Finance

Health Insurance When Traveling To Mexico

Modified: December 30, 2023

Get comprehensive health insurance coverage for your trip to Mexico. Protect your finances and have peace of mind while traveling.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Health Insurance Coverage in Mexico

- Types of Health Insurance Options for Traveling to Mexico

- Private Health Insurance Plans for Traveling to Mexico

- International Health Insurance Plans for Traveling to Mexico

- Government Health Insurance Programs in Mexico

- Considerations for Choosing the Right Health Insurance for Traveling to Mexico

- Common Exclusions and Limitations in Health Insurance Coverage for Traveling to Mexico

- Tips for Using Health Insurance in Mexico

- Conclusion

Introduction

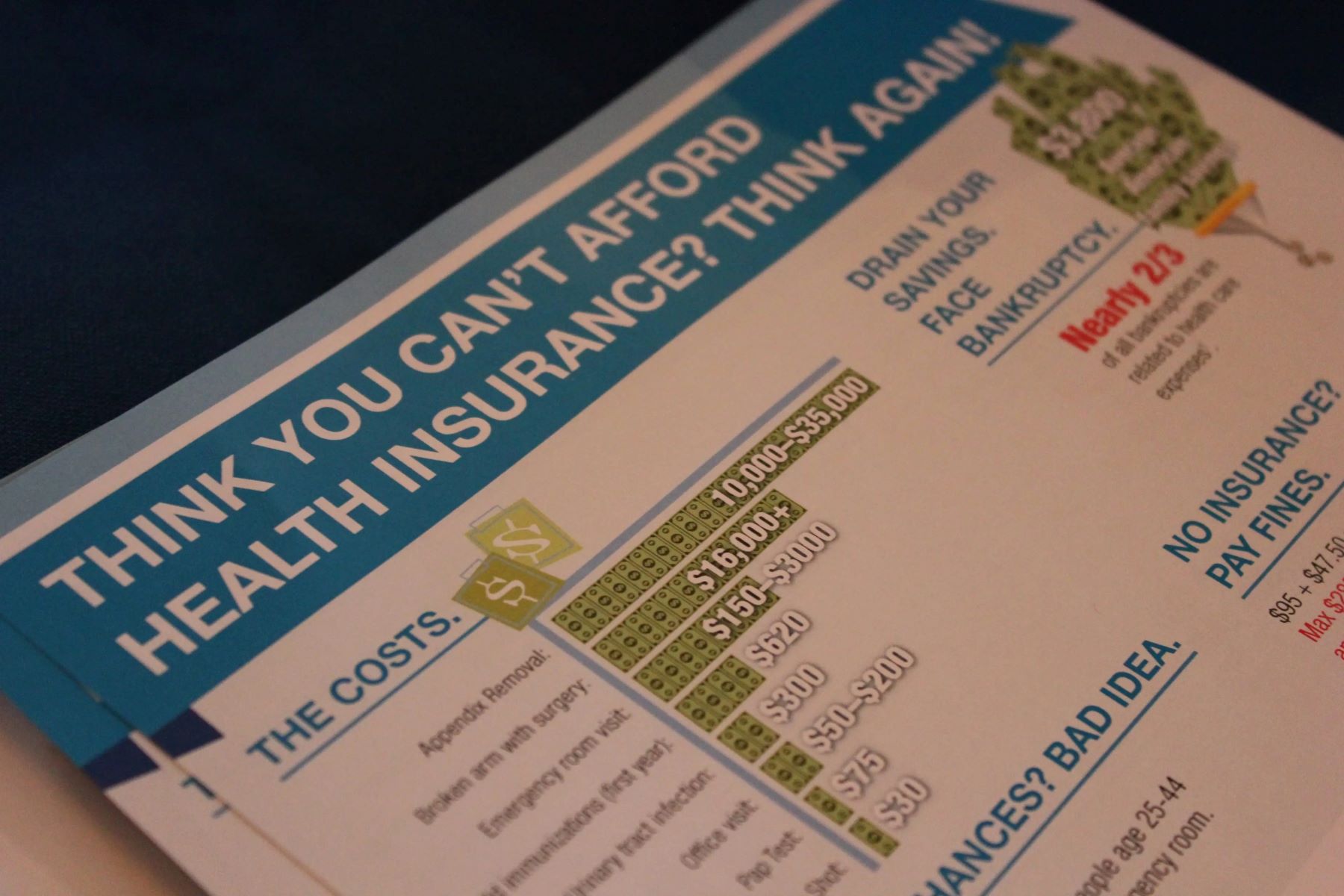

Traveling to Mexico can be an exciting and enriching experience, whether you’re going for a vacation, business trip, or to explore the vibrant culture and picturesque destinations. However, it’s essential to consider the unexpected and ensure that you have proper health insurance coverage during your stay.

