Home>Finance>How Is The Cash Surrender Value Of Life Insurance Taxed?

Finance

How Is The Cash Surrender Value Of Life Insurance Taxed?

Published: October 14, 2023

Learn about the taxation of cash surrender value in life insurance. Discover how it affects your finances. Get expert advice on managing your policies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Life insurance is an essential financial tool that helps protect your loved ones financially in the event of your death. However, life insurance policies often come with a feature known as cash surrender value, which can provide policyholders with access to funds during their lifetime. But how is the cash surrender value of life insurance taxed? Understanding the tax implications of accessing this value is crucial to making informed financial decisions.

First, let’s clarify what cash surrender value actually means. In simple terms, it refers to the amount of money that an insurance policyholder is entitled to receive if they cancel or surrender their policy before its maturity or death benefit is paid out. This amount is determined by subtracting any outstanding loans or fees from the accumulated cash value of the policy.

Now, when it comes to taxation, the treatment of the cash surrender value depends on various factors, such as the type of policy, the length of time the policy has been in force, and the amount of money policyholders have contributed over the years. Understanding these factors will help policyholders determine the potential tax implications of accessing the cash surrender value.

In the following sections, we will explore the taxation of the cash surrender value in more detail, including the treatment of ordinary income tax, tax-free loans, taxation of surrender or partial withdrawal, taxation of policy loans on permanent life insurance policies, and estate tax considerations. By examining these aspects, individuals can make informed decisions about accessing their life insurance cash surrender value while minimizing their tax liabilities.

What Is Cash Surrender Value?

The cash surrender value is an important aspect of life insurance policies that policyholders should understand. It represents the amount of money an insurance policyholder is entitled to receive if they decide to cancel or surrender their policy before its maturity or death benefit is paid out.

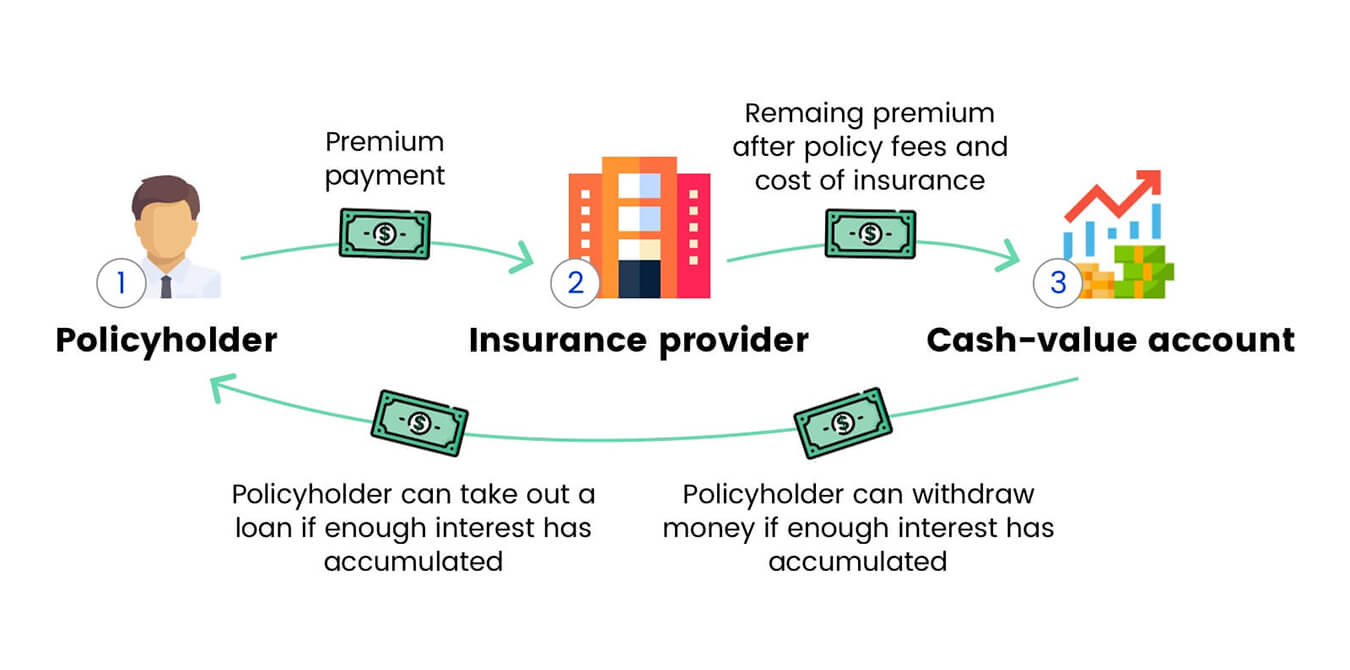

When you purchase a life insurance policy, you typically make regular premium payments. Part of these payments goes toward the cost of insurance coverage, administrative fees, and other expenses, while the remaining portion is invested by the insurance company to accumulate cash value over time.

