Home>Finance>What Interest Rates Are Charged To The Borrower For Ondeck

Finance

What Interest Rates Are Charged To The Borrower For Ondeck

Published: November 2, 2023

Find out what interest rates are charged to borrowers for Ondeck. Stay informed about finance and get the best rates for your borrowing needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of OnDeck loans, where small businesses can access the funding they need to grow and succeed. One of the key considerations when applying for any loan is the interest rate that will be charged to the borrower. Understanding how interest rates are determined and the factors that influence them is crucial in making informed borrowing decisions.

In this article, we will delve deeper into the world of OnDeck loans and explore the factors that affect interest rates. Whether you are a small business owner looking for financing or simply curious about the lending landscape, this article will provide valuable insights.

At OnDeck, the interest rates are competitive and tailored to meet the unique needs of each borrower. OnDeck takes into account various factors to determine the interest rate for individual loan applications, such as creditworthiness, business performance, and loan term. It is important to note that the interest rate charged will also depend on whether you qualify for a fixed interest rate or a variable interest rate.

So, let’s dive in and unravel the mysteries of interest rates for OnDeck borrowers.

Understanding OnDeck Loans

OnDeck is a leading online lender that offers financing solutions to small businesses. They understand the unique challenges faced by small business owners and aim to provide quick and convenient access to funds. OnDeck loans are designed to meet the working capital needs of businesses for various purposes, such as covering day-to-day expenses, funding inventory purchases, or investing in growth opportunities.

One of the key advantages of OnDeck loans is their flexibility and accessibility. Unlike traditional lenders, OnDeck uses advanced technology to streamline the loan application and approval process. This means that small business owners can apply for loans online and receive a decision quickly, often within hours. The funds can then be disbursed to the borrower’s account in as little as one business day.

OnDeck loans are typically short-term, ranging from three months to three years, with repayments made in regular installments. The loan amounts can range from $5,000 up to $500,000, depending on the needs of the business and their creditworthiness. This flexibility allows businesses to borrow the exact amount they need, without being tied down to long-term commitments.

What sets OnDeck apart is their focus on evaluating the health and potential of a business, rather than solely relying on personal credit scores. They consider various factors, such as business revenue, time in operation, and industry performance, to assess the creditworthiness of the borrower. This approach provides opportunities for businesses with limited credit history or less-than-perfect credit scores to access the funding they need.

OnDeck loans can be a valuable tool for small businesses looking to seize growth opportunities, manage cash flow, or navigate unexpected expenses. However, it’s important to understand the interest rates associated with these loans before applying, as they can have a significant impact on the cost of borrowing.

Factors Affecting Interest Rates

Interest rates for OnDeck loans are not determined arbitrarily; they are influenced by a variety of factors that reflect the borrower’s risk profile and the overall market conditions. Understanding these factors will help borrowers make informed decisions and potentially secure more favorable interest rates.

Creditworthiness: One of the primary factors that affect interest rates is the borrower’s creditworthiness. This includes factors such as personal credit score, business credit history, and any previous loan defaults. Borrowers with a higher credit score and a positive credit history are considered less risky and may be offered lower interest rates compared to those with a lower credit score.

Business Performance: OnDeck also takes into account the overall health and performance of the borrower’s business. Factors such as revenue, profitability, and industry outlook are considered to assess the likelihood of repayment. A business with a strong financial track record and positive growth trends may be offered more competitive interest rates.

Loan Term: The length of the loan term can also impact the interest rate charged. Generally, longer-term loans tend to have higher interest rates compared to shorter-term loans. This is because there is a greater level of uncertainty and risk associated with longer repayment periods.

