Finance

Fiduciary Income Tax Return: What Is It?

Modified: December 29, 2023

Learn what a fiduciary income tax return is and how it impacts your finances. Understand the importance of filing this tax return accurately to avoid penalties.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Fiduciary Income Tax Return

- Purpose of Fiduciary Income Tax Return

- Who Needs to File a Fiduciary Income Tax Return?

- Components of a Fiduciary Income Tax Return

- Income Reporting on a Fiduciary Income Tax Return

- Deductions and Credits on a Fiduciary Income Tax Return

- Filing Deadlines for Fiduciary Income Tax Returns

- Penalties for Late or Incorrect Filing

- Conclusion

Introduction

When it comes to filing taxes, individuals are often familiar with the standard income tax return. However, there is another type of tax return specifically designed for estates and trusts – the Fiduciary Income Tax Return. This return, also known as Form 1041, serves as the taxable reporting instrument for estates and trusts, ensuring compliance with the Internal Revenue Service (IRS) regulations.

Understanding the intricacies of the Fiduciary Income Tax Return is crucial for both executors and trustees, as it determines their tax responsibilities and obligations. In this article, we will delve into the fundamentals of the Fiduciary Income Tax Return, exploring its purpose, who needs to file it, and what key components it comprises.

Whether you are an executor navigating the tax landscape of an estate or a trustee responsible for managing a trust’s financial affairs, this guide will provide insights into the Fiduciary Income Tax Return process.

Definition of Fiduciary Income Tax Return

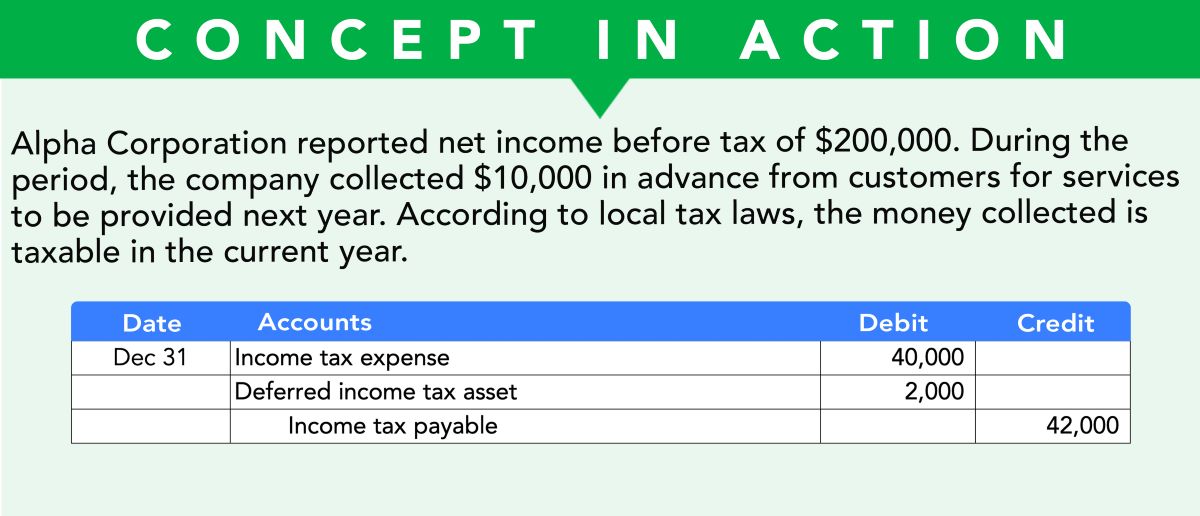

The Fiduciary Income Tax Return, also referred to as Form 1041, is a tax document specifically designed for estates and trusts. It serves as the instrument for reporting the income and deductible expenses of these entities to the Internal Revenue Service (IRS).

An estate is formed when a person passes away, and their assets and liabilities are managed by an executor until they are distributed to the beneficiaries. A trust, on the other hand, is a legal entity created to hold and manage assets on behalf of beneficiaries.

The Fiduciary Income Tax Return is filed annually, providing a comprehensive snapshot of the estate or trust’s financial activities during that tax year. It reports income generated by the estate or trust and any deductions or credits applicable.

