whether you have made payments on time, missed any payments, or have any accounts in collections or bankruptcy.

- Amount Owed: This factor looks at the total amount of debt you owe, both in terms of individual balances and the overall credit utilization ratio. It assesses if you are utilizing a high percentage of your available credit, which can negatively impact your score.

- Length of Credit History: The length of your credit history is also a significant factor. It takes into account the age of your oldest account, the age of your newest account, and the average age of all your accounts. Generally, a longer credit history demonstrates responsible credit management and can positively impact your score.

- Credit Mix: Having a diverse mix of credit accounts can contribute to a higher credit score. This factor assesses your ability to manage different types of credit, such as credit cards, loans, mortgages, and retail accounts.

- New Credit: Opening multiple new credit accounts within a short period can negatively impact your credit score. It signals to lenders that you may be taking on too much debt or potentially facing financial challenges.

Each of these factors is evaluated in the credit scoring process, with varying degrees of importance. The weight assigned to each factor may also differ based on individual circumstances.

It is important to note that credit scores are not static and can change over time. They are updated frequently based on new credit information and financial behavior. Your credit score is a fluid representation of your financial health and management skills.

By understanding how credit scores are calculated, you can take steps to improve and maintain a healthy credit profile, both as an individual and as a couple when you get married.

Marriage and Credit Scores

When you get married, your credit score won’t automatically combine with your spouse’s credit score. However, certain financial activities and decisions as a married couple can indirectly impact each person’s credit score.

One way that marriage can influence credit scores is through joint accounts. When you open a joint account, such as a credit card or a loan, both you and your spouse become responsible for the debt. Any late payments or defaults on joint accounts can negatively impact both of your credit scores. Therefore, it’s important to communicate and manage joint accounts responsibly to avoid damaging your credit profiles.

Another consideration is sharing credit cards. While it’s common for couples to have shared credit cards, it’s important to be aware that the financial behavior on these cards can impact both individuals’ credit scores. If one spouse consistently maxes out the credit card or makes late payments, it can negatively affect both credit scores. It’s essential to have open communication and joint responsibility when it comes to shared credit cards.

Marriage also plays a role in mortgage applications. Jointly applying for a mortgage means both individuals’ credit scores and financial histories will be taken into account. Lenders will assess the overall creditworthiness of the couple when determining the loan terms. It’s important for both partners to maintain good credit standing and manage their finances responsibly to secure favorable mortgage terms.

While there are instances where financial decisions as a married couple can impact credit scores, it’s important to remember that spouses can maintain separate credit scores. Each individual can have their own credit history and financial obligations. This means that even if one spouse has a low credit score, it doesn’t necessarily mean the other spouse will be affected.

Ultimately, marriage and credit scores are intertwined in certain areas, but they continue to remain separate. It’s essential for couples to have open communication about their financial goals, responsibilities, and the impact their decisions can have on their credit profiles.

Joint Accounts and Credit Scores

When you get married, one common financial decision is to open joint accounts, such as joint credit cards, joint bank accounts, or joint loans. While joint accounts can provide convenience and simplify financial management, it’s important to understand how they can impact credit scores.

When you open a joint account, both you and your spouse become equally responsible for the debt and the management of the account. This means that the credit activity on the joint account, both positive and negative, will be reflected on both individuals’ credit reports and can impact their credit scores.

Positive credit activity, such as making timely payments and keeping the account balance low, can help boost both individuals’ credit scores. On the other hand, if there are late payments or defaults on the joint account, it can adversely affect both credit scores.

It’s important to keep in mind that the impact on credit scores is not weighted based on equal responsibility. Credit reporting agencies do not differentiate between primary and secondary account holders when it comes to credit history and payment behavior.

For instance, if one spouse consistently makes late payments on the joint credit card, it can negatively impact the credit scores of both individuals, even if the other spouse is responsible for most of the charges and is diligent in making payments on time.

Therefore, it’s crucial to have open communication with your spouse when it comes to joint accounts. Both partners should be equally responsible for managing the accounts and ensuring that all payments are made on time. It’s a shared responsibility to maintain a good credit profile for both individuals.

Furthermore, it’s important to regularly review the statements and activity on joint accounts. By keeping a close eye on the account’s financial activity, you can quickly address any issues or discrepancies and prevent them from causing damage to your credit scores.

