Home>Finance>Efficient Market Hypothesis (EMH): Definition And Critique

Finance

Efficient Market Hypothesis (EMH): Definition And Critique

Published: November 17, 2023

Learn about the Efficient Market Hypothesis (EMH) in finance, its definition, and critique. Understand the key concepts and controversies surrounding this theory.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Efficient Market Hypothesis (EMH): Definition and Critique

Welcome to the finance category of our blog! Today, we’re diving into the fascinating world of the Efficient Market Hypothesis (EMH). Have you ever wondered why the stock market fluctuates so much or if it’s possible to consistently beat the market? Well, EMH attempts to answer these questions and provides a framework for understanding how financial markets function. In this blog post, we’ll define EMH, explore its three forms, and discuss some of the key criticisms it has faced. So let’s get started!

Key Takeaways:

- Efficient Market Hypothesis (EMH) states that financial markets are efficient and reflect all available information.

- EMH comes in three forms: weak, semi-strong, and strong, each representing a different level of information efficiency.

What is the Efficient Market Hypothesis?

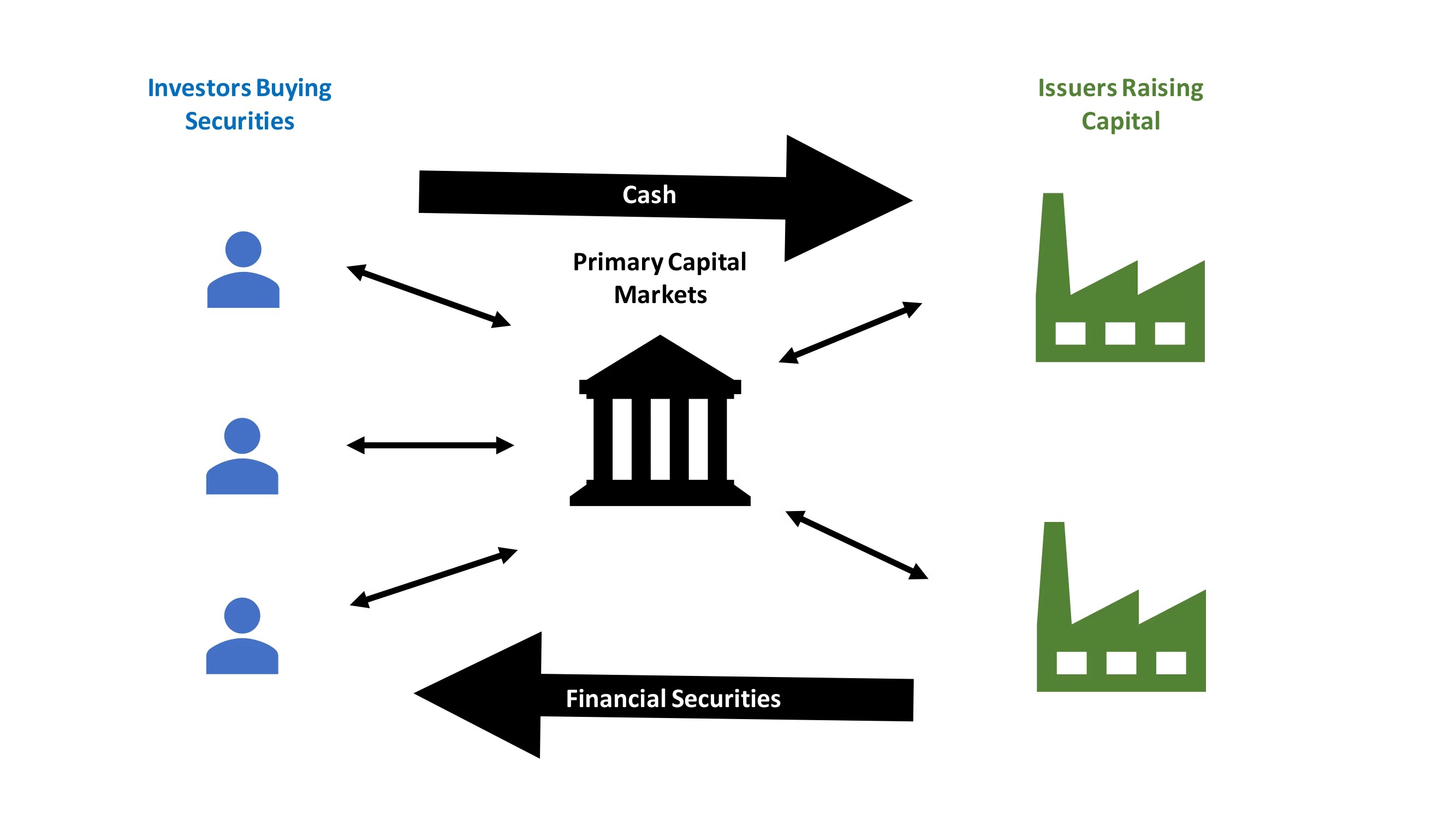

The Efficient Market Hypothesis (EMH) is a theory that suggests financial markets are efficient and therefore reflect all available information. According to EMH, it is impossible to consistently achieve above-average returns through active trading or investment strategies. In essence, EMH argues that it’s incredibly difficult, if not impossible, to beat the market consistently over time.

EMH comes in three different forms, each representing a different level of information efficiency:

- Weak Form EMH: This form suggests that current prices fully reflect all past price and volume information. In other words, the weak form implies that technical analysis cannot be used to consistently predict future price movements. For example, if a stock’s price has been declining for the past few days, weak form EMH would argue that this information is already incorporated into the stock’s current price.

- Semi-Strong Form EMH: This form builds upon the weak form and suggests that stock prices also reflect all publicly available information. This includes company announcements, financial statements, and other publicly disclosed information. According to semi-strong form EMH, it is futile to try and profit by trading based on publicly available information, as the market has already priced it in.

- Strong Form EMH: This is the most stringent form of EMH, stating that stock prices reflect all information, both public and private. If the strong form holds true, it means that even insider information would not give an investor an edge in the market. However, the existence of insider trading suggests that the strong form of EMH may not fully capture reality.

Critiques of the EMH:

While the Efficient Market Hypothesis has been widely discussed and recognized, it has also faced several critiques over the years. Some of the key criticisms include:

- Behavioral Biases: Critics argue that EMH fails to account for irrational human behavior, such as emotions and cognitive biases, which can lead to market inefficiencies. It is well known that investors can exhibit irrational exuberance during bull markets or panic-selling during bear markets, potentially leading to mispricings.

- Information Asymmetry: Another critique of EMH is the existence of information asymmetry, where some market participants possess non-public information that gives them an advantage. Insider trading cases have shown that certain individuals can profit from having access to privileged information, suggesting that the strong form of EMH may not hold true.

- Market Manipulation: EMH assumes that financial markets are free from manipulation, but history has shown that market manipulation does occur. Examples include price manipulation by large institutions or high-frequency trading algorithms exploiting market microstructure.

In Conclusion

The Efficient Market Hypothesis serves as a foundational concept in finance, describing the level of information efficiency in financial markets. While it provides a useful framework for understanding market dynamics, it is by no means a perfect theory. Critics argue that it fails to account for behavioral biases, information asymmetry, and market manipulation. As an investor, it’s important to be aware of these limitations while utilizing EMH to make informed investment decisions.