Home>Finance>Which Approach To Money Management Indicates An Understanding Of The Time Value Of Money?

Finance

Which Approach To Money Management Indicates An Understanding Of The Time Value Of Money?

Published: February 28, 2024

Learn the approach to money management that demonstrates a deep understanding of the time value of money. Explore finance strategies to optimize your financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the time value of money is a crucial aspect of effective money management. This fundamental concept serves as the cornerstone of various financial decisions, encompassing investment strategies, loan structuring, and business valuation. The ability to comprehend and apply the principles of the time value of money empowers individuals and businesses to make informed choices regarding cash flow, risk assessment, and long-term financial planning.

The time value of money recognizes that a dollar received today holds more worth than a dollar received in the future. This is primarily due to the potential earning capacity of money over time, which is influenced by factors such as inflation, interest rates, and the opportunity cost of alternative investments. By acknowledging this principle, individuals and organizations can optimize their financial decisions, thereby maximizing the potential for wealth accumulation and sustainable growth.

In the subsequent sections, we will delve into the definition and significance of the time value of money in the context of money management, exploring various approaches and strategies that embody a comprehensive understanding of this fundamental concept. By illuminating the practical implications of the time value of money, we aim to equip readers with the knowledge and insights necessary to navigate the intricate landscape of financial management with confidence and acumen.

Definition of Time Value of Money

The time value of money encapsulates the principle that the worth of money is contingent on the timing of its receipt or payment. This concept acknowledges that a dollar today holds more value than the same dollar in the future, owing to its potential earning capacity when invested or utilized immediately. At the core of the time value of money lies the premise that a rational individual would prefer to receive a fixed sum of money today rather than the same amount in the future, as the former provides the opportunity for immediate consumption or investment.

One of the foundational components of the time value of money is the concept of interest. By investing money today, an individual can generate returns in the form of interest, thereby increasing the future value of the initial sum. Conversely, when borrowing money, the borrower agrees to repay the principal amount along with interest, reflecting the increased value of money over time. This interplay between present value, future value, and the prevailing interest rate forms the bedrock of the time value of money.

Furthermore, the time value of money considers the impact of inflation, which erodes the purchasing power of money over time. As a result, a dollar received today can purchase more goods and services than the same dollar in the future, highlighting the significance of considering inflation in financial decision-making. Additionally, the opportunity cost of forgoing alternative investment opportunities is integral to the time value of money, as it underscores the potential gains that could have been accrued by investing funds in alternative ventures.

Ultimately, the time value of money serves as a guiding principle in various financial calculations, including present value, future value, annuities, and perpetuities. By comprehending and applying this concept, individuals and organizations can make informed financial decisions that align with their long-term objectives, mitigate risk, and capitalize on opportunities for wealth accumulation and sustainable financial growth.

Importance of Time Value of Money in Money Management

The time value of money holds immense significance in the realm of money management, exerting a pervasive influence on various financial decisions and strategies. By recognizing the temporal dimension of money, individuals and businesses can optimize their financial choices, enhance their investment outcomes, and navigate the complexities of borrowing and lending with prudence and foresight.

One of the primary implications of the time value of money is its role in investment evaluation. When assessing potential investment opportunities, understanding the time value of money enables investors to gauge the profitability and desirability of different ventures. By discounting future cash flows to their present value, investors can compare and prioritize investment options, thereby allocating capital to endeavors that offer the most favorable returns adjusted for the time value of money.

Moreover, the time value of money informs the structuring of loans and financing arrangements. Lenders and borrowers alike consider the implications of interest rates and the timing of cash flows, incorporating the time value of money into loan terms and repayment schedules. This consideration ensures that both parties account for the changing worth of money over time, thereby facilitating equitable and mutually beneficial lending arrangements.

Furthermore, the time value of money underpins the concept of risk and return in financial decision-making. By factoring in the potential effects of inflation, interest rates, and alternative investment opportunities, individuals and organizations can assess the inherent risks associated with financial choices and strive to maximize returns while mitigating exposure to adverse market conditions.

In essence, the time value of money serves as a guiding principle that informs prudent financial management, facilitates informed decision-making, and empowers individuals and businesses to optimize their financial resources. By integrating the time value of money into money management practices, stakeholders can navigate the dynamic landscape of finance with acumen and foresight, ultimately striving to achieve their long-term financial objectives while mitigating risk and maximizing wealth accumulation.

