Finance

Foreign Debt: Definition And Economic Impact

Published: November 26, 2023

Learn about the definition and economic impact of foreign debt in the world of finance, and how it affects countries' economic stability and growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Foreign Debt and Its Economic Impact

Welcome to our blog post on foreign debt! If you’ve ever wondered about the definition of foreign debt and its economic impact, you’ve come to the right place. In this article, we’ll break down what foreign debt is, how it is measured, and the effects it can have on economies. So, let’s dive in!

Key Takeaways:

- Foreign debt refers to the amount of money that a country owes to external creditors or foreign entities.

- It is measured using different indicators such as external debt-to-GDP ratio, debt service-to-export ratio, and debt per capita.

What is Foreign Debt?

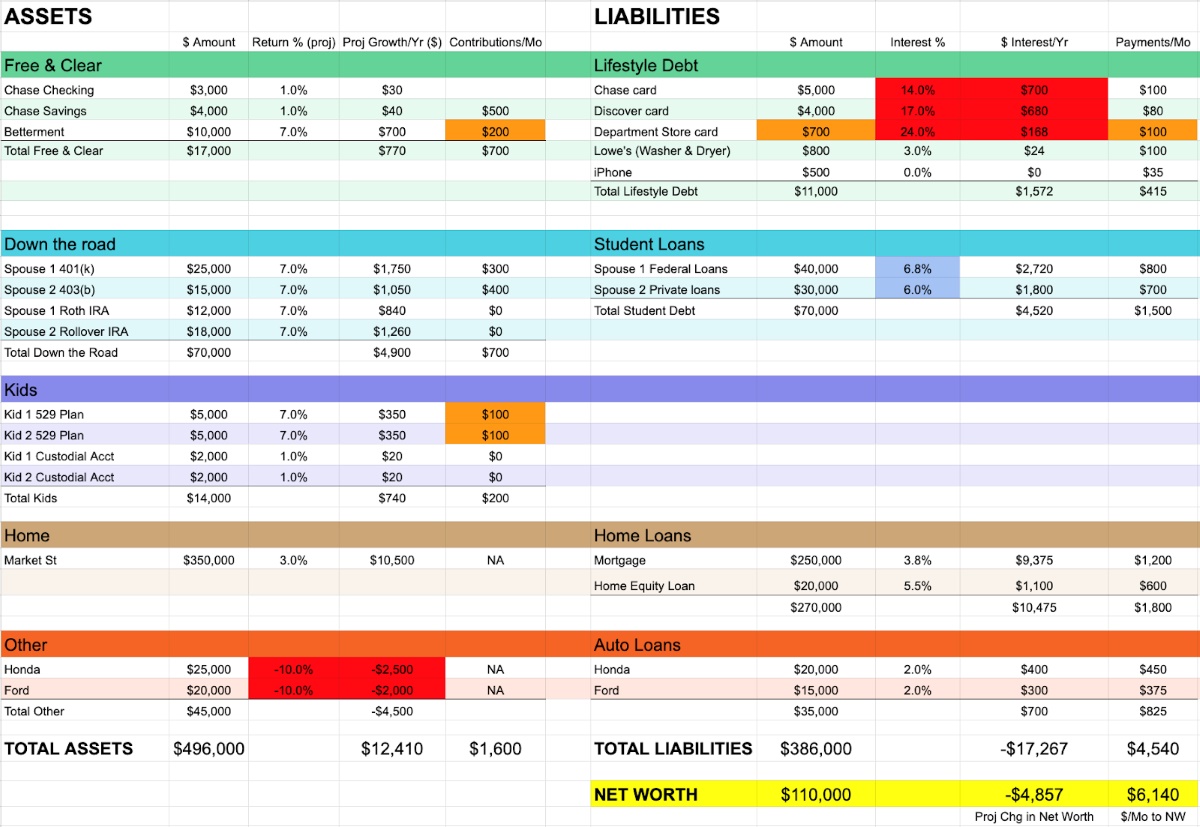

Foreign debt, also known as external debt, is the total amount of money that a country owes to external creditors or foreign entities. This debt is typically incurred by borrowing funds from other countries, international financial institutions, or through the issuance of debt securities to foreign investors.

Foreign debt can manifest in different forms, including government debt, corporate debt, or consumer debt. Governments often resort to borrowing from abroad to finance infrastructure projects, stimulate economic growth, or meet budgetary shortfalls. Similarly, businesses and consumers may take on foreign debt to fund long-term investments or purchases.

It’s important to note that foreign debt is different from domestic debt, which refers to money borrowed within a country’s borders.

How is Foreign Debt Measured?

Foreign debt is typically measured using various indicators that provide insights into a country’s ability to service its debt obligations. Some common measures include:

- External Debt-to-GDP Ratio: This ratio compares a country’s total external debt to its gross domestic product (GDP). It provides an indication of how sustainable a country’s debt burden is relative to its economic output.

- Debt Service-to-Export Ratio: This ratio measures the proportion of a country’s annual debt payments (principal and interest) to its annual exports. It helps gauge the country’s ability to generate enough foreign currency to meet its debt obligations.

- Debt Per Capita: This metric divides a country’s total external debt by its population, providing an estimate of the average debt burden per person.

The Economic Impact of Foreign Debt

The impact of foreign debt on an economy can vary depending on various factors, including the level of debt, the terms of borrowing, and the economic conditions of the borrowing country. Here are some general effects that foreign debt can have:

- Stimulating Growth: Foreign debt can inject capital into an economy, allowing governments, businesses, and consumers to finance investments, infrastructure projects, and other initiatives. This can bolster economic growth and development.

- Increased Vulnerability: Excessive or unsustainable foreign debt levels can make a country vulnerable to external shocks, such as economic downturns or changes in global financial markets. Inability to service debt can lead to defaults, which can have severe consequences for the borrowing country.

- Exchange Rate Effects: Foreign debt denominated in foreign currencies can expose a country to exchange rate risk. Currency depreciation can increase the burden of debt repayment, as more domestic currency is needed to satisfy the debt obligations.

- Crowding Out Domestic Investment: High levels of foreign debt may require a significant portion of a country’s resources to be allocated towards debt servicing, leaving less available for domestic investment, social welfare programs, or other essential expenditures.

Overall, foreign debt can play a significant role in shaping a country’s economic trajectory. It can provide opportunities for growth and development, but careful management and monitoring are essential to ensure its impact remains positive and sustainable.

We hope this article has provided you with a clear understanding of foreign debt and its economic impact. Whether you’re an individual curious about global finance or a policymaker seeking insights, being well-informed on this topic can contribute to making informed decisions.

Thank you for reading, and stay tuned for more informative articles on finance and economics!