Over the years, as you continue to make premium payments and the policy’s cash value increases, the cash surrender value also grows. It represents the portion of the accumulated cash value that you can access if you choose to surrender the policy.

It’s important to note that the cash surrender value may not be equal to the total amount of premiums you have paid. Insurance companies deduct certain fees, charges, and outstanding loans from the accumulated cash value to determine the final amount you will receive if you surrender the policy.

One of the key benefits of the cash surrender value is that it provides policyholders with a degree of financial flexibility. If you find yourself in a situation where you no longer need the coverage or require immediate access to funds, surrendering the policy and receiving the cash surrender value can be an attractive option.

However, it’s crucial to carefully consider the implications of surrendering a life insurance policy, as doing so may result in the loss of insurance coverage and potential tax consequences. It’s always recommended to consult with a financial advisor or tax professional before making any decisions.

Taxation of Cash Surrender Value

When it comes to the taxation of cash surrender value, several factors come into play, including the type of policy and the amount of money policyholders have contributed over the years. Understanding these factors is crucial to determining the potential tax implications of accessing the cash surrender value.

Ordinarily, the cash surrender value of a life insurance policy is not subject to immediate taxation. That means policyholders can accumulate cash value over time without having to pay taxes on the growth. This tax-deferred status provides individuals with an opportunity to build wealth within their policies during their lifetime.

While the cash value grows tax-free, it’s important to note that if you surrender your policy and receive a cash surrender value greater than your total premiums paid, the excess amount may be subject to taxation. This excess amount is considered taxable income and is subject to ordinary income tax rates.

It’s worth mentioning that policyholders who surrender their policies early may also be subject to surrender charges imposed by insurance companies. These charges are deducted from the cash surrender value and may reduce the taxable portion of the proceeds.

Additionally, if you have taken policy loans against your cash surrender value, the outstanding loan balance is subtracted from the cash surrender value upon surrender. If the loan balance exceeds the cash surrender value at the time of surrender, it may result in a taxable event. The amount of loan proceeds received is generally tax-free, but the interest accrued on the loan is not deductible.

It’s important to consult with a tax advisor or professional for guidance on the specific tax treatments for your individual circumstances. They can provide personalized advice and strategies to help minimize any potential tax liabilities associated with accessing the cash surrender value of your life insurance policy.

Ordinary Income Tax

When accessing the cash surrender value of a life insurance policy, one important tax consideration is the potential impact of ordinary income tax. If the cash surrender value exceeds the total premiums paid into the policy, the excess amount may be subject to ordinary income tax.

Ordinary income tax is calculated at your individual tax rate, which is determined by your total taxable income, filing status, and applicable tax brackets. It’s crucial to keep in mind that the tax rate for ordinary income can be higher than the tax rate for long-term capital gains.

Policyholders who surrender their policies and receive a cash surrender value greater than the total premiums paid will need to report the excess amount as taxable income on their federal income tax return. This means that the excess cash surrender value will be added to your other sources of income, such as wages, salaries, and investment income, and taxed accordingly.

It’s important to note that the taxation of the cash surrender value as ordinary income applies regardless of the policy type. Whether you have a term life insurance policy, whole life insurance policy, or universal life insurance policy, the taxable treatment remains the same if the cash surrender value exceeds the total premiums paid.

It’s crucial to consult with a tax professional or advisor to accurately determine your tax liabilities and potential strategies to minimize the impact of ordinary income tax. They can assist in understanding the tax implications specific to your situation and help you make informed decisions regarding accessing the cash surrender value of your life insurance policy.

Tax-Free Loans

One unique feature of certain life insurance policies is the ability to take tax-free loans against the cash surrender value. These policy loans allow policyholders to access funds without triggering immediate tax liabilities.

