Finance

How To Find My APR

Published: March 2, 2024

Learn how to find your APR and manage your finances effectively with our comprehensive guide. Get expert tips and tools to calculate and understand your annual percentage rate.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding APR

Understanding APR

When it comes to managing your finances, understanding the concept of Annual Percentage Rate (APR) is crucial. APR represents the annual cost of borrowing, including interest and additional fees, expressed as a percentage. It provides a comprehensive view of the total cost of a loan or credit card, enabling you to make informed decisions regarding your financial commitments.

Unlike the nominal interest rate, which solely reflects the interest charged on the principal amount, APR encompasses other expenses such as origination fees, discount points, and mortgage insurance, offering a more accurate representation of the actual cost of borrowing. By considering these additional costs, APR equips you with the knowledge to evaluate and compare various lending options effectively.

Furthermore, APR plays a pivotal role in assessing the affordability of credit products. Whether you are applying for a mortgage, auto loan, or credit card, understanding the APR allows you to gauge the long-term financial implications of the borrowing arrangement. This insight empowers you to select the most cost-effective and suitable financial products tailored to your specific needs and circumstances.

It is important to note that while APR serves as a valuable tool for evaluating the cost of borrowing, it may not fully capture certain variable factors, such as changes in interest rates for adjustable-rate loans. Therefore, it is essential to complement your understanding of APR with a comprehensive assessment of the terms and conditions associated with the financial product.