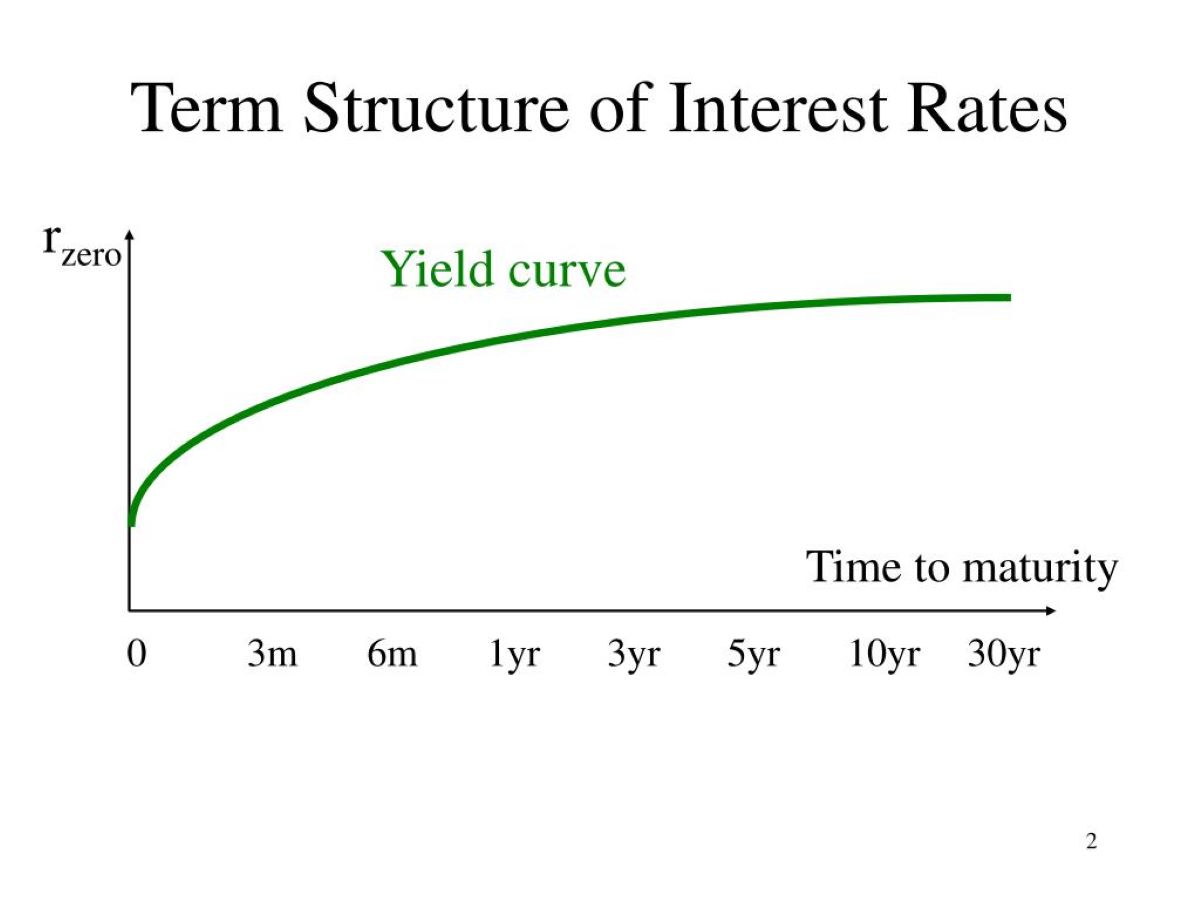

Market Conditions: Interest rates are not solely determined by the borrower’s profile; they are also influenced by the overall market conditions. Factors such as the economy, inflation rates, and the prevailing interest rate environment can all impact the interest rates offered by lenders like OnDeck. Borrowers should be aware that interest rates can fluctuate in response to market changes.

Loan Amount: The amount of funding being requested by the borrower can also impact the interest rate. In general, larger loan amounts may have lower interest rates compared to smaller loan amounts. This is because larger loans are typically seen as less risky for lenders as they have more collateral and potential repayment capacity.

Collateral: OnDeck loans are typically unsecured, meaning they do not require collateral. However, when evaluating interest rates, lenders may still consider the presence of collateral or personal guarantees. In such cases, having tangible assets that can be used as collateral can potentially lead to lower interest rates.

It’s important for borrowers to keep in mind that these factors are not independent of each other. Rather, they work together to determine the overall risk profile of the borrower, which ultimately influences the interest rate offered. By understanding these factors, borrowers can work towards improving their creditworthiness and presenting a strong business case to potentially secure more favorable interest rates.

Fixed Interest Rates vs. Variable Interest Rates

When considering an OnDeck loan, borrowers have the option to choose between fixed interest rates and variable interest rates. Understanding the differences between these two options is crucial in determining the most suitable financing arrangement.

A fixed interest rate is just as its name implies – it remains unchanged throughout the loan term. This means that the borrower’s monthly payments will remain consistent, providing predictability and stability. Fixed interest rates are ideal for borrowers who prefer to have a set repayment schedule and want to avoid any surprises in their loan payments.

On the other hand, variable interest rates are subject to change based on market conditions. These rates are often tied to an index, such as the Prime Rate or the London Interbank Offered Rate (LIBOR). If the index rate increases or decreases, the borrower’s interest rate will also adjust accordingly. Variable interest rates can be more beneficial in a declining interest rate environment, as borrowers can potentially benefit from lower interest payments. However, they also carry the risk of increasing rates, which can lead to higher monthly payments.

