Finance

What Is Accumulated Deficit On A Balance Sheet

Published: December 27, 2023

Learn about the finance term "accumulated deficit" and its significance on a balance sheet. Gain insights into how it impacts a company's financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Accumulated deficit is a term commonly used in finance to describe the negative balance that accumulates over time in a company’s retained earnings account. It represents the amount of financial losses a company has incurred throughout its operating history. This article will delve into the definition of accumulated deficit, how it is calculated, its significance, causes, impact on the balance sheet, and strategies for managing it.

Accumulated deficit is an essential metric to assess a company’s financial health and sustainability. It reflects a company’s ability to generate profits and manage its expenses effectively. An accumulated deficit can arise when a company consistently operates at a loss or experiences a significant decline in revenues.

The importance of understanding accumulated deficit extends beyond just financial analysis. It also provides insights into a company’s strategic decisions, management practices, and future prospects. Companies with a substantial accumulated deficit may face difficulties in obtaining loans or attracting investors, as they may be perceived as higher risk.

It’s crucial to note that accumulated deficit is different from current or future liabilities. While liabilities represent the financial obligations a company owes to others, accumulated deficit is a measure of historical losses. However, the accumulated deficit can impact a company’s ability to meet its current and future obligations, as it reduces the retained earnings available for reinvestment or debt repayment.

Throughout this article, we will explore the different aspects of accumulated deficit and how it can influence a company’s financial position. By gaining a deeper understanding of accumulated deficit, individuals and businesses can make informed decisions and take appropriate actions to improve their financial standing and profitability.

Definition of Accumulated Deficit

Accumulated deficit, also known as accumulated losses or retained losses, is the negative balance that accumulates in a company’s retained earnings account over time. Retained earnings represent the accumulated profits or losses of a company that are reinvested in the business rather than distributed to shareholders as dividends. When a company consistently operates at a loss or experiences periods of significant financial downturn, the cumulative effect results in an accumulated deficit.

The accumulated deficit reflects a company’s historical losses and indicates the extent to which it has not been able to generate profits or cover expenses over its operating lifetime. It is important to note that the accumulated deficit is distinct from the current year’s net loss. While the net loss reflects the financial performance of a company in a particular period, the accumulated deficit encompasses the overall financial position of the business since its inception.

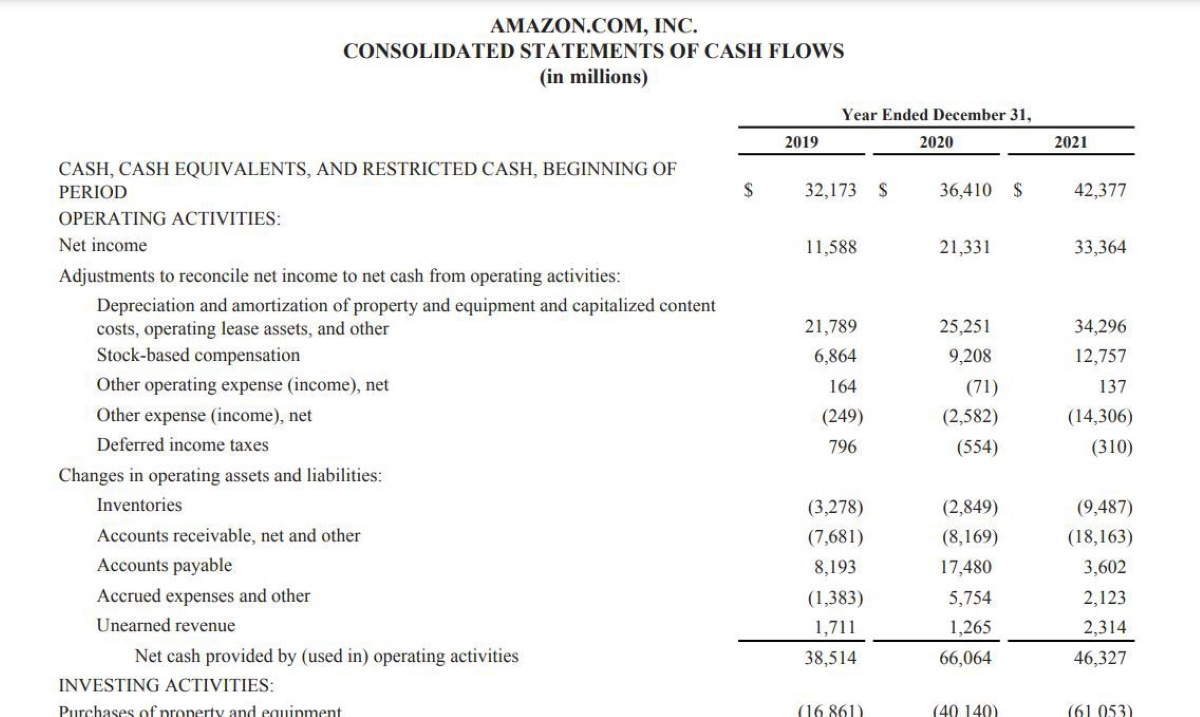

The calculation of accumulated deficit begins with the opening balance of retained earnings at the start of a company’s operations. If the company incurs a net loss in a given year, it is subtracted from the retained earnings. If there is a net profit, it is added to the retained earnings. This process is repeated year after year, resulting in the cumulative figure of accumulated deficit.

