Finance

What Is Cash Flow In A Business For Sale

Published: December 20, 2023

Learn the importance of cash flow in a business for sale and how it impacts finance. Enhance your understanding of financial management with our expert insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When considering buying a business, understanding its cash flow is crucial. Cash flow is the lifeblood of any company, including those that are up for sale. It represents the movement of cash in and out of a business and is a key indicator of its financial health. Cash flow provides valuable insights into the business’s ability to meet its financial obligations, fund growth initiatives, and generate profits.

For prospective buyers, evaluating the cash flow of a business is essential to determine its value and potential for long-term success. By analyzing the cash flow, buyers can gain a clear understanding of the business’s financial stability and its ability to generate consistent revenue. This knowledge is vital when making informed investment decisions.

In this article, we will delve into the importance of cash flow in a business for sale and explore how it can be evaluated and managed effectively. We will also discuss the factors that can impact cash flow and provide tips for improving it in a business for sale.

Understanding cash flow is not only important for buyers, but also for sellers. Presenting accurate and well-documented cash flow statements can attract potential buyers and increase the perceived value of the business. Transparency in financial information can build trust and confidence in the business’s ability to generate stable cash flow.

As a buyer, it is crucial to thoroughly evaluate the cash flow of a business before making an investment. By doing so, you can mitigate the risks associated with buying a business with poor cash flow and increase your chances of acquiring a profitable and sustainable venture.

Now, let’s dive deeper into the concept of cash flow and understand why it’s so important in a business for sale.

Understanding Cash Flow

Cash flow refers to the movement of money in and out of a business. It is the net amount of cash and cash equivalents generated or consumed by a company during a specific period. Cash flow can be categorized into three main types: operating cash flow, investing cash flow, and financing cash flow.

Operating cash flow represents the cash generated from the core operations of the business, such as revenue from sales and payment received from customers. It is a key indicator of the business’s ability to generate consistent cash flow from its daily operations.

Investing cash flow pertains to the cash used for acquiring or disposing of long-term assets, such as property, equipment, or investments. It reflects the business’s investment activities and can include capital expenditures, acquisitions, or proceeds from the sale of assets.

Financing cash flow involves the cash inflows and outflows related to the business’s financing activities. This can include raising capital through debt or equity, repaying loans, or distributing dividends to shareholders.

Positive cash flow indicates that the business is generating more cash inflows than outflows, which is a healthy sign. It suggests that the business has sufficient cash to meet its financial obligations, invest in growth opportunities, and distribute profits to shareholders. On the other hand, negative cash flow indicates that the business is spending more cash than it is generating, which can be a cause for concern.

Understanding the cash flow of a business is crucial because it provides insight into its financial well-being and stability. It allows buyers to assess the business’s ability to generate consistent revenue, cover expenses, and sustain its operations over the long term.

Furthermore, analyzing the cash flow can help identify any irregularities or discrepancies in financial statements. It enables buyers to spot potential red flags, such as cash flow problems, excessive debt, or poor financial management, which could have a negative impact on the business’s profitability and sustainability.

In the next section, we will explore the importance of cash flow in a business for sale and how it can influence investment decisions.

Importance of Cash Flow in a Business for Sale

When evaluating a business for sale, cash flow plays a crucial role in determining its value and potential for success. Here are several reasons why cash flow is of paramount importance in the buying process:

- Financial Stability: Cash flow provides insight into the financial stability of a business. It indicates whether the company is generating enough cash to cover its expenses, repay debts, and reinvest in the business. A business with a consistent and positive cash flow is more likely to weather economic downturns and sustain its operations over the long term.

- Profit Potential: Cash flow is closely tied to profitability. A business that consistently generates positive cash flow is more likely to be profitable. By analyzing the cash flow, buyers can assess the profitability potential of the business and estimate the returns on their investment.

- Ability to Repay Debts: Cash flow enables buyers to determine whether the business has the ability to meet its debt obligations. It provides insights into the business’s liquidity and its capacity to make timely repayments on loans or other financial commitments.

- Investment Return: Cash flow is a key factor in calculating the return on investment (ROI) for a business. Buyers can estimate how long it will take to recoup their initial investment based on the cash flow generated by the business. This helps in determining the attractiveness of the investment opportunity.

- Future Growth Potential: Positive cash flow indicates that a business has the financial resources to invest in growth opportunities. It allows buyers to assess the potential for future expansion, whether it be through developing new products or services, entering new markets, or acquiring additional assets.

