Home>Finance>How Many Futures Contracts Can You Trade Before Experiencing Slippage?

Finance

How Many Futures Contracts Can You Trade Before Experiencing Slippage?

Published: December 24, 2023

Discover the ideal number of futures contracts to trade in finance without encountering slippage. Learn how to optimize your trading strategy for maximum efficiency.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of futures trading, where participants have the opportunity to profit from price movements in various financial instruments and commodities. As a futures trader, one of the crucial factors to consider is slippage – the difference between the expected price of a trade and the actual price at which it is executed.

Slippage can have a significant impact on your profitability and trading strategies. It occurs when there is not enough liquidity in the market to fill your order at the desired price. This can result in unfavorable execution prices, especially when trading a large number of futures contracts.

But just how many futures contracts can you trade before experiencing slippage? The answer is not straightforward and depends on several factors. In this article, we will explore the concept of slippage in futures trading, the factors that affect it, and strategies to manage and minimize its impact.

Understanding slippage is essential because it can greatly affect the profitability of your trading activities. By gaining insight into this phenomenon and implementing effective risk management techniques, you can enhance your trading performance and achieve better results in the futures market.

Understanding Slippage in Futures Trading

Slippage is a common occurrence in futures trading that occurs when the expected execution price of a trade differs from the actual price at which it is executed. This can happen due to various factors, including market volatility, liquidity constraints, and order size.

Market volatility plays a significant role in slippage. During periods of high volatility, such as news announcements or economic events, prices can fluctuate rapidly. This can make it challenging to execute trades at the desired price, leading to slippage.

Liquidity is another crucial factor influencing slippage. When there is limited liquidity in a particular futures contract, it means there are fewer buyers and sellers in the market. Consequently, executing a large order can result in slippage as the market may not have enough participants to absorb the trade without affecting the price.

Order size also impacts slippage. When placing larger orders, the market may not have sufficient liquidity to fill the order completely at the desired price. This can lead to partial fills and subsequent slippage for the remaining portion of the order.

Slippage can occur in both directions, causing prices to move unfavourably or favourably for the trader. In some instances, slippage can even result in a better execution price than anticipated. However, it is important to note that slippage is generally considered to be an adverse event that affects the trader’s profitability.

Overall, understanding the concept of slippage is crucial for futures traders. It enables them to anticipate potential execution challenges and implement strategies to minimize its impact. By being aware of the factors contributing to slippage, traders can make more informed decisions and adjust their trading strategies accordingly.

Factors Affecting Slippage

Several factors influence the level of slippage experienced in futures trading. By understanding these factors, traders can better manage and mitigate slippage risk. Let’s explore some of the key factors affecting slippage:

- Market Volatility: Higher levels of volatility in the market can increase the likelihood of slippage. During volatile market conditions, prices can change rapidly, making it challenging to execute trades at the desired price. Traders should be mindful of the impact of volatility and adjust their trading strategies accordingly.

- Liquidity: The availability of liquidity in the market influences slippage. When there is limited liquidity, executing large orders can lead to slippage as the market may not have enough participants to match the desired price and volume. Highly liquid markets tend to have lower slippage risk compared to illiquid markets.

- Order Size: The size of the order has a direct impact on slippage. Placing larger orders can increase the likelihood of slippage as it may be difficult to find enough liquidity to fill the order completely at the desired price. Traders should consider dividing large orders into smaller, more manageable sizes to reduce slippage risk.

- Time of Day: The time of day can also affect slippage. During peak trading hours, when there is a higher volume of market participants, slippage may be less pronounced compared to periods of low liquidity, such as after market close or during holidays. Traders should be aware of the optimal trading hours for their chosen futures contracts.