Healthcare services in Mexico vary from those in your home country, and the cost of medical treatment can be significantly different. Without adequate health insurance, you may find yourself facing hefty medical bills in the event of an illness, injury, or emergency.

Having health insurance coverage when traveling to Mexico gives you peace of mind and safeguards your financial well-being. It allows you to access quality healthcare services in case of unexpected medical situations, ensuring you receive the necessary treatment without incurring exorbitant expenses.

Understanding the intricacies of health insurance coverage in Mexico is crucial to make an informed decision about the type of insurance that suits your needs.

In this article, we will explore different health insurance options available for travelers in Mexico, including private health insurance plans, international health insurance plans, and government health insurance programs. We will also discuss the considerations to keep in mind while choosing the right health insurance coverage, as well as common exclusions and limitations.

Furthermore, we will provide you with practical tips for using your health insurance in Mexico, ensuring a smooth and hassle-free experience during your stay.

So, let’s dive into the world of health insurance for traveling to Mexico and learn how you can protect yourself and your loved ones in the event of any unforeseen health-related circumstances.

Understanding Health Insurance Coverage in Mexico

Before delving into the various health insurance options available in Mexico, it is important to have a basic understanding of the healthcare system and how health insurance coverage works in the country.

Mexico offers a two-tier healthcare system comprising public and private healthcare providers. The public healthcare system, known as the Instituto Mexicano del Seguro Social (IMSS), primarily serves Mexican citizens and legal residents. It provides healthcare services to those who contribute to the national social security program.

On the other hand, the private healthcare sector in Mexico offers high-quality medical services and is particularly popular among expatriates and tourists. Private hospitals and clinics often have state-of-the-art facilities, English-speaking healthcare professionals, and shorter wait times compared to public healthcare institutions.

When it comes to health insurance coverage in Mexico, there are various options to consider. Mexicans who contribute to the IMSS system are automatically enrolled in the program and receive free or low-cost healthcare services. However, individuals who do not qualify for IMSS coverage, such as tourists and short-term visitors, will need to explore alternative insurance options.

It is worth mentioning that some international health insurance plans also provide coverage in Mexico. These plans are specifically designed for individuals who frequently travel to multiple countries or live abroad for an extended period. International health insurance offers comprehensive coverage, including medical expenses, emergency evacuation, and repatriation.

It is important to note that health insurance coverage, whether obtained through private insurers, international plans, or government programs, typically comes with specific terms, conditions, and exclusions. It is essential to carefully review the policy details, including coverage limits, deductibles, and any restrictions or limitations.

In the next sections, we will explore the different types of health insurance options available for traveling to Mexico, including private health insurance plans, international health insurance plans, and government health insurance programs. We will discuss their benefits, limitations, and factors to consider when choosing the right insurance coverage for your trip. Let’s dive in!

Types of Health Insurance Options for Traveling to Mexico

When it comes to health insurance options for traveling to Mexico, there are several choices to consider. Each type of insurance offers different coverage options and benefits, catering to the specific needs of travelers. Let’s explore the main types of health insurance available:

- Private Health Insurance Plans: Private health insurance plans in Mexico are provided by insurance companies that offer coverage specifically designed for tourists, expatriates, and those who do not qualify for government health insurance programs. These plans often cover a wide range of medical expenses, including hospital stays, doctor visits, medications, and emergency services. Private health insurance gives you access to private hospitals and clinics, which generally offer high-quality healthcare services. It is important to thoroughly review the coverage details, including deductibles, limits, and exclusions, before choosing a private health insurance plan.