Choosing between fixed and variable interest rates depends on several factors. If the borrower prefers certainty and wants to budget with fixed monthly payments, a fixed interest rate may be the better option. This is particularly advantageous for businesses that have a tight cash flow or those who prefer to have a fixed expense structure.

On the other hand, borrowers who are comfortable with potential fluctuations in interest rates and believe that rates will remain favorable or decrease in the future may opt for a variable interest rate. This allows them to potentially benefit from lower rates and reduce the overall cost of borrowing if interest rates decline.

It’s important for borrowers to assess their risk appetite and evaluate their ability to manage potential changes in interest rates. Additionally, borrowers should stay informed about market conditions and economic trends to make informed decisions regarding fixed or variable interest rates.

Regardless of the interest rate option chosen, OnDeck offers competitive rates designed to meet the needs of small businesses. Borrowers can discuss their options with a loan specialist at OnDeck to determine the best fit for their specific circumstances.

Calculating Interest Rates for OnDeck Borrowers

Calculating the interest rates for OnDeck loans involves several factors that determine the overall cost of borrowing. Understanding how these rates are calculated can help borrowers estimate their total repayment amount and make informed financial decisions.

The interest rate on an OnDeck loan is typically expressed as an Annual Percentage Rate (APR). The APR represents the total cost of borrowing over a year, including interest charges and any applicable fees. To calculate the APR, OnDeck takes into account the loan amount, repayment term, and the overall cost of capital.

For example, let’s say a borrower applies for a $50,000 OnDeck loan with a repayment term of 12 months. OnDeck offers them an interest rate of 20%. To calculate the APR, the borrower needs to factor in any additional fees, such as origination fees or processing fees.

In addition to the APR, borrowers should also consider the factor rate, which is used to determine the total repayment amount. The factor rate is a decimal figure that is multiplied by the loan amount to calculate the total repayment amount.

Continuing with the previous example, if the borrower’s loan has a factor rate of 1.2, the total repayment amount will be $50,000 x 1.2 = $60,000. This means that the borrower will repay a total of $60,000 over the course of the loan term.

It’s important to note that the interest rate and factor rate may vary based on factors such as creditworthiness, loan term, and the overall risk profile of the borrower. OnDeck assesses these factors to determine the interest rate offered to individual borrowers.

It’s advisable for borrowers to review the terms and conditions of their loan agreement to understand the detailed breakdown of interest charges, fees, and the overall repayment structure. This will help them estimate their monthly payments and budget accordingly.

It’s worth mentioning that OnDeck simplifies the repayment process by setting up automatic daily or weekly payments, depending on the borrower’s preference. This allows borrowers to repay the loan gradually over time, minimizing any potential strain on their cash flow.

By understanding how interest rates are calculated for OnDeck loans, borrowers can evaluate the affordability of the loan and ensure it aligns with their financial goals and capabilities. Comparing offers from multiple lenders and considering other financing options can also help borrowers secure the most favorable terms and rates for their business needs.

Determining Factors for Individual Interest Rates

When applying for an OnDeck loan, the interest rate offered to individual borrowers is determined by a combination of factors that assess their creditworthiness and overall risk profile. OnDeck takes a holistic approach to evaluating borrowers, considering various aspects that provide insights into their ability to repay the loan.

Here are some of the key factors that OnDeck considers when determining interest rates:

1. Credit Score: The borrower’s personal credit score is one of the primary factors considered. A higher credit score indicates a lower credit risk, and therefore, borrowers with a higher credit score may be offered more competitive interest rates. However, OnDeck doesn’t solely rely on credit scores and considers other factors as well.

2. Business Performance: OnDeck assesses the financial health and performance of the borrower’s business. Factors such as revenue, profitability, and industry trends are considered as indicators of the business’s ability to generate sufficient cash flow for loan repayment. Businesses with strong financial performance may be offered lower interest rates.

3. Time in Business: The length of time the borrower’s business has been operating is also taken into account. OnDeck typically prefers businesses with a minimum operational history of one year to reduce the risk associated with start-ups. Longer operational history can positively influence the interest rates offered.

4. Industry Risk: Certain industries may inherently carry more risk than others. OnDeck considers the industry in which the borrower’s business operates and evaluates its stability and growth potential. Industries with higher perceived risk may be subject to slightly higher interest rates due to the increased level of uncertainty.

5. Loan Amount and Term: The loan amount and repayment term selected by the borrower can also impact the interest rate. Larger loan amounts may have lower interest rates, as they represent a higher level of commitment for the borrower. Additionally, longer-term loans may have slightly higher interest rates compared to shorter-term loans due to the extended repayment period.