The accumulated deficit is reported on a company’s balance sheet under the equity section. It is important to monitor the accumulated deficit as it impacts a company’s financial health and can affect its ability to attract investors, obtain financing, or make necessary investments for growth.

Understanding the accumulated deficit is crucial for stakeholders, including investors, lenders, and management, as it provides insights into a company’s financial performance, sustainability, and future prospects. By analyzing the accumulated deficit, stakeholders can assess how effectively a company is managing its expenses, generating revenues, and creating value for its shareholders.

How is Accumulated Deficit Calculated?

The calculation of accumulated deficit involves the cumulative tracking of a company’s net losses or profits over its operating history. It is a straightforward process that requires the monitoring and adjustment of the company’s retained earnings account.

To calculate the accumulated deficit, follow these steps:

- Start with the opening balance of retained earnings, which is typically the retained earnings from the previous accounting period. If it is the company’s first year of operation, the opening balance of retained earnings will be zero.

- Review the company’s net income or net loss for the current accounting period. Net income represents the excess of revenues over expenses, while net loss represents the excess of expenses over revenues.

- If the company incurs a net loss, subtract the amount of the net loss from the opening balance of retained earnings. This adjustment will reduce the retained earnings and increase the accumulated deficit.

- If the company generates a net profit, add the amount of the net profit to the opening balance of retained earnings. This adjustment will increase the retained earnings and decrease the accumulated deficit.

- Repeat this process for each accounting period, considering the net income or net loss for that period.

- At the end of each accounting period, the resulting figure will be the accumulated deficit. It represents the cumulative losses that the company has incurred over its operating history.

It is important to note that the accumulated deficit can be reduced or eliminated if the company starts generating consistent profits in subsequent periods. When a company achieves net profits, those profits are added to the retained earnings, gradually reducing or eliminating the accumulated deficit.

Tracking the accumulated deficit is crucial for businesses as it provides insights into their historical financial performance and sustainability. It allows stakeholders to understand the extent to which a company has experienced losses and how it may impact its financial health and future prospects.

Significance of Accumulated Deficit

The accumulated deficit holds significant importance for businesses and stakeholders, as it provides valuable insights into a company’s financial health, management practices, and future prospects. Here are some key reasons why the accumulated deficit is considered significant:

1. Financial Health Indicator: The accumulated deficit is an essential metric for assessing a company’s financial health, indicating its ability to generate profits and manage expenses effectively. A higher accumulated deficit suggests that a company has experienced significant losses or has been unable to cover its expenses over time. This may raise concerns among investors and creditors about the company’s financial stability and long-term viability.

2. Investor Confidence: Investors closely analyze a company’s accumulated deficit when considering investment opportunities. A substantial accumulated deficit might indicate higher risk and lower profitability potential, making it challenging to attract new investors. Therefore, reducing the accumulated deficit or demonstrating a clear plan for its reduction can significantly improve investor confidence and increase chances of securing funding.

3. Creditor Perception: Lenders and creditors also consider the accumulated deficit when evaluating a company’s creditworthiness. A high accumulated deficit might suggest a higher likelihood of default and repayment difficulties. Thus, businesses with a significant accumulated deficit might face challenges when seeking additional financing or securing favorable credit terms.

4. Strategic Decision-making: The accumulated deficit plays a crucial role in strategic decision-making within a company. It prompts management to assess their current operations, identify areas of improvement, and develop strategies to turn losses into profits. Understanding the accumulated deficit can help drive informed decision-making to enhance profitability, reduce expenses, and stimulate growth.

5. Future Investment Opportunities: A lower accumulated deficit can make a company more attractive to potential investors and open doors for future investment opportunities. As the accumulated deficit decreases over time, the company demonstrates an improved financial performance and greater potential for generating returns on investment.

6. Compliance with Regulations: For certain industries or regulatory bodies, limits or thresholds may exist concerning the accumulated deficit. Exceeding these limits could result in penalties or even legal consequences. Therefore, monitoring the accumulated deficit is crucial to ensure compliance with industry-specific regulations and legal requirements.