- International Health Insurance Plans: International health insurance plans are designed for individuals who frequently travel to multiple countries or live abroad for an extended period. These plans provide comprehensive coverage, including medical expenses, emergency evacuation, repatriation, and more. They offer the flexibility to receive medical treatment in various countries, including Mexico. International health insurance plans typically have a higher level of coverage and broader network of healthcare providers. They are suitable for individuals who require long-term insurance coverage or have specific medical needs.

- Government Health Insurance Programs: Mexico has government health insurance programs targeted at its citizens and legal residents. These programs, such as the Instituto Mexicano del Seguro Social (IMSS) and Seguro Popular, provide healthcare services at little to no cost to those who contribute to the national social security program. However, these programs are not available to tourists or short-term visitors. It is important to note that even if you have private or international health insurance, you may still need to pay out-of-pocket for certain services if they are not covered by your insurance plan.

When choosing the right health insurance option for your trip to Mexico, consider factors such as the duration of your stay, your specific healthcare needs, your budget, and the level of coverage required. It is crucial to carefully review the terms, conditions, and coverage details of each insurance option to ensure that it meets your individual needs.

In the next sections, we will delve deeper into private health insurance plans, international health insurance plans, and government health insurance programs available for traveling to Mexico. We will explore their benefits, limitations, and considerations to keep in mind while making a decision. Let’s continue our journey!

Private Health Insurance Plans for Traveling to Mexico

Private health insurance plans for traveling to Mexico are specifically designed to provide coverage for tourists, expatriates, and individuals who do not qualify for government health insurance programs. These plans offer a range of benefits and coverage options, ensuring access to quality healthcare services during your stay in Mexico.

With private health insurance, you have the flexibility to choose from a network of private hospitals and clinics, which often boast state-of-the-art facilities and English-speaking healthcare professionals. This gives you the peace of mind knowing that you can receive medical treatment from trained and experienced providers.

Private health insurance plans typically cover a variety of medical expenses, including hospital stays, outpatient services, doctor visits, emergency care, prescription medications, and diagnostic tests. The coverage can vary depending on the specific plan you choose, so it is important to carefully review the policy details.

When selecting a private health insurance plan for your trip to Mexico, consider the following factors:

- Coverage Limits: Review the coverage limits for different medical services, such as hospitalization, surgeries, medications, and emergency care. Ensure that the coverage offered is sufficient for your needs.

- Deductibles: Determine the amount you are responsible for paying out-of-pocket before the insurance coverage kicks in. Higher deductibles may result in lower premiums, but consider your budget and ability to cover these costs.

- Exclusions and Limitations: Understand the exclusions and limitations of the policy. Some common exclusions may include pre-existing conditions, elective procedures, or certain high-risk activities. Make sure you are aware of any restrictions that may affect your coverage.

- Customer Service: Consider the reputation and quality of customer service provided by the insurance company. Look for reviews and feedback from other policyholders to ensure that you will receive prompt and reliable assistance when needed.

Having private health insurance coverage while traveling to Mexico gives you peace of mind, ensuring that you can receive the medical attention you need without incurring exorbitant expenses. It is important to thoroughly research and compare different private health insurance plans to find one that aligns with your requirements and provides comprehensive coverage.

Remember, private health insurance is not mandatory for travelers to Mexico, but it is highly recommended to protect yourself and your financial well-being in case of any medical emergencies or unforeseen circumstances. With private health insurance, you can focus on enjoying your trip, knowing that you have reliable coverage and access to quality healthcare services.

In the next section, we will explore international health insurance plans for traveling to Mexico, providing insights into the benefits and considerations associated with this type of health insurance coverage. Let’s continue our journey to find the right health insurance option for your trip.

International Health Insurance Plans for Traveling to Mexico

International health insurance plans are designed for individuals who frequently travel to multiple countries or live abroad for an extended period. These plans provide comprehensive coverage, including medical expenses, emergency evacuation, repatriation, and more, making them an excellent option for travelers to Mexico.

One of the key benefits of international health insurance is the flexibility it offers in terms of healthcare providers. These plans typically have a broad network of healthcare facilities and professionals, giving you access to quality medical services no matter where you are in the world, including Mexico.