It’s important to note that these factors are not viewed in isolation. OnDeck takes a comprehensive approach in assessing the overall risk profile of borrowers to determine the appropriate interest rates. They understand that each business is unique, and their evaluation process takes into account the specific circumstances of the borrower to offer tailored financing solutions.

Furthermore, by maintaining a positive borrowing relationship with OnDeck and demonstrating a track record of responsible loan repayment, borrowers may be eligible for lower interest rates on future loan applications. This highlights the importance of building and maintaining a strong credit profile.

Overall, the interest rates offered by OnDeck are designed to reflect the borrower’s risk level and ensure that the terms of the loan are reasonable and affordable. By understanding the factors that influence interest rates, borrowers can take proactive steps to improve their creditworthiness and secure more favorable rates.

Considerations for Borrowers

When considering an OnDeck loan, borrowers should carefully evaluate their financial situation and business needs. It’s important to take into account several key considerations to ensure that the loan aligns with their goals and is a suitable financing option. Here are some important factors for borrowers to consider:

1. Assessing Financial Need: Before applying for an OnDeck loan, borrowers should assess their financial needs and determine the exact amount of funding required. Having a clear understanding of the purpose of the loan and the specific expenses it will cover can help borrowers make informed decisions about loan terms and repayment capabilities.

2. Reviewing Repayment Terms: Borrowers should carefully review and understand the repayment terms associated with the loan. This includes the repayment schedule, interest rate, any applicable fees, and the total repayment amount. It’s important to ensure that the loan structure matches the business’s cash flow and ability to meet the repayment obligations.

3. Comparing Rates and Terms: In addition to OnDeck, borrowers should consider evaluating other lenders and loan options to compare rates, terms, and eligibility requirements. This allows borrowers to make a well-informed decision and secure the most favorable loan terms available to them.

4. Considering Collateral and Guarantees: OnDeck loans are typically unsecured, meaning they do not require collateral. However, borrowers should be aware that providing collateral or personal guarantees can potentially improve their chances of securing lower interest rates or accessing larger loan amounts.

5. Impact on Cash Flow: Borrowers should carefully consider the impact of the loan on their business’s cash flow. It’s important to ensure that the loan repayments are manageable within the existing cash flow structure and won’t strain the business’s ability to cover other financial obligations or operational expenses.

6. Understanding Early Repayment: OnDeck offers flexibility for borrowers who wish to repay their loan early. However, borrowers should closely evaluate the terms and any potential fees associated with early repayment. While early repayment can save on interest charges, it’s essential to assess whether it aligns with the business’s financial capabilities.

7. Long-term Business Goals: Borrowers should consider how the loan fits into their long-term business goals. It’s important to evaluate whether the loan is an investment in growth or addresses short-term needs. This ensures that the loan serves the business’s strategic objectives and contributes to its overall success.

By carefully considering these factors, borrowers can make informed decisions about taking on an OnDeck loan. It’s advisable to consult with financial advisors or loan specialists to gain a better understanding of the loan terms, potential risks, and opportunities associated with the financing.

Remember, borrowing should be a strategic decision that aligns with the business’s objectives and financial capabilities. Taking the time to assess the above considerations will help borrowers ensure that they are entering into a loan agreement that best supports their business’s growth and financial well-being.

Conclusion

Choosing the right financing option is crucial for small businesses looking to grow and thrive. OnDeck loans offer a convenient and accessible solution, providing the funding needed to seize opportunities and manage day-to-day expenses. Understanding the factors that influence interest rates and the considerations for borrowers is key to making informed decisions.

By evaluating personal and business creditworthiness, industry risk, loan terms, and financial goals, borrowers can determine the most suitable loan option for their unique circumstances. Additionally, considering the choice between fixed and variable interest rates allows borrowers to align their preferences and risk tolerance with their repayment strategy.

OnDeck takes a comprehensive approach to evaluate borrowers and offers competitive interest rates tailored to individual needs. Their focus on business performance and flexibility in loan terms make them an attractive option for small businesses seeking financing.

However, borrowers should carefully review the terms and repayment obligations associated with OnDeck loans. Considering factors such as financial need, impact on cash flow, and long-term business goals is essential to ensure that the loan is a strategic investment that supports the growth and financial stability of the business.

In conclusion, OnDeck loans provide small businesses with a valuable financing solution. By understanding the factors that influence interest rates, comparing loan options, and considering the specific needs of their business, borrowers can make informed decisions and secure the funding they need to succeed.

Remember, it’s always advisable to consult with financial advisors or loan specialists to gain a deeper understanding of the loan terms, risks, and opportunities associated with OnDeck loans. With careful consideration and planning, OnDeck loans can be a valuable tool for small businesses on their journey to success.