Understanding the importance of cash flow in a business for sale empowers buyers to make informed decisions. By carefully evaluating the cash flow, buyers can assess the financial health of the business, estimate its future prospects, and determine its value in the market. Identifying a business with strong and consistent cash flow is essential for minimizing risk and maximizing the potential for a successful investment.

Next, we will explore the various methods of evaluating the cash flow of a business to ensure that buyers have a comprehensive understanding of its financial position.

Evaluating the Cash Flow of a Business

When considering the purchase of a business, evaluating its cash flow is vital to determine its financial viability and potential for success. Here are some key methods for evaluating the cash flow of a business:

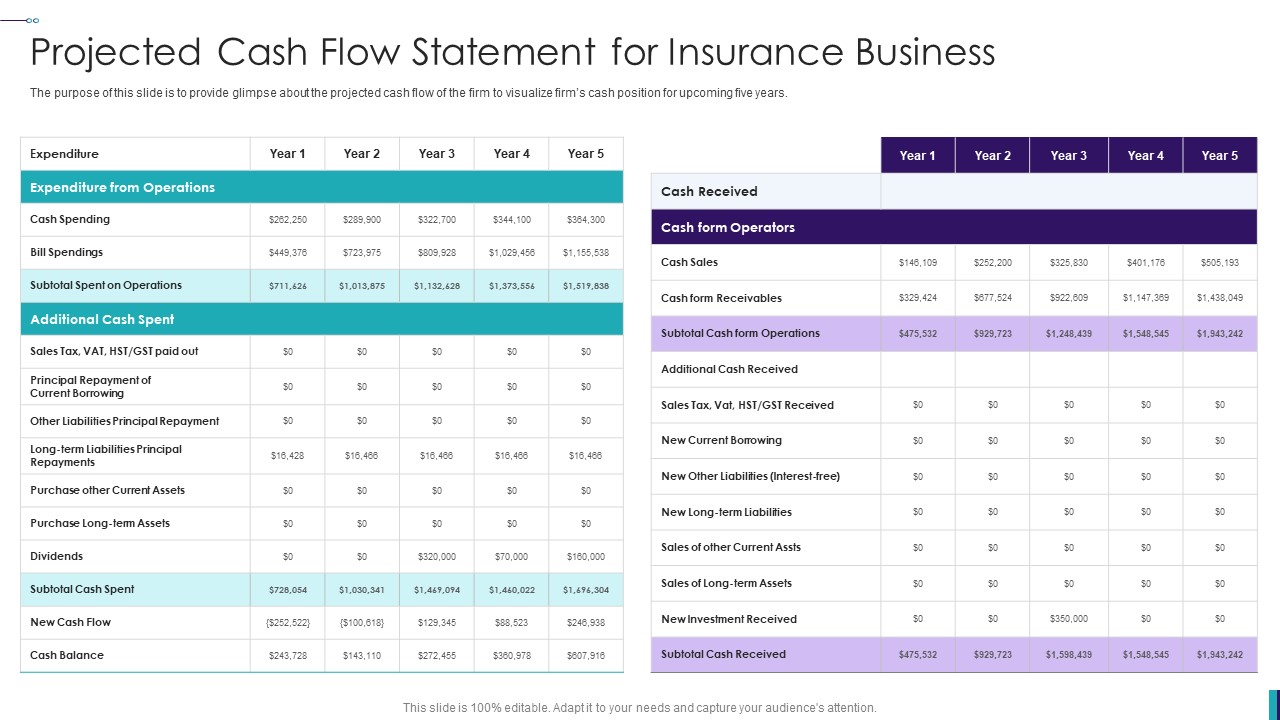

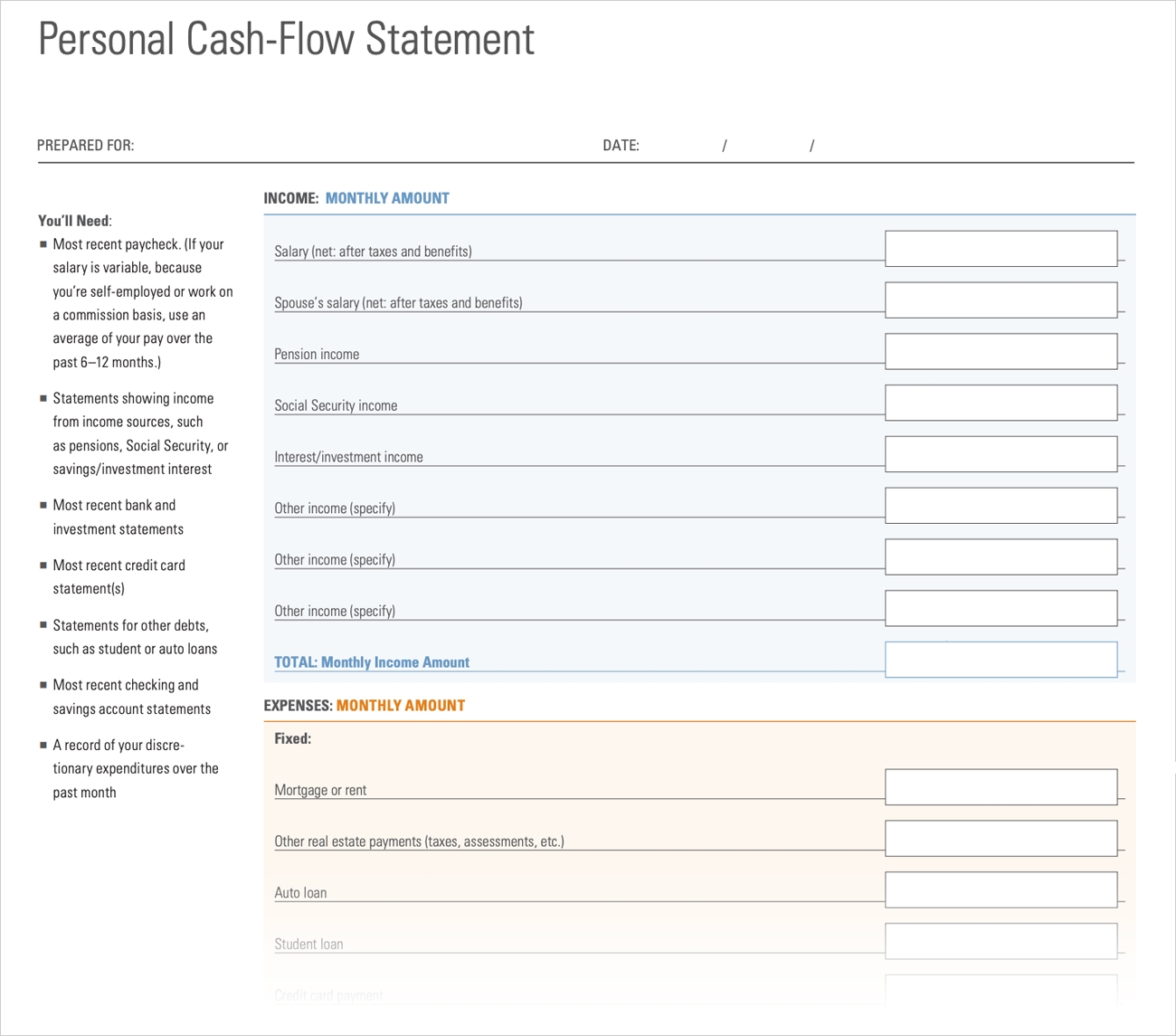

- Cash Flow Statement: The first step in evaluating cash flow is to review the business’s cash flow statement. This financial statement provides a comprehensive breakdown of the business’s cash inflows and outflows over a specified period. It includes information on operating activities, investing activities, and financing activities, allowing buyers to gauge the overall health of the business’s cash flow.

- Operating Cash Flow Ratio: The operating cash flow ratio measures the ability of a business to generate cash flow from its core operations. It is calculated by dividing the operating cash flow by the current liabilities. A higher ratio indicates a healthier cash flow situation, as it means the business has sufficient cash flow to cover its short-term obligations.

- Free Cash Flow: Free cash flow is a key indicator of the business’s ability to generate excess cash after meeting its operating expenses and capital expenditures. It represents the cash that is available for the business to invest in growth opportunities, pay dividends, or reduce debt. Evaluating the free cash flow provides insights into the business’s financial flexibility and its capacity to fund future initiatives.

- Historical Cash Flow Analysis: Analyzing the historical cash flow of the business over a period of time allows buyers to identify trends and patterns. It helps evaluate the consistency of cash flow and assess any potential seasonality or cyclical fluctuations. Buyers can use historical cash flow analysis as a basis for forecasting future cash flow and making informed investment decisions.

