Home>Finance>Semi-Strong Form Efficiency: Definition And Market Hypothesis

Finance

Semi-Strong Form Efficiency: Definition And Market Hypothesis

Published: January 26, 2024

Learn about semi-strong form efficiency in finance and understand its definition and market hypothesis. Discover how it impacts investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Semi-Strong Form Efficiency: Definition and Market Hypothesis Explained

Welcome to our finance blog post where we delve into the fascinating world of market efficiency. In particular, we are going to explore the concept of Semi-Strong Form Efficiency, a fundamental theory in finance. Have you ever wondered whether the stock market truly reflects all available information? What impact do public announcements or news events have on stock prices? We will uncover the answers to these questions and more in this article.

Key Takeaways:

- Semi-Strong Form Efficiency suggests that stock prices already incorporate all publicly available information.

- Efficient market hypothesis states that it is impossible to consistently achieve above-average market returns using only publicly available information.

What is Semi-Strong Form Efficiency?

Semi-Strong Form Efficiency is a concept that forms a significant part of the Efficient Market Hypothesis. It posits that stock prices accurately reflect all publicly available information. This means that analyzing historical market data or relying on recent news events will not provide an edge in generating consistent and above-average returns.

The theory of Semi-Strong Form Efficiency suggests that stocks adjust so quickly and accurately to new information that it becomes virtually impossible for investors to outperform the market based solely on publicly available information. Investors who attempt to beat the market by analyzing news events, company announcements, or financial statements are unlikely to consistently outperform the overall market in the long run.

To better understand this concept, let’s consider an example. Suppose a company releases its quarterly earnings report, which beats market expectations. In an environment of Semi-Strong Form Efficiency, this positive news will be quickly incorporated into the stock price. By the time the information becomes widely available, the stock price will already reflect the positive market sentiment, making it difficult for investors to profit solely from this news.

So, how does Semi-Strong Form Efficiency fit into the broader Efficient Market Hypothesis?

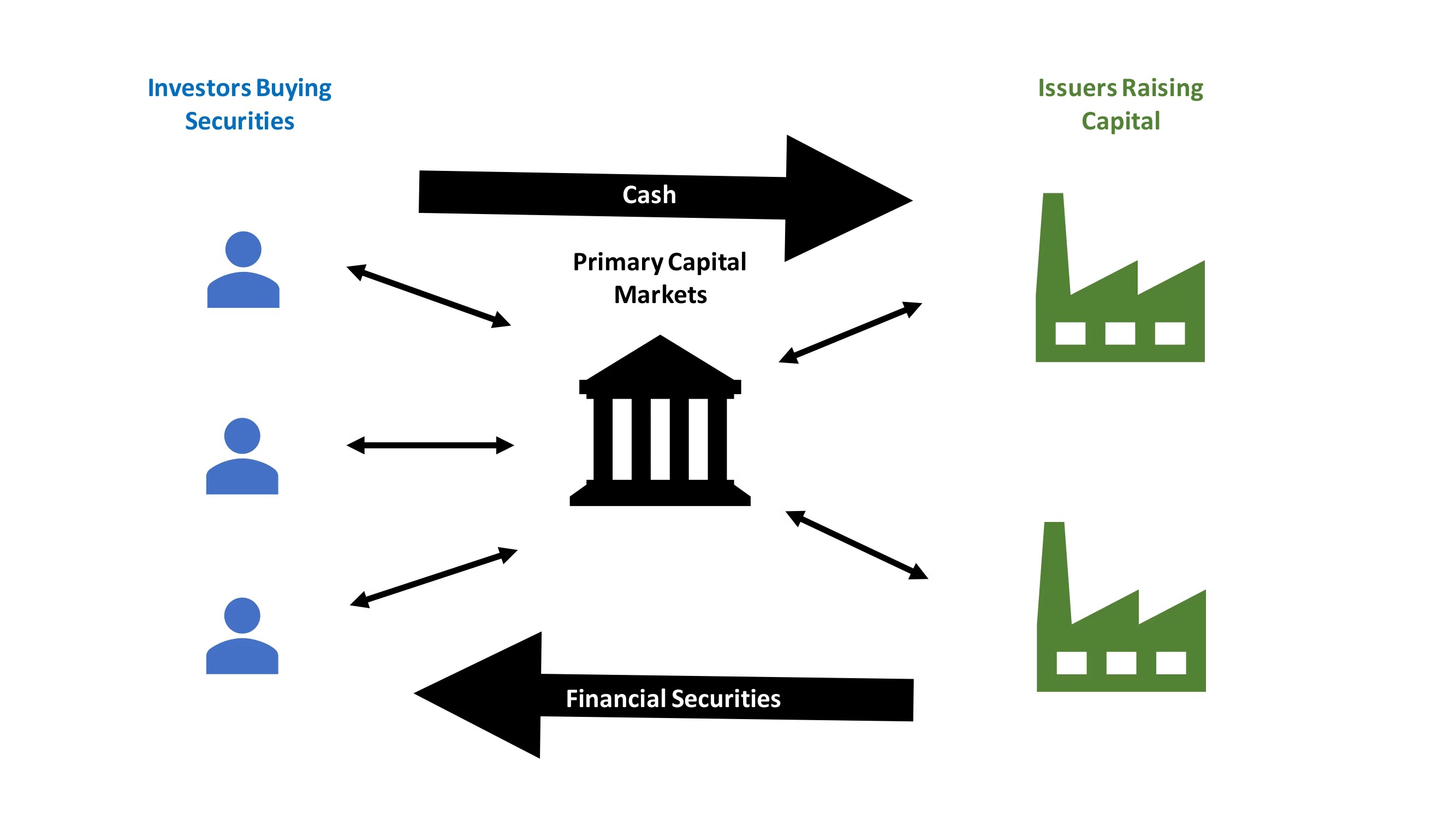

The Efficient Market Hypothesis (EMH) is a theory that states financial markets are efficient and that it is impossible to consistently achieve above-average market returns using only publicly available information. EMH classifies market efficiency into three forms: weak, semi-strong, and strong.

Semi-Strong Form Efficiency lies in the middle of these three forms. It posits that not only are stock prices influenced by past market data (weak form), but they also reflect all publicly available information (semi-strong form). In its strongest form, market efficiency theory suggests that stock prices also incorporate private or insider information that is not available to the public.

The Implications of Semi-Strong Form Efficiency

The theory of Semi-Strong Form Efficiency has several implications for investors:

- Efficient Market Hypothesis Challenges Active Management: As the Efficient Market Hypothesis suggests that investors cannot consistently outperform the market based on publicly available information, proponents argue that active stock picking and market timing are unlikely to lead to superior returns. This challenges the idea that professional fund managers or individual investors can beat the market consistently.

- Focus on Other Investment Strategies: In light of Semi-Strong Form Efficiency, many investors turn to other strategies that do not rely solely on publicly available information. These strategies include passive investing (such as index fund investing) and alternative investment vehicles like private equity or hedge funds that may have access to additional information sources.

- Importance of Fundamental Analysis: Although Semi-Strong Form Efficiency suggests that analyzing publicly available information may not consistently yield above-average returns, it does not render fundamental analysis useless. Understanding a company’s financials, industry trends, and competitive advantages can still provide valuable insights for long-term investment decision making and risk management.

In conclusion, Semi-Strong Form Efficiency is a critical concept within the field of finance. By acknowledging that stock prices efficiently reflect all publicly available information, investors can make more informed decisions and shape their investment strategies accordingly. While it challenges the ability to consistently outperform the market using publicly available data, it highlights the importance of alternative investment strategies and a comprehensive understanding of fundamental analysis.