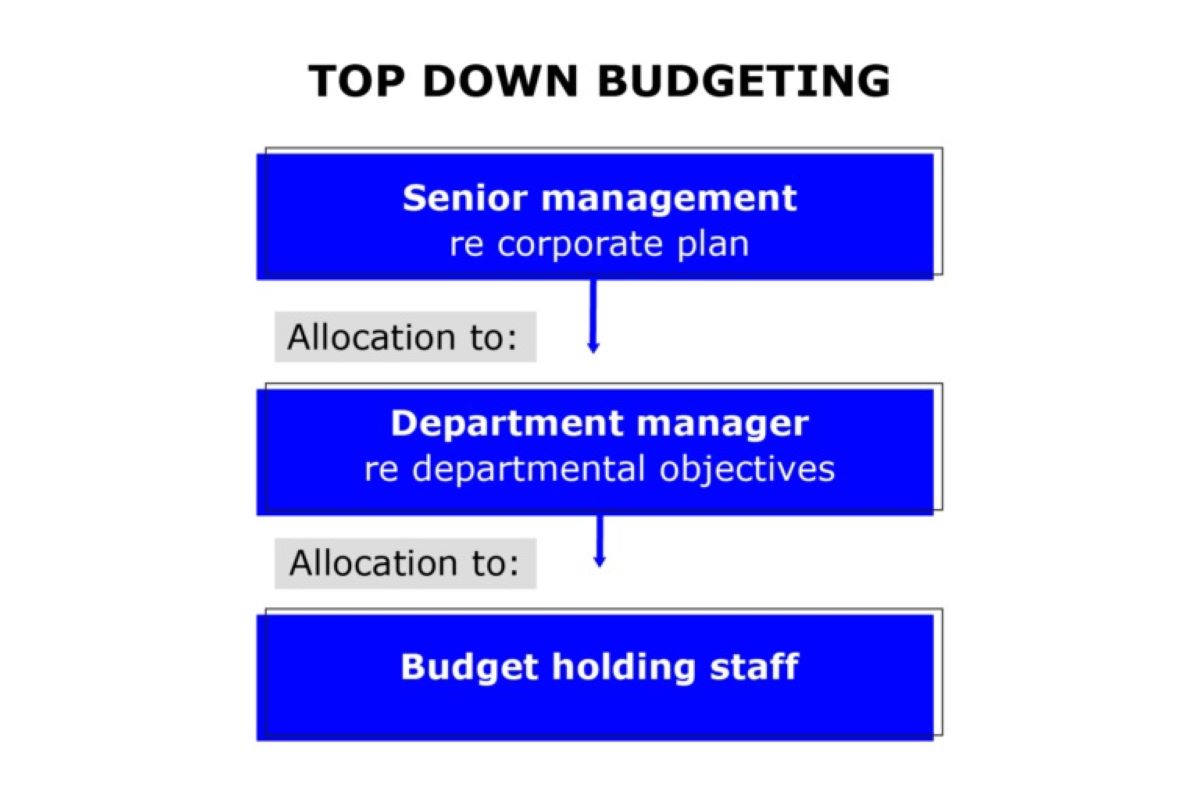

Approaches to Money Management

Effective money management encompasses various approaches that individuals and businesses can adopt to optimize their financial resources and achieve their long-term objectives. These approaches are underpinned by an understanding of the time value of money, integrating this fundamental concept into the fabric of financial decision-making to maximize wealth accumulation and mitigate risk.

1. Investment Diversification: Diversifying investment portfolios is a fundamental approach to money management that leverages the time value of money. By allocating funds across a range of assets and investment vehicles, individuals and organizations can mitigate risk and optimize returns, thereby harnessing the potential for wealth accumulation over time.

2. Long-Term Financial Planning: Embracing a long-term perspective in financial planning is essential for effective money management. By considering the time value of money, individuals can make strategic decisions regarding retirement planning, education funds, and legacy planning, ensuring that their financial resources are optimized to meet future needs and objectives.

3. Debt Management: Managing debt obligations in a manner that acknowledges the time value of money is critical for sustainable financial health. By structuring loan repayments and debt management strategies with the understanding of interest rates and inflation, individuals and businesses can minimize the long-term cost of debt and optimize their financial position.