When you take a policy loan, you are essentially borrowing money from the insurance company using your cash surrender value as collateral. The loan amount is typically limited to a percentage of the cash surrender value, and interest is charged on the borrowed amount.

The advantage of policy loans is that they are treated as advances against the death benefit and not as taxable income. As a result, policyholders are not required to pay taxes on the loan proceeds as long as the policy remains in force.

Another benefit is that there are no limitations or restrictions on how you can use the loan proceeds. You can use the funds for any purpose, whether it’s to finance a major expense, pay for education, cover medical bills, or even invest in a business venture.

It’s also worth noting that policy loans do not need to be repaid immediately. Instead, the outstanding loan balance, including any accrued interest, is deducted from the death benefit when the insured individual passes away. However, it’s important to carefully manage policy loans to ensure that the death benefit is not significantly reduced.

While policy loans provide a tax-efficient way to access funds, it’s essential to understand the terms and conditions of the loan, including interest rates and repayment requirements. Failing to repay policy loans can result in reduced death benefit proceeds and potential tax consequences.

It’s recommended to consult with a financial advisor or insurance professional before taking a policy loan to fully understand the implications and ensure that it aligns with your financial goals and objectives.

Taxation of Surrender or Partial Withdrawal

When policyholders decide to surrender their life insurance policies or make partial withdrawals from the cash surrender value, there are potential tax implications to consider. The tax treatment can vary depending on the amount withdrawn and the policy type.

If you choose to surrender your life insurance policy entirely, any cash surrender value received that exceeds the total premiums paid may be subject to ordinary income tax. The excess amount is treated as taxable income and must be reported on your federal income tax return.

On the other hand, if you opt for a partial withdrawal from the cash surrender value, the taxation will depend on whether the amount withdrawn is considered a partial surrender or a withdrawal of basis.

A partial surrender refers to withdrawing an amount above and beyond the premiums paid. This excess amount is subject to taxation as ordinary income. Similar to surrendering the entire policy, the excess withdrawal will be added to your other sources of income and taxed accordingly.

However, if the amount withdrawn from the cash surrender value is equal to or less than the premiums paid, it is considered a withdrawal of basis. In this case, the withdrawal is typically tax-free since it is viewed as a return of your own money.

It’s important to note that the taxation of surrender or partial withdrawals can also be influenced by other factors, such as the policy’s age, the length of time premiums have been paid, and any outstanding loans against the policy. Consulting with a tax professional or advisor is crucial to understanding the specific tax implications and making informed decisions.

Additionally, each policyholder’s circumstances may differ, so personalized tax advice is essential to ensure compliance with applicable tax laws and optimizing your financial situation.

Taxation of Loans on Permanent Life Insurance Policies

Permanent life insurance policies, such as whole life or universal life insurance, often allow policyholders to take loans against the cash surrender value of their policies. These policy loans can provide a tax-efficient way to access funds while keeping the tax benefits of the policy intact.

When a policyholder takes a loan against the cash surrender value of a permanent life insurance policy, the loan proceeds are not considered taxable income. The borrowed amount is treated as an advance against the death benefit, allowing policyholders to access funds without triggering immediate tax liabilities.

As with any loan, policyholders are required to repay the borrowed amount, along with any accrued interest. If the loan is not repaid before the policyholder’s death, the outstanding loan balance, including interest, will be deducted from the death benefit payable to the beneficiaries.

One important aspect to consider is that the interest charged on policy loans is generally not tax-deductible. This means that the interest payments made on the loan cannot be used to reduce taxable income for the policyholder.

It’s essential to keep track of the outstanding loan balance and ensure that it does not exceed the cash surrender value of the policy. If the loan balance surpasses the cash surrender value, it may result in the policy lapsing, and potential tax consequences can arise.

In summary, loans taken against the cash surrender value of permanent life insurance policies are generally tax-free, but the interest accrued on these loans is not tax-deductible. Policyholders should carefully manage their policy loans, making timely repayments to avoid policy lapses and potential tax liabilities.

Consulting with a financial advisor or insurance professional can provide valuable guidance on the specific tax implications of policy loans and help you make informed decisions based on your individual circumstances.

Taxation of Policy Loans on TERM Life Insurance Policies

Unlike permanent life insurance policies, term life insurance policies generally do not accumulate a cash surrender value. Consequently, policyholders with term life insurance policies do not have the option to take policy loans against the cash surrender value.

