Finance

What Does 770 Credit Score Mean

Modified: March 6, 2024

Discover the meaning of a 770 credit score and its impact on your finance. Learn how this score can affect your ability to obtain loans and interest rates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A credit score is a crucial financial tool that lenders use to assess a borrower’s creditworthiness. It is a numerical representation of an individual’s credit history and helps lenders determine the risk associated with lending money to that person. One such credit score that is widely recognized and highly regarded is a 770 credit score.

A 770 credit score is considered excellent and indicates a strong credit profile. It signifies responsible financial management and a consistent track record of meeting financial obligations. Having a 770 credit score opens doors to various financial opportunities, including favorable interest rates, higher credit limits, and greater borrowing power.

In this article, we will delve into what a 770 credit score means and why it is highly valued in the world of finance. We will also discuss the factors that can impact a 770 credit score and provide tips on maintaining and even improving this stellar credit rating.

Whether you are a seasoned borrower or just starting to build your credit history, understanding the importance and benefits of a 770 credit score can empower you to make informed financial decisions and achieve your goals.

What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness, which is based on their credit history and financial behavior. It is a three-digit number that lenders and financial institutions use to assess the risk associated with lending money to a borrower.

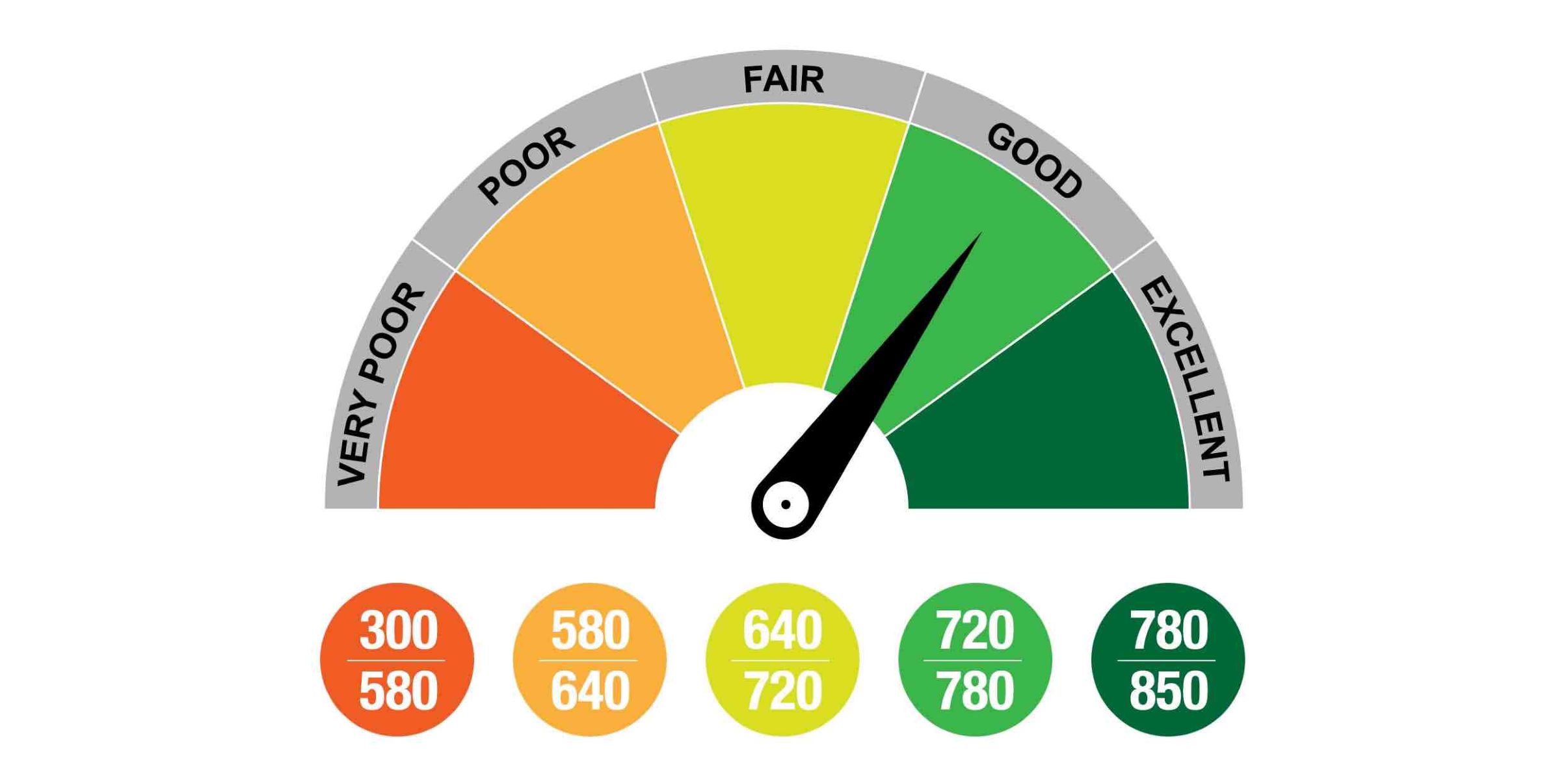

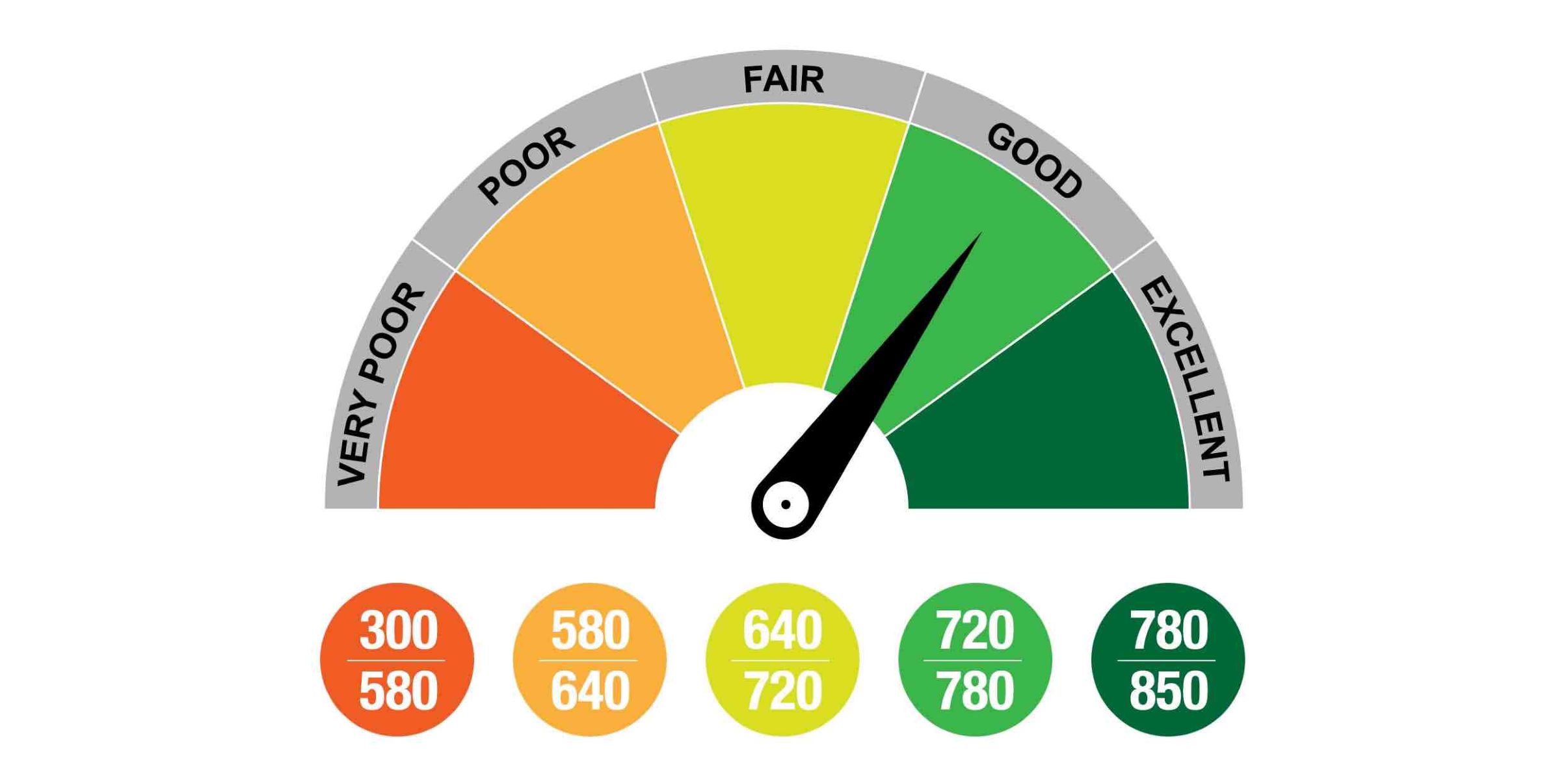

