Home>Finance>Does Car Insurance Go Down When You Get Married

Finance

Does Car Insurance Go Down When You Get Married

Published: November 12, 2023

Find out if car insurance rates decrease after getting married and how it affects your finance. Get expert advice to save money on insurance premiums.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Car Insurance Rates

- Factors That Influence Car Insurance Rates

- Does Marital Status Affect Car Insurance Rates?

- Why Car Insurance Rates May Decrease When You Get Married

- Other Factors That Can Influence Car Insurance Rates After Marriage

- Tips to Save on Car Insurance as a Married Couple

- Conclusion

Introduction

Car insurance is a necessity for every driver, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. However, the cost of car insurance can vary significantly from person to person. One factor that can influence car insurance rates is marital status.

Marriage is a major life event that can have a wide range of implications, including financial ones. When it comes to car insurance, many people wonder if their rates will change when they tie the knot. Does car insurance go down when you get married? In this article, we will delve into this question and explore why car insurance rates may decrease after marriage.

Before we dive into the impact of marital status on car insurance, it is important to understand how car insurance rates are determined in the first place. Insurance companies use a variety of factors to assess risk and calculate premiums. These factors include:

- Age and driving experience

- Driving record and claims history

- Location and use of the vehicle

- Type and value of the vehicle

- Credit history

Now, let’s explore whether or not marital status has any influence on car insurance rates.

Understanding Car Insurance Rates

Car insurance rates are determined by a variety of factors, all aimed at assessing the level of risk associated with insuring a particular driver. Insurance companies consider multiple variables and data points to calculate premiums that reflect the likelihood of a policyholder filing a claim.