4. Risk Management: Integrating risk management principles into money management approaches involves considering the time value of money in assessing and mitigating financial risks. By factoring in the potential effects of inflation and interest rates, stakeholders can make informed decisions to safeguard their financial resources and investments.

5. Income and Expense Management: Effectively managing income and expenses with an understanding of the time value of money is crucial for sustainable financial well-being. By optimizing cash flows, minimizing unnecessary expenses, and leveraging investment opportunities, individuals and businesses can enhance their financial position and capitalize on the potential for wealth accumulation over time.

These approaches to money management underscore the pervasive influence of the time value of money in shaping financial decisions and strategies. By integrating this fundamental concept into their approach to money management, individuals and organizations can strive to achieve sustainable growth, prudent risk management, and optimized wealth accumulation in the dynamic landscape of finance.

Understanding the Time Value of Money in Money Management

Comprehending the time value of money is integral to astute money management, as it underpins the rationale behind various financial decisions and strategies. By internalizing the principles of the time value of money, individuals and businesses can navigate the intricacies of financial management with acumen and foresight, optimizing their resources and striving to achieve their long-term objectives.

One of the pivotal aspects of understanding the time value of money is recognizing the impact of inflation on the purchasing power of money. Inflation erodes the value of currency over time, necessitating a proactive approach to financial management that accounts for the diminishing worth of money. By factoring in the effects of inflation, individuals can make informed decisions regarding investment opportunities, loan structures, and long-term financial planning, ensuring that their financial resources are shielded from the erosive effects of inflation.

Furthermore, understanding the time value of money empowers individuals and businesses to evaluate the desirability and profitability of investment opportunities. By discounting future cash flows to their present value, stakeholders can compare and prioritize investment options, optimizing their allocation of capital to endeavors that offer favorable returns adjusted for the time value of money. This approach enables investors to harness the potential for wealth accumulation over time, aligning their investment decisions with their long-term financial objectives.

Moreover, comprehending the time value of money facilitates prudent debt management, as borrowers and lenders alike can structure loan terms and repayment schedules with the understanding of interest rates and the changing worth of money over time. By integrating the time value of money into debt management strategies, individuals and businesses can minimize the long-term cost of debt and optimize their financial position, thereby enhancing their overall financial well-being.

In essence, understanding the time value of money in money management empowers stakeholders to make informed, strategic decisions that align with their long-term financial objectives. By acknowledging the temporal dimension of money and integrating the principles of the time value of money into their financial strategies, individuals and organizations can strive to achieve sustainable growth, mitigate risk, and optimize wealth accumulation in the dynamic landscape of finance.

Conclusion

The time value of money stands as a cornerstone of prudent and effective money management, permeating various aspects of financial decision-making and strategic planning. By recognizing the temporal dimension of money and internalizing the principles of the time value of money, individuals and businesses can optimize their financial resources, mitigate risk, and strive to achieve sustainable growth and wealth accumulation.

From investment evaluation to debt management, the time value of money informs and guides a myriad of financial decisions, empowering stakeholders to navigate the complexities of finance with acumen and foresight. By factoring in the impact of inflation, interest rates, and alternative investment opportunities, individuals and organizations can make informed choices that align with their long-term objectives, safeguarding their financial resources from erosion and capitalizing on opportunities for wealth accumulation over time.

Furthermore, the integration of the time value of money into money management approaches underscores the pervasive influence of this fundamental concept in shaping prudent financial strategies. Whether through investment diversification, long-term financial planning, or risk management, the time value of money serves as a guiding principle that facilitates informed decision-making and optimized resource allocation.

In essence, the understanding of the time value of money in money management empowers stakeholders to navigate the dynamic landscape of finance with confidence and acumen. By embracing this fundamental concept and integrating it into their financial practices, individuals and businesses can strive to achieve sustainable growth, prudent risk management, and optimized wealth accumulation, thereby fostering long-term financial well-being and resilience.

Ultimately, the time value of money transcends mere numerical calculations, embodying a strategic mindset and a proactive approach to financial management. By acknowledging the significance of the time value of money and internalizing its principles, stakeholders can embark on a journey towards financial empowerment, harnessing the potential of their resources to achieve enduring prosperity and success.