Calculating APR

Calculating APR

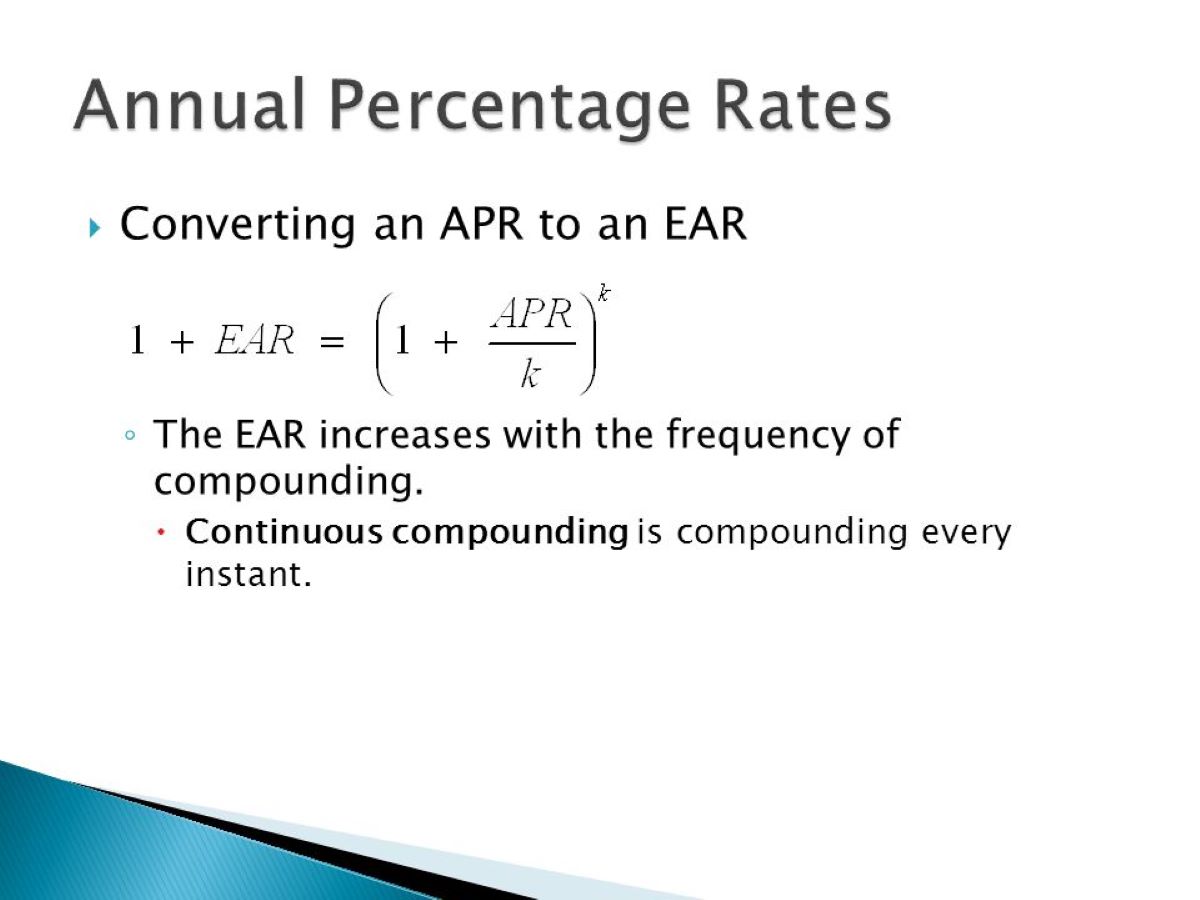

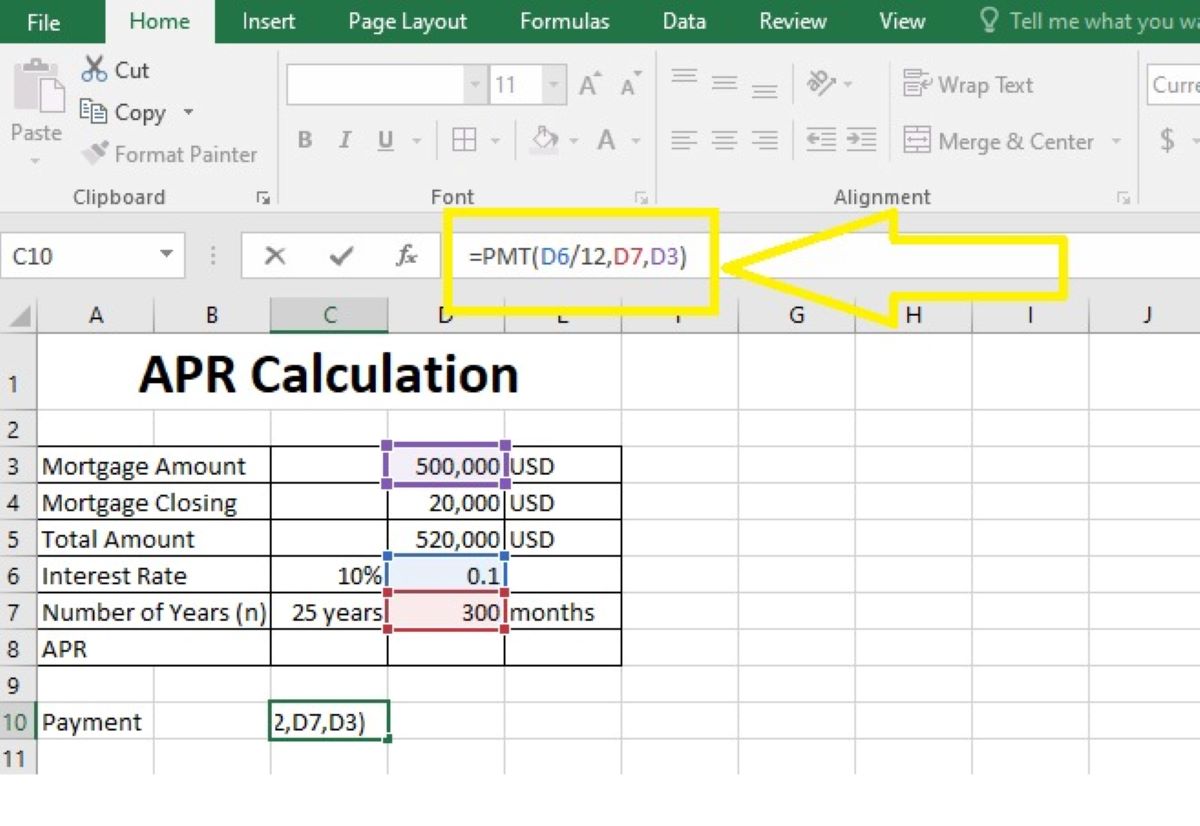

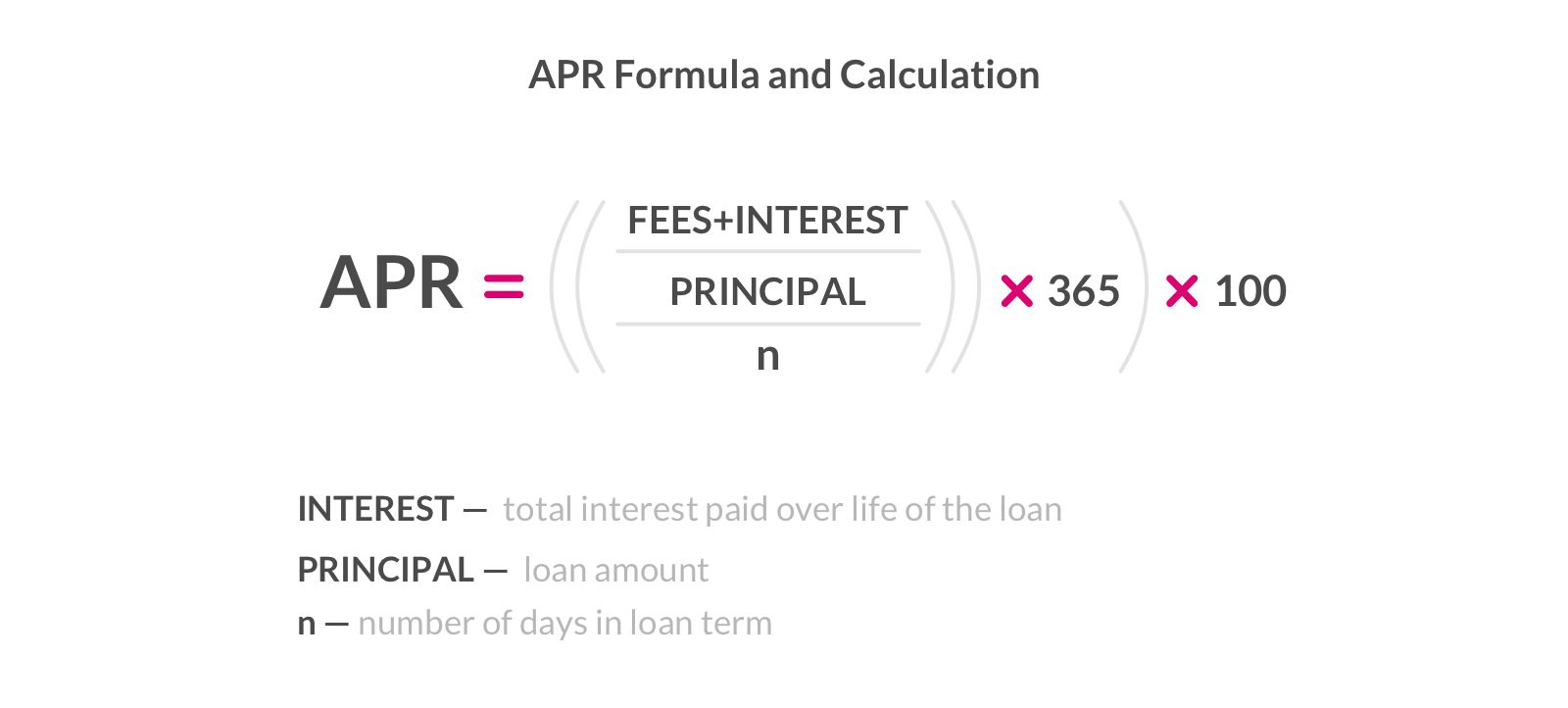

Calculating the Annual Percentage Rate (APR) involves a series of steps to derive the accurate representation of the borrowing cost. While the specific formula may vary depending on the type of credit arrangement, the fundamental principle remains consistent across different financial products.

To calculate the APR for a loan or credit card, you first need to gather essential information, including the total loan amount, the annual interest rate, and any additional fees or charges imposed by the lender. Once you have these details, you can proceed with the following steps:

- Determine the Total Finance Charge: Begin by calculating the total finance charge over the entire term of the loan. This encompasses the cumulative interest and any applicable fees associated with the borrowing.

- Account for the Repayment Schedule: Next, consider the repayment schedule to ascertain the timing and frequency of payments. Whether the loan follows a monthly, bi-monthly, or other payment schedule, understanding the payment structure is crucial for precise APR computation.

- Consider the Loan Term: Evaluate the duration of the loan or credit arrangement, as this directly influences the total cost of borrowing. Shorter loan terms often result in lower overall interest payments, impacting the APR calculation.