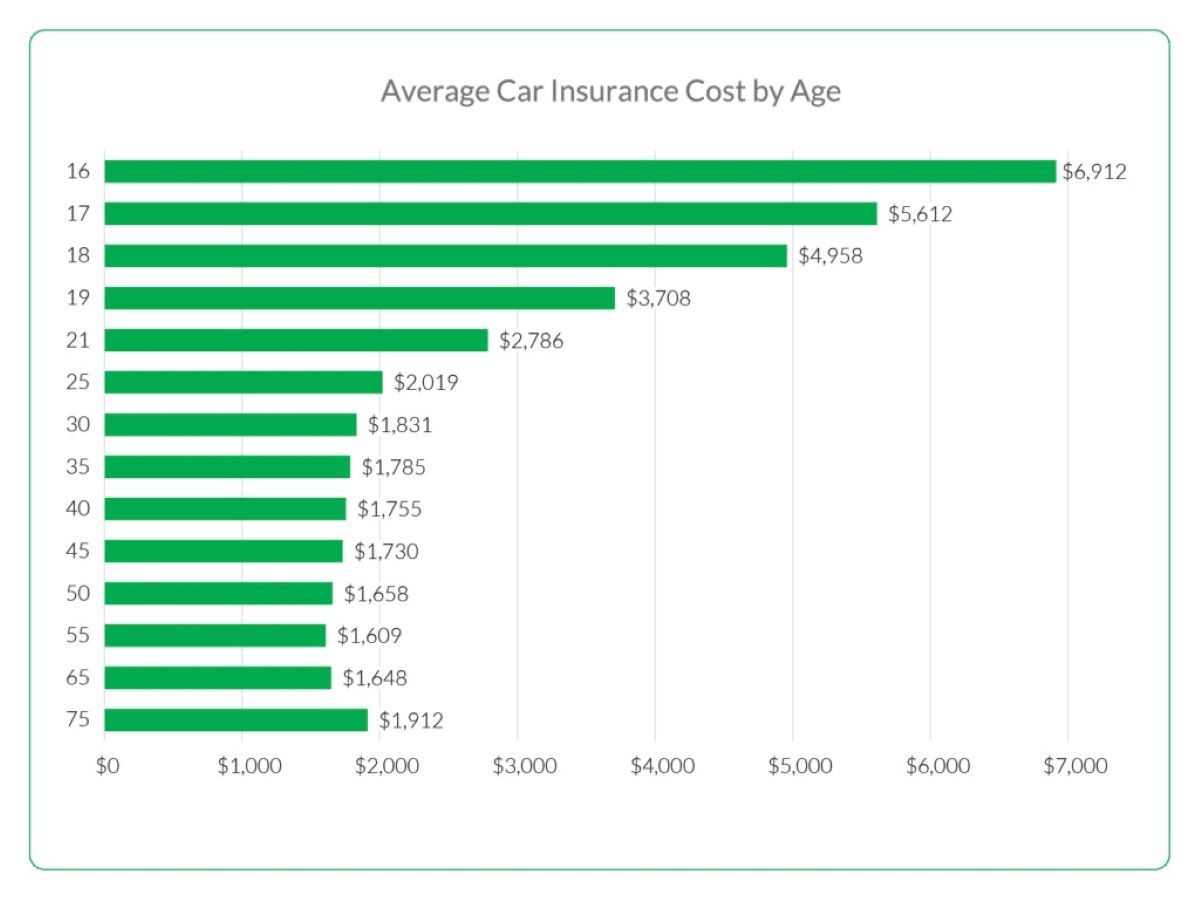

One of the key factors that insurance companies evaluate is the driver’s level of risk. This includes elements such as age, driving experience, and driving record. Younger drivers or those with less experience are generally considered higher risk due to their limited time on the road. Drivers with a history of accidents or violations are also deemed riskier to insure as they have demonstrated a higher likelihood of being involved in future incidents.

Another crucial factor that insurers take into account is the type of vehicle being insured. The make, model, age, and safety features of a car can impact its risk profile. Typically, expensive or high-performance vehicles have higher premiums since they are more costly to repair or replace. Vehicles with excellent safety ratings and security features, on the other hand, may qualify for discounts as they reduce the risk of injury or theft.

Additional factors that influence car insurance rates include the location where the vehicle is primarily parked or used. Urban areas with high traffic congestion or a higher incidence of accidents may trigger higher premiums. Insurers consider the likelihood of theft or vandalism in certain areas and adjust rates accordingly. The frequency and purpose of car usage, such as commuting long distances or using the vehicle for business purposes, can also influence insurance prices.

Lastly, insurance companies take into account a driver’s credit history when determining car insurance rates. Research has shown a correlation between credit scores and the probability of filing insurance claims. Generally, individuals with better credit scores are perceived as less risky and may benefit from lower premiums.

Understanding these factors that contribute to car insurance rates is important for drivers seeking coverage. By comprehending the variables that impact their premiums, individuals can better assess how their circumstances and decisions may affect their insurance costs.

Factors That Influence Car Insurance Rates

When it comes to determining car insurance rates, insurance companies take into account a variety of factors that help them assess the level of risk associated with insuring a particular driver. Understanding these factors can help individuals make informed decisions and potentially lower their insurance premiums. Here are some key factors that influence car insurance rates:

- Age and driving experience: Younger and inexperienced drivers are generally considered higher risk due to their limited time on the road. Insurance companies often charge higher premiums for drivers under the age of 25. Conversely, older drivers with more driving experience may qualify for lower rates.

- Driving record: Your driving record and claims history can significantly impact insurance rates. Drivers with a history of accidents or traffic violations are more likely to file future claims, which makes them riskier to insure. On the other hand, individuals with clean driving records can often enjoy lower premiums.

- Vehicle type and value: The type, make, model, age, and value of the vehicle you drive affect insurance rates. Expensive or high-performance vehicles are generally more expensive to repair or replace, so insurers charge higher premiums for them. On the other hand, vehicles with good safety ratings and security features may qualify for discounts.

- Location: Where you live and primarily use your vehicle can impact your insurance rates. Urban areas with high traffic congestion or a higher incidence of accidents may result in higher premiums. Insurers also consider the likelihood of theft or vandalism in certain areas, which can affect rates.

- Usage of the vehicle: How you use your car can also influence insurance rates. If you primarily use your vehicle for commuting long distances or for business purposes, you may be charged higher premiums as you are on the road more frequently, increasing the likelihood of accidents.

- Credit history: It may come as a surprise, but your credit history can also impact your car insurance rates. Studies have shown that individuals with better credit scores are less likely to file insurance claims, making them less risky to insure. As a result, those with good credit may enjoy lower premiums.

Keep in mind that these factors may vary depending on the insurance provider and the specific policy. It’s also worth noting that different states and countries have different regulations and factors that influence car insurance rates. Therefore, it’s essential to consult with your insurance agent or provider to understand the specific factors that apply to your location and situation.

By being aware of these influential factors, drivers can make conscious choices to potentially lower their car insurance rates or take advantage of discounts and incentives that may be available to them.

Does Marital Status Affect Car Insurance Rates?