When considering opening joint accounts, it’s important to have a clear understanding of your partner’s financial habits and discuss how you will handle the finances together. Establishing trust, setting financial goals, and maintaining open lines of communication will help ensure that joint accounts have a positive impact on both credit profiles.

Sharing Credit Cards and Credit Scores

It’s not uncommon for couples to share credit cards, whether it’s for convenience or to take advantage of joint rewards programs. However, it’s important to be aware that the financial activity on shared credit cards can impact both individuals’ credit scores.

When you share a credit card with your spouse, the payment history, credit utilization, and overall management of the card will affect both of your credit scores. For example, if one spouse consistently maxes out the credit card or carries a high balance, it can negatively impact both credit scores.

Similarly, late payments or defaults on a shared credit card can have adverse effects on both individuals’ credit profiles. It’s crucial for both partners to prioritize making timely payments and keeping the credit card balance low.

It’s also important to note that if one spouse has a poor credit score and is added as an authorized user on the other spouse’s credit card, it may or may not directly affect the authorized user’s credit score. This is because some credit scoring models may not factor authorized user accounts into the calculation of the authorized user’s credit score.

As the primary cardholder, it’s essential to regularly monitor the credit card activity and keep both partners informed about the account status. This will help you identify and address any potential issues or discrepancies that could impact your credit scores.

Communication is key when sharing credit cards. It’s important to have open discussions with your spouse about financial responsibility, spending limits, and payment schedules. By establishing clear guidelines and a mutual understanding, you can both work together to maintain a healthy credit profile.

If both partners have individual credit cards in addition to shared cards, it’s equally important to manage those cards responsibly. A positive credit history on individual cards can help offset any negative impact from shared cards and contribute to maintaining good credit scores.

By being transparent, setting spending limits, and working together to make timely payments, sharing credit cards can be a beneficial arrangement for couples. It can help them build credit, earn rewards, and manage their finances effectively while minimizing any negative impact on their credit scores.

Credit Scores and Mortgages

When it comes to obtaining a mortgage, credit scores play a crucial role in the process. Lenders use credit scores as part of their assessment to determine whether to approve a mortgage application and what terms to offer.

Typically, mortgage lenders will review both spouses’ credit scores and financial histories when evaluating a joint mortgage application. This means that both individuals’ credit scores are taken into consideration when determining the loan eligibility and interest rates.

A higher credit score can improve the chances of securing a mortgage and can also lead to more favorable loan terms, such as lower interest rates and reduced closing costs. On the other hand, a lower credit score may result in a loan denial or less favorable terms.

In addition to credit scores, lenders will also assess other factors, such as income, debt-to-income ratio, employment stability, and the size of the down payment. All these factors together determine the overall risk and affordability for the lender.

To maximize your chances of getting a favorable mortgage deal, it’s important to maintain good credit scores as a couple. This includes making timely payments on all debts, keeping credit card balances low, and avoiding any late payments or defaults.

If either spouse has a lower credit score, it may be worth considering ways to improve it before applying for a mortgage. This can involve paying down debt, resolving any outstanding collection accounts, and avoiding applying for new credit in the months leading up to the mortgage application.

It’s worth noting that even if one spouse has a lower credit score, it doesn’t mean that it’s impossible to secure a mortgage. Lenders look at the overall creditworthiness of the couple and take into account other factors as well.

Working with a knowledgeable mortgage professional can help you navigate the application process and explore potential options if one spouse has a lower credit score. They can provide guidance on improving credit scores and finding suitable mortgage programs that may be more lenient or offer assistance for applicants with lower credit scores.

Remember, maintaining good credit scores and managing your finances responsibly as a married couple is not only important for obtaining a mortgage; it also sets a solid foundation for your future financial well-being.

Maintaining Separate Credit Scores

While marriage can involve shared finances and joint financial goals, it’s still possible and sometimes beneficial for couples to maintain separate credit scores. Keeping individual credit scores can provide financial independence and flexibility for each spouse.

Maintaining separate credit scores means that each spouse has their own credit history and individual responsibility for their debts and financial decisions. This allows individuals to establish and maintain their own creditworthiness and have control over their personal financial affairs.

