Home>Finance>Accumulated Earnings And Profits (E&P): Definition, Vs. Retained

Finance

Accumulated Earnings And Profits (E&P): Definition, Vs. Retained

Modified: December 30, 2023

Learn about accumulated earnings and profits (E&P), its definition, and how it compares to retained earnings. Explore the insights into finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Accumulated Earnings and Profits (E&P): Definition, Vs. Retained

Finance can be a complex and daunting subject for many individuals and businesses. However, it is important to gain a solid understanding of key financial concepts to make informed decisions. In this blog post, we will shed light on one such concept called Accumulated Earnings and Profits (E&P) and its difference from retained earnings. So, let’s dive in and unravel the mysteries of E&P!

Key Takeaways:

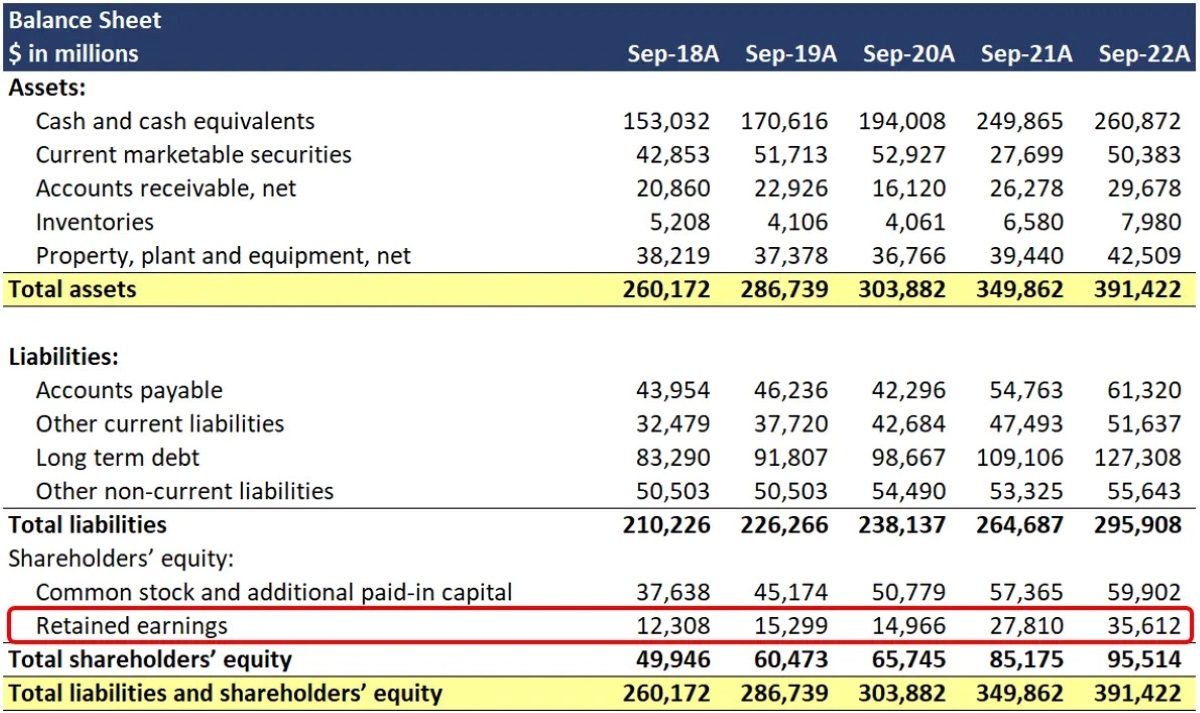

- Accumulated Earnings and Profits (E&P) represent the net profits of a corporation that have not been distributed as dividends.

- Retained earnings, on the other hand, refer to the portion of net earnings a company keeps after paying dividends to its shareholders.

What is Accumulated Earnings and Profits (E&P)?

Accumulated Earnings and Profits (E&P) is a financial term that refers to the accumulated net profits of a corporation over time. These profits have been generated through the company’s operations and have not been distributed to its shareholders in the form of dividends. Instead, they have been retained by the company for various purposes such as reinvestment, debt repayment, or future expansion.

E&P is an important metric that provides insights into a company’s financial health, as it reflects its ability to generate profits and accumulate wealth over time. It serves as an indicator of a company’s retained earnings and its potential for future growth.

How is E&P different from Retained Earnings?

While E&P and retained earnings may seem similar, there are some significant differences between the two:

- Definition: E&P represents the total net profits of a corporation that have not been distributed as dividends, including both the current and previous years’ earnings. On the other hand, retained earnings refer to the portion of net earnings that a company retains after paying dividends to its shareholders.

- Usage: E&P is often used for tax purposes, as it determines the amount of accumulated profits a corporation can distribute as dividends without incurring additional taxes. Retained earnings, however, are mainly used for financial reporting and to assess a company’s financial stability and growth.

- Legal Considerations: E&P calculations are crucial for determining the tax consequences of dividend distributions. If a corporation accumulates earnings without a reasonable business purpose, it may face penalty taxes, commonly referred to as “accumulated earnings tax” or “personal holding company tax.” On the other hand, there are no specific legal restrictions or penalties associated with retained earnings.

Both E&P and retained earnings are vital indicators of a company’s financial position and performance. They are used by investors, analysts, and tax authorities to evaluate a company’s profitability, stability, and compliance with tax regulations.

It is important to note that calculating E&P can be complex and requires expertise in tax regulations and accounting principles. Therefore, it is advisable to consult with a qualified professional such as a tax advisor or accountant to accurately determine a company’s Accumulated Earnings and Profits.

In conclusion, Accumulated Earnings and Profits (E&P) are an essential financial metric that captures the accumulated net profits of a corporation over time. Understanding the difference between E&P and retained earnings is crucial for making informed financial decisions and complying with tax regulations. So, the next time you come across these terms, you’ll have a better understanding of what they represent and their significance in the world of finance.