- Comparison to Industry Benchmarks: It is essential to compare the business’s cash flow performance to industry benchmarks and standards. This provides a benchmark for evaluating the business’s cash flow against its peers and helps identify areas of strength or weakness. Buyers can use the industry benchmarks as a reference point to assess the business’s financial performance and competitiveness.

By employing these methods, buyers can effectively evaluate the cash flow of a business and gain a deeper understanding of its financial position. It is important to note that evaluating cash flow should not be done in isolation; it should be done in conjunction with a thorough analysis of other financial statements, such as the balance sheet and income statement.

Understanding the cash flow of a business is a critical step in the due diligence process and can significantly impact investment decisions. A thorough evaluation of cash flow provides buyers with valuable information regarding the business’s financial health, profitability, and potential for growth.

Now, let’s explore the factors that can affect cash flow in a business for sale.

Factors Affecting Cash Flow in a Business for Sale

Several factors can have a significant impact on the cash flow of a business for sale. Buyers should consider these factors to understand the potential risks and opportunities associated with the business’s cash flow. Here are some key factors to consider:

- Sales and Revenue: The level and stability of sales and revenue directly affect the cash inflow of a business. Buyers should evaluate the historical sales performance and assess the potential for future growth. Fluctuations in sales can have a direct impact on cash flow and should be carefully analyzed.

- Customer Base: The composition and loyalty of the customer base can influence cash flow. A diverse and loyal customer base provides a more stable revenue stream. Buyers should consider factors such as customer concentration, recurring revenue, and customer retention rates when evaluating cash flow.

