Finance

Field Of Use Definition And Example

Published: November 23, 2023

Get a concise definition and example of the field of use in finance. Explore how this concept is applied in different financial contexts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking Financial Success: A Comprehensive Guide

Welcome to our Finance category, where we dive deep into the world of money management, investments, and financial success. In this blog post, we will provide you with expert advice and insights that can help you achieve your financial goals. Whether you’re just starting on your financial journey or looking to take your finances to the next level, we’ve got you covered!

Key Takeaways:

- Effective money management is crucial for anyone looking to build wealth and achieve financial success.

- Investing wisely and diversifying your portfolio can help maximize returns and minimize risk.

Understanding the Field of Finance

Finance, as a field of use, encompasses a wide range of activities related to the management, creation, and study of money and assets. It involves making smart decisions about how we allocate our funds, whether it’s budgeting, investing, or planning for the future.

When venturing into the world of finance, it’s important to have a solid understanding of key concepts, strategies, and trends. This knowledge can empower individuals to make informed decisions and ultimately achieve financial freedom. So, let’s take a closer look at some essential areas within the field of finance:

1. Personal Finance

Personal finance is all about managing your own finances effectively. It includes budgeting, saving, debt management, and retirement planning. By adopting healthy financial habits and creating a strong foundation, individuals can navigate their personal finances with confidence and build a secure future.

2. Investments

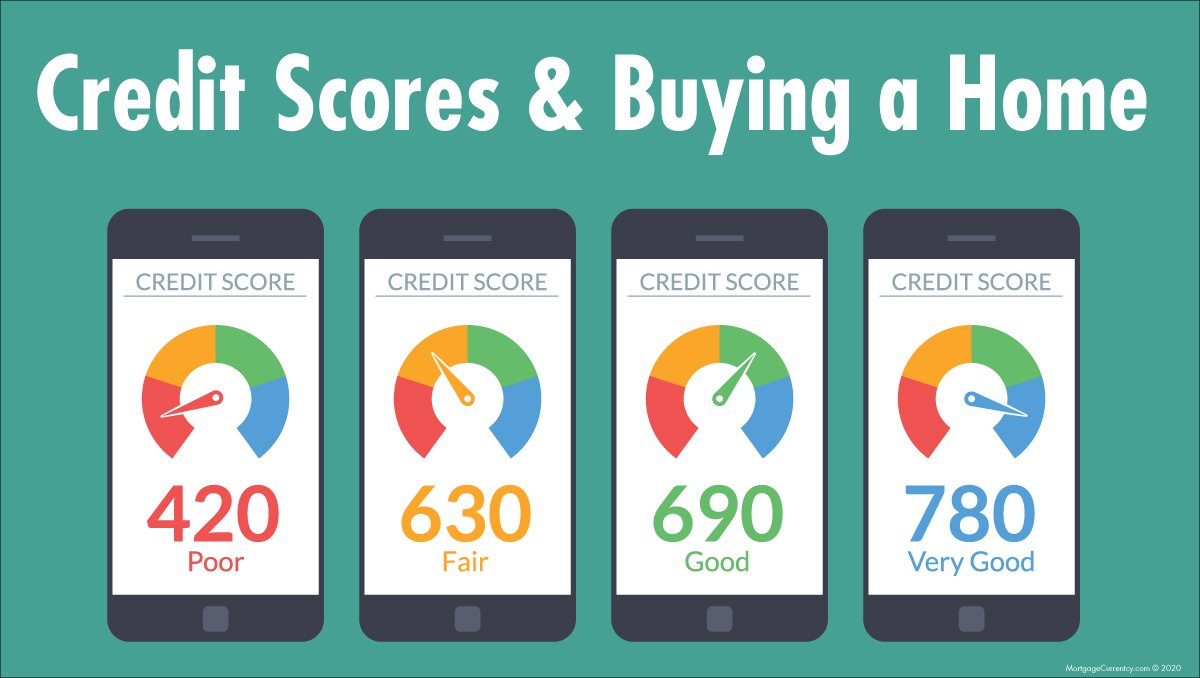

Investing allows individuals to put their money to work and potentially grow their wealth over time. This can be done through various channels, such as stocks, bonds, real estate, or mutual funds. Understanding the different investment options, risks, and strategies is key to making informed and profitable investment decisions.

3. Financial Markets

Financial markets are the platforms where buyers and sellers trade financial assets such as stocks, bonds, and commodities. These markets play a crucial role in determining asset prices and ensuring liquidity. Staying informed about market trends and analyzing market data can assist investors in making well-timed and profitable trades.

4. Risk Management

Risk is an inevitable part of any financial endeavor. Effective risk management involves identifying potential risks, assessing their impact, and implementing strategies to mitigate them. This can include diversifying investments, purchasing insurance, or employing hedging techniques. Understanding and managing risks is vital for safeguarding assets and minimizing potential losses.

5. Entrepreneurship and Startups

Entrepreneurship and startups are closely linked to finance. Entrepreneurs must understand financial management, funding options, and profitability analysis to establish and grow successful businesses. This includes areas such as raising capital, creating financial projections, and managing cash flow.

Conclusion

Finance encompasses a diverse range of aspects crucial to achieving financial success. By understanding and implementing effective financial strategies, individuals can take control of their financial futures and work towards financial independence. Remember, consistent learning, disciplined money management, and informed decision-making are key factors in unlocking your path to financial success!

Key Takeaways:

- Effective money management is crucial for anyone looking to build wealth and achieve financial success.

- Investing wisely and diversifying your portfolio can help maximize returns and minimize risk.