It is important to note that while the accumulated deficit can present challenges, it is not necessarily an indication of long-term failure. Companies with accumulated deficits often implement strategic measures, such as cost-cutting initiatives, revenue diversification, or operational improvements, to overcome financial difficulties and restore profitability.

Overall, the accumulated deficit remains a significant metric that provides stakeholders with important insights into a company’s financial performance, risk profile, and potential for future success.

Causes of Accumulated Deficit

The accumulated deficit in a company’s financial statement can be attributed to various factors and circumstances that lead to consistent losses. Understanding the causes behind the accumulated deficit is crucial for identifying underlying issues and implementing effective measures to mitigate them. Here are some common causes of accumulated deficit:

1. Operating Losses: One of the primary causes of accumulated deficit is a pattern of operating losses. This occurs when a company’s expenses consistently exceed its revenues over an extended period of time. Operating losses can be attributed to various factors, such as low sales volumes, high production costs, inefficient operations, or pricing strategies that fail to generate adequate profit margins.

2. Economic Downturn: A severe economic downturn, such as a recession or financial crisis, can significantly impact a company’s financial performance. During challenging economic times, companies may face declining sales, reduced consumer spending, and increased competition. These factors can contribute to lower revenues and increased expenses, resulting in an accumulated deficit.

3. Industry or Market Changes: Industries and markets undergo constant changes, including shifts in consumer preferences, technological advancements, or regulatory requirements. When companies fail to adapt to these changes or anticipate future trends, they may experience a decline in sales, increased costs, or a loss of competitive advantage, leading to an accumulated deficit.

4. Mismanagement of Finances: Poor financial management practices, such as inadequate budgeting, excessive borrowing, or ineffective cost management, can contribute to an accumulated deficit. Failure to allocate resources effectively, monitor cash flows, or control expenses can result in financial losses and the continuous accumulation of deficits.

5. Product or Service Failures: Companies heavily reliant on a single product or service may face significant risks if that product or service fails to meet market expectations or becomes obsolete. Product recalls, quality issues, or failure to innovate can lead to decreased sales, negative customer perception, and subsequent financial losses.

6. Excessive Debt: A high level of debt or interest payments can strain a company’s financial resources, impede growth opportunities, and ultimately contribute to an accumulated deficit. The burden of debt servicing can limit the company’s ability to make necessary investments, adapt to market changes, or generate sufficient profits to offset expenses.

7. Legal or Regulatory Issues: Companies facing lawsuits, fines, or legal disputes may incur substantial costs that impact their financial standing and contribute to an accumulated deficit. Regulatory non-compliance, environmental liabilities, or intellectual property infringements can result in significant financial penalties and expenses.

Addressing the causes of accumulated deficit requires a comprehensive assessment of the company’s operations, management practices, market dynamics, and financial strategies. Implementing proactive measures such as cost-cutting initiatives, diversifying revenue streams, improving operational efficiency, and developing strategic plans can help mitigate the impact of accumulated deficit and pave the way for sustained profitability.

Impact on the Balance Sheet

The accumulated deficit has a significant impact on a company’s balance sheet, specifically on the equity section. The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a given point in time. Here’s how the accumulated deficit affects the balance sheet:

1. Equity Reduction: The accumulated deficit is deducted from the equity section of the balance sheet. It represents the cumulative losses a company has incurred over its operating history. As the accumulated deficit increases, it reduces the amount of retained earnings, which is a component of shareholders’ equity. This reduction is a reflection of the financial losses that the company has not yet recovered.

2. Negative Equity: In some cases, if the accumulated deficit exceeds the retained earnings and other components of equity, it can result in negative equity. Negative equity implies that the company’s liabilities exceed its assets, which can adversely affect the financial health and creditworthiness of the business. Negative equity may lead to difficulties in obtaining financing, attracting investors, and complying with certain legal requirements.

3. Book Value of Equity: The accumulated deficit influences the book value of equity, which is the net worth of a company as recorded on the balance sheet. With an increase in the accumulated deficit, the book value of equity decreases. This reduction in equity value can impact the overall perception of the company’s financial strength and its ability to generate future profits.

4. Shareholders’ Confidence: The accumulated deficit can affect shareholders’ confidence in the company and its management. A significant and continuously growing accumulated deficit may raise concerns among existing shareholders, impacting investor sentiment and potentially leading to a decline in share value. Shareholders may also be reluctant to invest additional capital in a company with a substantial accumulated deficit, further inhibiting the company’s growth prospects.

5. Restrictions on Dividend Payments: Accumulated deficit can also impact a company’s ability to distribute dividends to shareholders. Negative or significant accumulated deficits may restrict or eliminate dividend payments altogether, as the company seeks to retain earnings to offset losses and strengthen its financial position. This can disappoint shareholders who rely on dividend income and may have implications for the company’s stock valuation.