One way to maintain separate credit scores is to have individual credit accounts. Each spouse can have their own credit cards, loans, and other financial obligations. By managing their own credit responsibly, such as making timely payments and keeping credit utilization low, individuals can build and improve their credit scores over time.

Another important aspect of maintaining separate credit scores is regular monitoring. Both spouses should review their individual credit reports at least once a year to ensure accuracy and identify any potential errors or discrepancies. It’s also advisable to monitor credit scores on a periodic basis to track progress and identify areas that may need improvement.

When it comes to joint accounts, it’s important to be aware that activity on these accounts can still impact individual credit scores. For example, if a joint account experiences a late payment or default, it can be reflected on both individuals’ credit reports. Therefore, it’s crucial to have open communication and joint responsibility for managing joint accounts to prevent any negative impact on individual credit scores.

Separate credit scores can also be advantageous in case of unforeseen circumstances or financial hardships. If one spouse faces difficulties with their credit, it won’t directly impact the other spouse’s credit score. This can provide a safety net and allow the other spouse to maintain good credit standing for future financial opportunities.

Lastly, maintaining separate credit scores doesn’t mean that couples can’t work together to achieve their financial goals. By openly communicating about finances and joint financial objectives, couples can still make informed decisions and collaborate on shared financial responsibilities without merging their credit profiles.

Ultimately, maintaining separate credit scores in a marriage provides both spouses with independence, flexibility, and the ability to establish and maintain their individual financial reputation. It’s important to strike a balance between joint financial management and individual credit responsibility to foster a healthy financial foundation as a couple.

Improving Credit Scores as a Married Couple

Improving credit scores as a married couple is a shared goal that can lead to better financial opportunities and a stronger financial foundation. By working together and implementing smart strategies, you can take steps to improve your credit scores as a couple.

1. Pay bills on time: Late payments can have a significant negative impact on credit scores. Make it a priority to pay all bills, including credit card bills, loans, and utilities, on time each month.

2. Reduce debt: High levels of debt can hurt credit scores. Create a plan to pay down existing debt, focusing on high-interest accounts first. Aim to keep credit card balances well below the credit limit to improve credit utilization ratios.

3. Communicate about finances: Open and regular communication about financial matters is essential. Discuss your financial goals, create a budget, and track spending together. By working as a team, you can make better financial decisions and avoid unnecessary debt.

4. Avoid unnecessary credit inquiries: Each time a potential lender checks your credit, it results in a hard inquiry, which can temporarily lower your credit score. Avoid applying for credit unless necessary and be cautious when considering new credit opportunities.

5. Review credit reports: Regularly review your credit reports to ensure accuracy and identify any errors or discrepancies. If you notice any incorrect information, contact the credit reporting agencies to dispute and correct the errors promptly.

6. Monitor credit scores: Keep an eye on your credit scores regularly. There are various free credit monitoring services available that can provide you with updates and alerts regarding changes in your credit scores. This can help you track your progress and identify areas that need improvement.

7. Consider credit-building strategies: If one or both spouses have limited or poor credit history, consider credit-building strategies such as becoming an authorized user on a responsible spouse’s credit card or obtaining a secured credit card to establish and rebuild credit.

8. Seek professional advice: Consult with a financial advisor or credit counselor who can provide guidance on managing debt, improving credit scores, and achieving your financial goals. They can offer personalized advice based on your specific circumstances.

Remember, improving credit scores takes time and effort. It’s important to be patient and consistent in your financial habits. By working together as a married couple and taking proactive steps, you can both make progress in improving your credit scores and building a brighter financial future.

Conclusion

When you get married, your credit scores do not automatically merge together. Each individual maintains their own credit score, reflecting their financial behavior and history. However, certain financial decisions and activities as a married couple can indirectly impact each person’s credit score.

