Home>Finance>Cut-Off Score: Definition And What It Means To Consumers

Finance

Cut-Off Score: Definition And What It Means To Consumers

Published: November 7, 2023

Learn the meaning of cut-off score in finance and how it impacts consumers. Find out why understanding cut-off scores is essential for financial decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Cut-Off Score: What It Means for You

When it comes to managing your finances, it’s important to understand the key factors that impact your financial well-being. One such factor is the cut-off score. But what exactly is a cut-off score and what does it mean for consumers? In this blog post, we will dive into the definition of a cut-off score and its significance in the world of finance.

Key Takeaways:

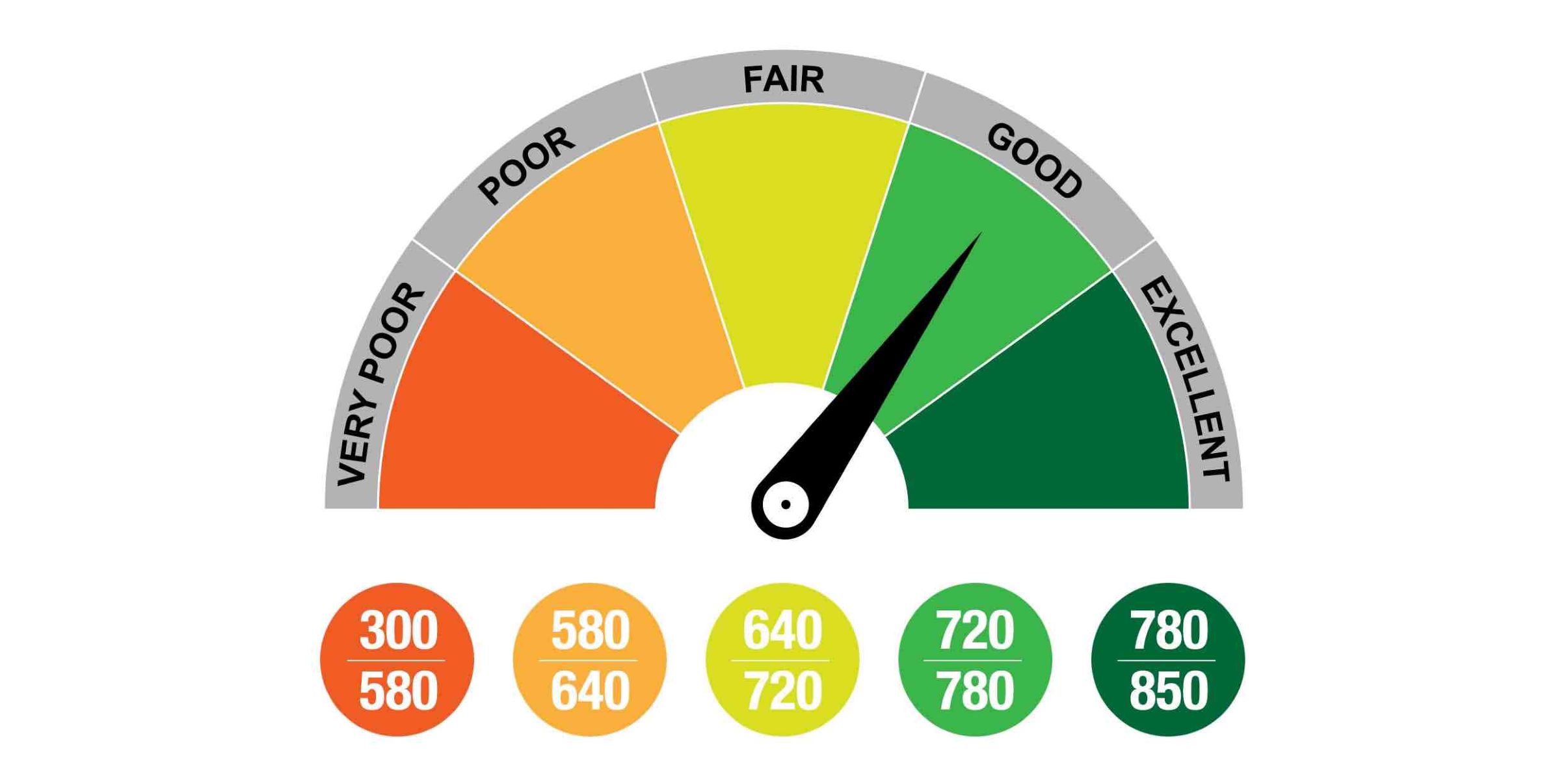

- A cut-off score is a specific numerical value used by lenders or credit agencies to determine creditworthiness.

- Understanding your cut-off score can help you gauge the likelihood of being approved for credit or loans, as well as determine the interest rates you may be eligible for.

At its core, a cut-off score is a predetermined threshold that serves as a benchmark for evaluating credit applications. This score is typically based on various factors such as credit history, payment behavior, income, and debt-to-income ratio. Lenders and credit agencies utilize cut-off scores to assess the level of risk associated with lending money to an individual.

For consumers, the cut-off score is a crucial metric that plays a crucial role in their financial health. Here are a few important points to consider:

- Loan Applications: When you apply for a loan or credit, lenders will evaluate your creditworthiness using your cut-off score. Meeting or exceeding the cut-off score drastically increases your chances of approval.

- Interest Rates: Your cut-off score also influences the interest rates you may qualify for. Higher scores can result in lower interest rates, ultimately saving you money over time.

- Favorable Terms: A good cut-off score can improve your bargaining power and enable you to negotiate more favorable terms with lenders.

- Credit Opportunities: Understanding your cut-off score helps you identify the types of credit or loans you may be eligible for.

Overall, the cut-off score serves as a critical tool for lenders to assess risk and make informed lending decisions, while also empowering consumers to gauge their own creditworthiness and potential opportunities. It’s essential to stay proactive in managing your credit health by monitoring your cut-off score regularly.

Remember, every individual’s financial situation is unique, and there is no one-size-fits-all cut-off score. Different lenders and credit agencies may have varying standards, so it’s important to research and understand the specific cut-off score requirements for the type of credit you are seeking.

In conclusion, familiarizing yourself with the concept of the cut-off score can provide valuable insights into your financial standing and aid you in making informed financial decisions. By understanding this metric, you can take proactive steps toward improving your creditworthiness and achieving your financial goals.