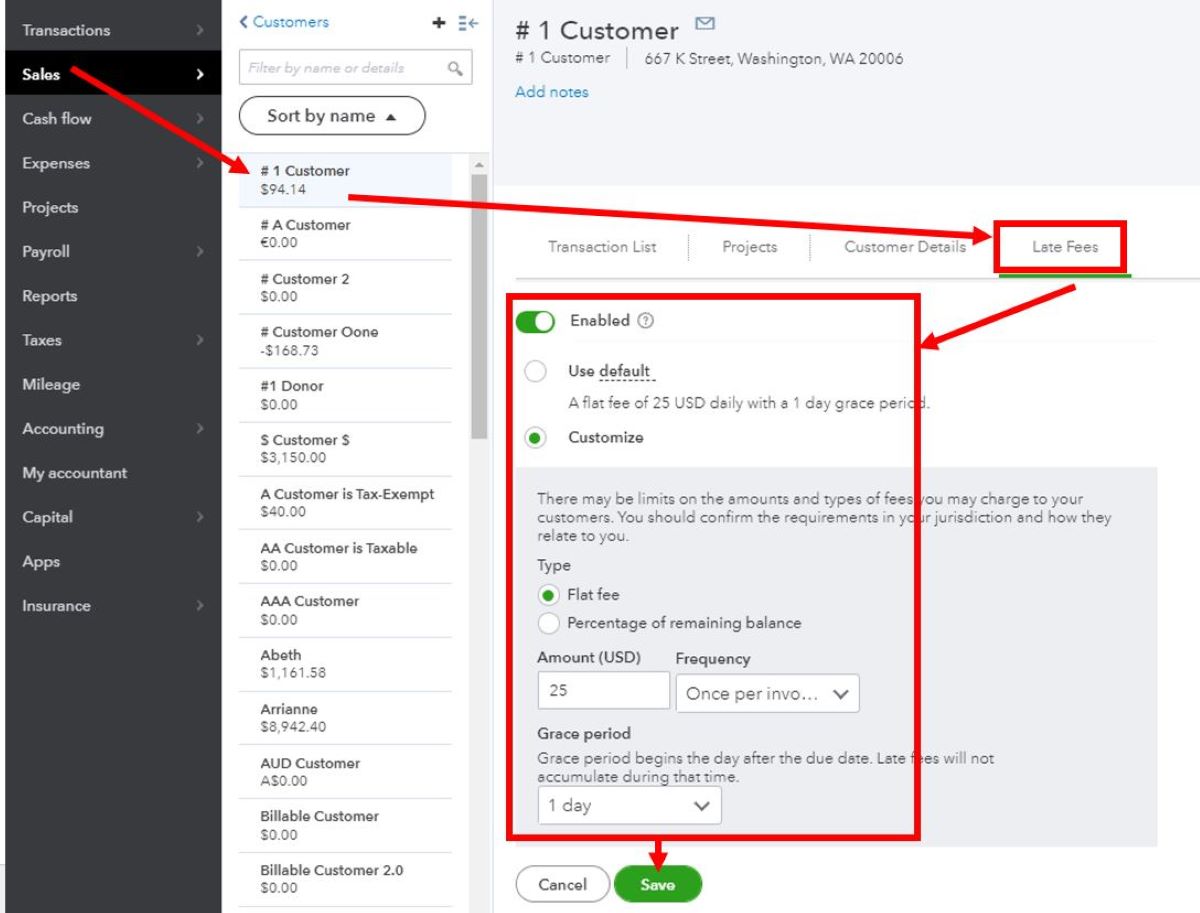

- Payment Terms: The payment terms offered to customers can affect the timing of cash inflows. Longer payment terms or extended payment cycles can delay cash receipts and impact cash flow. Buyers should review the payment terms to understand their impact on cash flow and assess any potential risks.

- Operating Expenses: The management and control of operating expenses play a crucial role in cash flow. Buyers should analyze the business’s cost structure, including fixed and variable expenses, and identify any potential inefficiencies or cost-saving opportunities. Effective expense management can improve cash flow and profitability.

- Inventory Management: For businesses with inventory, managing inventory levels effectively is essential. Excess inventory ties up cash, while insufficient inventory can lead to missed sales opportunities. Buyers should assess the inventory turnover rate, obsolescence risk, and the impact of inventory on cash flow.

- Accounts Payable and Receivable: The management of accounts payable and receivable impacts cash flow. Buyers should review the business’s payment terms with suppliers and analyze the aging of accounts receivable. Delayed payments from customers or long payment cycles with suppliers can negatively affect cash flow.

- Capital Expenditures: Capital expenditures, such as investments in equipment, technology, or facilities, can impact cash flow. Buyers should evaluate the business’s capital expenditure plans and assess their impact on cash flow. Proper planning and management of capital expenditures are crucial for maintaining positive cash flow.

These factors are just a few examples of what can affect the cash flow of a business for sale. Each business is unique, and buyers should conduct a thorough analysis of the specific factors that can impact its cash flow. By understanding these factors, buyers can anticipate potential risks and opportunities and make more informed investment decisions.

Next, let’s explore the strategies for managing cash flow in a business for sale to ensure its sustainability and profitability.

Managing Cash Flow in a Business for Sale

Effective cash flow management is crucial for the long-term success and profitability of a business for sale. Here are some strategies that can help buyers and business owners manage cash flow effectively:

- Monitor and Project Cash Flow: Regularly monitoring cash flow and projecting it into the future is essential. Establish a cash flow budget or forecast that includes anticipated revenue and expenses. This can help identify potential cash flow gaps or surpluses and allow for proactive management.

- Improve Receivables Management: Timely collection of accounts receivable is critical for maintaining a healthy cash flow. Implement efficient invoicing and payment collection processes, set clear payment terms, and follow up on overdue payments. Consider offering incentives for early payment and consider factoring to improve cash flow.

- Negotiate Payment Terms with Suppliers: Negotiating favorable payment terms with suppliers can help improve cash flow. Request extended payment terms or explore vendor financing options to allow for a longer cash conversion cycle, ensuring that cash outflows align with cash inflows.

- Control Inventory Levels: Proper inventory management is essential to avoid tying up excessive cash in inventory. Analyze sales trends, forecast demand, and optimize inventory levels to reduce carrying costs and free up cash. Consider implementing just-in-time inventory management or drop-shipping to minimize inventory holding costs.

- Reduce Operating Expenses: Review all operating expenses and identify areas where costs can be cut without compromising the business’s operations or quality. This can include renegotiating contracts with suppliers, implementing energy-efficient practices, or exploring outsourcing options.

- Streamline Operations: Look for opportunities to streamline and automate business processes to improve efficiency and save costs. Adopting technology solutions can help automate tasks, reduce manual errors, and free up resources that can be allocated towards improving cash flow.

- Explore Financing Options: In cases where cash flow gaps cannot be sufficiently managed internally, consider exploring financing options. This may include taking out a short-term loan, securing a line of credit, or seeking alternative financing methods to bridge cash flow shortages.