The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. The higher the credit score, the more favorable the borrower’s credit profile is considered. A credit score can impact an individual’s ability to qualify for loans, credit cards, mortgages, and other financial products.

A credit score is calculated using various factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit applications. These factors are weighted differently, with payment history having the greatest impact on the credit score.

The credit score provides lenders with an indication of how likely a borrower is to repay their debts based on their past behavior. It serves as a measure of financial responsibility and helps lenders assess the potential risk and determine the terms of a loan or credit agreement.

It’s important to note that credit scores are specific to each individual and can vary across different credit bureaus. The three major credit bureaus – Equifax, Experian, and TransUnion – generate credit reports that contain the information used to calculate credit scores.

Overall, credit scores play a significant role in an individual’s financial life, impacting their ability to obtain credit, secure favorable interest rates, and even rent an apartment or obtain insurance. Understanding credit scores and how they are calculated is essential for maintaining a healthy financial profile.

Understanding Credit Scores

Credit scores can sometimes be confusing and overwhelming, but understanding how they work is essential for managing your finances effectively. Here are some key aspects to consider when it comes to understanding credit scores:

1. Score Range: Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Different lenders may have varying interpretations of what constitutes a good score, but generally, a score above 700 is considered favorable.

2. Credit Scoring Models: The most widely used credit scoring model is the FICO score, developed by the Fair Isaac Corporation. However, there are other scoring models as well, such as VantageScore. Each model has its own algorithms and criteria for calculating credit scores.

3. Credit Report: Credit scores are derived from the information in your credit report. Your credit report contains data about your credit accounts, payment history, outstanding debts, and public records like bankruptcies or tax liens. It’s important to regularly review your credit report to ensure its accuracy.

4. Credit Bureaus: There are three major credit bureaus – Equifax, Experian, and TransUnion – that collect and maintain credit information. Each bureau may have slightly different information, which can result in variations in credit scores. It’s a good idea to check your credit report from all three bureaus periodically.

5. Credit Factors: Specific factors influence your credit score. The most influential factor is payment history, which reflects whether you have been making your credit payments on time. Other factors include credit utilization (the percentage of available credit you’re using), length of credit history, types of credit used, and recent credit applications.

6. Credit Improvement: If you have a less than desirable credit score, it’s possible to improve it over time. Paying bills on time, paying down debts, and keeping credit card balances low can positively impact your score. However, building good credit takes patience and disciplined financial habits.

7. Credit Inquiries: When you apply for credit, the lender typically requests your credit report, resulting in a “hard inquiry.” Multiple hard inquiries within a short period may negatively impact your credit score. However, checking your own credit report or having a lender check it for pre-approval purposes typically results in a “soft inquiry,” which doesn’t affect your score.