- Factor in Additional Costs: Take into account any additional costs or charges, such as origination fees, closing costs, or annual fees for credit cards. These supplementary expenses contribute to the comprehensive APR calculation.

After obtaining the necessary data and completing the aforementioned steps, you can utilize the standardized formula to compute the APR. This formula accounts for the total finance charge, the repayment schedule, and the loan term, yielding the percentage that represents the annual cost of borrowing.

By familiarizing yourself with the methodology for calculating APR, you gain valuable insight into the true cost of credit, enabling you to make well-informed financial decisions and select the most advantageous borrowing options.

Finding Your APR

Finding Your APR

Discovering the Annual Percentage Rate (APR) associated with your loan or credit card is essential for gaining a comprehensive understanding of the total cost of borrowing. Whether you are reviewing existing financial agreements or considering new credit options, identifying the APR empowers you to make informed decisions regarding your financial commitments.

When seeking to find your APR, the process may vary depending on the type of credit product and the information available to you. Here are several approaches to assist you in uncovering your APR:

- Review Loan Documents: If you have an existing loan, carefully examine the loan agreement and related documentation provided by the lender. The APR should be clearly stated within these materials, offering transparency regarding the borrowing cost.

- Check Credit Card Statements: For credit card APR, refer to your monthly statements or the initial card agreement to locate the specified APR. Credit card issuers are mandated to disclose the APR, enabling cardholders to access this vital information easily.

- Consult with Lenders: In the case of new loan applications, engage in direct communication with potential lenders to obtain clarity on the APR associated with the proposed credit arrangement. Request full disclosure of all costs and fees, ensuring that the provided APR encompasses the comprehensive borrowing expenses.

- Utilize Online Resources: Various online tools and financial websites offer APR calculators and resources to estimate the APR based on the provided loan details. While these estimates may not be exact, they can serve as valuable references for initial assessment.

By employing these methods, you can effectively uncover and comprehend the APR linked to your credit obligations. This knowledge equips you with the insights needed to evaluate the affordability of your current loans or to make informed decisions when exploring new credit opportunities.

Remember that the APR represents the total cost of borrowing, encompassing both the interest and any additional fees. By being aware of your APR, you can navigate your financial landscape with confidence and make prudent decisions aligned with your long-term financial well-being.

Factors Affecting Your APR

Factors Affecting Your APR

Several key factors influence the Annual Percentage Rate (APR) associated with your loans and credit cards. Understanding these determinants is essential for comprehending the variations in APR across different financial products and for making informed decisions regarding your borrowing arrangements.

Credit Score: Your credit score plays a pivotal role in determining the APR offered by lenders. A higher credit score typically translates to a lower APR, reflecting the lower risk associated with lending to individuals with strong credit histories. Conversely, individuals with lower credit scores may encounter higher APRs, reflecting the heightened risk perceived by lenders.

Market Conditions: Fluctuations in the broader economic landscape, particularly changes in the prevailing interest rates set by central banks, can impact the APR. In a rising interest rate environment, borrowers may experience higher APRs, while declining interest rates may lead to more favorable borrowing terms.

Loan Term: The duration of the loan or credit agreement influences the APR. Generally, longer loan terms may result in higher APRs due to the extended exposure to interest rate risk for the lender. Conversely, shorter-term loans may offer lower APRs, reflecting the reduced risk over a shorter period.

Type of Credit Product: The nature of the credit product, whether it is a mortgage, auto loan, or credit card, can impact the APR. Mortgage loans, for instance, often feature lower APRs compared to credit cards, given the asset-backed nature of mortgage financing.

Income and Debt-to-Income Ratio: Lenders also consider your income and debt-to-income ratio when determining the APR. A higher income and a lower ratio of debt relative to income may lead to more favorable APRs, as they indicate a lower risk of default.

Regulatory and Lender-Specific Fees: Additional fees imposed by lenders, such as origination fees, closing costs, and annual fees for credit cards, contribute to the overall APR. Understanding these fees is crucial for evaluating the true cost of borrowing.

By recognizing these influential factors, you can navigate the borrowing landscape with a deeper understanding of the elements shaping the APR. This awareness empowers you to take proactive steps to enhance your creditworthiness, explore favorable borrowing opportunities, and make informed financial decisions aligned with your long-term goals.