Finance

Law Of 29 Definition

Published: December 16, 2023

Get a clear understanding of the Law of 29 in finance, its definition, and how it can affect your financial strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Law of 29: A Key to Financial Success

Are you tired of living paycheck to paycheck? Do you want to take control of your finances and build a secure future for yourself? If so, then you need to understand the Law of 29. In this blog post, we will explore what the Law of 29 is, how it can help you achieve financial success, and why it is essential to your overall financial well-being.

Key Takeaways

- The Law of 29 states that if you can maintain a 29-day cushion of living expenses, you will have financial security.

- By saving and investing wisely, you can gradually build up this cushion and gain peace of mind.

So, what exactly is the Law of 29? The Law of 29 is a simple but powerful concept that revolves around creating a financial safety net by setting aside a buffer of 29 days’ worth of living expenses. This means having enough money to cover your essential needs for nearly a month without relying on your regular paycheck.

By implementing the Law of 29, you create a buffer zone that protects you from unexpected emergencies, sudden job loss, or any disruption in your regular income stream. This cushion provides financial security, allowing you to weather any storm and adapt to changing circumstances without falling into debt or financial distress.

Implementing the Law of 29 starts with a budget. Calculate your monthly expenses, including rent or mortgage payments, utility bills, groceries, transportation, and any other necessary costs. Once you have determined your monthly expenses, aim to set aside enough savings to cover these expenses for 29 days.

Here are some practical steps you can take to build your cushion and achieve financial security:

- Create a budget: Track your income and expenses to identify areas where you can cut back and save.

- Automate your savings: Set up automatic transfers from your paycheck to a separate savings account dedicated to your Law of 29 cushion.

- Minimize debt: Pay off high-interest debt to free up more money for savings.

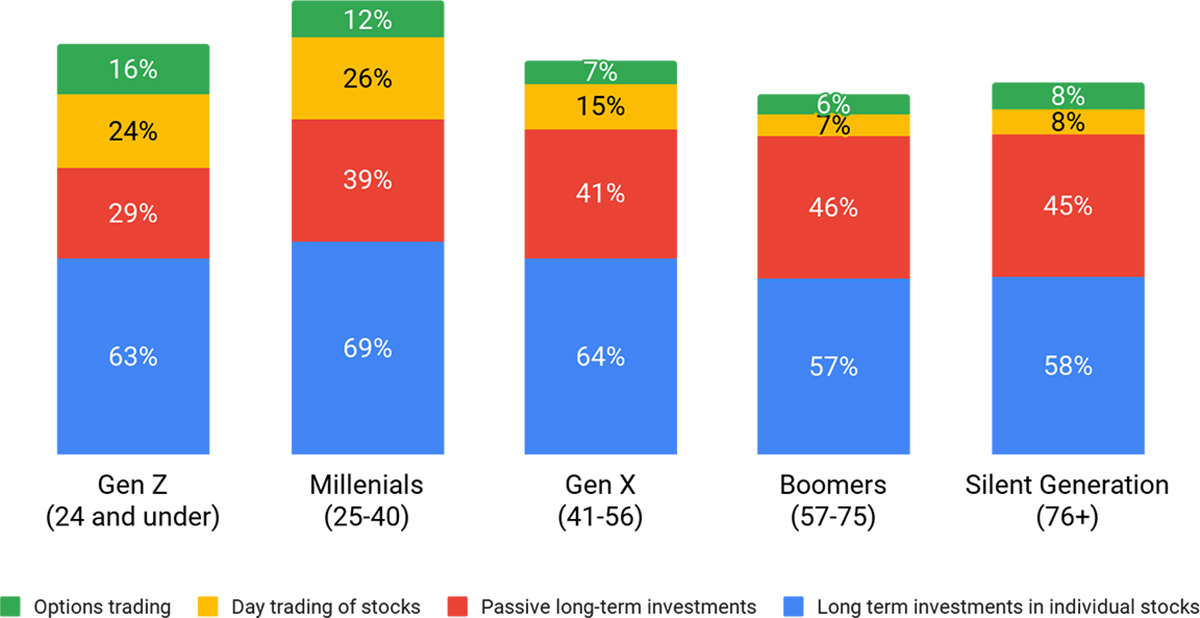

- Invest wisely: Grow your wealth by exploring investment opportunities such as stocks, bonds, or real estate.

As you work towards building your Law of 29 cushion, remember that financial success is a journey. It may take time to reach your goal, but every step forward counts. Stay committed to your budget, make wise financial decisions, and celebrate each milestone along the way.

In conclusion, the Law of 29 is a powerful tool that can help you achieve financial security and freedom. By maintaining a 29-day cushion of living expenses, you can protect yourself from unexpected financial challenges and gain peace of mind. Implement the Law of 29 in your financial planning, and take control of your financial future today!