Understanding the fundamentals of credit scores allows you to make informed decisions that can positively impact your financial well-being. By managing your credit responsibly and maintaining a good credit score, you open doors to better loan terms, lower interest rates, and increased financial opportunities.

How Credit Scores are Calculated

Credit scores are calculated using complex algorithms that weigh various factors to determine an individual’s creditworthiness. While the exact formulas used by credit scoring models like FICO and VantageScore are not publicly disclosed, we can still understand the general components that contribute to the calculation process. Here is a breakdown of how credit scores are typically calculated:

1. Payment History (35%): Your payment history is the most influential factor in calculating your credit score. It takes into account whether you have made your credit payments on time, any missed or late payments, and the severity of any delinquencies or defaults. Consistently making payments on time has a positive impact on your credit score.

2. Credit Utilization (30%): Credit utilization refers to how much of your available credit you are using. It is calculated by dividing your total credit card balances by your total credit limits. Higher credit utilization can indicate higher credit risk. Maintaining a low utilization rate, ideally below 30%, demonstrates responsible credit management and can positively impact your credit score.

3. Credit History Length (15%): The length of your credit history is measured by the age of your oldest and newest accounts, as well as the average age of all your accounts. A longer credit history demonstrates more experience in managing credit and can positively impact your credit score. It’s beneficial to maintain older credit accounts, even if they are rarely used.

4. Credit Mix (10%): Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can demonstrate your ability to manage different types of credit responsibly. A healthy credit mix can positively impact your credit score. However, it’s important to only apply for credit that you actually need and can manage responsibly.

5. New Credit Applications (10%): Frequent applications for new credit can negatively impact your credit score. When you apply for credit, it results in a hard inquiry on your credit report. Multiple hard inquiries within a short period can suggest higher credit risk. It’s important to be cautious when applying for new credit and only do so when necessary.

It’s worth noting that the specific weightings given to these factors may vary slightly between credit scoring models. Additionally, individual credit histories and circumstances may influence the impact of each factor on an individual’s credit score. Therefore, the exact calculations may differ from person to person.

By understanding how credit scores are calculated, individuals can focus on maintaining a positive credit history, making timely payments, keeping credit utilization low, and managing credit responsibly. These actions can lead to higher credit scores and better financial opportunities in the future.

Importance of a 770 Credit Score

A 770 credit score holds significant importance in the world of finance. It represents excellent creditworthiness and opens the door to a myriad of financial benefits. Here are some key reasons why a 770 credit score is highly valued:

1. Favorable Interest Rates: With a 770 credit score, you are likely to qualify for loans and credit cards with the most competitive interest rates. Lenders consider borrowers with high credit scores as lower risk and are willing to offer them better terms. This can result in substantial savings over the life of a loan or credit card use.

2. Higher Credit Limits: Having a 770 credit score often translates into being approved for higher credit limits. Lenders are more confident in your ability to manage credit responsibly, allowing you greater borrowing power. Higher credit limits provide the flexibility to make larger purchases or handle unexpected expenses without maxing out your available credit.

3. Easier Loan Approvals: A 770 credit score makes it easier to get approved for various types of loans, such as mortgages, auto loans, and personal loans. Lenders are more likely to view you as a reliable borrower and extend loan offers with favorable terms. This can make it simpler to achieve important milestones, like purchasing a home or financing a vehicle.

4. Access to Premium Credit Cards and Rewards Programs: A high credit score opens doors to premium credit cards with exclusive benefits and rewards programs. These cards often offer perks like cashback, travel rewards, and discounts on purchases. With a 770 credit score, you are more likely to qualify for these elite credit cards and enjoy the accompanying privileges.

5. Better Rental Opportunities: Landlords commonly conduct credit checks on potential tenants to evaluate their reliability. With a 770 credit score, you are more likely to be approved for rental properties and have a wider range of options available. A strong credit score can also result in lower apartment deposits and better leasing terms.