International health insurance plans often provide coverage for a wide range of medical services, including hospitalization, surgeries, doctor visits, prescription medications, and emergency care. They may also offer additional benefits such as maternity coverage, dental care, mental health services, and preventive care.

When considering an international health insurance plan for traveling to Mexico, keep the following factors in mind:

- Coverage Area: Check if the plan includes coverage in Mexico and if there are any restrictions or limitations in accessing healthcare services in the country.

- Coverage Limits and Deductibles: Understand the coverage limits and deductibles associated with different medical services. Ensure that the coverage offered is sufficient for your needs and consider how much you are willing to pay out-of-pocket before the insurance coverage comes into effect.

- Emergency Evacuation and Repatriation: Look for plans that include coverage for emergency evacuation to a suitable medical facility or repatriation to your home country if necessary.

- Pre-existing Conditions: Consider if the plan covers pre-existing conditions, as some plans may have specific waiting periods or exclusions for certain medical conditions.

- Customer Support and Assistance: Research the reputation and reliability of the insurance company in terms of customer support and assistance. Read reviews and feedback from policyholders to ensure that you will receive timely and efficient help during your travel.

International health insurance offers a higher level of coverage and flexibility for global travelers, providing comprehensive protection for medical expenses and emergencies. These plans are particularly beneficial for individuals who frequently move between countries or spend extended periods abroad, as they ensure consistent access to healthcare services.

It is important to carefully review and compare different international health insurance plans, considering your specific healthcare needs, travel patterns, and budget. By choosing the right plan, you can have peace of mind knowing that you are covered for any unexpected medical situations while traveling to Mexico.

In the next section, we will discuss government health insurance programs in Mexico, providing an overview of the options available to Mexican citizens and legal residents. Let’s continue exploring the various health insurance choices for traveling to Mexico.

Government Health Insurance Programs in Mexico

Mexico has government health insurance programs aimed at providing healthcare services to its citizens and legal residents. These programs play a vital role in ensuring access to medical care for those who contribute to the national social security program.

The main government health insurance program in Mexico is the Instituto Mexicano del Seguro Social (IMSS). It offers comprehensive healthcare coverage, including doctor visits, hospitalization, medications, laboratory tests, and more. Mexicans who contribute to the IMSS system are automatically enrolled in the program and receive medical services at little to no cost.

Another government health insurance program available in Mexico is Seguro Popular. It provides coverage for individuals who are not eligible for IMSS or other social security programs. Seguro Popular offers medical services to those who do not have formal employment or are self-employed. The program covers a range of healthcare services, including preventive care, consultations, surgeries, medications, and emergency care.

It’s important to note that government health insurance programs like IMSS and Seguro Popular are generally not available to tourists or short-term visitors to Mexico. These programs cater to Mexican citizens or legal residents who contribute to the national social security system.

However, even if you have private or international health insurance coverage, there may be instances where you can access services through these government programs. Some private hospitals or clinics in Mexico have agreements with government programs, allowing those with private insurance to receive medical treatment at reduced costs or even use the facilities.

While government health insurance programs in Mexico provide substantial benefits for citizens and residents, it’s crucial for travelers to understand that these programs are not designed for short-term visitors. Therefore, it is highly recommended for tourists and other non-eligible individuals to consider private health insurance or international health insurance options.

In the next section, we will discuss the considerations to keep in mind when choosing the right health insurance for traveling to Mexico. Whether you opt for private health insurance, international health insurance, or other types of coverage, these factors will help you make an informed decision. Let’s continue our journey to find the ideal health insurance option for your trip.

Considerations for Choosing the Right Health Insurance for Traveling to Mexico

When it comes to choosing the right health insurance for traveling to Mexico, there are several important factors to consider. Each person’s healthcare needs and preferences vary, so it’s essential to evaluate these considerations to make an informed decision:

- Coverage: Assess the extent of coverage provided by the insurance plan. Consider the types of medical services covered, such as hospitalization, doctor visits, emergency care, medications, and diagnostics. Ensure that the coverage is comprehensive and tailored to your specific needs.

- Network: Take into account the network of healthcare providers associated with the insurance plan. Evaluate the quality of the hospitals, clinics, and doctors enlisted. Check if there are preferred providers in Mexico that you can easily access for medical assistance.

