Home>Finance>Form 4797: Sales Of Business Property Definition, How To File

Finance

Form 4797: Sales Of Business Property Definition, How To File

Published: November 27, 2023

Learn the definition of Sales of Business Property and how to file Form 4797. Get expert guidance and tips for managing your finances effectively in the process.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Everything You Need to Know About Form 4797: Sales of Business Property Definition, How to File

Welcome to our Finance category where we dive deep into various topics related to money management, investments, and taxation. Today, we’re going to focus on an important form that can have a significant impact on your tax obligations: Form 4797 – Sales of Business Property. Understanding what this form entails and how to file it correctly can help you maximize your tax benefits while staying within the boundaries of the law.

Key Takeaways:

- Form 4797 is used to report the sale of business property, including real estate, machinery, and equipment.

- Filing Form 4797 correctly can help you offset your gains with any losses and potentially reduce your tax liability.

So, let’s dive straight into what Form 4797 is all about and how you can tackle it like a pro when it comes to filing your taxes.

What is Form 4797?

Form 4797, officially known as “Sales of Business Property,” is a tax form used to report the sale or exchange of certain business properties. These properties can include but are not limited to:

- Real estate properties

- Machinery

- Equipment

- Vehicles

- Intangible assets

Essentially, if you sell any property that is used for your trade or business purpose, you may need to report it on Form 4797.

How to File Form 4797 Correctly

To ensure you file Form 4797 correctly, follow these steps:

- Gather all necessary information: Before starting the filing process, gather all the relevant information about the property sale. This should include the purchase date, sale date, purchase price, and selling price.

- Calculate your gains or losses: Determine whether the sale resulted in a gain or loss. To calculate your gain, subtract the adjusted basis of the property from the selling price. If the selling price is less than the adjusted basis, you have a loss instead of a gain.

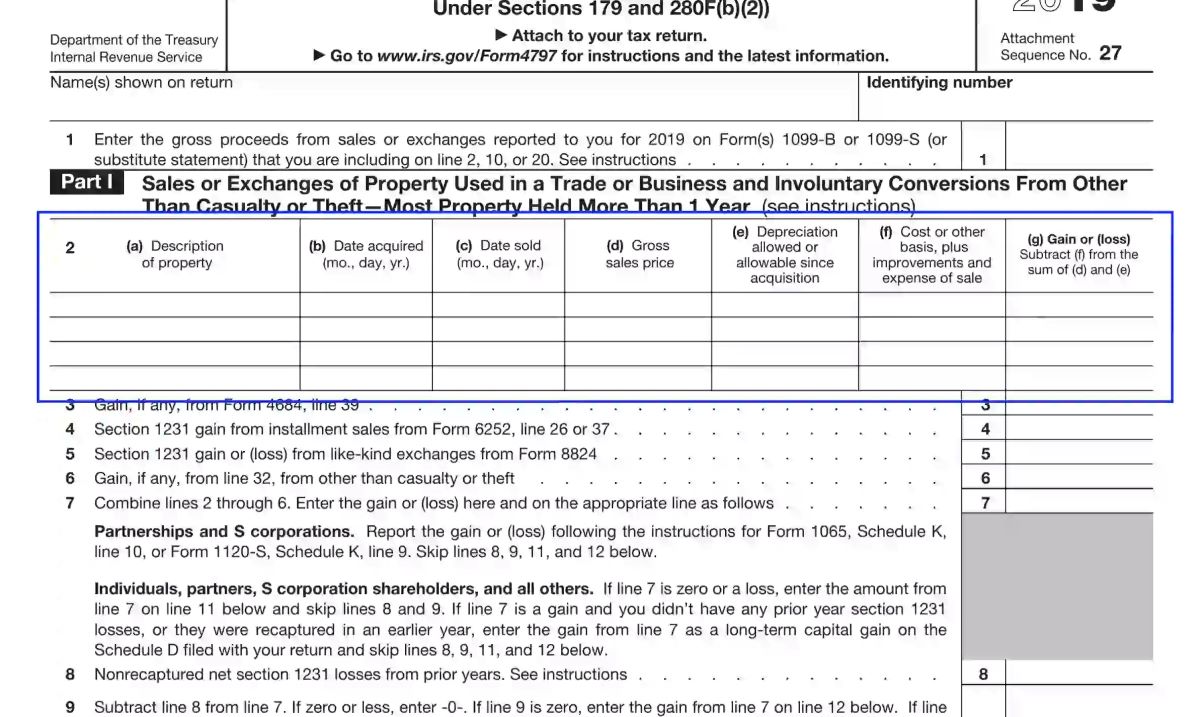

- Complete Part I or Part II: Depending on the type of property sold, you will need to complete either Part I or Part II of Form 4797. Part I covers the sale of depreciable property, while Part II is for the sale of real estate property. Provide all the necessary details, including the property description, sale date, and relevant depreciation information.

- Offset gains with losses: If you have any losses from other sales or exchanges of business property, you can use them to offset the gains reported on Form 4797. Include these losses in Part III of the form.

- Transfer to relevant tax schedules: Once you have completed Form 4797, transfer the relevant information to your individual or business tax return. The gains or losses reported on Form 4797 may impact your overall tax liability.

Remember, it’s crucial to carefully review the instructions provided by the IRS and make sure you comply with all the requirements when filing Form 4797. If you have any doubts or complex situations, consulting a tax professional can provide valuable guidance.

Maximize Your Tax Benefits with Form 4797

Understanding the intricacies of Form 4797 can help you leverage it to your advantage and potentially reduce your tax liability. By carefully calculating your gains or losses and properly reporting the sale of business property, you can optimize your tax benefits.

Key Takeaways:

- Filing Form 4797 correctly ensures you report the sale of business property accurately.

- Utilizing losses to offset gains can potentially reduce your overall tax liability.

Now that you have a solid understanding of Form 4797 and how to file it, you can confidently tackle this tax form without the stress and uncertainty that often accompanies tax season. Remember, staying informed and seeking professional guidance when needed is vital in navigating the complex world of taxes.

Stay tuned for more informative articles on our Finance page, where we aim to empower you with valuable knowledge to aid in your financial journey.