6. Employment Opportunities: Certain employers, particularly those in the financial industry, may check credit scores as part of the hiring process. A 770 credit score reflects your financial responsibility and may enhance your chances of securing job offers in these sectors. It demonstrates your ability to manage money and can be seen as a testament to your reliability and trustworthiness.

It is important to note that a credit score is just one part of the overall financial picture. Other factors, such as income, employment history, and debt-to-income ratio, also play a role in lending decisions. However, a 770 credit score puts you in an advantageous position and can significantly impact your financial opportunities.

By maintaining a 770 credit score and continuing to exercise responsible credit management, you can enjoy the benefits that come with excellent creditworthiness and set yourself up for a strong financial future.

Benefits of a 770 Credit Score

A 770 credit score comes with a range of benefits that can positively impact your financial life. With this exceptional credit score, you can enjoy various advantages that can save you money, expand your borrowing power, and provide peace of mind. Here are some key benefits that come with a 770 credit score:

1. Lower Interest Rates: One of the most notable benefits of a 770 credit score is qualifying for loans and credit cards with lower interest rates. Lenders view individuals with high credit scores as low risk, which means they are more likely to offer them loans at preferential rates. This can result in significant savings over time, whether you’re getting a mortgage, car loan, or personal loan.

2. Access to Premium Credit Cards: With a 770 credit score, you gain access to premium credit cards that offer exclusive perks, rewards programs, and benefits. These cards often provide cashback on purchases, travel rewards, and concierge services. Enjoying these privileges can enhance your lifestyle and provide valuable savings and convenience.

3. Higher Credit Limits: A 770 credit score opens doors to higher credit limits. Lenders are more willing to extend larger credit lines to individuals with strong credit profiles. Higher credit limits provide you with more flexibility in managing your finances and making larger purchases. It’s important to use these credit limits responsibly and avoid excessive borrowing.

4. Improved Loan Approval: When applying for loans, from mortgages to personal loans, having a 770 credit score significantly improves your chances of approval. Lenders see a high credit score as a sign of financial responsibility and are more inclined to offer you favorable loan terms and conditions. This can expedite the loan process and make it easier to achieve your goals.

5. Better Insurance Premiums: Insurers often consider your credit score when determining insurance premiums. With a 770 credit score, you may be eligible for lower rates on auto, home, and other types of insurance. Insurance companies perceive individuals with high credit scores as lower risk and are more likely to offer them discounted premiums.

6. Enhanced Negotiation Power: A 770 credit score gives you leverage when negotiating financial terms. Whether you’re discussing a loan or credit card offer, having a strong credit profile sets a positive impression. You can use your high credit score to negotiate better interest rates, lower fees, and improved terms on various financial products.

7. Increased Rental Options: Landlords and property management companies often run credit checks on prospective tenants. With a 770 credit score, you stand out as a reliable tenant, opening up a broader range of rental options. Additionally, you may be able to secure better leasing terms and lower security deposits.

It’s important to remember that a credit score is just one aspect of your overall financial health. Other factors such as income, employment history, and debt-to-income ratio also come into play when lenders evaluate creditworthiness. Nevertheless, a 770 credit score positions you favorably and provides numerous financial benefits that can enhance your financial well-being and provide you with more opportunities.

Maintaining a 770 Credit Score

Maintaining a 770 credit score requires consistent effort and responsible financial habits. While achieving a high credit score is commendable, it’s important to continue managing your credit wisely to preserve your excellent credit profile. Here are some essential tips for maintaining a 770 credit score:

1. Pay Bills on Time: Payment history has the most significant impact on your credit score. Make a habit of paying all bills, including credit card balances, loans, and utilities, on time. Consider setting up automatic payments or using reminders to ensure you never miss a payment.

2. Keep Credit Utilization Low: Aim to keep your credit utilization, or the percentage of available credit you’re using, below 30%. High credit utilization can negatively impact your credit score. To manage this, pay off your credit card balances in full each month and avoid maxing out your credit limits.