- Duration of Stay: Consider the duration of your stay in Mexico. If you plan to stay for an extended period, it may be more beneficial to opt for long-term insurance coverage such as international health insurance. Short-term visitors may prefer travel insurance plans that cover the duration of their trip.

- Budget: Evaluate your budget and determine the premium amount you are comfortable paying for health insurance coverage. Consider the balance between affordability and the level of coverage offered, ensuring that it aligns with your financial capabilities.

- Pre-Existing Conditions: If you have pre-existing medical conditions, it’s crucial to check if the insurance plan covers such conditions. Some plans may have waiting periods or exclusions for pre-existing conditions, so ensure that your specific healthcare needs are adequately addressed.

- Emergency Services: Assess the coverage for emergency services, including emergency evacuation and repatriation. Determine if the insurance plan provides these services and the associated costs, as medical emergencies can be financially burdensome without proper coverage.

- Customer Support: Consider the quality of customer support and assistance provided by the insurance company. Read reviews and feedback from other policyholders to ensure that the company is reliable and responsive in helping you navigate any issues or concerns during your stay in Mexico.

By carefully considering these factors, you can select the right health insurance coverage that fits your individual needs and provides the necessary support during your time in Mexico. It’s crucial to remember that health insurance provides not only financial protection but also peace of mind, enabling you to enjoy your trip without worry.

In the next section, we will discuss common exclusions and limitations in health insurance coverage for traveling to Mexico. Understanding these factors is essential to manage expectations and ensure that you are aware of any potential gaps in your coverage. Let’s continue our exploration of health insurance for traveling to Mexico.

Common Exclusions and Limitations in Health Insurance Coverage for Traveling to Mexico

While health insurance coverage provides valuable protection during your trip to Mexico, it’s important to be aware of common exclusions and limitations that may exist in your policy. These exclusions and limitations outline specific situations or conditions where your insurance coverage may not apply. Understanding them will help you manage expectations and plan accordingly. Here are some common exclusions and limitations to be aware of:

- Pre-Existing Conditions: Many health insurance policies have exclusions for pre-existing medical conditions. This means that any treatment or expenses related to a condition you had before obtaining the insurance coverage may not be covered. It’s essential to review the policy details to understand how pre-existing conditions are handled.

- High-Risk Activities: Certain high-risk activities or sports, such as extreme sports, bungee jumping, or mountain climbing, may be excluded from coverage. If you plan to engage in these activities during your trip to Mexico, consider obtaining additional coverage or look for an insurance plan that includes coverage for such activities.

- Elective Procedures: Health insurance policies often exclude coverage for elective or cosmetic procedures that are not deemed medically necessary. If you plan to undergo any elective procedures while in Mexico, check if your insurance plan provides coverage for them or consider alternative options.

- Waiting Periods: Some insurance plans have waiting periods for specific treatments or procedures. This means that coverage for those services will only be provided after a certain period of time from the start of the insurance policy. Review the waiting periods mentioned in your policy to understand the limitations associated with them.

- Geographical Limitations: Some insurance plans may have limitations based on the geographic region. This means that your coverage may not be applicable in certain areas or may have reduced benefits. For instance, coverage may be different for remote or rural areas compared to major cities. Understand the geographical limitations of your policy and how they may impact your coverage in Mexico.

- Maximum Coverage Limits: Health insurance policies often come with maximum coverage limits, meaning there is a cap on the total amount the insurance company will pay for medical expenses. Be aware of these limits and ensure they are sufficient to cover potential healthcare costs in Mexico.

It’s crucial to carefully review the policy documents and contact your insurance provider for any clarifications regarding exclusions and limitations. Additionally, keep all receipts and documentation of medical expenses during your trip as they may be required for reimbursement claims or insurance purposes.

Understanding the common exclusions and limitations in your health insurance coverage will help you make informed decisions, anticipate potential gaps, and plan accordingly. By being aware of these factors, you can ensure that you have appropriate coverage and avoid any unwanted surprises during your stay in Mexico.

In the next section, we will provide some practical tips for using your health insurance in Mexico. These tips will help you navigate the healthcare system and make the most of your coverage. Let’s continue our guide to health insurance for traveling to Mexico.

