Finance

Covered Combination Definition

Published: November 4, 2023

Discover the meaning of covered combination in finance and learn how it can optimize your investment strategy. Explore the benefits and risks of this versatile financial concept today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Covered Combinations in Finance

When it comes to managing your finances, having a variety of investment options is essential. One such option that every investor should be familiar with is the covered combination. But what exactly is a covered combination, and how can it benefit your financial portfolio? In this blog post, we will delve into the definition of a covered combination, its advantages, and how it can contribute to your overall investment strategy.

Key Takeaways:

- A covered combination involves simultaneously buying or owning an underlying asset while also engaging in a specific options trading strategy.

- This strategy incorporates both bullish and bearish components to hedge against potential losses and optimize profit potential.

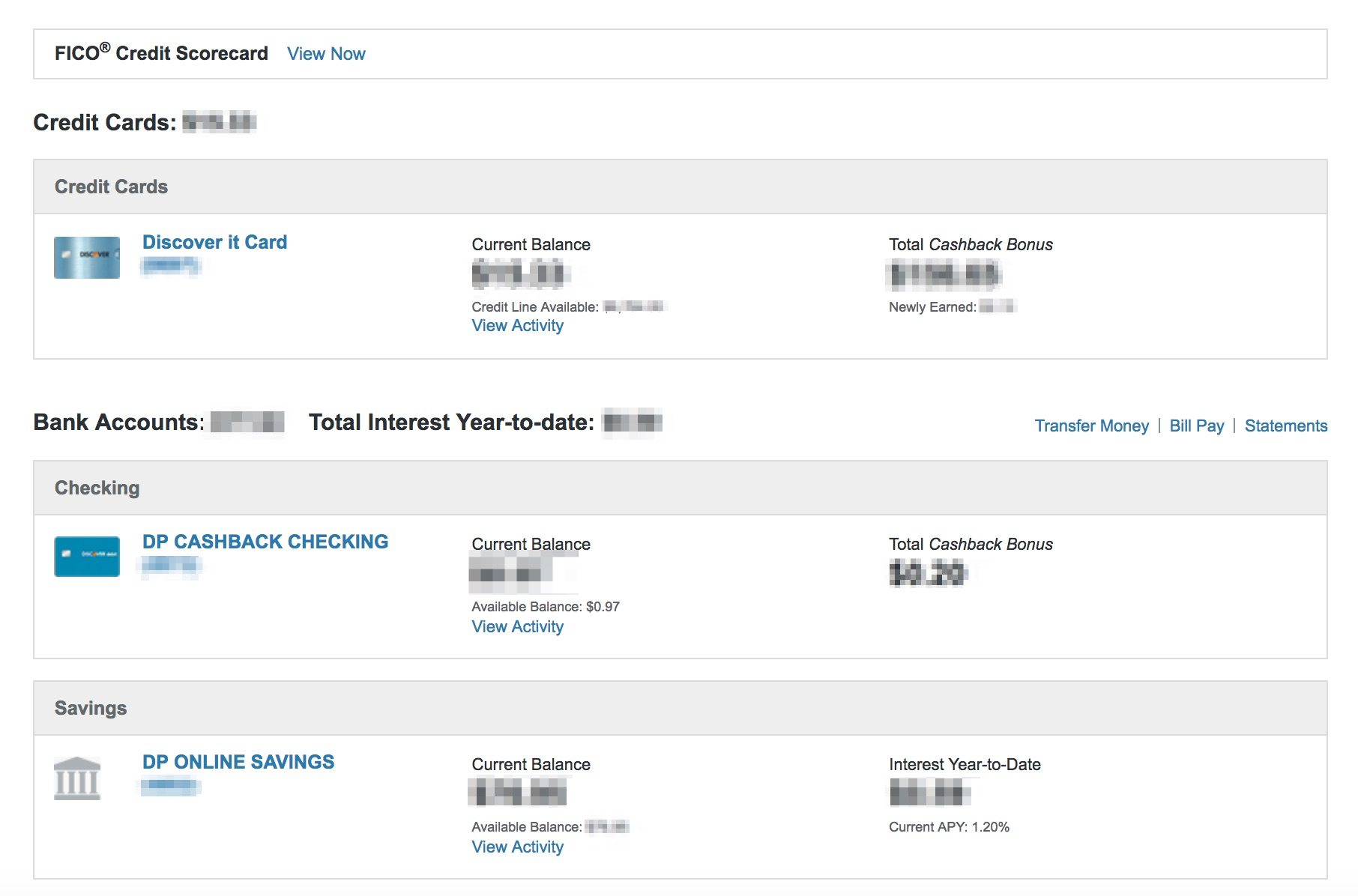

What is a Covered Combination?

A covered combination, sometimes referred to as a covered combo, is an options trading strategy that combines the ownership or purchase of an underlying asset with specific options trading positions. This strategy involves both bullish and bearish elements, allowing investors to hedge against potential losses while still optimizing profit potential.

In a covered combination, the underlying asset is typically a stock or other security that the investor owns or is willing to buy. This asset is used as a means of generating income and providing a basis for the options trading positions.

The options trading component of a covered combination strategy consists of two primary positions: a long or short call option and a written put option. The long call option allows the investor to profit from upward movements in the price of the underlying asset, while the written put option provides a means of generating income and offering protection against potential downside risk.

Advantages of Covered Combinations

Now that we have a clear understanding of what a covered combination entails, let’s explore some of the key advantages that this strategy offers:

- Diversification: By incorporating both bullish and bearish components, a covered combination provides investors with a diversified approach to their portfolio. This helps to mitigate the risks associated with holding a single position and provides a more balanced investment strategy.

- Risk Management: One of the primary goals of a covered combination is to manage risk effectively. By combining the ownership or purchase of an underlying asset with specific options trading positions, investors can create a strategy that hedges against potential losses. This allows for more control over risk exposure and can help protect against unfavorable market conditions.

As with any investment strategy, it is essential to thoroughly understand the concepts and risks associated with covered combinations before incorporating them into your portfolio. Consulting with a qualified financial advisor can provide valuable insights and guidance specific to your individual financial goals and circumstances.

In conclusion, a covered combination is a versatile options trading strategy that combines both bullish and bearish elements. By owning or purchasing an underlying asset while engaging in specific options trading positions, investors can enjoy the benefits of diversification and risk management. If used appropriately and with a solid understanding of the associated risks, a covered combination can be a valuable addition to your investment toolbox.