This tax return is effectively a standalone entity, separate from the personal tax returns of the beneficiaries. Even if the beneficiaries themselves have to file personal income tax returns, the estate or trust is still responsible for filing a separate Fiduciary Income Tax Return.

It’s important to note that not all estates and trusts are required to file this tax return. The necessity to file depends on certain criteria, such as the type and amount of income generated by the estate or trust and whether it meets certain thresholds outlined by the IRS.

In the following sections, we will explore in more detail who needs to file a Fiduciary Income Tax Return and what components it entails.

Purpose of Fiduciary Income Tax Return

The primary purpose of the Fiduciary Income Tax Return is to report the income and deductions of an estate or trust to the IRS. By filing this tax return, the executor or trustee ensures compliance with tax laws and fulfills their tax obligations as the fiduciary of the estate or trust.

Here are some key purposes of the Fiduciary Income Tax Return:

- Income Reporting: The tax return allows the estate or trust to report all sources of income generated throughout the tax year. This includes interest, dividends, rental income, capital gains, and any other forms of income earned by the estate or trust.

- Tax Assessment: The Fiduciary Income Tax Return enables the IRS to assess the tax liability of the estate or trust. The income reported on the return is subject to taxation, and the IRS determines the applicable tax rate based on the income brackets for estates and trusts.

- Deductible Expenses: The tax return provides a platform for claiming deductions and expenses incurred by the estate or trust during the tax year. These deductions can include administration expenses, attorney fees, trustee fees, tax preparation fees, and any other necessary expenses related to the management and distribution of the estate or trust.

- Allocation of Income: In some cases, income generated by an estate or trust may be distributed to beneficiaries. The Fiduciary Income Tax Return allows for the proper allocation and reporting of this income, ensuring that beneficiaries are aware of their taxable portion.

- Distribution Deductions: If income is distributed to beneficiaries, the estate or trust may be eligible for deductions based on these distributions. The tax return allows for the calculation of allowable distribution deductions, reducing the overall taxable income of the estate or trust.

- Compliance with Tax Laws: Filing the Fiduciary Income Tax Return is necessary to comply with federal tax laws and regulations. By fulfilling tax obligations, the executor or trustee protects the estate or trust from potential penalties or audits by the IRS.

Overall, the purpose of the Fiduciary Income Tax Return is to provide a comprehensive overview of the financial activities of the estate or trust, ensuring proper tax reporting and compliance with IRS regulations. By accurately reporting income and expenses, the executor or trustee contributes to the fair and lawful taxation of the estate or trust.

Who Needs to File a Fiduciary Income Tax Return?

Not all estates and trusts are required to file a Fiduciary Income Tax Return, as it depends on certain criteria outlined by the IRS. The filing requirement is determined by various factors, including the type and amount of income generated by the estate or trust, as well as meeting specific thresholds. Let’s explore who needs to file a Fiduciary Income Tax Return:

- Estates: If the decedent’s estate generates any gross income during the tax year, a Fiduciary Income Tax Return must be filed. Gross income includes interest, dividends, rental income, capital gains, and other forms of income. Additionally, if the estate has any net income or taxable income, it will be subject to filing a tax return.

- Complex Trusts: Complex trusts, which have provisions allowing for the accumulation of income, are generally required to file a Fiduciary Income Tax Return. A trust is considered complex if it does not meet the criteria to be classified as a simple trust (a trust that distributes all its income annually to beneficiaries) or as a grantor trust (a trust where the grantor maintains certain control over the trust).

- Charitable Remainder Trusts: Charitable remainder trusts, which are created to provide income to beneficiaries with the remaining assets going to a designated charity, are generally required to file a Fiduciary Income Tax Return.

- Electing Small Business Trusts (ESBTs): ESBTs, which are trusts formed to hold qualified S corporation stock, are required to file a Fiduciary Income Tax Return if they have any taxable income or if certain elections are made regarding the trust’s tax treatment.

- Specific Cases: There are specific cases where even if an estate or trust does not generate enough income to meet the standard filing requirements, a Fiduciary Income Tax Return may still need to be filed. For instance, if there is a nonresident alien beneficiary or if the estate or trust has any tax withholding, a tax return may be necessary.