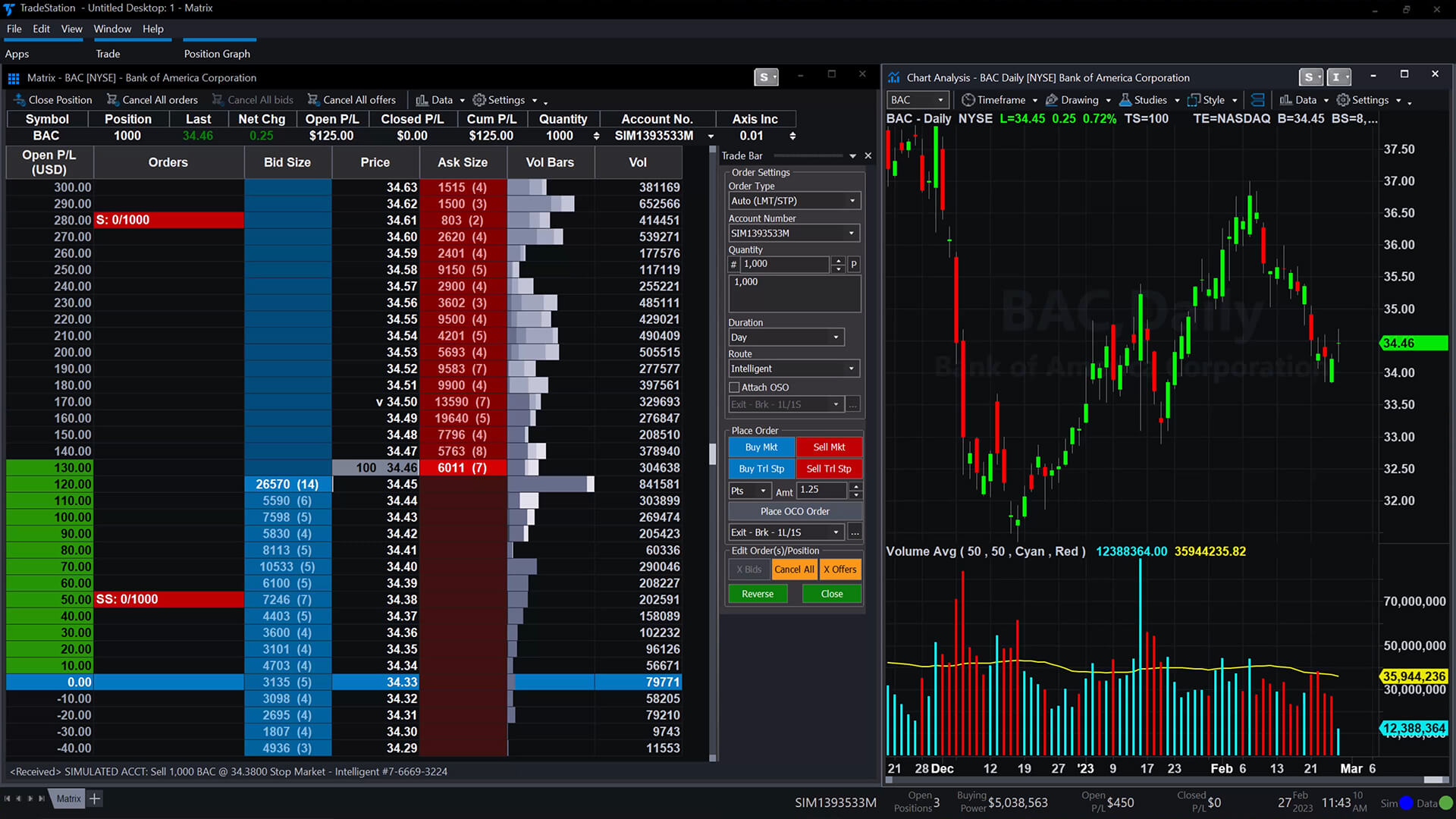

- Market Depth: Market depth refers to the number of buy and sell orders available at various price levels. Deeper markets with a higher number of bids and offers provide more liquidity and reduce the likelihood of slippage. It is important for traders to assess the market depth before executing trades to gauge the potential slippage risk.

- Order Type: The type of order used can impact slippage. Market orders are executed at the best available price in the market, which may result in immediate execution but can also lead to slippage if there is a sudden price movement. Limit orders, on the other hand, allow traders to specify the maximum price they are willing to pay or the minimum price they are willing to sell at, potentially reducing slippage risk.

By closely monitoring and analyzing these factors, traders can make informed decisions and employ appropriate strategies to mitigate slippage risk in futures trading. The goal is to strike a balance between desired execution prices and the potential slippage impact, ultimately maximizing profitability and minimizing trading costs.

Determining the Quantity of Futures Contracts

When trading futures contracts, determining the appropriate quantity to trade is crucial to manage slippage risk effectively. Here are some considerations to help you determine the optimal quantity:

- Account Size: One of the primary factors to consider is the size of your trading account. The amount of capital you have available will influence the number of futures contracts you can comfortably trade. It is generally recommended to risk only a small percentage of your total account balance on any single trade to prevent overexposure.

- Risk Tolerance: Every trader has a unique risk tolerance level. Some may be comfortable with higher levels of risk, while others prefer a more conservative approach. Assess your risk tolerance and determine the maximum number of contracts you are willing to trade based on your comfort level.

