Home>Finance>Deferred Tax Liability Definition: How It Works With Examples

Finance

Deferred Tax Liability Definition: How It Works With Examples

Published: November 9, 2023

Discover the definition and examples of deferred tax liability in finance. Understand how this concept works to better manage your taxes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Deferred Tax Liability: How It Works With Examples

Welcome to the world of finance! In this article, we’ll delve into the concept of deferred tax liability and its significance in the financial landscape. As a business owner or investor, understanding deferred tax liability can help you make informed decisions, ensure compliance, and effectively manage your tax obligations. So, let’s dig in and unravel the complexities of deferred tax liability together!

Key Takeaways:

- Deferred tax liability is a financial obligation that arises due to temporary differences between the accounting method used for tax purposes and the one used in financial statements.

- It represents taxes that will be payable in the future as a result of these temporary differences.

What Is Deferred Tax Liability?

Deferred tax liability refers to the amount of taxes a business or individual will owe in the future due to temporary differences between the tax treatment of certain transactions and their recognition in the financial statements.

Temporary differences can occur due to various reasons, such as different depreciation methods, recognition of revenue or expenses, or the use of tax credits. These temporary differences result in the deferral of tax payments, creating a future tax liability.

To illustrate, let’s consider an example:

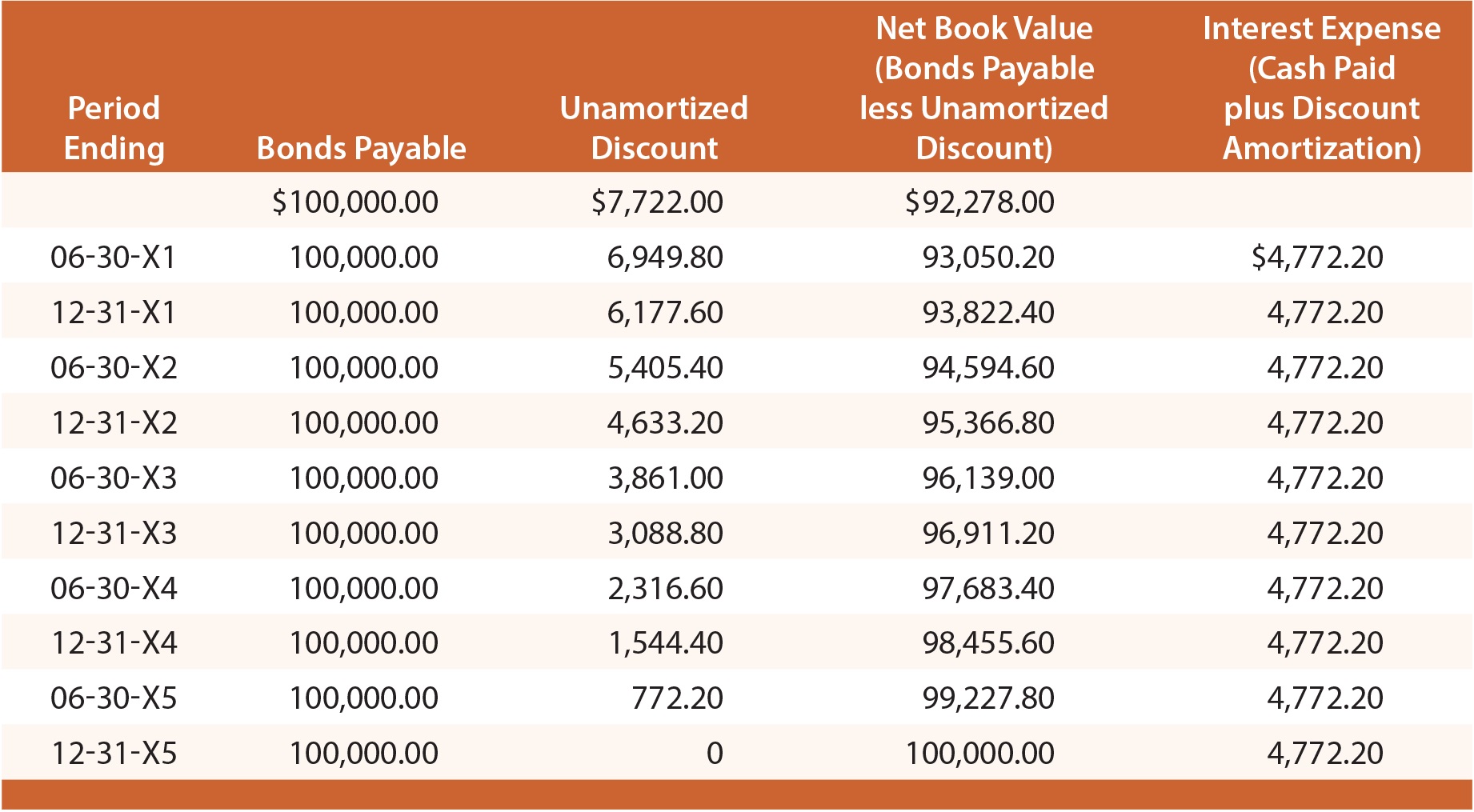

Company ABC purchases a piece of machinery worth $100,000. For tax purposes, the machinery is depredated using the straight-line method over ten years, resulting in a $10,000 tax depreciation expense each year. However, for financial reporting purposes, the machinery is depreciated using the accelerated method, resulting in a $20,000 depreciation expense each year.

This difference in depreciation methods creates a temporary difference, as the tax expense is lower than the financial reporting expense during each year of the machinery’s useful life. As a result, the company will have a deferred tax liability, representing the additional tax it will have to pay in the future.

Why Is Deferred Tax Liability Important?

Deferred tax liability is important for several reasons:

- Accurate Financial Reporting: Adhering to accounting regulations requires businesses to accurately report financial statements. By recognizing deferred tax liabilities, businesses can present a more accurate representation of their financial position.

- Effective Tax Planning: Understanding deferred tax liabilities allows businesses to plan ahead and strategize for the future tax implications of their decisions. By accounting for these liabilities, businesses can minimize surprises and optimize their tax strategies.

- Investor Confidence: Investors analyze financial statements to assess the performance and stability of a business. Transparent reporting, including the recognition of deferred tax liabilities, can foster investor trust and confidence.

It’s essential to consult with tax professionals or accounting experts to ensure proper recognition and management of deferred tax liabilities.

Conclusion

Deferred tax liability represents the taxes a business or individual will owe in the future due to temporary differences in accounting methods for tax and financial reporting. By understanding and accounting for these liabilities, businesses can ensure accurate financial reporting, plan for future tax obligations, and maintain investor confidence. Remember, partnering with tax professionals or accounting experts can provide valuable insights and guidance when it comes to managing deferred tax liabilities.

We hope this article has shed light on the concept of deferred tax liability and its importance in the finance world. Stay tuned for more informative content in our Finance category!