3. Maintain a Mix of Credit: Having a mix of credit accounts, such as credit cards, loans, and mortgages, can be beneficial for your credit score. However, only take on credit that you genuinely need and can manage responsibly. Avoid opening multiple new accounts within a short period, as it can temporarily lower your score.

4. Monitor Credit Reports: Regularly check your credit reports from all three major credit bureaus – Equifax, Experian, and TransUnion. Review the information for accuracy and report any discrepancies immediately. Monitoring your credit allows you to detect and address any fraudulent activity or errors promptly.

5. Avoid Closing Credit Accounts: Closing old credit accounts can impact the length of your credit history and credit utilization. Instead of closing accounts, make occasional small purchases with them and pay them off promptly to keep them active. This can help maintain a healthy credit age and utilization ratio.

6. Limit New Credit Applications: Limit the number of new credit applications you make. Each application results in a hard inquiry on your credit report, which can temporarily lower your score. Apply for new credit only when necessary and take advantage of pre-qualification offers to minimize the impact on your credit.

7. Manage Debt Responsibly: Avoid taking on excessive debt and work towards reducing your existing debts. Keeping your debt-to-income ratio low demonstrates financial responsibility and can positively impact your credit score. Create a budget and prioritize paying down debt to achieve a healthier financial position.

By following these tips, you can maintain a 770 credit score and continue to enjoy the benefits of excellent creditworthiness. Consistent and responsible credit management will not only preserve your high credit score but also contribute to your overall financial stability and success.

Factors that Can Impact a 770 Credit Score

While a 770 credit score is considered excellent, it’s important to understand that various factors can impact your score. It’s essential to be aware of these factors to maintain and protect your creditworthiness. Here are some key factors that can affect a 770 credit score:

1. Payment History: Past payment behavior plays a significant role in credit scores. Making payments on time reflects responsible credit management and positively impacts your score. However, late or missed payments can have a negative effect, potentially lowering your score.

2. Credit Utilization: Credit utilization refers to the percentage of available credit you’re using. Maintaining a low credit utilization rate, ideally below 30%, is beneficial for credit scores. High credit utilization can indicate higher credit risk and potentially lower your score.

3. Credit Age: The length of your credit history can impact your score. Generally, a longer credit history demonstrates more experience in managing credit and can positively influence your score. Keeping older credit accounts open, even if they are rarely used, can help maintain a healthy credit age.

4. Credit Mix: Having a mix of different types of credit accounts can impact your credit score. A healthy credit mix, including credit cards, loans, and mortgages, can demonstrate your ability to manage various types of credit responsibly. However, it’s important to only take on credit that you genuinely need and can manage.

5. New Credit Applications: When you apply for new credit, it results in a hard inquiry on your credit report. Multiple hard inquiries within a short period can negatively impact your credit score. Limit new credit applications and be cautious when opening new accounts.

6. Negative Information: Negative information such as bankruptcies, foreclosures, and collections can significantly impact your credit score. Having these types of derogatory marks on your credit report can lower your score and make it more challenging to access credit in the future.

7. Credit Account Management: Managing credit accounts responsibly is crucial. Closing multiple credit accounts at once, maxing out credit limits, or defaulting on loans can negatively impact your score. Proper account management, including regular payments and responsible credit utilization, helps maintain and improve your credit score.

Remember, these factors may impact credit scores differently depending on individual circumstances. It’s important to monitor your credit regularly, review your credit reports for accuracy, and take steps to address any negative factors. By understanding the factors that can impact your credit score, you can make informed decisions to maintain a high credit rating and enjoy the associated financial benefits.