- Build Cash Reserves: As part of a long-term cash flow management strategy, aim to build cash reserves during periods of strong cash flow. This provides a buffer for unexpected expenses or cash flow fluctuations, helping to maintain the business’s financial stability.

Implementing these strategies can help buyers and business owners effectively manage cash flow in a business for sale. By maintaining a healthy cash flow, businesses can operate smoothly, meet financial commitments, and have the financial flexibility to invest in growth opportunities.

Now, let’s explore some actionable tips for improving cash flow in a business for sale.

Tips for Improving Cash Flow in a Business for Sale

Improving cash flow is a priority for any business, especially for those that are up for sale. Here are some actionable tips to help buyers and business owners enhance cash flow in a business for sale:

- Accelerate receivables: Expedite the collection of accounts receivable by implementing clear payment terms, sending timely and accurate invoices, and following up with customers regarding outstanding payments. Consider incentivizing early payment or offering discounts for prompt settlement of invoices.

- Manage payables strategically: Negotiate favorable payment terms with suppliers to optimize cash flow. Take advantage of extended payment periods or vendor financing options, while ensuring that creditor relationships remain healthy.

- Optimize inventory management: Keep inventory levels in line with demand to avoid excessive carrying costs. Regularly review and update procurement strategies, forecast demand accurately, and implement just-in-time inventory management practices to minimize cash tied up in inventory.

- Control operating expenses: Evaluate all operating expenses to identify areas where costs can be reduced without impacting the business’s operations or quality. Renegotiate contracts, consolidate suppliers, and explore cost-saving measures such as energy efficiency and waste reduction.

- Improve cash flow forecasting: Develop a robust cash flow forecast to monitor cash flow trends, anticipate potential gaps, and make informed decisions. Regularly update the forecast to reflect changes in revenue, expenses, and market conditions.

- Offer flexible payment options: Consider offering flexible payment options to customers, such as installment plans or subscription-based services. This can encourage customer loyalty, improve cash flow, and reduce the risk of bad debts.

- Implement expense tracking and control: Use expense tracking tools to monitor and control all business expenses proactively. Regularly review and analyze expenses to identify areas where costs can be reduced or reallocated to critical areas.

- Explore alternative financing options: In challenging situations, consider alternative financing methods such as invoice financing, factoring, or crowdfunding to bridge cash flow gaps and maintain smooth business operations.

- Regular financial reviews: Conduct regular reviews of financial statements, cash flow projections, and key performance indicators to identify opportunities for improvement and to promptly address any cash flow challenges.

- Build relationships with lenders and investors: Establish strong relationships with lenders, investors, and potential buyers who can provide financial support or investment opportunities when needed. These relationships can help bridge cash flow gaps and fuel growth initiatives.

Implementing these tips can help buyers and business owners improve the cash flow of a business for sale. By adopting proactive cash flow management strategies, businesses can enhance their financial stability, minimize risks, and increase their attractiveness to potential buyers.

Now, let’s conclude our discussion on cash flow in a business for sale.

Conclusion

Cash flow is a critical aspect to consider when evaluating a business for sale. It provides valuable insights into the financial health, profitability, and potential of the business. By understanding the importance of cash flow, buyers can make informed investment decisions and assess the potential risks and opportunities associated with a business.

Evaluating the cash flow of a business involves analyzing financial statements, projecting future cash flow, and comparing performance to industry benchmarks. This evaluation helps buyers determine the value and sustainability of the business, enabling them to make well-informed investment decisions.

Several factors can impact cash flow, such as sales and revenue, customer base, payment terms, operating expenses, inventory management, and accounts payable and receivable. By carefully assessing these factors, buyers can identify potential risks and take proactive measures to manage and improve cash flow.

To effectively manage cash flow in a business, buyers and business owners can implement strategies such as monitoring and projecting cash flow, improving receivables and payables management, optimizing inventory levels, controlling operating expenses, and exploring financing options. These strategies help maintain a healthy cash flow, increase financial stability, and enhance the potential for long-term success.

In conclusion, cash flow is a fundamental aspect to consider in a business for sale. By thoroughly evaluating and effectively managing cash flow, buyers can mitigate risks, maximize profitability, and position the business for sustainable growth. It is crucial for buyers to conduct thorough due diligence, seek expert advice, and harness the power of cash flow analysis to make informed investment decisions and achieve long-term success in the dynamic world of business acquisition.