Home>Finance>Deceased Account: Definition, Who Notifies, And How They’re Closed

Finance

Deceased Account: Definition, Who Notifies, And How They’re Closed

Published: November 8, 2023

Discover the meaning and process behind a deceased account in finance, including who notifies and the steps taken to close them.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Deceased Accounts: What You Need to Know

Dealing with financial matters is already a complex task, and when a loved one passes away, it can become even more challenging. One aspect that often arises in these situations is the handling of deceased accounts. If you find yourself in this unfortunate circumstance, it’s essential to understand the definition of a deceased account, who is responsible for notifying the relevant parties, and the process of closing these accounts. In this blog post, we will shed light on these key aspects to help you navigate through this difficult time.

Key Takeaways:

- A deceased account refers to a bank or financial account held by an individual who has passed away.

- The responsibility of notifying the appropriate parties, such as banks and creditors, usually falls on the executor or personal representative of the deceased’s estate.

What is a Deceased Account?

When someone passes away, their assets, including bank accounts and other financial holdings, become part of their estate. A deceased account, therefore, refers to any account that belongs to an individual who has died.

Deceased accounts can include various types of financial products, such as:

- Bank accounts, including savings, checking, and certificate of deposit (CD) accounts

- Investment accounts, such as brokerage or retirement accounts

- Credit card accounts

- Loans, mortgages, or lines of credit

It is crucial to note that the process for handling deceased accounts may vary depending on the financial institution and the jurisdiction in which the deceased lived. Therefore, it’s vital to consult with legal and financial professionals who can guide you through the specific steps applicable to your situation.

Who Notifies the Appropriate Parties?

Upon the death of an account holder, it is generally the responsibility of the executor or personal representative of the deceased’s estate to notify the relevant parties. This notification includes informing banks, creditors, and other financial institutions of the account holder’s passing.

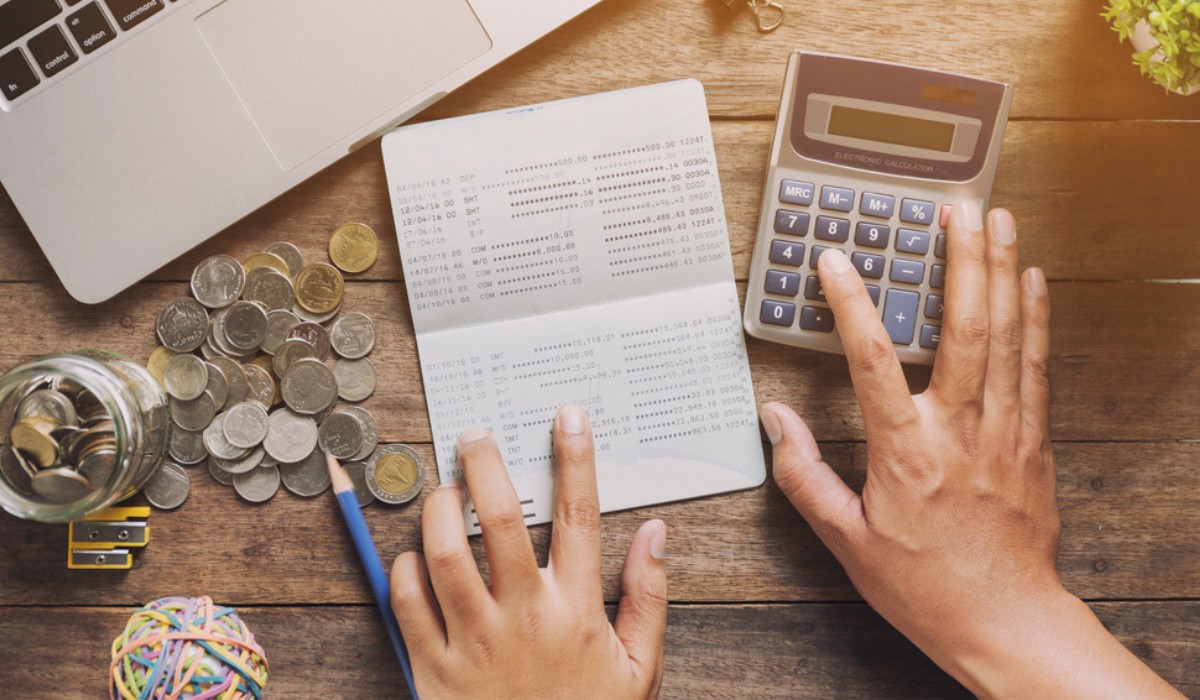

The executor or personal representative of the estate will typically need to provide the financial institution with necessary documents, such as a death certificate and probate documents, to verify their authority to handle the deceased’s affairs. This verification process ensures that the correct person is in charge of the account and facilitates the closure or transfer of funds.

How Are Deceased Accounts Closed?

The process of closing a deceased account may involve several steps, depending on the specific circumstances and the policies of the financial institution. Here are some general guidelines to help you understand the process:

- Notify the financial institution: As mentioned earlier, the executor or personal representative should inform the bank or financial institution of the deceased client’s passing.

