Home>Finance>Over-the-Counter (OTC): Trading And Security Types Defined

Finance

Over-the-Counter (OTC): Trading And Security Types Defined

Published: January 5, 2024

Learn about over-the-counter (OTC) trading and various security types in the finance industry. Gain insights into OTC securities and their characteristics, including stocks, bonds, and derivatives.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Over-the-Counter (OTC): Trading and Security Types Defined

Finance is a vast and ever-evolving field, with various instruments and mechanisms that contribute to its growth and efficiency. One such mechanism is Over-the-Counter (OTC) trading, which offers alternative avenues for investors to buy and sell securities directly from one another. In this blog post, we will delve into the world of OTC trading, exploring its definition, security types, and the advantages it provides. Whether you are an experienced investor or someone who wants to learn more about the finance industry, this article will help demystify OTC trading and provide you with valuable insights.

Key Takeaways:

- Over-the-Counter (OTC) trading allows investors to trade securities directly without the involvement of a centralized exchange.

- Common types of OTC securities include stocks, bonds, derivatives, and foreign currencies.

What is OTC Trading?

Before we dive into the various security types, let’s first understand what OTC trading entails. In simple terms, OTC trading refers to the buying and selling of financial instruments, such as stocks, bonds, and derivatives, directly between two parties without the need for a centralized exchange. Unlike traditional exchange-traded securities, OTC securities are traded on decentralized dealer networks, allowing for greater flexibility and accessibility for investors.

While OTC trading may not be as well-known as exchange-traded trading, it plays a significant role in the finance industry. Now, let’s explore some of the common types of securities that are traded over the counter.

1. OTC Stocks:

OTC stocks, also known as penny stocks, are shares of small or emerging companies that do not meet the listing requirements of major exchanges. These companies often trade on OTC markets such as the OTCQB and Pink Sheets. Investing in OTC stocks carries a higher level of risk due to their lower liquidity and limited regulatory oversight. However, they also present an opportunity for investors to discover undervalued companies with substantial growth potential.

2. OTC Bonds:

OTC bond trading involves the buying and selling of debt securities directly between investors. Unlike exchange-traded bonds, OTC bonds provide more flexibility in terms of pricing and customization. Institutional investors, such as banks and mutual funds, often participate in OTC bond trading, allowing them to tailor their investment portfolios to meet specific needs and risk profiles.

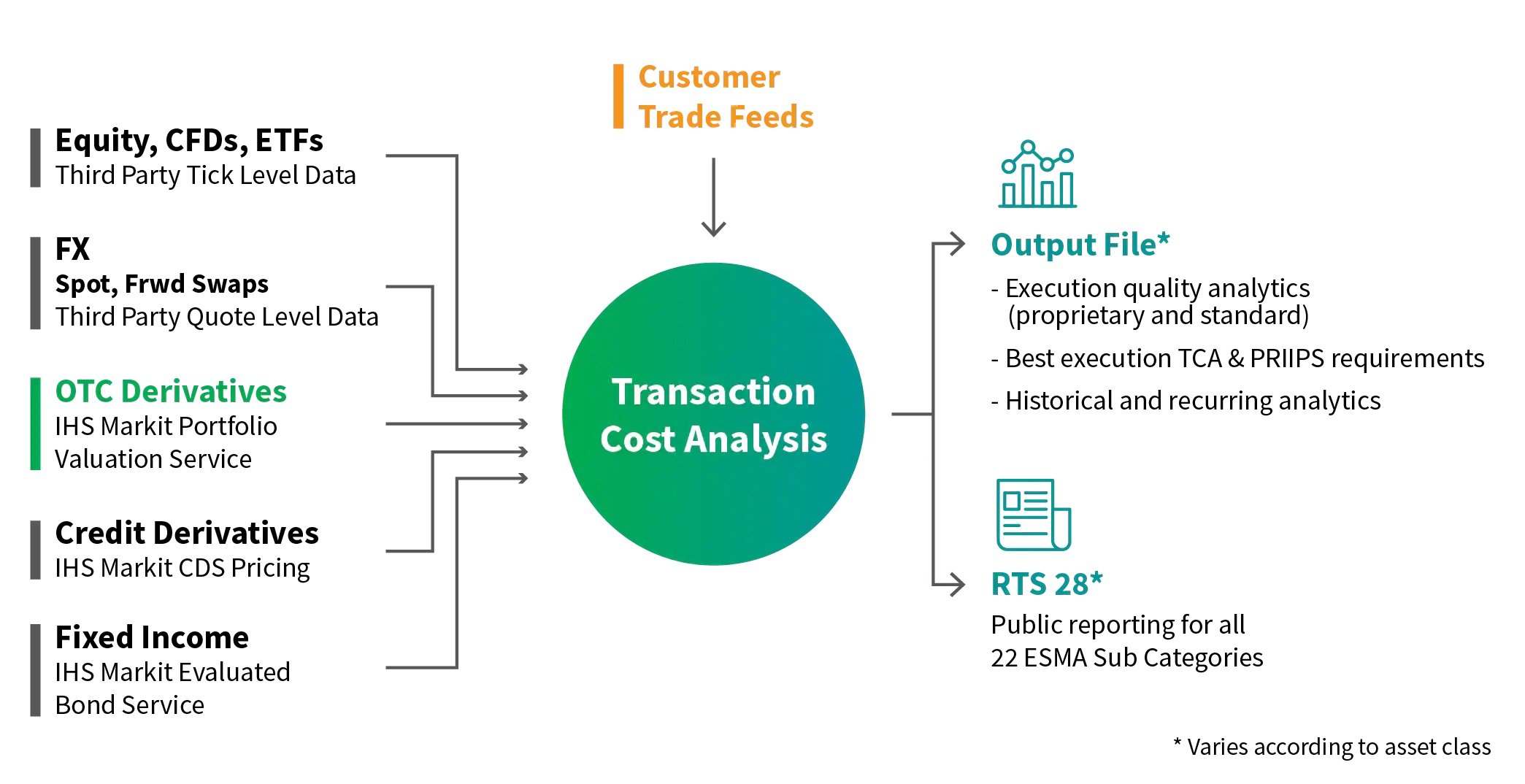

3. OTC Derivatives:

Derivatives are financial contracts whose value is derived from an underlying asset, such as stocks, bonds, or commodities. OTC derivatives are customized contracts traded directly between two parties. Common types of OTC derivatives include options, swaps, and forwards. These instruments provide investors with opportunities to hedge against market risks, speculate on future price movements, and manage their exposure to various financial variables.

4. OTC Foreign Currencies:

Foreign exchange (Forex) trading is a popular form of OTC trading, where individuals, businesses, and financial institutions trade currencies directly with one another. Unlike trading stocks and bonds on centralized exchanges, Forex trading takes place on a decentralized network of banks and other financial institutions. Traders can speculate on the price movements of various currency pairs, such as EUR/USD or GBP/JPY, to capitalize on market fluctuations and profit from changes in exchange rates.

As you can see, OTC trading encompasses a wide range of securities, providing investors with diverse options to meet their investment objectives. While it offers several advantages, such as increased flexibility and accessibility, it’s essential to conduct thorough research and understand the risks associated with OTC trading before diving in.

So, whether you are a seasoned investor looking to diversify your investment portfolio or someone who wants to learn more about the intricacies of finance, OTC trading is a fascinating domain worth exploring. Keep in mind the key takeaways mentioned above, and venture into the world of OTC trading with confidence, armed with knowledge and understanding. Happy investing!