6. Creditworthiness: A large accumulated deficit can adversely affect a company’s creditworthiness. Lenders and creditors consider the accumulated deficit when assessing the company’s ability to repay debts and meet financial obligations. A high accumulated deficit may result in higher borrowing costs, stricter loan covenants, or limited access to credit, which can hinder the company’s growth and financial stability.

It is important to manage and address the accumulated deficit to maintain a healthy balance sheet and strengthen the financial position of the company. Implementing strategies to reduce losses, enhance profitability, and improve cash flow generation are essential in minimizing the impact of the accumulated deficit on the balance sheet and restoring the company’s financial health.

Managing Accumulated Deficit

Managing accumulated deficit is crucial for companies seeking to improve their financial position, attract investors, and ensure long-term sustainability. While reducing or eliminating the accumulated deficit takes time and requires strategic planning, implementing effective measures can lead to positive outcomes. Here are some strategies to manage accumulated deficit:

1. Cost-Cutting Measures: Conduct a thorough evaluation of the company’s expenses and identify areas where costs can be reduced without sacrificing the quality of products or services. This may involve renegotiating contracts with suppliers, optimizing operational processes, and implementing efficient resource management.

2. Revenue Diversification: Explore opportunities to diversify revenue streams by targeting new markets, launching new products or services, or expanding the customer base. By expanding revenue sources, companies can reduce their reliance on a single market or product and improve their ability to generate profits.

3. Operational Efficiency: Streamline operations to improve efficiency and reduce waste. This can involve implementing lean management practices, automating repetitive tasks, and optimizing the supply chain to reduce costs and enhance productivity.

4. Strategic Pricing: Review pricing strategies to ensure they align with market demand and competitors while maintaining profitability. Conduct market research to understand customers’ willingness to pay and adjust pricing accordingly.

5. Debt Management: Evaluate existing debt levels and look for opportunities to restructure or refinance debt to reduce interest payments and improve cash flow. Implement proactive debt management practices to prevent further accumulation of debt and ensure timely repayment.

6. Investment in Innovation: Invest in research and development to drive innovation and create new revenue streams. By continuously improving products and services, companies can attract new customers and differentiate themselves from competitors.

7. Capital Infusion: Seek additional capital through equity financing or debt financing to strengthen the company’s financial position and fund growth initiatives. Access to additional capital can provide resources to invest in new markets, product development, or operational improvements.

8. Strategic Partnerships: Form strategic alliances or joint ventures with complementary businesses to leverage their expertise, customer base, or distribution channels. Strategic partnerships can help expand market reach and drive revenue growth.

9. Financial Restructuring: In certain cases, companies may need to consider financial restructuring, including debt-for-equity swaps, recapitalization, or merger and acquisition activities. These options can provide opportunities to reduce debt burdens, optimize operations, and improve financial performance.

10. Clear Communication with Stakeholders: Transparent and proactive communication with stakeholders, including shareholders, investors, creditors, and employees, is crucial. Provide regular updates on financial performance, outlining strategies to manage the accumulated deficit and restore profitability. Open communication fosters trust and ensures all stakeholders are aligned in working towards a common goal.

Managing accumulated deficit requires a comprehensive and disciplined approach. It involves analyzing the company’s operations, financials, and market dynamics to identify areas for improvement and implement appropriate strategies. By taking proactive steps to reduce losses, improve profitability, and strengthen the financial position, companies can gradually mitigate the impact of the accumulated deficit and create a solid foundation for long-term success.

Conclusion

The accumulated deficit is an important financial metric that reflects the cumulative losses a company has incurred over its operating history. It is a reflection of the company’s ability to generate profits, manage expenses, and sustain financial health. Accumulated deficits can impact a company’s balance sheet, shareholder confidence, and creditworthiness.

Understanding the causes and implications of accumulated deficit is key to managing and addressing it effectively. By implementing strategic measures such as cost-cutting initiatives, revenue diversification, operational efficiency improvements, and debt management strategies, companies can gradually reduce the accumulated deficit and restore financial strength.

It is crucial for companies to proactively communicate with stakeholders, including investors, creditors, and employees, about the efforts being made to address the accumulated deficit. Transparency and clear communication instill confidence and demonstrate a commitment to sustainable financial growth.

Successfully managing the accumulated deficit requires a long-term mindset and a comprehensive approach. Companies should continuously monitor their financial performance, adapt to market changes, and implement strategies to improve profitability and cash flow generation. By doing so, they can gradually reduce the accumulated deficit and ensure a stronger financial position for future success.

In conclusion, the accumulated deficit serves as a critical indicator of a company’s financial health and profitability. By effectively managing and reducing the accumulated deficit, companies can pave the way for sustainable growth, attract investors, and enhance their long-term prospects in the competitive business landscape.