Finance

Health Insurance: Definition, How It Works

Modified: December 30, 2023

Get a clear understanding of health insurance, how it works, and its importance in your financial planning. Explore different finance options for securing your health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Health Insurance: Definition, How It Works

Financial stability plays a crucial role in everyone’s life. From managing daily expenses to planning for the future, having a solid grip on your finances can offer a sense of security and peace of mind. As part of our commitment to helping you navigate the world of personal finance, today we will delve into the world of health insurance. In this blog post, we will cover the definition of health insurance, how it works, and everything you need to know to make informed decisions about your healthcare coverage. So, let’s get started!

Key Takeaways:

- Health insurance provides financial protection against medical expenses, safeguarding individuals and families from high healthcare costs.

- Understanding the terms and conditions of your health insurance policy is essential to ensure adequate coverage and avoid any surprises when seeking medical care.

What is Health Insurance?

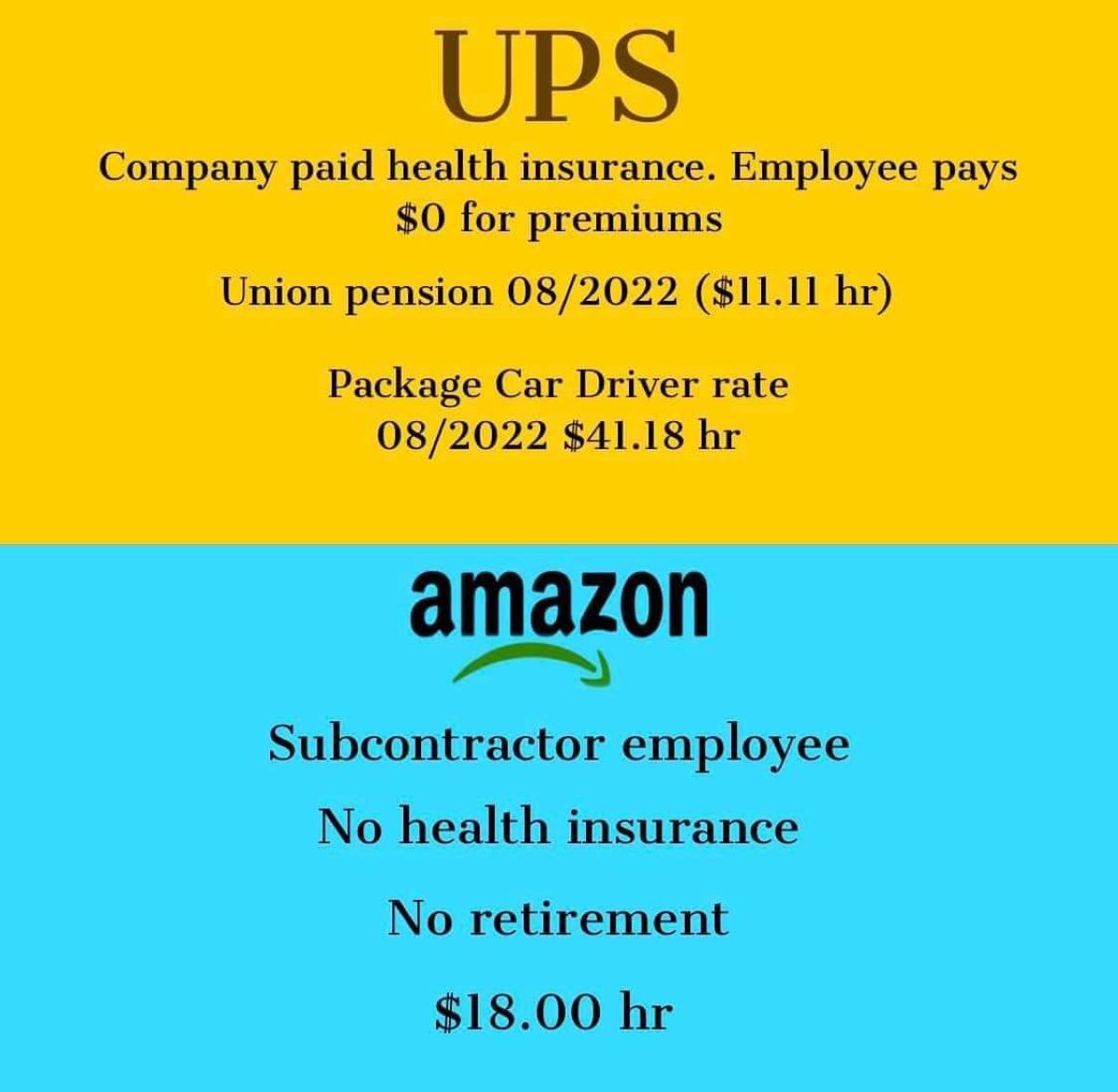

Health insurance is a type of coverage that provides financial protection against medical expenses. It acts as a safety net for individuals and families by mitigating the potentially crippling costs associated with medical treatments, doctor visits, hospital stays, medications, and other healthcare services. By paying a regular premium, policyholders gain access to a wide range of healthcare services at reduced costs or sometimes even with no out-of-pocket expenses.

Health insurance plans are typically offered by private insurance companies, employers, or government programs, such as Medicare and Medicaid. Each plan has its own set of benefits, coverage limits, and rules, so it’s crucial to carefully review and understand the terms and conditions before enrolling.

How Does Health Insurance Work?

Health insurance operates on the principle of risk-sharing. When individuals pay their insurance premiums, these funds are pooled together to create a pool of money that can be used to cover medical costs. This pool of money is then used to reimburse healthcare providers for the services they provide to policyholders.

Here’s a step-by-step breakdown of how health insurance works:

- Enrollment: Individuals sign up for a health insurance plan, either through their employer, a private insurance company, or a government program.

- Premium Payments: Policyholders pay regular premiums, usually monthly or annually, to maintain their coverage. These premium payments contribute to the pool of funds that are used to cover medical expenses.

- Medical Services: When individuals seek medical services, they present their health insurance information. The healthcare provider then bills the insurance company for the cost of the services rendered.

- Claim Processing: The insurance company reviews the claim submitted by the healthcare provider to ensure it aligns with the policy’s terms and conditions. They determine the amount covered by the policy and any deductible, co-payments, or co-insurance that may apply.

- Reimbursement: The insurance company reimburses the healthcare provider for the covered expenses, and the policyholder may be responsible for any remaining out-of-pocket costs as specified by their policy.

By understanding the workings of health insurance, you can make informed decisions when choosing a plan, researching providers, and managing your healthcare expenses. It’s important to note that policies can vary widely, so it’s advisable to carefully compare different options and choose one that best suits your needs.

In Conclusion

Health insurance is an essential tool for protecting yourself and your family from the financial burdens of healthcare expenses. By choosing the right plan and understanding its terms and conditions, you can gain peace of mind knowing that you have the necessary coverage to address your healthcare needs.

Remember these key takeaways:

- Health insurance provides financial protection against medical expenses, safeguarding individuals and families from high healthcare costs.

- Understanding the terms and conditions of your health insurance policy is essential to ensure adequate coverage and avoid any surprises when seeking medical care.

So, whether you’re just starting to explore health insurance options or currently have coverage, taking the time to educate yourself about its definition and how it works is a worthy investment. Protect your health and finances by making informed decisions about your healthcare coverage today.