Home>Finance>How To Combine Discover Savings And Credit Card

Finance

How To Combine Discover Savings And Credit Card

Published: January 16, 2024

Learn how to combine your Discover savings account and credit card to optimize your finance strategy and maximize your savings. Discover the benefits today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Benefits of Combining Discover Savings and Credit Card

- Steps to Combine Discover Savings and Credit Card

- Eligibility Criteria for Combining Discover Savings and Credit Card

- Tips for Maximizing Benefits from Discover Savings and Credit Card Combination

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

Welcome to the world of Discover, where you can unlock a powerful combination of savings and credit card benefits. Discover is a renowned financial institution that offers a range of services, including savings accounts and credit cards. But did you know that you can actually combine these two to maximize your financial gains?

In this article, we will explore the benefits of combining Discover savings and credit card, the steps to do so, the eligibility criteria, and some handy tips to make the most out of this powerful combination. Whether you’re a long-time Discover customer or considering opening an account, this information will be invaluable in assisting you with your financial goals.

Combining your Discover savings and credit card offers a multitude of advantages. Apart from providing a convenient way to manage your finances, it helps you earn rewards, save money, and build credit simultaneously. So let’s delve deeper into the benefits and learn how to leverage this winning combination.

Benefits of Combining Discover Savings and Credit Card

Combining your Discover savings and credit card can open up a world of financial advantages. Here are some key benefits to consider:

- Streamlined Account Management: By combining your savings and credit card accounts, you have the convenience of managing both accounts in one place. This eliminates the need to log into multiple platforms or remember different login credentials. You can easily track your transactions, monitor balances, and make payments seamlessly.

- Earn Rewards Twice: Discover offers a variety of rewards programs for their credit cardholders, such as cashback, travel rewards, and more. When you link your savings account to your credit card, you can earn rewards not just on your credit card purchases but also on your savings. This means that you can earn cashback or other rewards on both your credit card spending and the interest you earn on your savings.

- Maximize Your Savings: Combining your Discover savings and credit card allows you to leverage the benefits of both to maximize your savings potential. You can take advantage of high-interest rates on your savings account while also enjoying cashback or rewards on your credit card purchases. This dual approach helps you grow your savings faster and make the most of your spending.

- Build Credit History: If you’re looking to build or improve your credit history, combining your savings and credit card can be a smart move. Regularly using your credit card, making timely payments, and maintaining a healthy savings account balance can demonstrate responsible financial behavior to credit bureaus. This, in turn, can positively impact your credit score and increase your chances of qualifying for better loan terms and credit opportunities in the future.

- Financial Flexibility: Having a combined Discover savings and credit card account gives you greater flexibility in managing unexpected expenses or financial emergencies. You can utilize the funds in your savings account if needed, and have the option to pay off the balance on your credit card over time. This flexibility can provide peace of mind and help you navigate unexpected financial situations without undue stress.

Combining your Discover savings and credit card offers a plethora of benefits that can enhance your financial well-being. It simplifies your account management, allows you to earn rewards twice, helps you maximize your savings, build credit history, and provides financial flexibility when you need it most. Now that you understand the advantages, let’s dive into how to combine your Discover savings and credit card accounts.

Steps to Combine Discover Savings and Credit Card

Combining your Discover savings and credit card accounts is a straightforward process that can be completed in a few simple steps:

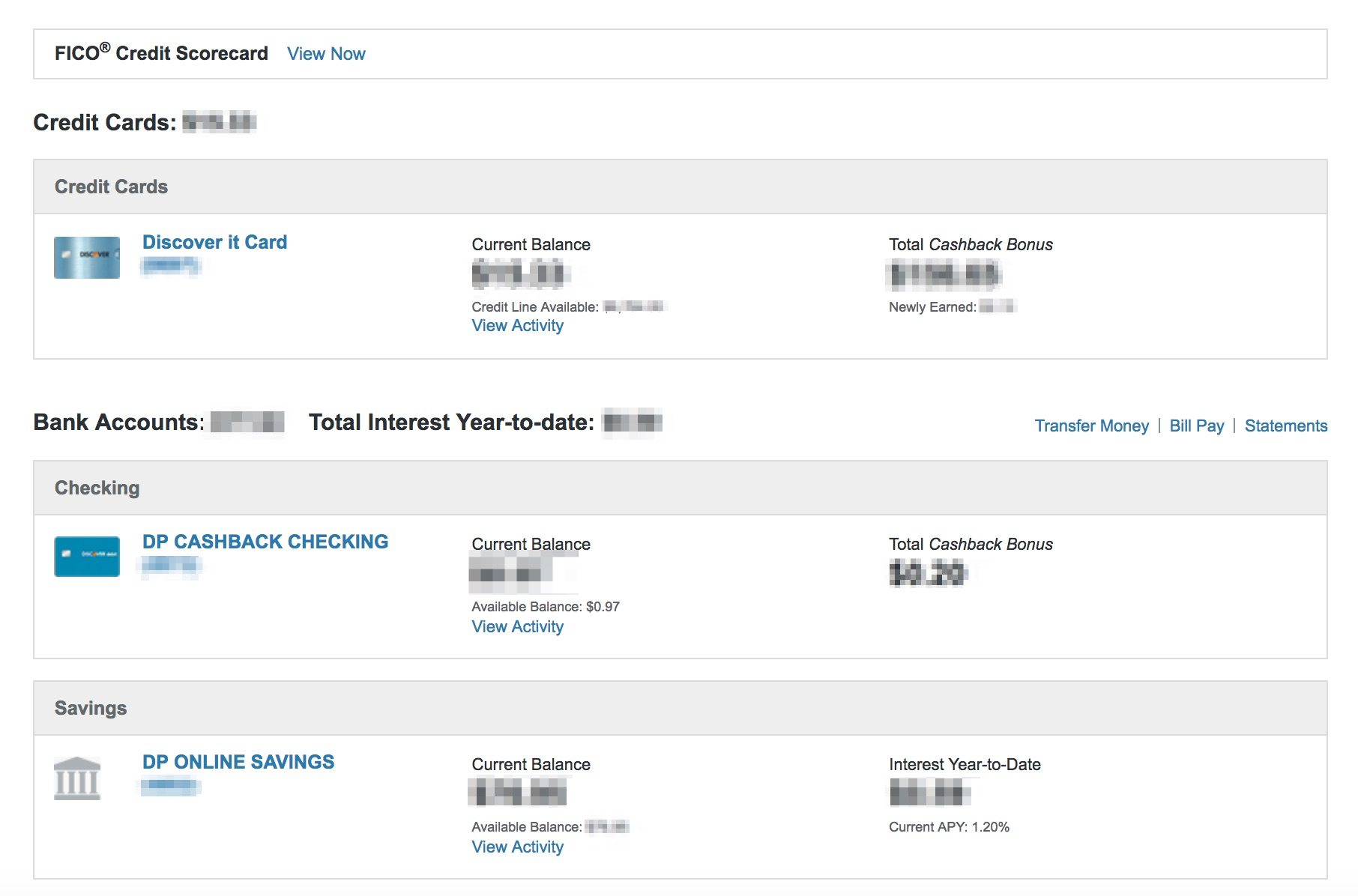

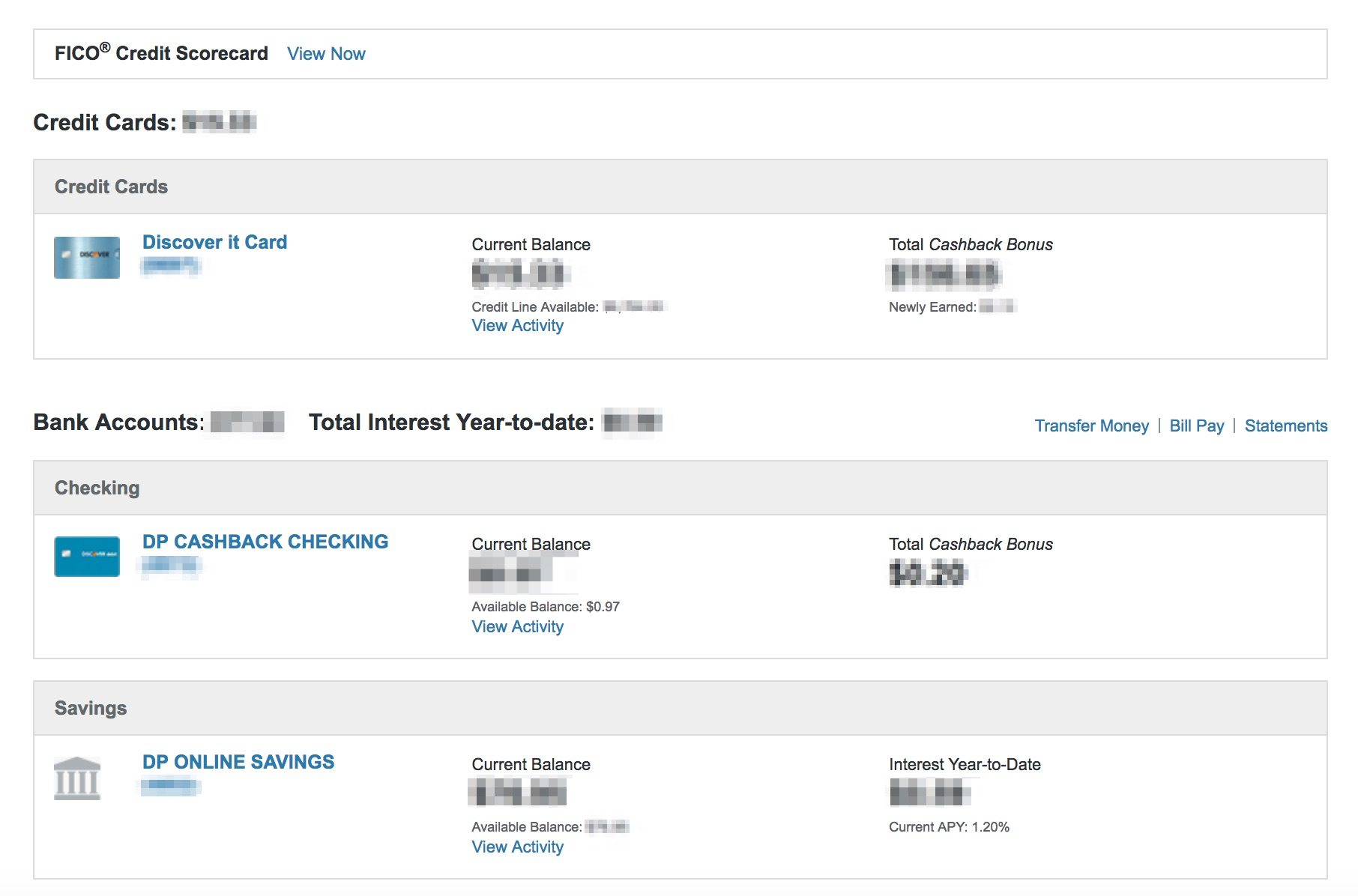

- Log into your Discover Account: Visit the Discover website and log into your account using your username and password. If you don’t have an account, you will need to create one by providing the required information.

- Navigate to “Account Preferences”: Once you’re logged in, locate the “Account Preferences” section. You can typically find this option in the account dashboard or settings menu.

- Link your Savings Account: In the “Account Preferences” section, you will find an option to link your savings account. Click on this option and follow the prompts to connect your savings account to your credit card account.

- Verify and Confirm: After linking your savings account, you may be required to verify some information to ensure the accounts are linked accurately. Review the information carefully and confirm the linkage when prompted.

- Review Confirmation: Once the linkage is confirmed, you will receive a confirmation message or email stating that your Discover savings and credit card accounts have been successfully combined.

It’s important to note that the exact steps and process may vary depending on your specific account and Discover’s interface. If you encounter any difficulties or have questions during the process, it’s recommended to reach out to Discover’s customer support for assistance.

Once your accounts are combined, you can start enjoying the benefits of managing your savings and credit card in one place. You’ll have a comprehensive view of your financial profile, be able to earn rewards on both accounts, and make the most of the perks and features offered by Discover.

Now that you know how to combine your Discover savings and credit card, let’s find out if you’re eligible for this powerful combination.

Eligibility Criteria for Combining Discover Savings and Credit Card

To combine your Discover savings and credit card accounts, you will need to meet certain eligibility criteria. Here are the general requirements:

- Existing Discover Accounts: You must have both a Discover savings account and a Discover credit card to be eligible for combining them.

- Account Ownership: The savings account and credit card must be registered in your name. If you have joint ownership or authorized user status on the accounts, you may need to provide additional documentation or obtain consent from the primary account holder.

- Good Standing: Your savings account and credit card should be in good standing, meaning that you have not defaulted on payments, have not had your accounts closed due to fraud or violations of the terms and conditions, and have not declared bankruptcy.

- Verification: Depending on the requirements set by Discover, you may need to verify your identity and ownership of the accounts. This can involve providing personal identification documents, account statements, or other relevant information.

- Agreement to Terms: By combining your Discover savings and credit card accounts, you agree to the terms and conditions provided by Discover. Take the time to read and understand these terms to ensure you are comfortable with the agreement.

It’s worth noting that eligibility criteria may vary depending on Discover’s policies and any specific promotions or offers available at the time. It’s always a good idea to review the latest requirements on Discover’s official website or contact their customer support for accurate and up-to-date information.

Once you have determined your eligibility and gathered any necessary documents, you can proceed with the process of combining your Discover savings and credit card accounts. This will unlock the full potential of both accounts and provide you with a comprehensive financial management solution.

Now that you know the eligibility criteria, let’s explore some practical tips to help you make the most of combining your Discover savings and credit card.