Marital status is a significant factor that insurance companies consider when calculating car insurance rates. In general, married individuals tend to experience lower car insurance premiums compared to their unmarried counterparts. The reason behind this lies in the statistical data that demonstrates married individuals, on average, are less likely to be involved in accidents.

Insurance companies rely heavily on data and statistics to assess risk and determine premiums. Research has consistently shown that married individuals tend to have fewer accidents and file fewer claims compared to single individuals. This is believed to be due to the fact that being married often brings about a more stable lifestyle, responsibilities, and a heightened sense of caution.

So, if you’re wondering “does car insurance go down when you get married?” the answer is generally yes. However, it’s important to note that this is not a guaranteed reduction in rates and can vary depending on other factors like your driving history, credit score, and the specific insurance provider.

It’s worth mentioning that domestic partnerships or civil unions may also be considered for potential discounts equivalent to married couples’ rates. It’s important to check with your insurance provider to understand the specific criteria and requirements for receiving these benefits.

On the other hand, if you’re recently divorced or widowed, you may see a slight increase in your car insurance rates. This is due to the fact that your marital status has changed and insurance companies may perceive newly single individuals as being potentially less cautious on the road.

Ultimately, while marital status can influence car insurance rates, it is just one piece of the puzzle. Insurance companies assess multiple factors to calculate premiums and determine risk levels. It’s important to remember that rates can vary significantly among different insurance providers, so it’s advisable to shop around and compare quotes to find the best coverage at the most affordable price.

Why Car Insurance Rates May Decrease When You Get Married

There are several reasons why car insurance rates may decrease when you get married. Insurance companies view marriage as an indicator of stability and responsible behavior, leading to a perception that married individuals are less likely to engage in risky driving habits. Here are some key reasons why car insurance rates tend to decrease after marriage:

- Statistics and Risk Assessment: Insurance companies rely on statistical data to assess risk and determine premiums. The data consistently shows that married individuals are less likely to be involved in accidents or file insurance claims compared to single individuals. As a result, insurance providers view married couples as lower-risk drivers, which can lead to lower car insurance rates.

- Increased Responsibility: Marriage often brings about a sense of increased responsibility and a more stable lifestyle. This change in mindset can translate into more cautious and responsible behavior on the road. Insurance companies value these traits as they contribute to a reduced likelihood of accidents and claims.

- Shared Ownership and Usage: When you get married, you may combine your assets and share ownership of vehicles. This can result in consolidated car insurance policies and potentially more favorable rates. Insurance providers often offer multi-car discounts for households with multiple vehicles, which can help lower insurance costs for married couples.

- Consolidation of Policies: Beyond consolidating car insurance policies, getting married can also lead to the consolidation of other insurance policies, such as home insurance or renter’s insurance. Many insurance companies offer multi-policy discounts for customers who have multiple policies with them. By bundling multiple insurance policies together, couples may be eligible for discounted rates.

- Improved Credit Score: Getting married can also have a positive impact on your credit score. As you and your spouse combine finances and share financial responsibilities, you may have the opportunity to build a stronger credit history together. Insurance companies often consider credit scores when determining car insurance rates, so an improved credit score may result in lower premiums.

It’s important to note that while car insurance rates generally decrease after marriage, other factors such as driving history, the type of vehicles insured, and location can still influence the overall rates. Additionally, insurance providers may have their own specific criteria and algorithms for determining premiums. Therefore, it’s recommended to shop around, compare quotes, and communicate with insurance agents to find the best coverage and rates for your specific circumstances as a married couple.

Other Factors That Can Influence Car Insurance Rates After Marriage

While getting married can lead to decreased car insurance rates, it’s important to understand that other factors can still influence insurance premiums. These factors go beyond marital status and can vary among insurance providers. Here are some additional factors that can impact car insurance rates after marriage:

- Driving History: Both spouses’ driving histories play a crucial role in insurance rates. If one partner has a poor driving record with accidents or traffic violations, it can still affect the premiums for both individuals. Conversely, if both partners have clean driving records, it can result in more favorable rates.

- Combining Policies: While consolidating car insurance policies can lead to discounts, it’s essential to consider the effect of combining other policies. If one partner has a poor credit score or a history of claims on other policies, it may impact the overall insurance rates when policies are bundled together.

- Changes in Vehicle Usage: Marriage can sometimes bring about changes in vehicle usage. For example, if one partner starts working from home or no longer has a lengthy commute, it can influence the insurance rates. Insurance providers consider the frequency of vehicle usage and the purpose of the vehicle (e.g., commuting, personal, or business use) when determining premiums.