It’s important to consult with a qualified tax professional or review the IRS guidelines to determine if filing a Fiduciary Income Tax Return is required for a specific estate or trust. Failing to file a required tax return may result in penalties and potential IRS audits.

Components of a Fiduciary Income Tax Return

A Fiduciary Income Tax Return, also known as Form 1041, comprises several components that provide a comprehensive overview of the estate or trust’s financial activities during the tax year. Understanding these components is crucial for accurately reporting income, deductions, and credits. Let’s explore the key components of a Fiduciary Income Tax Return:

- Identification Information: This section requires basic information about the estate or trust, such as the name, address, and taxpayer identification number (TIN). The TIN is typically the same as the social security number (SSN) of the decedent or a separate employer identification number (EIN) obtained for the estate or trust.

- Income: This section requires reporting all sources of income generated by the estate or trust during the tax year. It includes interest, dividends, rental income, capital gains, royalties, and any other forms of income received. Each type of income must be reported separately, including income from investments, business activities, and rental properties.

- Deductions: The deductions section allows for the reporting of expenses and deductions incurred by the estate or trust. This can include administrative expenses, attorney fees, trustee fees, tax preparation fees, and other expenses related to the management and distribution of assets. Deductions should be carefully documented and supported by relevant documentation.

- Tax Calculation: This section calculates the taxable income of the estate or trust based on the reported income and deductions. The tax rates for estates and trusts are different from individual tax rates, so it’s essential to ensure accurate calculations to determine the final tax liability.

- Credits: If eligible, certain credits can be applied to reduce the tax liability of the estate or trust. Common credits may include the foreign tax credit, education credits, or credits for certain renewable energy investments. These credits should be properly claimed, supported by documentation, and comply with IRS guidelines.

- Distributions to Beneficiaries: If any income was distributed to beneficiaries during the tax year, it must be reported in this section. The percentage of income distributed to each beneficiary should be documented, as it may impact their individual tax obligations.

- Final Return: If the estate or trust is in the final year of its existence, a separate section is included to report the final accounting of the income, deductions, and distributions. This section is crucial for wrapping up the financial affairs of the estate or trust.

Accurately completing each component of the Fiduciary Income Tax Return is essential to comply with IRS regulations and ensure proper tax reporting for the estate or trust. It is advisable to consult with a tax professional or utilize tax software specifically designed for fiduciary tax returns to ensure accuracy and avoid potential penalties or audits.

Income Reporting on a Fiduciary Income Tax Return

Income reporting is a crucial component of a Fiduciary Income Tax Return (Form 1041). It involves accurately documenting and reporting all sources of income generated by the estate or trust during the tax year. Reporting income correctly ensures compliance with IRS regulations and determines the taxable income of the estate or trust. Let’s explore the key aspects of income reporting on a Fiduciary Income Tax Return:

Sources of Income: The estate or trust must report various sources of income separately on the tax return. Common sources of income include:

- Interest income from bank accounts, certificates of deposit (CDs), or bonds.

- Dividend income from stocks and mutual funds.

- Rental income generated from real estate properties.

- Capital gains from the sale of assets, such as stocks, real estate, or artwork.

- Business and professional income earned by the estate or trust.

- Royalties from intellectual property rights.

- Annuity payments received.

Timing of Income: Income should be reported in the tax year it is earned or accrued. For example, interest income should be reported when it is credited to the estate or trust’s account, regardless of whether it has been withdrawn or reinvested. Similarly, rental income should be reported when it is received or becomes due, even if the payment is delayed.

Determination of Taxable Income: Once all sources of income are reported, deductions and expenses can be subtracted to determine the taxable income of the estate or trust. This taxable income is then subject to taxation at the appropriate estate or trust tax rates, which are different from individual tax rates.

Separate Share Rule: If multiple beneficiaries are entitled to the income of the estate or trust, the income should be allocated and reported separately for each beneficiary. This is known as the “separate share rule” and ensures that each beneficiary reports their appropriate share of income on their individual tax returns.

Documentation: Accurate record-keeping is essential when reporting income on a Fiduciary Income Tax Return. It is crucial to maintain documentation that supports the reported income, such as bank statements, brokerage statements, rent receipts, and any other relevant financial documents. This documentation will serve as evidence in the event of an IRS examination or audit.

