Finance

Downtick Definition

Published: November 14, 2023

Learn what downtick means in finance and how it impacts markets. Discover the significance of this term in trading and investing strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Downtick Definition: Understanding the Concept of Market Declines

When it comes to finance, understanding the various terms and concepts is key to navigating the complex world of markets and investments. One such term that is commonly used in financial discussions is the downtick. But what exactly is a downtick? In this blog post, we will explore the downtick definition and its significance in the world of finance.

Key Takeaways:

- A downtick refers to a decrease in the price of a financial instrument compared to the last trade.

- It plays a crucial role in technical analysis and is often used by traders to identify market trends and make trading decisions.

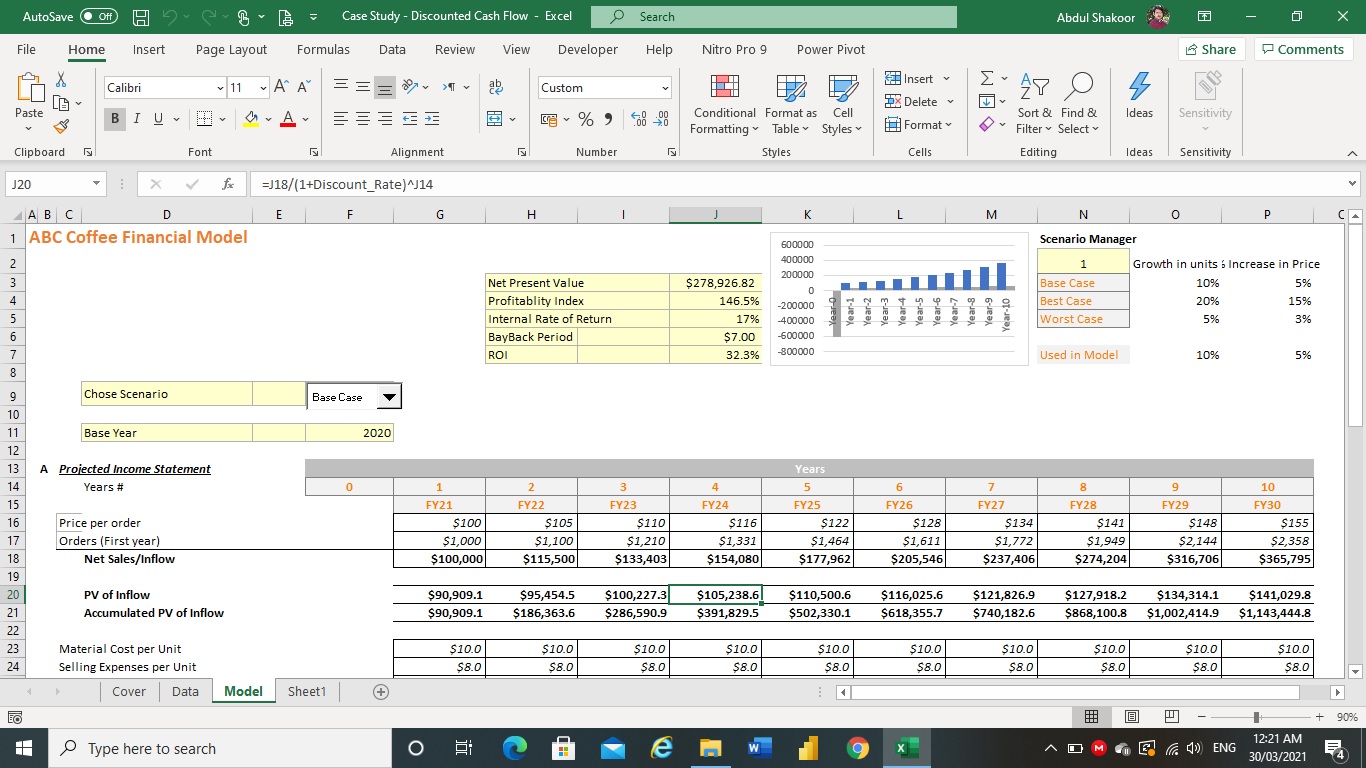

Understanding Downticks

In simple terms, a downtick occurs when the price of a financial instrument, such as a stock or a commodity, decreases compared to the price of the last trade. It is essentially a measure of market decline. But why is a downtick important?

One of the key reasons for paying attention to downticks is that they play a significant role in technical analysis. Technical analysts study price movements and patterns to predict future market trends. By analyzing downticks, they can identify potential market reversals and make more informed trading decisions. In addition, downticks are also used to measure market sentiment, as increased downticks may indicate a bearish or negative market outlook.

Here are a few important points to keep in mind when it comes to downticks:

- Short Selling: Downticks are particularly relevant in the context of short selling. When traders engage in short selling, they borrow shares of a stock and sell them with the expectation that the price will decrease. To prevent manipulation and excessive market declines, most exchanges have implemented rules that require short trades to be executed on a downtick or a zero-plus tick.

- Regulation: Downticks are closely monitored by regulators to ensure fair and orderly markets. In some jurisdictions, there are specific rules in place to restrict short selling during periods of extreme market volatility to prevent excessive downward pressure.

- Contrast with Upticks: The opposite of a downtick is an uptick, which occurs when the price of a financial instrument increases compared to the last trade. Upticks are often considered positive indicators, signaling market strength or an upward trend.

Conclusion

Understanding the downtick definition is essential for any investor or trader looking to navigate the financial markets. Downticks serve as important signals for technical analysts, helping them identify market trends and make informed trading decisions. In addition, downticks play a vital role in regulating short selling and maintaining fair and orderly markets. By grasping the concept of downticks, you can better comprehend market dynamics and ultimately improve your financial decision-making.