- Trading Strategy: Your trading strategy plays a significant role in determining the quantity of futures contracts to trade. Different strategies have varying levels of risk and profit potential. Scalping strategies, for example, may involve trading larger quantities more frequently, while swing trading strategies may focus on fewer contracts with longer holding periods.

- Market Conditions: The current market conditions can also impact the appropriate quantity of futures contracts. During times of high volatility and low liquidity, it is advisable to scale back on the number of contracts to mitigate slippage risk. On the other hand, when market conditions are stable and liquid, you may consider trading a larger quantity of contracts.

- Slippage Impact: Evaluate the potential slippage impact on your trades based on historical data and market analysis. Consider backtesting your trading strategy to assess how slippage has affected your past trades. This analysis can provide insights into the optimal quantity of contracts to trade while minimizing slippage impact.

- Trade Management: Proper trade management is crucial to limit slippage risk. Implement effective stop-loss orders and profit targets to exit trades at predetermined levels. This can help you determine the appropriate quantity of contracts to trade based on your risk-reward ratios and desired trade management rules.

It’s important to note that determining the quantity of futures contracts to trade is not a one-size-fits-all approach. Each trader has their own unique circumstances and should consider these factors in combination with their individual goals and preferences. By carefully assessing these considerations, you can determine an appropriate quantity that aligns with your trading strategy and risk management plan, ultimately reducing slippage risk and improving your overall trading performance.

Evaluating Slippage Impact on Different Futures Contracts

Slippage can vary across different futures contracts, as each market has its own characteristics and liquidity levels. Evaluating the slippage impact on different futures contracts is crucial for traders to make informed decisions and manage their risk effectively. Here are some factors to consider when evaluating slippage impact:

- Liquidity: The liquidity of a futures contract plays a significant role in determining the slippage impact. Highly liquid contracts, such as those for major stock indices or currency pairs, tend to have lower slippage as there is a larger pool of participants willing to buy and sell at various price levels. Illiquid contracts, on the other hand, can result in higher slippage due to limited trading activity.

- Volatility: Volatility is another factor that affects slippage impact. Contracts with higher levels of volatility may experience more significant price movements, which can lead to larger slippage. Traders should assess the historical volatility of different futures contracts and consider the potential impact on slippage when deciding on their trading strategies.

- Market Depth: Market depth refers to the number of buy and sell orders available at various price levels. Deeper markets with a higher number of bids and offers provide more liquidity and typically result in lower slippage. Traders should examine the market depth of different futures contracts to gauge their slippage risk.

- Trading Volume: The trading volume of a futures contract can indicate its popularity and liquidity. Higher trading volumes generally indicate greater participation and liquidity, resulting in lower slippage. Traders should consider the average daily trading volume of different contracts when evaluating slippage impact.

- Spread: The spread refers to the difference between the bid and ask prices of a futures contract. Contracts with tight spreads have lower slippage risk as there is less price difference between buying and selling. Traders should compare the spreads of different futures contracts to assess their potential slippage impact.

- Time of Day: Slippage impact can also vary depending on the time of day. During peak trading hours, there tends to be higher liquidity and lower slippage. Traders should be aware of the optimal trading hours for different futures contracts to minimize slippage risk.

By evaluating the slippage impact on different futures contracts, traders can focus on those with lower slippage and higher liquidity levels. This allows them to execute their trades more efficiently and reduce the adverse effects of slippage. It is important to conduct thorough research and analysis to understand the characteristics of each futures contract and make informed trading decisions based on their individual slippage risk.

Case Studies: Slippage in Various Futures Markets

To gain a better understanding of slippage in futures trading, let’s explore a few case studies that highlight the slippage impact in different futures markets:

Case Study 1: E-mini S&P 500 Futures

The E-mini S&P 500 Futures contract is one of the most actively traded futures contracts, representing the performance of the U.S. stock market. Due to its high liquidity and trading volume, slippage is generally less pronounced compared to less liquid contracts. However, during periods of extreme market volatility, such as major news events or economic releases, slippage can occur as prices can rapidly fluctuate. Traders should be cautious during these times and use limit orders to mitigate slippage risk.

Case Study 2: Crude Oil Futures

Crude oil futures contracts are highly liquid and widely traded in the commodities market. However, due to the inherent volatility of the oil market, slippage can occur, especially when trading large quantities. The release of oil inventory data or geopolitical events can cause significant price movements and increase slippage risk. Traders should be mindful of these factors and consider adjusting their order sizes or using advanced order types to manage slippage.