Tips for Improving a 770 Credit Score

While a 770 credit score is already excellent, there is always room for improvement. Taking steps to enhance your credit score can provide even greater financial opportunities and benefits. Here are some tips to help you improve your 770 credit score:

1. Monitor Your Credit: Regularly monitor your credit report to ensure its accuracy and identify any potential errors or fraudulent activity. You can request a free copy of your credit report from each of the three major credit bureaus once a year. Review the information carefully and report any discrepancies promptly.

2. Pay Bills on Time: Consistently paying your bills on time is one of the most critical factors in improving your credit score. Set up automatic payments or reminders to ensure you never miss a payment. Even one late payment can have a negative impact on your credit score, so make timely payments a priority.

3. Reduce Credit Utilization: Aim to keep your credit utilization rate below 30%. To achieve this, pay down your credit card balances and avoid maxing out your credit limits. Keep in mind that low utilization rates demonstrate responsible credit management and can positively impact your credit score.

4. Diversify Your Credit Mix: Having a mix of different types of credit accounts can show lenders that you can handle various types of credit responsibly. Consider diversifying your credit by obtaining a variety of credit accounts, such as credit cards, loans, and mortgages. However, only take on credit that you genuinely need and can manage effectively.

5. Avoid Opening New Credit Accounts Frequently: Opening multiple new credit accounts within a short period can negatively impact your credit score. Limit new credit applications and only apply for credit when necessary. Be cautious about accepting new credit offers and ensure that you can manage the additional credit responsibly.

6. Keep Older Accounts Open: Length of credit history is an essential component of your credit score. Keep older credit accounts open, even if you no longer use them frequently. Closing old accounts can decrease the average age of your credit history, which may have a negative impact on your score.

7. Reduce Outstanding Debt: Paying down your existing debts can positively impact your credit score. Develop a strategy to reduce your outstanding debt systematically. Focus on paying off high-interest debts first while making minimum payments on other accounts.

8. Limit Credit Inquiries: Each time you apply for credit, a hard inquiry is recorded on your credit report. Multiple hard inquiries within a short period can indicate an increased credit risk. Be cautious about making new credit applications and only apply for credit when necessary.

9. Establish a Budget and Financial Plan: Creating a budget can help you manage your finances effectively and ensure that you meet your financial obligations on time. Establishing a comprehensive financial plan can guide you in managing your debts, savings, and investments.

10. Be Patient and Persistent: Improving your credit score takes time and consistent effort. It’s essential to be patient and persistent in your credit-building strategies. Stick to responsible financial habits, and over time, you’ll see your credit score improve.

Remember, improving your credit score is a gradual process. By following these tips, you can take proactive steps towards enhancing your already excellent 770 credit score. As you continue to practice responsible credit management, you’ll reap the benefits of improved creditworthiness and open doors to even more financial opportunities.

Conclusion

A 770 credit score is a significant achievement that reflects responsible financial management and strong creditworthiness. It opens doors to various opportunities and benefits that can positively impact your financial life.

In this article, we’ve explored the meaning and importance of a 770 credit score. We discussed how credit scores are calculated and the factors that can influence a 770 credit score. We also provided tips on maintaining and improving this exceptional credit rating.

By understanding credit scores, monitoring your credit report, and practicing responsible credit habits, you can continue to maintain a 770 credit score. Consistently paying bills on time, keeping credit utilization low, diversifying your credit mix, and effectively managing debt are all essential components of maintaining a healthy credit profile.

Remember, a high credit score can provide significant benefits, such as lower interest rates, higher credit limits, better loan approvals, and access to exclusive rewards programs. It can also boost your chances of securing rental properties and even job opportunities that require a strong financial background.

As you strive to maintain and improve your credit score, be patient and persistent. Building and maintaining good credit is a long-term process that requires discipline and responsible financial habits. By doing so, you’ll not only enjoy the benefits of excellent creditworthiness but also set yourself up for a strong and stable financial future.

Take the knowledge and tips provided in this article and apply them to your own financial journey. With a 770 credit score and a commitment to smart credit management, you can achieve your financial goals and enjoy the peace of mind that comes with having an exceptional credit rating.