Finance

Foreign Deposits Definition

Published: November 26, 2023

Discover the meaning of foreign deposits in finance and how they impact global markets. Explore the benefits and risks associated with this financial term.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Foreign Deposits: A Comprehensive Guide

Welcome to our FINANCE category, where we dive into various topics related to personal finance and investment strategies. In this blog post, we’ll be exploring the concept of foreign deposits – what they are, how they work, and why they matter in the world of finance.

If you’ve ever wondered about the significance of foreign deposits or how they can impact your financial portfolio, you’re in the right place. Keep reading to gain a clear understanding of this essential financial concept and how it relates to global markets.

Key Takeaways:

- Foreign deposits refer to funds held in a financial institution located outside of an individual’s home country.

- Investing in foreign deposits can provide diversification, potential asset protection, and access to new investment opportunities.

What Are Foreign Deposits?

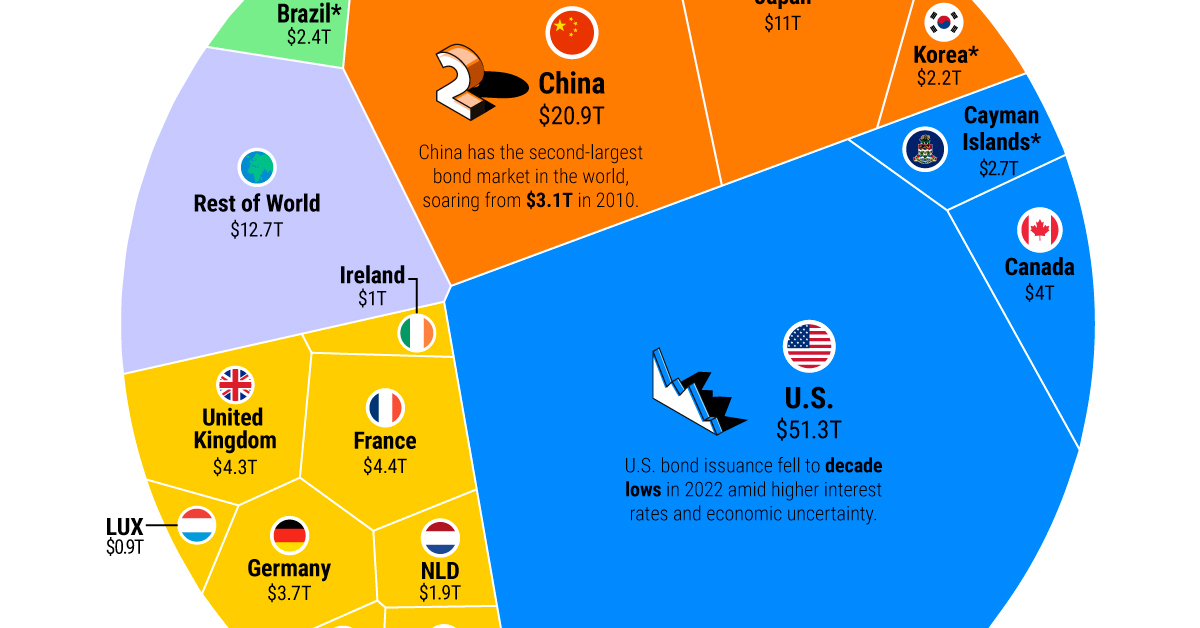

Foreign deposits are financial assets held by individuals or institutions in a bank or financial institution located outside their home country. In simple terms, it means keeping money in a bank account abroad rather than in a domestic account. The deposited funds are typically denominated in a foreign currency, which adds an element of foreign exchange risk to the equation.

Many factors can lead individuals or businesses to choose foreign deposits. These include currency diversification, investment opportunities, access to higher interest rates, tax optimization, and asset protection. For individual investors, foreign deposits can be part of a broader strategy to diversify and hedge against geopolitical and economic risks.

How Do Foreign Deposits Work?

Foreign deposits function similarly to domestic bank deposits. Once deposited, the funds are typically subject to the regulations and financial system of the country where the institution is located.

Here’s a step-by-step breakdown of how foreign deposits work:

- Choose a foreign financial institution: Research and select a reputable foreign bank or financial institution where you plan to deposit your funds.

- Open an account: Follow the account opening process of the chosen institution, which may involve providing identification documents, proof of address, and meeting any other requirements.

- Deposit funds: Transfer or physically deposit your funds into the foreign bank account. The deposit can be made in the form of cash, checks, or electronic transfer, depending on the institution’s policies.

- Manage and access your funds: Once your funds are deposited, you can manage and access them through the bank’s online or physical banking channels, depending on the services provided by the institution.

Why Do Foreign Deposits Matter?

Foreign deposits matter for several reasons:

- Diversification: Investing in foreign deposits allows you to diversify your financial portfolio beyond your home country’s financial system, potentially mitigating risks associated with a single economy or currency.

- Asset Protection: Holding funds offshore may provide protection against political instability, economic crises, or legal issues in your home country.

- Investment Opportunities: Foreign deposits can present unique investment opportunities, including access to higher interest rates, foreign stock markets, or specific sectors that may be thriving in another country.

- Tax Optimization: Some individuals may benefit from tax advantages and optimization strategies by holding assets in foreign jurisdictions. It’s important to consult with a tax professional to navigate the complexities of international tax laws.

While foreign deposits offer potential benefits, it’s crucial to consider the associated risks, such as currency fluctuations, political instability, and regulatory differences. Researching and understanding the specific country’s economic and political landscape where you plan to hold your deposits is paramount.

In conclusion, foreign deposits are an essential component of global finance, enabling individuals and businesses to diversify their assets, access investment opportunities, and protect their wealth. By learning about foreign deposits, you can make informed decisions to enhance your financial strategies and navigate the world of international finance with confidence.