Case Study 3: Eurodollar Futures

Eurodollar futures contracts are based on the interest rates on U.S. dollar-denominated deposits held outside the United States. These contracts are highly liquid and widely traded by institutions and professional traders. Slippage in Eurodollar futures is generally minimal due to the deep liquidity and high trading volume. Traders can expect to execute trades at or near the desired price, with lower slippage as compared to less liquid contracts.

Case Study 4: Natural Gas Futures

Natural gas futures contracts are known for their seasonal volatility and price fluctuations. Slippage can occur in this market, especially during significant weather events or shifts in supply and demand fundamentals. Traders should exercise caution when trading natural gas futures, monitoring market conditions closely and using appropriate order types to manage slippage risk effectively.

It is important to note that slippage impact can vary based on market conditions, trading strategies, and individual trade execution. Traders should conduct thorough research and analysis specific to the futures contracts they plan to trade to understand the potential slippage risk involved and adjust their strategies accordingly.

Strategies to Minimize Slippage

While it is challenging to completely eliminate slippage in futures trading, there are several strategies that traders can employ to minimize its impact. Here are some effective approaches to mitigate slippage:

- Trade During High Liquidity: One of the most effective ways to reduce slippage is to trade during periods of high liquidity. This typically aligns with peak trading hours when there is a greater number of market participants. More participants mean more liquidity and a higher likelihood of executing trades at the desired price.

- Use Limit Orders: Placing limit orders allows traders to set specific price levels at which they are willing to buy or sell a futures contract. By using limit orders, traders can have more control over the execution price and potentially reduce slippage. However, it is important to keep in mind that limit orders may not always be immediately filled, especially during fast-moving markets.

- Monitor Market Depth: Before placing a trade, it is essential to assess the market depth of the futures contract. By evaluating the number of buy and sell orders at various price levels, traders can gauge the available liquidity. Deeper markets with larger order sizes at each price level indicate higher liquidity and reduce the likelihood of significant slippage.

- Consider Scaling In and Out: Instead of executing large orders all at once, traders can consider scaling in and out of positions. This involves dividing the order into smaller sizes and executing them at different price levels or time intervals. Scaling in and out can help manage slippage risk by reducing the impact of a large order on liquidity and allowing for better price execution.

- Implement Advanced Order Types: Some trading platforms offer advanced order types, such as iceberg orders or fill-or-kill orders, which can help minimize slippage. Iceberg orders hide the order size from the market, revealing only a portion of the order at a time. Fill-or-kill orders require immediate execution of the entire order or none at all, preventing partial fills and subsequent slippage.

- Adjust Position Sizes: Carefully evaluating the appropriate position size for each trade can also help mitigate slippage. By trading smaller sizes relative to account size and market conditions, traders can reduce the impact of their orders on market liquidity and minimize slippage risk.

It’s important to note that each strategy has its own advantages and considerations. Traders should thoroughly backtest and evaluate these strategies based on their trading style, risk tolerance, and the specific futures contracts they are trading. Additionally, continuously monitoring market conditions, news events, and price movements will help traders make informed decisions and adapt their strategies to minimize slippage in real-time.

Conclusion

Slippage is an inherent part of futures trading that can impact the execution and profitability of trades. Understanding and effectively managing slippage is crucial for traders to optimize their trading strategies and minimize the risk of unfavorable price differences.

In this article, we explored the concept of slippage in futures trading and identified key factors that can influence its occurrence, such as market volatility, liquidity, order size, and market depth. By being aware of these factors, traders can make more informed decisions and adjust their trading strategies accordingly to mitigate slippage risk.

We also discussed how to determine the appropriate quantity of futures contracts to trade, considering factors like account size, risk tolerance, and trading strategy. By carefully evaluating these factors, traders can strike a balance between desired execution prices and potential slippage impact.

Furthermore, we examined the slippage impact in various futures markets through case studies. It became evident that slippage can vary depending on the liquidity, volatility, market depth, and trading volume of each specific contract.

To minimize slippage, we discussed strategies such as trading during high liquidity, using limit orders, monitoring market depth, considering scaling in and out of positions, implementing advanced order types, and adjusting position sizes. These strategies can help traders optimize their execution and reduce the impact of slippage on their trades.

In conclusion, while slippage cannot be entirely eliminated, it can be effectively managed through proper risk management techniques, careful analysis of market conditions, and the implementation of appropriate trading strategies. By understanding and proactively addressing slippage, traders can enhance their trading performance and increase the likelihood of achieving their desired outcomes in the dynamic world of futures trading.