- Changes in Location: Getting married may involve relocating to a different area. Insurance rates can vary significantly based on your new location, as insurers consider factors such as traffic congestion, crime rates, and the likelihood of accidents or theft. It’s important to update your insurance provider with your new address to ensure accurate premium calculations.

- Policy Limits and Deductibles: When getting married, it’s a good time to reassess your policy limits and deductibles. The coverage and limits you choose can affect your premiums. For example, higher liability limits or lower deductibles may result in higher premiums, while lower limits or higher deductibles may reduce your rates.

Remember, insurance companies use complex algorithms and consider multiple factors when determining car insurance rates. While marital status is an important factor, it is just one piece of the puzzle. It’s essential to discuss these factors with your insurance provider and explore any potential discounts or adjustments that may apply specifically to your situation as a married couple.

Tips to Save on Car Insurance as a Married Couple

As a married couple, there are several strategies you can adopt to save money on your car insurance premiums. Here are some useful tips to help you reduce your car insurance costs:

- Compare Quotes: Take the time to shop around and compare quotes from different insurance providers. Rates can vary significantly, so it’s important to get multiple quotes to find the best coverage at the most affordable price.

- Bundle Policies: Consider bundling your car insurance policy with other insurance policies such as home or renter’s insurance. Many insurance companies offer multi-policy discounts, which can lead to substantial savings.

- Take Advantage of Multi-Car Discounts: If you and your spouse have multiple vehicles, insure them under the same policy to qualify for multi-car discounts. This can result in lower premiums for both vehicles.

- Consider Increasing Deductibles: Increasing your deductibles can lower your premium costs. However, make sure you choose a deductible amount that you can comfortably afford to pay out of pocket in the event of a claim.

- Review Your Coverage: Periodically review your coverage to ensure that you’re not paying for unnecessary add-ons or coverage you no longer need. Adjusting your coverage levels based on your changing circumstances can help optimize your premiums.

- Improve Your Credit Score: Maintaining a good credit score can positively impact your car insurance rates. Pay your bills on time, keep credit card balances low, and monitor your credit report for any errors or inaccuracies.

- Take Defensive Driving Courses: Completing a defensive driving course can sometimes qualify you for discounts on your car insurance premiums. These courses provide valuable skills and demonstrate your commitment to safe driving.

- Ask About Occasional Driver Discounts: If one spouse drives significantly less than the other, inquire about occasional driver discounts. Some insurance companies offer reduced rates for individuals who drive fewer miles or have a lower risk of being involved in accidents.

- Install Safety and Anti-Theft Devices: Equipping your vehicles with safety features such as anti-lock brakes, airbags, and anti-theft devices can make them less prone to accidents or theft. Additionally, insurance companies often offer discounts for vehicles with such features.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents to keep your car insurance rates low. Safe driving and maintaining a clean driving record can help you qualify for additional discounts and prevent any rate hikes.

Remember to consult with your insurance provider to understand the specific discounts and savings opportunities available to you as a married couple. By implementing these tips, you can potentially enjoy significant savings on your car insurance premiums while maintaining the coverage you need.

Conclusion

Getting married can have a positive impact on your car insurance rates, as married individuals generally experience lower premiums compared to their unmarried counterparts. Insurance companies perceive married couples as lower-risk drivers due to factors like increased responsibility and statistical data that shows married individuals are less likely to be involved in accidents. However, it’s important to remember that car insurance rates are influenced by multiple factors, and marital status is just one piece of the puzzle.

Other variables, such as driving history, vehicle type, location, and credit history, can also affect the cost of your car insurance premiums. It’s crucial to communicate with your insurance provider, compare quotes, and explore potential discounts and savings opportunities that may be available to you as a married couple.

To save on car insurance as a married couple, consider bundling policies, taking advantage of multi-car discounts, increasing deductibles, improving your credit score, and reviewing your coverage periodically. Additionally, maintaining a clean driving record, installing safety features in your vehicles, and completing defensive driving courses can contribute to lower premiums.

Remember that every insurance provider has its own criteria and algorithms for determining car insurance rates. Shopping around, comparing quotes, and seeking personalized advice from insurance agents can help you find the best coverage at the most affordable price.

By understanding the factors that influence car insurance rates and implementing these tips, you can potentially save money on your car insurance as a married couple. Prioritize responsible driving habits, continue to reassess your coverage needs, and take advantage of available discounts to ensure you have the right protection while keeping your premiums manageable.