Since term life insurance policies do not build cash value, there are no taxation considerations related to policy loans. Policyholders of term life insurance policies do not need to worry about the tax implications or repayment requirements associated with policy loans.

Term life insurance policies are designed to provide pure death benefit coverage for a specified period, typically 10, 20, or 30 years. These policies do not offer any cash value or investment component, which means there are no funds to borrow against.

While term life insurance policies do not provide the opportunity for tax-free loans, they offer affordable and straightforward protection for individuals looking to safeguard their loved ones financially during the policy term. The primary tax advantage of term life insurance is that the death benefit received by beneficiaries is typically tax-free.

It’s important to note that although term life insurance policies do not build cash value or allow for policy loans, they serve as a valuable financial tool for individuals seeking temporary life insurance coverage. However, it’s essential to review and understand the terms and limitations of your specific policy, including any potential conversion options to permanent life insurance policies that may offer cash value and tax advantages.

As with any insurance-related matter, it’s recommended to consult with a financial advisor or insurance professional to discuss your specific needs and objectives. They can guide you on the most suitable life insurance options and provide valuable insights into the tax implications particular to your situation.

Estate Tax Considerations

Estate taxes, also known as inheritance taxes or death taxes, are levied on the total value of a person’s estate upon their death. The inclusion of life insurance proceeds in the taxable estate depends on several factors, including the ownership of the policy and any beneficiary designations.

If the policyholder is the owner of the life insurance policy, the death benefit proceeds are generally included in their taxable estate. This means that the value of the life insurance policy will be subject to estate taxes if it exceeds the applicable exemption threshold set by the tax authorities.

However, if the policy is owned by a different person or an irrevocable trust, the death benefit proceeds may be excluded from the taxable estate. By transferring the policy ownership to another individual or a trust, the policyholder can potentially reduce the overall estate tax burden.

It’s important to note that estate tax laws can vary from country to country and even state to state, so it’s critical to consult with a qualified estate planning attorney or tax professional who specializes in estate and inheritance tax matters.

In addition, life insurance policies can also serve as a useful tool to offset potential estate taxes. Policyholders can use life insurance to provide liquidity to their estate, ensuring that the necessary funds are available to pay any estate taxes owed by their beneficiaries.

Life insurance death benefit proceeds are typically income tax-free to the beneficiaries. However, if the policyholder has taken loans against the policy or has assigned it as collateral for another loan, the amount outstanding at the time of death may reduce the death benefit and potentially create taxable income to the beneficiaries.

Considering the complexities surrounding estate taxes and the potential impact on beneficiaries, it’s crucial to have a comprehensive estate plan in place. This includes reviewing beneficiary designations, exploring trust options, and consulting with professional advisors to ensure that the life insurance proceeds are handled in a tax-efficient manner.

By carefully navigating the estate tax landscape and leveraging appropriate strategies, individuals can maximize the financial benefits of their life insurance policies and provide their loved ones with the necessary financial support while minimizing estate tax liabilities.

Conclusion

Understanding the taxation of the cash surrender value of life insurance is crucial for policyholders who are considering accessing the funds during their lifetime. While the cash surrender value itself is not typically subject to immediate taxation, there are important tax considerations to keep in mind.

Policyholders should be aware of the potential tax implications of surrendering or making partial withdrawals from the cash surrender value. Excess amounts received may be subject to ordinary income tax, while withdrawals of basis may be tax-free. Additionally, policy loans can provide a tax-efficient way to access funds while keeping the tax benefits of the policy intact.

Estate tax considerations also play a significant role, as the inclusion of life insurance proceeds in the taxable estate depends on ownership and beneficiary designations. Understanding estate tax laws and utilizing appropriate estate planning strategies can help minimize potential tax burdens on beneficiaries.

It’s important for individuals to consult with financial advisors, tax professionals, and insurance experts to navigate the intricacies of life insurance taxation. These professionals can provide tailored guidance based on individual circumstances and help make informed decisions that align with financial goals and objectives.

Ultimately, by staying informed, policyholders can make the most of their life insurance policies while ensuring that potential tax implications are carefully managed. With the right knowledge and strategies, individuals can protect their loved ones financially and optimize their overall financial well-being.