Home>Finance>Cumulative Interest Definition, Formulas And Uses

Finance

Cumulative Interest Definition, Formulas And Uses

Published: November 6, 2023

Learn about the definition, formulas, and uses of cumulative interest in finance. Gain a deeper understanding of how this concept impacts financial calculations and planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Cumulative Interest Definition, Formulas, and Uses

Are you curious about how cumulative interest is calculated? Or perhaps you’re wondering how it affects your finances? Look no further! In this blog post, we’ll provide you with a comprehensive guide to understanding cumulative interest, including its definition, formulas, and practical uses.

Key Takeaways:

- Cumulative interest is the total amount of interest earned or paid over a specific period.

- It is calculated by multiplying the principal amount by the annual interest rate and the time period.

Cumulative interest plays a significant role in finance, especially when it comes to loans, investments, and savings. Whether you’re a student looking to grasp the concept or a seasoned investor wanting to optimize your financial decisions, understanding cumulative interest is crucial. Let’s dive deeper into this topic with the following key points:

- Definition: Cumulative interest refers to the sum of interest earned or paid over time. It is a measure of the total impact that interest has on a loan, investment, or savings account. Cumulative interest can be positive or negative, depending on whether you are earning or paying the interest.

- Formulas: To calculate cumulative interest, you can use the following formula:

CI = P × (1 + r/n)^(nt) – P

Where:

CI represents the cumulative interest

P is the principal amount

r is the annual interest rate

n is the number of times interest is compounded per year

t is the time period in years - Uses: Cumulative interest has various practical applications. Here are a few ways it plays a role in financial calculations:

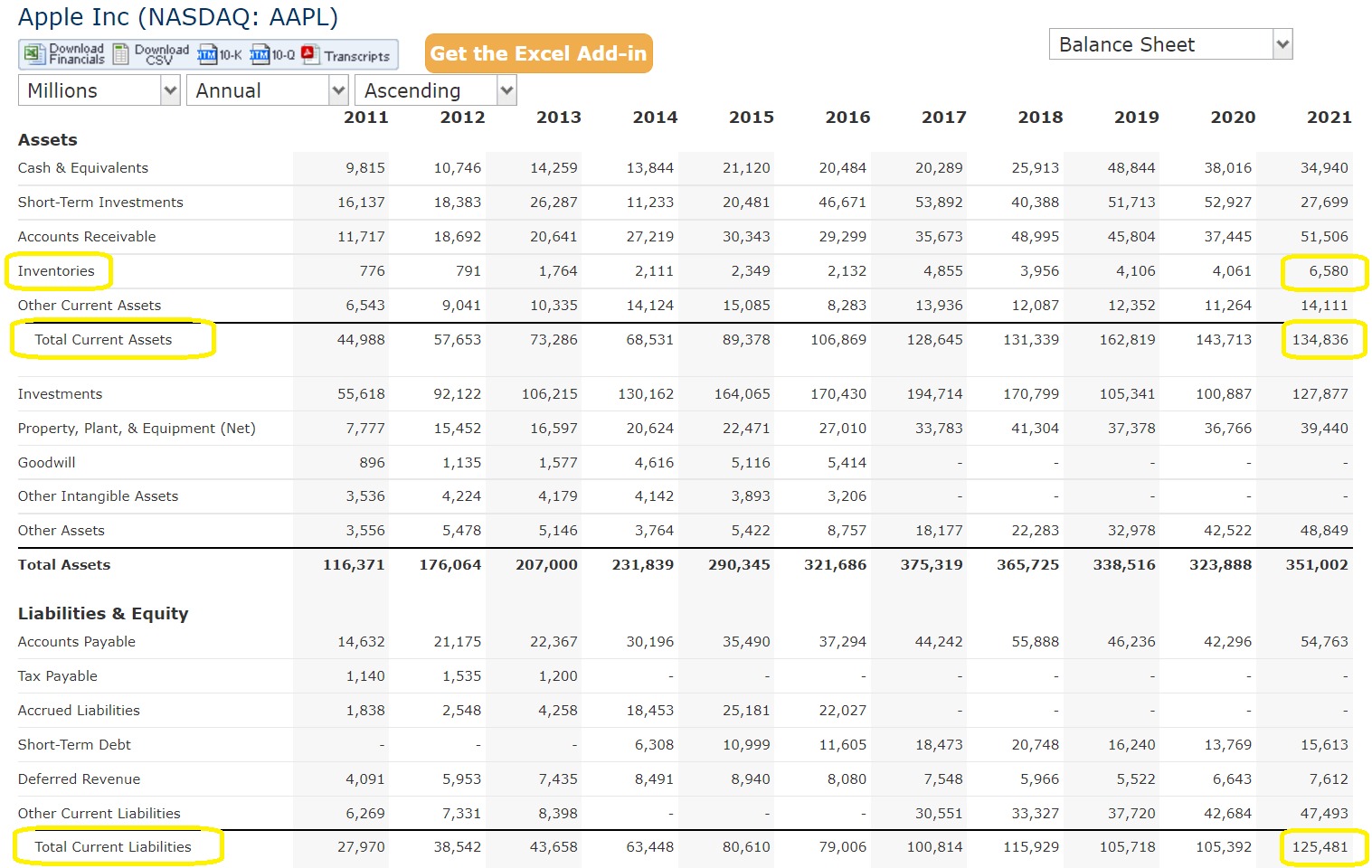

a) Loans: When you take out a loan, understanding the cumulative interest is essential. It helps you determine the total repayment amount and choose the most affordable loan option.

b) Investments: Cumulative interest can help you evaluate the potential return on investment. By considering the compounding effect, you can assess the long-term growth of your investments.

c) Savings: If you’re saving money, knowing the cumulative interest can help you set realistic savings goals and see the impact of compounding interest over time.

Now that you have a clear understanding of cumulative interest, you can make informed decisions about your finances. Remember, whether you’re dealing with loans, investments, or savings, cumulative interest plays a crucial role in shaping your financial journey. Stay informed and maximize the power of compounding interest to achieve your financial goals!