Tips for Maximizing Benefits from Discover Savings and Credit Card Combination

Combining your Discover savings and credit card accounts can provide you with a range of financial advantages. To maximize the benefits of this combination, consider the following tips:

- Understand the Reward Programs: Familiarize yourself with the rewards programs offered by Discover for both savings accounts and credit cards. Take note of any specific categories or spending thresholds that offer higher rewards. This knowledge will help you optimize your savings and credit card usage to earn the most rewards.

- Create a Savings Goal: Set a savings goal to motivate yourself to save more. Whether it’s for a vacation, a down payment on a house, or an emergency fund, having a specific goal in mind can help you stay on track and make saving a priority. Utilize the interest earned from your savings account and credit card rewards to accelerate your progress towards your goal.

- Pay Your Credit Card Balance in Full: Avoid carrying a balance on your credit card whenever possible. Paying your balance in full by the due date allows you to avoid interest charges and maximize the benefits of your credit card rewards. Use your savings account to cover any necessary payments and maintain a healthy credit utilization ratio.

- Set Up Automatic Transfers: Take advantage of automatic transfers to regularly move a portion of your earnings into your savings account. This helps you build savings consistently and eliminates the risk of forgetting to save. Additionally, consider setting up automatic payments for your credit card to avoid late fees and maintain a positive payment history.

- Monitor and Review Statements: Stay proactive by regularly reviewing your savings account and credit card statements. Look for any discrepancies, unauthorized charges, or errors that may require attention. By detecting and addressing issues promptly, you can protect your finances and ensure the accuracy of your rewards earnings.

- Utilize Discover’s Online Tools and Resources: Discover offers various online tools, calculators, and resources to help you make informed financial decisions. Take advantage of their budgeting tools, spending analysis, and educational material to manage your finances effectively and make the most of your savings and credit card combination.

- Stay Informed about Promotions and Offers: Keep an eye out for special promotions and offers from Discover. They often provide limited-time bonus rewards or incentives for certain spending categories or actions. By staying informed, you can take advantage of these opportunities to boost your rewards and savings even further.

Implementing these tips will help you optimize the benefits of combining your Discover savings and credit card. From earning more rewards to saving money and building a solid financial foundation, you’ll be well on your way to achieving your financial goals.

Now let’s address some common questions you may have about combining Discover savings and credit card.

Frequently Asked Questions (FAQs)

Here are some commonly asked questions about combining Discover savings and credit card:

- Can I combine my existing Discover savings and credit card accounts?

- Will combining my accounts affect my credit score?

- Is there a fee to combine Discover savings and credit card accounts?

- Can I earn rewards on both my savings account and credit card by combining them?

- What happens if I close one of my combined accounts?

- Can I unlink my savings and credit card accounts after combining them?

Yes, you can combine your existing Discover savings and credit card accounts by linking them through the account preferences section of your Discover account.

Combining your accounts should not have a direct impact on your credit score. However, it can indirectly help build your credit history by allowing you to responsibly manage both your savings and credit card accounts in one place.

No, there is typically no fee associated with combining your Discover savings and credit card accounts.

Yes, by combining your accounts, you can earn rewards on both your savings account and credit card spending simultaneously. This allows you to maximize your rewards potential.

If you choose to close one of your combined accounts, the other account will remain active and unaffected. However, you will no longer be able to enjoy the benefits of combining both accounts.

Yes, if you decide to separate your savings and credit card accounts after combining them, you can contact Discover’s customer support for assistance in unlinking the accounts.

If you have any further questions or concerns about combining your Discover savings and credit card accounts, it’s recommended to reach out to Discover directly. They will be able to provide you with accurate and personalized information based on your individual circumstances.

Now, let’s wrap up our discussion.

Conclusion

Combining your Discover savings and credit card accounts is an excellent way to optimize your financial management and maximize your benefits. By merging these accounts, you can streamline your account management, earn rewards on both accounts, save money, and build credit history.

We discussed the benefits of combining Discover savings and credit card, including streamlined account management, double rewards earning potential, maximizing savings, building credit history, and gaining financial flexibility.

To combine your accounts, follow the steps of logging into your Discover account, navigating to the account preferences section, linking your savings account, and verifying the linkage. Don’t forget to meet the eligibility criteria, such as having existing Discover accounts in good standing and agreeing to the terms and conditions.

To make the most of your combined accounts, utilize Discover’s rewards programs, set savings goals, pay your credit card balance in full, automate transfers, monitor statements, and take advantage of their online tools and resources. Stay informed about promotions and offers to boost your rewards and savings opportunities.

Remember to address any specific questions or concerns you may have with Discover’s customer support, as they can provide personalized assistance based on your individual situation.

Combining your Discover savings and credit card accounts can provide you with the financial leverage and convenience you need to achieve your money goals. Start exploring the advantages of this powerful combination today and unleash the full potential of your Discover accounts.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Please consult with a professional financial advisor or contact Discover directly for personalized guidance.