It is recommended to consult with a tax professional or use tax software specifically designed for fiduciary tax returns to ensure accurate income reporting and compliance with IRS guidelines. Proper income reporting on a Fiduciary Income Tax Return helps avoid penalties and maintains the integrity of the estate or trust’s tax obligations.

Deductions and Credits on a Fiduciary Income Tax Return

Deductions and credits play a crucial role in reducing the taxable income of an estate or trust on a Fiduciary Income Tax Return (Form 1041). Properly identifying and claiming eligible deductions and credits can significantly impact the tax liability of the estate or trust. Let’s explore the key aspects of deductions and credits on a Fiduciary Income Tax Return:

Deductions: Deductions are expenses incurred by the estate or trust that are considered necessary and ordinary for the administration and distribution of assets. Common deductions may include:

- Administrative expenses, such as attorney fees, accountant fees, and trustee fees.

- Tax preparation fees related to the completion and filing of the Fiduciary Income Tax Return.

- Interest expenses paid on debts related to the estate or trust.

- Charitable contributions made by the estate or trust during the tax year.

- State and local taxes paid by the estate or trust.

- Mortgage interest paid on real estate owned by the estate or trust.

Election of Deduction: Estates have the option to claim either a deduction for distributions made to beneficiaries or a deduction for income that is distributed. The estate should evaluate these options to determine the most advantageous deduction for tax purposes.

Credits: Credits directly reduce the tax liability of the estate or trust. They are applied after the taxable income has been calculated. Some common credits that may be applicable to a Fiduciary Income Tax Return include:

- Foreign tax credits for taxes paid to foreign jurisdictions.

- Education credits for certain educational expenses.

- Renewable energy credits for qualified investments in renewable energy projects.

- Alternative minimum tax (AMT) credits for AMT paid in prior tax years.

Record Keeping: Documentation is important when claiming deductions and credits on a Fiduciary Income Tax Return. The estate or trust should maintain all necessary records, such as receipts, invoices, and statements, to substantiate the claimed deductions and credits. Proper record-keeping ensures compliance with IRS requirements and provides support in case of an audit or examination.

It is recommended to consult with a tax professional or utilize tax software specifically designed for fiduciary tax returns to identify all eligible deductions and credits and ensure accurate reporting. By maximizing deductions and credits, the estate or trust can reduce its taxable income and potentially lower its overall tax liability.

Filing Deadlines for Fiduciary Income Tax Returns

Just like individual income tax returns, Fiduciary Income Tax Returns (Form 1041) have specific filing deadlines set by the Internal Revenue Service (IRS). It’s important for estates and trusts to adhere to these deadlines to avoid penalties and ensure timely compliance. Let’s explore the key aspects of filing deadlines for Fiduciary Income Tax Returns:

General Deadline: The general deadline for filing a Fiduciary Income Tax Return is the 15th day of the fourth month following the close of the tax year. In most cases, this means the return is due on April 15th. However, if the tax year ends on a different date, the deadline is determined by counting four months from that end date.

Extension Option: If an estate or trust needs additional time to file its tax return, it can request an extension by filing Form 7004. This grants an automatic extension of five and a half months, moving the deadline from April 15th to September 30th. However, it’s important to note that the extension only applies to filing the return, not to paying any taxes owed. Taxes owed are still due by the original deadline to avoid potential penalties and interest.

Final Return Deadline: If the estate or trust is in its final year of existence, the final Fiduciary Income Tax Return should be filed by the regular due date or the extended due date, whichever applies. The “Final Return” box on Form 1041 should be checked to indicate that it is the final return for the estate or trust.

Estimated Tax Payments: Estates and trusts may be required to make estimated tax payments throughout the tax year if they expect to owe $1,000 or more in tax. These payments should be made using Form 1041-ES and follow quarterly payment deadlines. The due dates for estimated tax payments are generally April 15th, June 15th, September 15th, and January 15th of the following year.

State Tax Deadlines: It’s important to note that state filing deadlines for fiduciary income tax returns may differ from federal deadlines. Each state has its own set of rules and deadlines, so it’s essential to consult the applicable state’s tax authority or a tax professional for specific information regarding state tax filing deadlines for fiduciary income tax returns.