- Secure necessary legal documents: The executor will need to provide the required legal documents, such as a death certificate, probate documents, and letters testamentary or letters of administration, to prove their authority to handle the deceased’s affairs.

- Freeze the account: In some cases, the bank may freeze the account once they receive notification of the account holder’s death. This prevents any unauthorized access or activity.

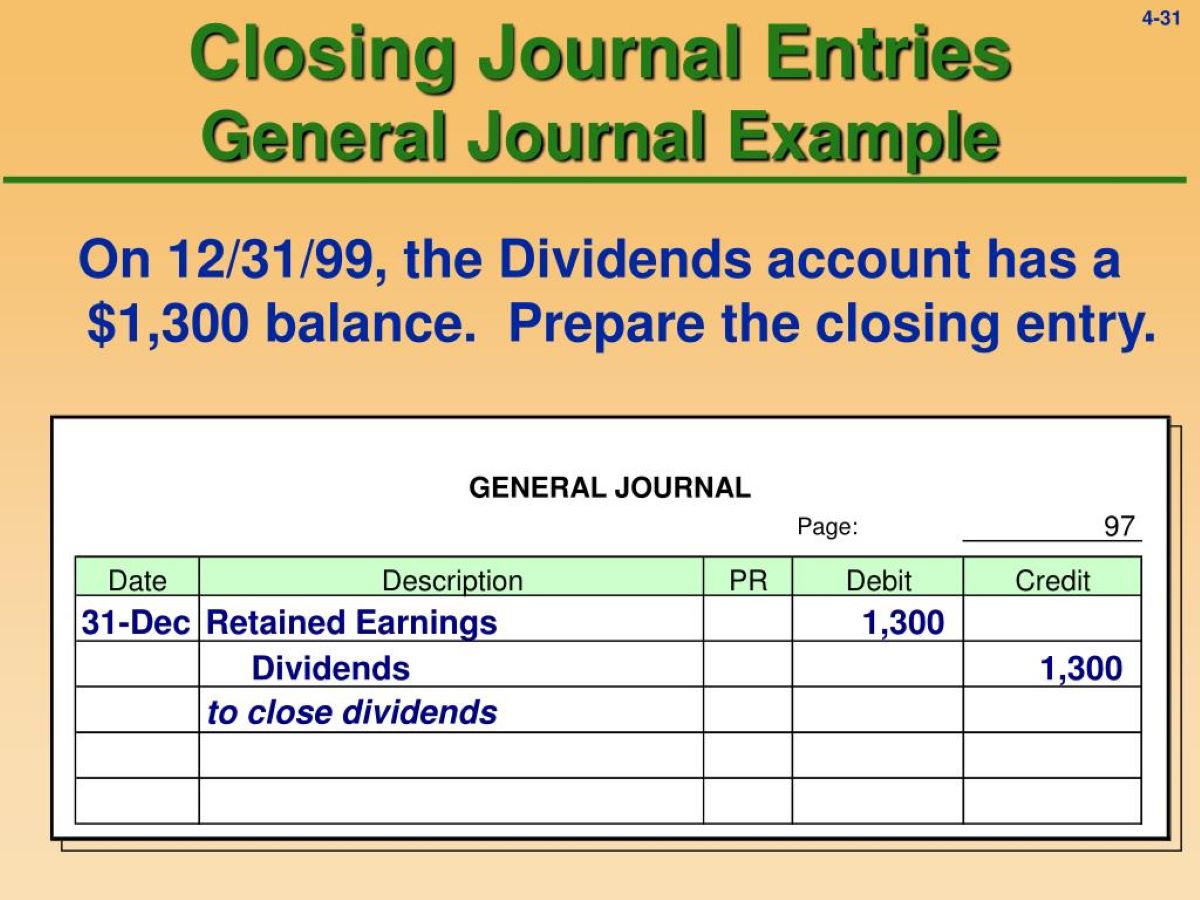

- Transfer funds or close the account: Depending on the specific circumstances and the wishes of the deceased, the funds in the account may be transferred to another account or distributed to beneficiaries named in the estate plan. Alternatively, the executor may need to close the account entirely.

- Settle outstanding debts: If the deceased account holder had outstanding debts, the executor may need to use the funds in the account to settle those obligations before distributing the remaining assets.

It’s essential to approach the process of closing a deceased account with patience and thoroughness. Each financial institution may have its own policies and requirements, so be prepared to provide any additional documentation or information as requested.

In Conclusion

Dealing with a deceased account can be a challenging task, but understanding the process and who is responsible for handling it can help ease the burden. Remember these key takeaways:

- A deceased account refers to a bank or financial account held by an individual who has passed away.

- The responsibility of notifying the appropriate parties, such as banks and creditors, usually falls on the executor or personal representative of the deceased’s estate.

When faced with this situation, it is highly recommended to consult with legal and financial professionals who can provide guidance tailored to your specific circumstances. By taking the necessary steps, you can ensure that the deceased’s accounts are properly handled and the transition is made as smoothly as possible.