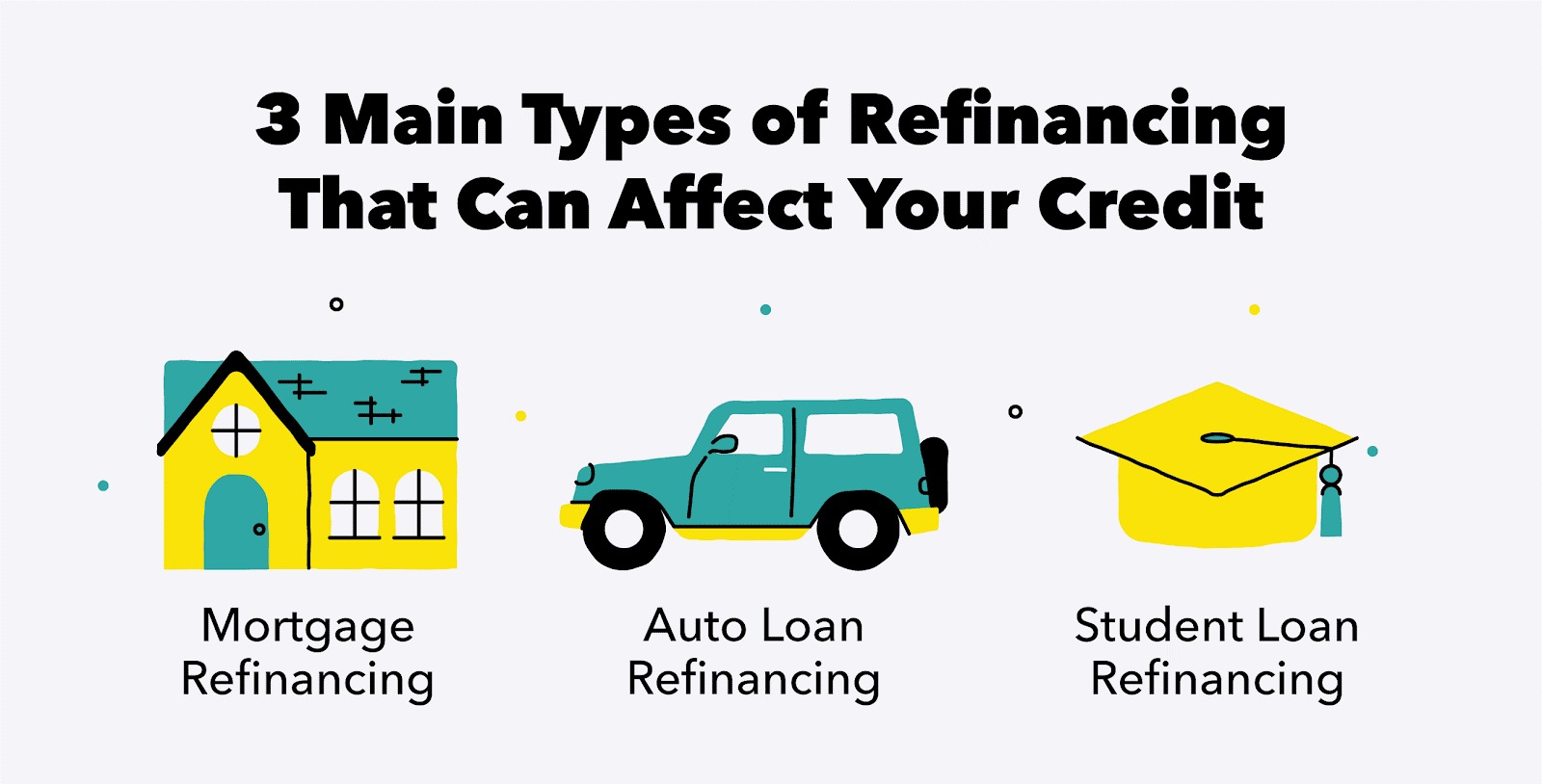

Understanding credit scores and how they are calculated is essential for navigating the intersection of marriage and finances. Joint accounts, shared credit cards, and mortgages are some examples of where marriage can have an influence on credit scores.

Maintaining separate credit scores can provide financial independence and flexibility for both spouses. It allows each individual to establish and maintain their own creditworthiness. However, responsible management of joint accounts and shared credit cards is crucial to avoid any negative impact on individual credit scores.

Improving credit scores as a married couple requires open communication, responsible financial habits, and joint financial goals. By paying bills on time, reducing debt, monitoring credit reports, and working together to make smart financial decisions, you can improve your credit scores and enhance your financial well-being as a couple.

Remember, marriage is not just about the union of hearts, but also the merging of financial lives. By understanding and actively managing your credit scores, you can navigate the financial aspects of marriage with confidence and set a solid foundation for a prosperous future together.