Tips for Using Health Insurance in Mexico

When using your health insurance in Mexico, it’s important to be aware of certain tips and considerations to ensure a smooth and hassle-free experience. Here are some practical tips to help you navigate the healthcare system and maximize your health insurance coverage:

- Review Your Policy: Familiarize yourself with the details of your health insurance policy before you travel. Understand the coverage limits, exclusions, and any specific requirements or procedures for obtaining medical services in Mexico.

- Contact Your Insurance Provider: Before seeking medical treatment, contact your insurance provider to understand the process for filing claims and the documentation required. This will help you navigate the claims process more effectively and ensure that you have the necessary information at hand.

- Find In-Network Providers: Whenever possible, seek medical care from healthcare providers who are in-network with your health insurance plan. In-network providers typically have established agreements with insurance companies, which may result in reduced costs and smoother claims processing. Check with your insurance provider for a list of in-network providers in Mexico.

- Keep Documentation: Maintain copies of all medical documentation, including bills, receipts, and medical reports. These documents will be crucial when filing claims with your insurance provider. It’s also a good idea to keep a record of any communication or correspondence with healthcare providers or insurance representatives.

- Emergency Services: In case of a medical emergency, call the emergency services number provided by your insurance company. Confirm that the facility you go to is recognized by your insurance provider to ensure that the costs will be covered according to your policy.

- Language Assistance: If you are not fluent in Spanish, consider having a translator or interpreter accompany you to medical appointments. This will help facilitate effective communication between you, the healthcare providers, and your insurance company.

- Plan Ahead for Prescription Medications: If you require prescription medications, ensure that you have an adequate supply for the duration of your stay in Mexico. Check with your insurance provider if they cover prescription medications and whether there are any specific procedures for obtaining them while abroad.

- Utilize Telemedicine: Some health insurance providers offer telemedicine services, which allow you to consult with healthcare professionals remotely. This can be particularly useful if you have minor medical concerns or need medical advice during your trip to Mexico.

By following these tips, you can make the most of your health insurance coverage in Mexico, ensuring that you receive necessary medical care and streamline the claims process. Remember to always keep your insurance card with you and be prepared to provide relevant policy details when seeking healthcare services.

It’s important to note that health insurance coverage may vary depending on the specific plan you have chosen. Therefore, it’s essential to refer to your policy documentation and consult with your insurance provider for personalized advice and guidance.

Finally, while health insurance provides financial protection and peace of mind, it’s also important to prioritize your well-being and take necessary precautions to maintain good health while traveling in Mexico.

After covering these tips, we have reached the end of our guide to health insurance for traveling to Mexico. Armed with this knowledge, you can confidently explore Mexico while ensuring that you have the necessary coverage and support for your health needs.

Conclusion

Health insurance coverage is a critical aspect to consider when traveling to Mexico. The healthcare system and medical costs may differ from your home country, making it essential to have proper coverage for unexpected illnesses, injuries, or emergencies. With the right health insurance, you can protect yourself financially and access quality healthcare services during your trip.

In this comprehensive guide, we have discussed various health insurance options available for traveling to Mexico. Private health insurance plans cater specifically to tourists and individuals who do not qualify for government programs, offering coverage for a range of medical services. International health insurance plans offer comprehensive coverage for frequent travelers and expatriates. Additionally, Mexico has government health insurance programs for citizens and legal residents.

When choosing the right health insurance coverage, it’s crucial to consider factors such as coverage limits, deductibles, exclusions, and the duration of your stay. Understand the common exclusions and limitations in health insurance policies to manage expectations effectively. Remember to contact your insurance provider for policy details and to follow the recommended tips for using your health insurance in Mexico.

By selecting the appropriate health insurance coverage and following the tips provided, you can have peace of mind knowing that you are adequately protected during your time in Mexico. However, it’s important to review your policy, understand the coverage, and communicate with your insurance provider to ensure a seamless healthcare experience.

Remember, health insurance is not only a financial safety net but also a means to embrace your travel experience with confidence and optimism. Enjoy your trip to Mexico, knowing that you have taken the necessary steps to protect your health and well-being.

Safe travels!