Home>Finance>Fiscal Deficit: Definition And History In The U.S.

Finance

Fiscal Deficit: Definition And History In The U.S.

Published: November 25, 2023

Learn about the definition and history of fiscal deficit in the U.S. with this comprehensive finance guide. Master the fundamentals of finance today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Fiscal Deficit: Definition and History in the U.S.

Welcome to our FINANCE category, where we delve into all things related to money, investments, and economic concepts. In this blog post, we will explore one vital aspect of public finance – the fiscal deficit. From its definition to its historical significance in the United States, we aim to provide you with a comprehensive understanding of this crucial topic.

Key Takeaways:

- The fiscal deficit represents the amount by which a government’s spending exceeds its revenue in a given period.

- A high fiscal deficit can lead to economic instability and may require the government to borrow money, further increasing national debt.

Now, let’s dive in and explore the definition and history of the fiscal deficit in the United States.

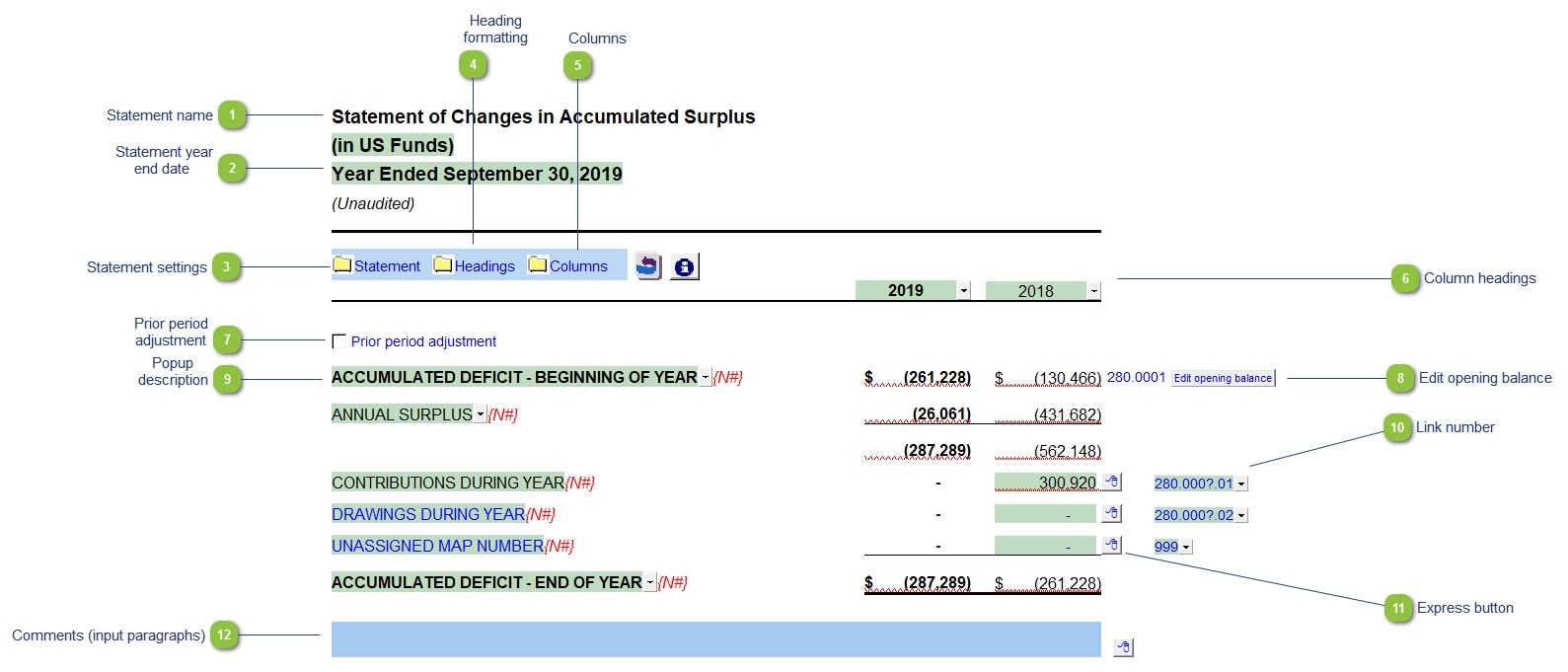

What is the Fiscal Deficit?

The fiscal deficit refers to the situation in which a government’s total spending exceeds its total revenue in a specified timeframe, usually a year. It is important to note that the fiscal deficit is different from national debt. While the fiscal deficit represents a shortfall in current-year revenue, national debt accounts for the accumulation of all past fiscal deficits.

In simpler terms, the fiscal deficit can be understood as the amount of money needed to bridge the gap between what the government spends and what it collects in taxes and other forms of income. When the fiscal deficit is prominent, a government must seek alternative sources to fund its expenditures, such as borrowing money. Accumulated fiscal deficits contribute to the national debt and have long-term implications for a country’s economy.

The History of Fiscal Deficit in the U.S.

The United States has a complex history when it comes to fiscal deficits. Over the years, various factors such as economic conditions, policy decisions, wars, and recessions have influenced the country’s fiscal deficit levels. Let’s take a quick look at some significant moments in the history of fiscal deficit in the U.S.:

- The Great Depression: In the 1930s, the U.S. experienced an unprecedented economic downturn. To combat high unemployment rates and stimulate the economy, the government implemented expansionary fiscal policies, leading to substantial fiscal deficits.

- World War II: The U.S. financed its involvement in World War II through heavy borrowing, resulting in significant fiscal deficits. However, the war effort also stimulated economic growth and led to a boost in productivity.

- Recession and Financial Crisis: The 2008 recession and subsequent financial crisis posed significant challenges for the U.S. economy. The government implemented several measures, including stimulus packages, to stabilize the economy, raising the fiscal deficit considerably.

Conclusion

The fiscal deficit plays a crucial role in a country’s fiscal management. It represents the shortfall when a government’s total spending surpasses its total revenue. Accumulated fiscal deficits contribute to national debt and can have long-term implications for an economy. Understanding the history and causes of fiscal deficits helps shed light on the complex relationship between government spending, revenue, and economic stability. Stay tuned to our FINANCE category for more insights on economic concepts!