Complying with the filing deadlines for Fiduciary Income Tax Returns is essential to avoid penalties and maintain proper tax compliance. It is recommended to consult with a tax professional or utilize tax software specifically designed for fiduciary tax returns to ensure accurate and timely filing.

Penalties for Late or Incorrect Filing

Failure to comply with the filing requirements for Fiduciary Income Tax Returns (Form 1041) can result in various penalties imposed by the Internal Revenue Service (IRS). It’s important for estates and trusts to understand these penalties to avoid unnecessary financial burdens. Let’s explore the key penalties associated with late or incorrect filing of Fiduciary Income Tax Returns:

Late Filing Penalty: If the estate or trust fails to file the Fiduciary Income Tax Return by the deadline, it may be subject to a late filing penalty. The penalty is generally calculated based on the unpaid tax liability and is assessed at a rate of 5% per month (or part of a month) up to a maximum of 25% of the unpaid tax. The penalty is in addition to any interest accrued on the unpaid tax amount.

Late Payment Penalty: If the estate or trust fails to pay the taxes owed by the filing deadline, it may be subject to a late payment penalty. The penalty is determined based on the amount of tax due and is generally 0.5% of the unpaid tax per month (or part of a month) up to a maximum of 25% of the unpaid tax. The penalty is also subject to interest charges on the unpaid tax amount.

Accuracy-Related Penalty: If the Fiduciary Income Tax Return is found to have substantial inaccuracies or understatements of tax liability, the estate or trust may be subject to an accuracy-related penalty. This penalty is generally 20% of the underpayment resulting from the accuracy-related issue. It’s important to ensure accurate reporting and calculations on the tax return to avoid this penalty.

Negligence or Fraud Penalty: If the IRS determines that the estate or trust has negligently or fraudulently underreported its tax liability, it may be subject to a penalty. The penalty ranges from 20% to 75% of the underpayment, depending on the severity of the negligence or fraud. Intentional disregard of tax rules can lead to higher penalties and potential criminal charges.

Failure to Pay Estimated Tax Penalty: If the estate or trust is required to make estimated tax payments throughout the year but fails to do so or underpays the required amount, it may be subject to a penalty. The penalty is generally calculated based on the underpayment amount and is assessed at a rate determined by the IRS for that specific tax year.

It’s important for estates and trusts to file accurate and timely Fiduciary Income Tax Returns to avoid these penalties. Consulting with a tax professional and utilizing tax software specifically designed for fiduciary tax returns can help ensure compliance and minimize the risk of incurring penalties. It’s always recommended to proactively address any potential filing issues and seek professional guidance when necessary.

Conclusion

Filing a Fiduciary Income Tax Return, also known as Form 1041, is an essential obligation for estates and trusts. This comprehensive tax return enables proper reporting of income, deductions, and credits, ensuring compliance with IRS regulations and fulfilling tax responsibilities as a fiduciary.

In this guide, we have explored the key aspects of a Fiduciary Income Tax Return, including its definition, purpose, and components. We have learned that estates and trusts must file this tax return if they meet certain criteria, such as generating income or meeting specific thresholds.

The accurate reporting of income on a Fiduciary Income Tax Return is crucial to determine the tax liability of the estate or trust. Deductions and credits play a significant role in reducing the taxable income and potentially lowering the overall tax obligation. It is important to properly document deductions and credits and consult with tax professionals or use specialized software to ensure accurate reporting.

Meeting the filing deadlines for Fiduciary Income Tax Returns is essential to avoid penalties. Late or incorrect filing can result in financial penalties imposed by the IRS, such as late filing penalties, late payment penalties, accuracy-related penalties, and negligence or fraud penalties. It is important to be aware of these penalties and strive to file the return accurately and on time.

In conclusion, understanding the intricacies of the Fiduciary Income Tax Return is vital for individuals who are responsible for managing the financial affairs of estates and trusts. By ensuring accurate reporting, adhering to filing deadlines, and seeking professional guidance as needed, executors and trustees can navigate the tax landscape effectively and fulfill their tax obligations with confidence.